Technical Analysis on Selected Stocks of Energy Sector

... statistics generated by market activity, such as past prices and volume. Technical analysts do not attempt to measure a securities intrinsic value, but instead use charts and other tools to identify patterns that can suggest future activity. In fact the decision made on the basis of technical analys ...

... statistics generated by market activity, such as past prices and volume. Technical analysts do not attempt to measure a securities intrinsic value, but instead use charts and other tools to identify patterns that can suggest future activity. In fact the decision made on the basis of technical analys ...

SCHEDULE 13G Amendment No. Alaska Air Group Incorporated

... Depending upon its future evaluations of the business and prospects of the Company and upon other developments, including, but not limited to, general economic and business conditions and money market and stock market conditions, FIL may determine to cease making additional purchases of shares or to ...

... Depending upon its future evaluations of the business and prospects of the Company and upon other developments, including, but not limited to, general economic and business conditions and money market and stock market conditions, FIL may determine to cease making additional purchases of shares or to ...

flow of funds - WordPress.com

... to raise funds in the financial markets is to issue a debt instrument, such as a bond. • The maturity of a debt instrument is the number of years (term) until that instrument’s expiration date. – A debt instrument is short-term if its maturity is less than a year (T-bills). – Debt instruments are ca ...

... to raise funds in the financial markets is to issue a debt instrument, such as a bond. • The maturity of a debt instrument is the number of years (term) until that instrument’s expiration date. – A debt instrument is short-term if its maturity is less than a year (T-bills). – Debt instruments are ca ...

Chapter 11

... stock is called a share. Stocks are also called equities. • Stockowners can earn a profit in two ways: 1. Dividends, which are portions of a corporation’s profits, are paid out to stockholders of many corporations. The higher the corporate profit, the higher the dividend. 2. A capital gain is earned ...

... stock is called a share. Stocks are also called equities. • Stockowners can earn a profit in two ways: 1. Dividends, which are portions of a corporation’s profits, are paid out to stockholders of many corporations. The higher the corporate profit, the higher the dividend. 2. A capital gain is earned ...

Chapter 18 -- Dividend Policy

... shares of stock to shareholders. Often used in place of or in addition to a cash dividend. Small-percentage stock dividends ...

... shares of stock to shareholders. Often used in place of or in addition to a cash dividend. Small-percentage stock dividends ...

Measuring Efficiency in Corporate Law: The Role of Shareholder

... – elimination or reduction of supermajority voting requirements – majority voting in uncontested director elections – the right for shareholders to call a special meeting – the right for shareholders to act by written consent ...

... – elimination or reduction of supermajority voting requirements – majority voting in uncontested director elections – the right for shareholders to call a special meeting – the right for shareholders to act by written consent ...

Learning Goals

... the ask price is the price at which he is willing to sell a security. The difference is called the bid-ask spread. A market order is one that can be executed at the market price, while a limit order either specifies a specific bid price (buy order) or a specific ask price (sell order). Hence as long ...

... the ask price is the price at which he is willing to sell a security. The difference is called the bid-ask spread. A market order is one that can be executed at the market price, while a limit order either specifies a specific bid price (buy order) or a specific ask price (sell order). Hence as long ...

Clean Tech - GreenWorld Capital, LLC

... • Derivative Issues – Conversion option must be considered indexed to the issuing Company’s own stock per EITF 07-5 and be considered to be an equity instrument per the requirements in EITF 00-19 in order for the option to not be treated as a derivative • The provisions within these Issues are very ...

... • Derivative Issues – Conversion option must be considered indexed to the issuing Company’s own stock per EITF 07-5 and be considered to be an equity instrument per the requirements in EITF 00-19 in order for the option to not be treated as a derivative • The provisions within these Issues are very ...

successful stock investing

... Information can be obtained from a responsible broker. They have large research libraries and a knowledge of stocks in general. Never buy on “tips” or from high pressure stock salesmen. We recommend strongly that any investor subscribe to the Wall Street Journal and study it carefully every business ...

