Judul - Binus Repository

... – amount of stock a corporation is allowed to sell as indicated by its charter •The authorization of capital stock does not result in a formal accounting entry. This event has no immediate effect on either corporate assets or stockholders’ equity. ...

... – amount of stock a corporation is allowed to sell as indicated by its charter •The authorization of capital stock does not result in a formal accounting entry. This event has no immediate effect on either corporate assets or stockholders’ equity. ...

Economics: Principles in Action

... paid out to stockholders of many corporations. The higher the corporate profit, the higher the dividend. 2. A capital gain is earned when a stockholder sells stock for more than he or she paid for it. A stockholder that sells stock at a lower price than the purchase price suffers a capital loss. ...

... paid out to stockholders of many corporations. The higher the corporate profit, the higher the dividend. 2. A capital gain is earned when a stockholder sells stock for more than he or she paid for it. A stockholder that sells stock at a lower price than the purchase price suffers a capital loss. ...

MEDICAN ENTERPRISES, INC.

... price than commissions on higher-priced stocks, the current average price per share of the Common Stock can result in individual shareholders paying transaction costs representing a higher percentage of their total share value than would be the case if the share price were substantially higher. It s ...

... price than commissions on higher-priced stocks, the current average price per share of the Common Stock can result in individual shareholders paying transaction costs representing a higher percentage of their total share value than would be the case if the share price were substantially higher. It s ...

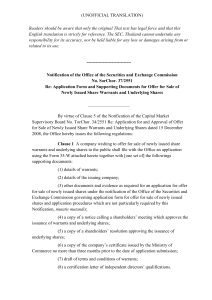

ประกาศคณะกรรมการกำกับหลักทรัพย์และตลาดหลักทรัพย์

... By virtue of Clause 5 of the Notification of the Capital Market Supervisory Board No. TorChor. 34/2551 Re: Application for and Approval of Offer for Sale of Newly Issued Share Warrants and Underlying Shares dated 15 December 2008, the Office hereby issues the following regulations: Clause 1 A compan ...

... By virtue of Clause 5 of the Notification of the Capital Market Supervisory Board No. TorChor. 34/2551 Re: Application for and Approval of Offer for Sale of Newly Issued Share Warrants and Underlying Shares dated 15 December 2008, the Office hereby issues the following regulations: Clause 1 A compan ...

Side Arrows Background

... Common Stock • Disadvantages of Common Stock Financing 1. It gives new shareholders the right to share control of the corporation. 2. It has a dilutive effect on the corporation’s earnings per share and price per share 3. It is more expensive to underwrite and distribute common stock than preferred ...

... Common Stock • Disadvantages of Common Stock Financing 1. It gives new shareholders the right to share control of the corporation. 2. It has a dilutive effect on the corporation’s earnings per share and price per share 3. It is more expensive to underwrite and distribute common stock than preferred ...

Rule 1: Think Like a Fundamentalist

... which mathematically tells me how much a trade can move against me and still be in an uptrend. We call this value an “Expected Move” (EM). It basically means that we know, with mathematical certainty, how much a stock’s price can move and stay within one standard deviation of normal volatility, base ...

... which mathematically tells me how much a trade can move against me and still be in an uptrend. We call this value an “Expected Move” (EM). It basically means that we know, with mathematical certainty, how much a stock’s price can move and stay within one standard deviation of normal volatility, base ...

Document

... • Also, adopting good CG practices leads to a better system of internal control, thus leading to greater accountability and better profit margins. • Good CG practices can pave the way for possible future growth, diversification, or a sale, including the ability to attract equity investors – national ...

... • Also, adopting good CG practices leads to a better system of internal control, thus leading to greater accountability and better profit margins. • Good CG practices can pave the way for possible future growth, diversification, or a sale, including the ability to attract equity investors – national ...

Stock Basics Tutorial

... buyer. Really, a stock market is nothing more than a super-sophisticated farmers' market linking buyers and sellers. Before we go on, we should distinguish between the primary market and the secondary market. The primary market is where securities are created (by means of an IPO) while, in the secon ...

... buyer. Really, a stock market is nothing more than a super-sophisticated farmers' market linking buyers and sellers. Before we go on, we should distinguish between the primary market and the secondary market. The primary market is where securities are created (by means of an IPO) while, in the secon ...

