Market Design with Blockchain Technology

... To examine the implications of this choice, we consider a trading process that explicitly allows peer-to-peer trading and it allows market participants to actively search for a counterparty. This peer-to-peer process in our model shares features of “request-forquote” systems in current OTC markets, ...

... To examine the implications of this choice, we consider a trading process that explicitly allows peer-to-peer trading and it allows market participants to actively search for a counterparty. This peer-to-peer process in our model shares features of “request-forquote” systems in current OTC markets, ...

SunAmerica Dynamic Allocation Portfolio Summary

... and short-term investments (the “Overlay Component”). The Fund-of-Funds Component will allocate approximately 50% to 80% of its assets to Underlying Portfolios investing primarily in equity securities and 20% to 50% of its assets to Underlying Portfolios investing primarily in fixed income securitie ...

... and short-term investments (the “Overlay Component”). The Fund-of-Funds Component will allocate approximately 50% to 80% of its assets to Underlying Portfolios investing primarily in equity securities and 20% to 50% of its assets to Underlying Portfolios investing primarily in fixed income securitie ...

predictions, projections, and precautions: conveying cautionary

... It allows consumers to consider relevant risks and decide for themselves whether to buy the product or engage in the contemplated behavior.16 Although products liability law and the regulation of securities markets are two distinct legal regimes, both share similar concerns for the preservation of i ...

... It allows consumers to consider relevant risks and decide for themselves whether to buy the product or engage in the contemplated behavior.16 Although products liability law and the regulation of securities markets are two distinct legal regimes, both share similar concerns for the preservation of i ...

Price Impact of Block Trades in the Saudi Stock Market

... stock. Participants in the market learn new information about the underpricing or overpricing of stocks from the decision of large traders to initiate buy or sell trades. The information effect uses the identity of traders and the size of the transaction as proxies for the information content of the ...

... stock. Participants in the market learn new information about the underpricing or overpricing of stocks from the decision of large traders to initiate buy or sell trades. The information effect uses the identity of traders and the size of the transaction as proxies for the information content of the ...

What it Means to be an ERISA Fiduciary

... how the federal securities laws and the rules of the Securities Exchange Commission (“SEC”) and an applicable self-regulatory organization (“SRO”) impact their business practices. As required by the SEC and SROs, BDs and RIAs have written compliance procedures and assign compliance officers to overs ...

... how the federal securities laws and the rules of the Securities Exchange Commission (“SEC”) and an applicable self-regulatory organization (“SRO”) impact their business practices. As required by the SEC and SROs, BDs and RIAs have written compliance procedures and assign compliance officers to overs ...

NBER WORKING PAPER SERIES A MARKET BASED SOLUTION TO PRICE EXTERNALITIES:

... the spot market price, and this discrepancy depends on type h endowments, his choice of collateral allocation, and the specific target fundamental/price. An alternative example is in Kilenthong and Townsend (2011), in which the rights to trade are implicitly embedded in the incentive comparability ...

... the spot market price, and this discrepancy depends on type h endowments, his choice of collateral allocation, and the specific target fundamental/price. An alternative example is in Kilenthong and Townsend (2011), in which the rights to trade are implicitly embedded in the incentive comparability ...

Familiarity Breeds Investment

... advice: by and large, investors’ money stays in their home countries. Kang and Stulz (1997) observe: “Many Financial Economists have noticed that even though the barriers to international investment have fallen dramatically, foreign ownership of shares is still extremely limited and much smaller tha ...

... advice: by and large, investors’ money stays in their home countries. Kang and Stulz (1997) observe: “Many Financial Economists have noticed that even though the barriers to international investment have fallen dramatically, foreign ownership of shares is still extremely limited and much smaller tha ...

Word - corporate

... Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes No Indicate by check mark whether the registrant has submitted electro ...

... Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes No Indicate by check mark whether the registrant has submitted electro ...

1 Plaintiff`s First Amended Consolidated Class Action Complaint 01

... complained of herein and were aware of, or recklessly disregarded, the misstatements contained therein and omissions therefrom, and were aware of their materially false and misleading nature. Because oftheir Board membership and/or executive and managerial positions with Omega, each of the Individua ...