... Information can be obtained from a responsible broker. They have large research libraries and a knowledge of stocks in general. Never buy on “tips” or from high pressure stock salesmen. We recommend strongly that any investor subscribe to the Wall Street Journal and study it carefully every business ...

Announces Filing of Final Prospectus for Bought Deal Prospectus

... The securities offered have not been and will not be registered under the U.S. Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an available exemption from the registration requirements thereof. This press release shall not constitute an ...

... The securities offered have not been and will not be registered under the U.S. Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an available exemption from the registration requirements thereof. This press release shall not constitute an ...

a new perspective

... actual property is only a consideration if you plan on disposing of it. This paper proposes that a person can use this same reasoning to train their brain to look at the stock market in a similar fashion. This would allow a person to mentally ignore the ups and downs of the stock market. After all, ...

... actual property is only a consideration if you plan on disposing of it. This paper proposes that a person can use this same reasoning to train their brain to look at the stock market in a similar fashion. This would allow a person to mentally ignore the ups and downs of the stock market. After all, ...

Company Number Form AR ANNUAL RETURN OF A COMPANY

... document required by law to be annexed thereto) together with a copy of the report of the auditors thereon (certified as aforesaid) and if any such balance sheet is in a foreign language there must also be annexed to it a translation thereof in English certified in the prescribed manner to be a corr ...

... document required by law to be annexed thereto) together with a copy of the report of the auditors thereon (certified as aforesaid) and if any such balance sheet is in a foreign language there must also be annexed to it a translation thereof in English certified in the prescribed manner to be a corr ...

FREE Sample Here

... 76. Which of the following is true of over-the-counter markets? a. Trading takes place by telephone or electronic network b. It is regulated by the Securities and Exchange Commission and the National Association of Securities Dealers c. The total securities traded represent the largest dollar volume ...

... 76. Which of the following is true of over-the-counter markets? a. Trading takes place by telephone or electronic network b. It is regulated by the Securities and Exchange Commission and the National Association of Securities Dealers c. The total securities traded represent the largest dollar volume ...

semester v cm05bba05 – investment management

... Promoters contribution in case of public issues by unlisted companies and promoter’s share holding in case of ‘ offers for sale’ shall not be less than __________of post issue capital a. 50% b. 15% c. 20% d. 30% ...

... Promoters contribution in case of public issues by unlisted companies and promoter’s share holding in case of ‘ offers for sale’ shall not be less than __________of post issue capital a. 50% b. 15% c. 20% d. 30% ...

Lecture 8

... currency which is different from the home currency of the investor. • The bond will NOT be offered in the capital market of the country whose currency it is denominated in. • Example: A Chinese company issuing a U.S. dollar denominated bond in Japan. This bond will NOT be issued in the United States ...

... currency which is different from the home currency of the investor. • The bond will NOT be offered in the capital market of the country whose currency it is denominated in. • Example: A Chinese company issuing a U.S. dollar denominated bond in Japan. This bond will NOT be issued in the United States ...

Wells Real Estate Investment Trust, Inc.

... We are pleased to announce that Wells REIT's real estate portfolio was recently appraised, and after taking into account its other assets and liabilities, third-party experts calculated a new estimated net asset value (NAV) per share of our common stock. Based on their findings, the estimated NAV pe ...

... We are pleased to announce that Wells REIT's real estate portfolio was recently appraised, and after taking into account its other assets and liabilities, third-party experts calculated a new estimated net asset value (NAV) per share of our common stock. Based on their findings, the estimated NAV pe ...

to View

... d. Full payment – The investor has to pay the full amount of share price during application, unlike in the other methods. e. Pro-rata allotment – Allotment is done on a pro-rata basis in cases of both over-subscription and under-subscription. ii. Book Building Method – In this method, unlike a fixe ...

... d. Full payment – The investor has to pay the full amount of share price during application, unlike in the other methods. e. Pro-rata allotment – Allotment is done on a pro-rata basis in cases of both over-subscription and under-subscription. ii. Book Building Method – In this method, unlike a fixe ...

Download attachment

... represents ownership in a company and a claim on a portion of profits (dividends). Investors get one vote per share to elect the board members who oversees the major decisions made by management. Over the long term, common stock, by means of capital growth, yields higher returns than almost every ot ...