ФИТАТ U.U. Umbetov1, A.N. Murzakhmetov2 1, 2 M.Kh. Dulaty

... that the Internet has changed the way in which information is diffused and reexamined some financial theories with Internet-based new proxies [1]. Theoretical part. The investment process is a mechanism of interaction between the market participants offering investments with members that represent t ...

... that the Internet has changed the way in which information is diffused and reexamined some financial theories with Internet-based new proxies [1]. Theoretical part. The investment process is a mechanism of interaction between the market participants offering investments with members that represent t ...

The exercise price is equal to the market price of $24 per share

... shares of stock. Rather they are given an option to buy shares at some time in the future. Options are usually granted 1. for a specified number of shares, 2. at a specified price, 3. during a specified period of time. ...

... shares of stock. Rather they are given an option to buy shares at some time in the future. Options are usually granted 1. for a specified number of shares, 2. at a specified price, 3. during a specified period of time. ...

THE INS AND OUTS OF “ACCELERATION OUT” CLAUSES IN

... options accelerate upon the consummation of an acquisition. An acquirer will understand that if all options accelerate, it will be necessary for the acquirer to develop new “handcuffs” in order to assure that the employees are suitably incentivized. Thus, if all of the target company’s options accel ...

... options accelerate upon the consummation of an acquisition. An acquirer will understand that if all options accelerate, it will be necessary for the acquirer to develop new “handcuffs” in order to assure that the employees are suitably incentivized. Thus, if all of the target company’s options accel ...

MacroGenics Enters Collaboration and License Agreement with

... Under the terms of the agreement and subject to the termination or expiration of any applicable waiting periods under HartScott-Rodino Act, MacroGenics will receive a $50 million upfront license fee and Johnson & Johnson Innovation - JJDC, Inc. will invest $75 million to purchase 1,923,077 new share ...

... Under the terms of the agreement and subject to the termination or expiration of any applicable waiting periods under HartScott-Rodino Act, MacroGenics will receive a $50 million upfront license fee and Johnson & Johnson Innovation - JJDC, Inc. will invest $75 million to purchase 1,923,077 new share ...

Technical analysis

... The technician contends that there are several problems with accounting statements: 1-the lack of great deal of info needed by security analysts, such as a info related to sales, earning, and capital utilized by product line and customers. 2-according to GAAP corporations may choose among several p ...

... The technician contends that there are several problems with accounting statements: 1-the lack of great deal of info needed by security analysts, such as a info related to sales, earning, and capital utilized by product line and customers. 2-according to GAAP corporations may choose among several p ...

This publication is intended for general guidance and represents our

... Our team acts for start-up/scale-up businesses and individual and institutional investors, and whilst we agree in broad terms with the recommendations set out in the report, we are working with investors who are increasing active in providing the growth capital/debt needed by scale-up businesses. Ve ...

... Our team acts for start-up/scale-up businesses and individual and institutional investors, and whilst we agree in broad terms with the recommendations set out in the report, we are working with investors who are increasing active in providing the growth capital/debt needed by scale-up businesses. Ve ...

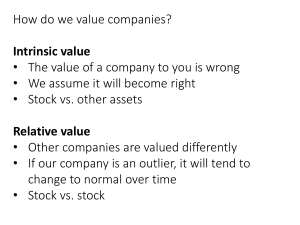

Chapter 7: Principles of Asset Valuation

... Seemly Violation to the Law of One Price If seemly identical assets were selling at different prices, we would suspect – Something was interfering with the normal operation of the competitive market. ...

... Seemly Violation to the Law of One Price If seemly identical assets were selling at different prices, we would suspect – Something was interfering with the normal operation of the competitive market. ...

8-K (8-K) - Spirit AeroSystems

... Spirit AeroSystems Holdings, Inc., a corporation organized and existing under the laws of the State of Delaware, hereby certifies as follows: 1. The name under which the corporation was originally incorporated was Mid-Western Aircraft Systems Holdings, Inc. (the “Corporation”) and the date of filing ...

... Spirit AeroSystems Holdings, Inc., a corporation organized and existing under the laws of the State of Delaware, hereby certifies as follows: 1. The name under which the corporation was originally incorporated was Mid-Western Aircraft Systems Holdings, Inc. (the “Corporation”) and the date of filing ...

Shanghai-Hong Kong Stock Connect to Commence

... shares through Hong Kong, while Mainland Chinese investors will be able to trade Hong Kong-listed shares directly. Announced in April, the programme had been expected to launch in late October, although a formal commencement date was never announced. Rumours circulated that operations would commence ...