... complained of herein and were aware of, or recklessly disregarded, the misstatements contained therein and omissions therefrom, and were aware of their materially false and misleading nature. Because oftheir Board membership and/or executive and managerial positions with Omega, each of the Individua ...

Raising Capital- Get the Money You Need To Grow Your Business

... An Overview—How Things Have Changed The climate for entrepreneurship and business growth has changed considerably since the publication of the first edition of Raising Capital. Stock market corrections, dot-com failures, the events of 9/11 and war on terrorism, the wave of corporate scandals and the ...

... An Overview—How Things Have Changed The climate for entrepreneurship and business growth has changed considerably since the publication of the first edition of Raising Capital. Stock market corrections, dot-com failures, the events of 9/11 and war on terrorism, the wave of corporate scandals and the ...

AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION

... 1997, the Company opened three additional bakery cafes in the new terminal of the Washington National Airport. These three bakery cafes are operated by the Company under a subcontract with Host Marriott. The Company is evaluating sites for at least one additional bakery cafe for a planned opening in ...

... 1997, the Company opened three additional bakery cafes in the new terminal of the Washington National Airport. These three bakery cafes are operated by the Company under a subcontract with Host Marriott. The Company is evaluating sites for at least one additional bakery cafe for a planned opening in ...

Heat Waves, Meteor Showers, and Trading Volume: An Analysis of

... in New York until roughly 5:30 p.m. Regardless of location, the trading process for U.S. Treasuries is the same; the same securities are traded by the same dealers through the same interdealer brokers with the same brokerage fees. Trades agreed upon during the Tokyo and London trading hours typicall ...

... in New York until roughly 5:30 p.m. Regardless of location, the trading process for U.S. Treasuries is the same; the same securities are traded by the same dealers through the same interdealer brokers with the same brokerage fees. Trades agreed upon during the Tokyo and London trading hours typicall ...

Form: 10-K, Received: 09/13/2011 15:47:50

... We have contracted with AGR Peak Well Management Limited (“AGR”) to manage our exploration drilling project in offshore Republic of Guinea. AGR will handle well construction project management services, logistics, tendering and contracting for materials as well as overall management responsibilities ...

... We have contracted with AGR Peak Well Management Limited (“AGR”) to manage our exploration drilling project in offshore Republic of Guinea. AGR will handle well construction project management services, logistics, tendering and contracting for materials as well as overall management responsibilities ...

Proceedings of 7th Annual American Business Research Conference

... 23 - 24 July 2015, Sheraton LaGuardia East Hotel, New York, USA, ISBN: 978-1-922069-79-5 shareholders of to-be-delisted firms have a strong incentive to use their private information at the expense of outside investors in the Japanese market. There have been a few empirical studies on delisting in t ...

... 23 - 24 July 2015, Sheraton LaGuardia East Hotel, New York, USA, ISBN: 978-1-922069-79-5 shareholders of to-be-delisted firms have a strong incentive to use their private information at the expense of outside investors in the Japanese market. There have been a few empirical studies on delisting in t ...

Form ADV Part 2A Nuveen Asset Management, LLC 333 West

... For certain strategies, NAM provides certain non-discretionary or model portfolio investment services to clients that may include banks, broker-dealers and other financial services firms (including affiliated or non-affiliated unit investment trust “UIT” sponsors), and other investors. Such services ...

... For certain strategies, NAM provides certain non-discretionary or model portfolio investment services to clients that may include banks, broker-dealers and other financial services firms (including affiliated or non-affiliated unit investment trust “UIT” sponsors), and other investors. Such services ...

Market Efficiency: A Theoretical Distinction and So What?

... implies that the pre-CAPM conventional wisdom is probably correct. An alternate version of the CAPM speaks of investors holding short as well as long positions. But the portfolios this alternate CAPM permits are as unrealistic as those of the Sharpe–Lintner CAPM with unlimited borrowing. The alterna ...