... represents ownership in a company and a claim on a portion of profits (dividends). Investors get one vote per share to elect the board members who oversees the major decisions made by management. Over the long term, common stock, by means of capital growth, yields higher returns than almost every ot ...

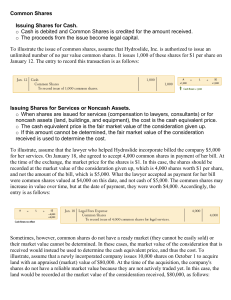

Common Shares

... to a new shareholders' equity account for the contributed capital from the reacquisition of the shares. The balance in this account is reported as contributed capital in the shareholders' equity section of the balance sheet, along with the share capital, to indicate the total capital contributed by ...

... to a new shareholders' equity account for the contributed capital from the reacquisition of the shares. The balance in this account is reported as contributed capital in the shareholders' equity section of the balance sheet, along with the share capital, to indicate the total capital contributed by ...

Stocks: An Introduction

... What are stocks? Stock equals ownership A stock represents a share of ownership in a business. When you hold one or more shares of stock in a company, you actually own a piece of that company. Your percentage of ownership will depend on how many shares you hold in relation to the total number of sha ...

... What are stocks? Stock equals ownership A stock represents a share of ownership in a business. When you hold one or more shares of stock in a company, you actually own a piece of that company. Your percentage of ownership will depend on how many shares you hold in relation to the total number of sha ...

Read more here

... TripleNine has changed its settlement policy in order to avoid unpleasant surprises. The market for TripleNine products has been growing all year and this has caused the Board of directors to change the settlement policy. In future, we will pay for the fish on the basis of an expected conservatively ...

... TripleNine has changed its settlement policy in order to avoid unpleasant surprises. The market for TripleNine products has been growing all year and this has caused the Board of directors to change the settlement policy. In future, we will pay for the fish on the basis of an expected conservatively ...

1 SCHEDULE 14A (RULE 14a-101) INFORMATION REQUIRED IN

... The Board of Directors believes that it is desirable for the Company to have available additional authorized but unissued shares of Common Stock to provide the Company with shares of Common Stock to be used for general corporate purposes, future acquisitions and equity financings. Since the Company' ...

... The Board of Directors believes that it is desirable for the Company to have available additional authorized but unissued shares of Common Stock to provide the Company with shares of Common Stock to be used for general corporate purposes, future acquisitions and equity financings. Since the Company' ...

(the “Stock Exchange”) take no responsi

... under the terms and conditions of the CBBCs (the “Conditions”), a Mandatory Call Event (the “MCE”) in respect of the CBBCs described in the table below occurred at the time (the “MCE Time”) specified in the table below on 12 July 2017 (the “MCE Date”) and trading of the CBBCs has been suspended by t ...

... under the terms and conditions of the CBBCs (the “Conditions”), a Mandatory Call Event (the “MCE”) in respect of the CBBCs described in the table below occurred at the time (the “MCE Time”) specified in the table below on 12 July 2017 (the “MCE Date”) and trading of the CBBCs has been suspended by t ...

(the “Stock Exchange”) take no responsi

... under the terms and conditions of the CBBCs (the “Conditions”), a Mandatory Call Event (the “MCE”) in respect of the CBBCs described in the table below occurred at the time (the “MCE Time”) specified in the table below on 11 July 2017 (the “MCE Date”) and trading of the CBBCs has been suspended by t ...

... under the terms and conditions of the CBBCs (the “Conditions”), a Mandatory Call Event (the “MCE”) in respect of the CBBCs described in the table below occurred at the time (the “MCE Time”) specified in the table below on 11 July 2017 (the “MCE Date”) and trading of the CBBCs has been suspended by t ...

Risk and Return and the Financing Decision: Bonds vs

... Risk (risk of Bankruptcy) In bankruptcy, the creditors are paid first. Stockholders are last in line. ...

... Risk (risk of Bankruptcy) In bankruptcy, the creditors are paid first. Stockholders are last in line. ...