... shares through Hong Kong, while Mainland Chinese investors will be able to trade Hong Kong-listed shares directly. Announced in April, the programme had been expected to launch in late October, although a formal commencement date was never announced. Rumours circulated that operations would commence ...

The Hidden Cost of Holding a Concentrated Position

... may be prevented from selling due to regulatory constraints, such as prohibition from selling during blackout periods or when in possession of material nonpublic information. The Securities and Exchange Commission (SEC), recognizing that corporate insiders were greatly restricted by these rules, cre ...

... may be prevented from selling due to regulatory constraints, such as prohibition from selling during blackout periods or when in possession of material nonpublic information. The Securities and Exchange Commission (SEC), recognizing that corporate insiders were greatly restricted by these rules, cre ...

Chapter 5- Valuation Concepts

... Stock Valuation Models Term: Expected Dividends D̂ t dividendthe stockholder expects to receive at the end of Year t D0 is the most recent dividendalready paid D̂1 is the next dividendexpected to be paid, and it willbe paid at the end of this year D̂ 2 is the dividendexpected at the end of two ye ...

... Stock Valuation Models Term: Expected Dividends D̂ t dividendthe stockholder expects to receive at the end of Year t D0 is the most recent dividendalready paid D̂1 is the next dividendexpected to be paid, and it willbe paid at the end of this year D̂ 2 is the dividendexpected at the end of two ye ...

the purchase by a corporation of its own shares of stock.

... with other creditors whatever assets there may be left. Such a situation is, of course, opposed to public policy and cannot be permitted to exist." Prior to this decision, Vice-Chancellor Stevens had expressed a strong doubt that the implied power to purchase, granted by ihe Berger case,28 went the ...

... with other creditors whatever assets there may be left. Such a situation is, of course, opposed to public policy and cannot be permitted to exist." Prior to this decision, Vice-Chancellor Stevens had expressed a strong doubt that the implied power to purchase, granted by ihe Berger case,28 went the ...

Report of the Executive Board

... Report of the Executive Board Report of the Executive Board on Items 6 and 7 of the Agenda pursuant to §§ 203 Para. 2 in conjunction with § 186 Para. 4 Sentence 2 Stock Corporation Act (AktG) (in conjunction with Article 9 Para. 1 Letter c) ii) of the SE Regulation) The company most recently adopted ...

... Report of the Executive Board Report of the Executive Board on Items 6 and 7 of the Agenda pursuant to §§ 203 Para. 2 in conjunction with § 186 Para. 4 Sentence 2 Stock Corporation Act (AktG) (in conjunction with Article 9 Para. 1 Letter c) ii) of the SE Regulation) The company most recently adopted ...

“Mini-Tender” Offer

... unsolicited mini-tender offer by TRC Capital Corporation (TRC Capital) to purchase up to 2.5 million Thomson Reuters common shares, or approximately 0.31% of the common shares outstanding, at a price of C$39.75 per share. Thomson Reuters does not endorse this unsolicited mini-tender offer and recomm ...

... unsolicited mini-tender offer by TRC Capital Corporation (TRC Capital) to purchase up to 2.5 million Thomson Reuters common shares, or approximately 0.31% of the common shares outstanding, at a price of C$39.75 per share. Thomson Reuters does not endorse this unsolicited mini-tender offer and recomm ...

Business Organizations

... Corporation (cont.) • Corporate structure• Types of stockCommon stock- voting stock 1 vote per share Preferred stock- Non voting stock, but receives dividends before common stock holders. Also get investment back before common shareholders. • Have many officers, usually to handle different areas of ...

... Corporation (cont.) • Corporate structure• Types of stockCommon stock- voting stock 1 vote per share Preferred stock- Non voting stock, but receives dividends before common stock holders. Also get investment back before common shareholders. • Have many officers, usually to handle different areas of ...

Merger Arbitrage & Shareholder Wealth Effects of M&A

... – if the filing date happens to occur in the midst of negotiations, there can be tough questions about whether information about the deal needs to be disclosed, – particularly under the broad Regulation S‐K, the common disclosure base for the various SEC disclosure ...

... – if the filing date happens to occur in the midst of negotiations, there can be tough questions about whether information about the deal needs to be disclosed, – particularly under the broad Regulation S‐K, the common disclosure base for the various SEC disclosure ...