... implies that the pre-CAPM conventional wisdom is probably correct. An alternate version of the CAPM speaks of investors holding short as well as long positions. But the portfolios this alternate CAPM permits are as unrealistic as those of the Sharpe–Lintner CAPM with unlimited borrowing. The alterna ...

Tsung Sheng Liu , Polaris Financial Group, Taiwan

... Year 1997 Completed liberalization of the investment trust business, foreign investors, banks had set-up or merged the existing counterparties ...

... Year 1997 Completed liberalization of the investment trust business, foreign investors, banks had set-up or merged the existing counterparties ...

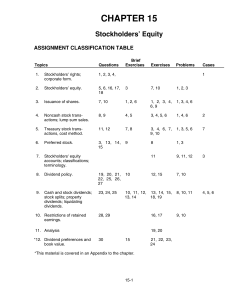

CHAPTER 15 Stockholders` Equity

... 3. Additional Paid-in Capital is credited for the excess of the proceeds from the issuance of the common stock over its stated value. ...

... 3. Additional Paid-in Capital is credited for the excess of the proceeds from the issuance of the common stock over its stated value. ...

Adverse Selection and Competitive Market Making

... A market for a security is liquid if investors can buy or sell large amounts of the security at a low transaction cost. Liquidity is a valuable characteristic of a security because it allows investors to realize more of the gains from optimal risk sharing through dynamic trading.1 In many markets l ...

... A market for a security is liquid if investors can buy or sell large amounts of the security at a low transaction cost. Liquidity is a valuable characteristic of a security because it allows investors to realize more of the gains from optimal risk sharing through dynamic trading.1 In many markets l ...

Victory Capital Management Inc ADV Part 2A

... provided by the client, stipulates the investment strategies, objectives, restrictions (which may include (without limitation) restrictions on: the market-capitalization of investments held in the account, cash levels permitted in the account, the purchase of foreign securities, or the types of inve ...

... provided by the client, stipulates the investment strategies, objectives, restrictions (which may include (without limitation) restrictions on: the market-capitalization of investments held in the account, cash levels permitted in the account, the purchase of foreign securities, or the types of inve ...

Market Signals Associated with Taiwan REIT IPOs

... Finally, based on the research of Akhigbe, Johnston, Madura and Springer (2004), MARKETUP is used to estimate recent market sentiment. When the market sentiment is more favorable, investors may evaluate the issue information more optimistically. Thus, construction stocks may generate better cumulati ...

... Finally, based on the research of Akhigbe, Johnston, Madura and Springer (2004), MARKETUP is used to estimate recent market sentiment. When the market sentiment is more favorable, investors may evaluate the issue information more optimistically. Thus, construction stocks may generate better cumulati ...

Mitigating Systemic Risk - A Role for Securities Regulators

... contribution in addressing systemic risk (and promoting financial stability). Securities regulators need to consider how the core functions of business conduct regulation and ensuring transparent, fair and efficient markets can support, and in turn be supported by, monitoring and mitigation of syste ...

... contribution in addressing systemic risk (and promoting financial stability). Securities regulators need to consider how the core functions of business conduct regulation and ensuring transparent, fair and efficient markets can support, and in turn be supported by, monitoring and mitigation of syste ...

Saudi Capital Market Overview

... that has a legal personality which falls within one of the entities mentioned below. All QFI applicants; including government and investment funds, must be licensed or regulated by a regulatory authority and incorporated in an approved jurisdiction ...

... that has a legal personality which falls within one of the entities mentioned below. All QFI applicants; including government and investment funds, must be licensed or regulated by a regulatory authority and incorporated in an approved jurisdiction ...

It’s All About the Accounting

... With this Act, Congress created the Securities and Exchange Commission. The Act empowers the SEC with broad authority over all aspects of the securities industry. This includes the power to register, regulate, and oversee brokerage firms, transfer agents, and clearing agencies as well as the nation' ...

... With this Act, Congress created the Securities and Exchange Commission. The Act empowers the SEC with broad authority over all aspects of the securities industry. This includes the power to register, regulate, and oversee brokerage firms, transfer agents, and clearing agencies as well as the nation' ...