Chapter 11 Financial Reconstruction

... danger of being put into liquidation, owing debts that it cannot repay, and so the creditors of the company agree to accept securities in the company, perhaps including equity shares, in settlement of their debts. 2.1.3 On the other hand a company may be willing to undergo some financial restructuri ...

... danger of being put into liquidation, owing debts that it cannot repay, and so the creditors of the company agree to accept securities in the company, perhaps including equity shares, in settlement of their debts. 2.1.3 On the other hand a company may be willing to undergo some financial restructuri ...

More Builders and Fewer Traders

... Over the past three decades, the share of resources corporations use to repurchase their own shares has soared. For example, take the 248 companies continuously listed in the S&P 500 since 1981. That year, stock buybacks by these firms consumed a mere 2 percent of net income. Between 1984 and 1993, ...

... Over the past three decades, the share of resources corporations use to repurchase their own shares has soared. For example, take the 248 companies continuously listed in the S&P 500 since 1981. That year, stock buybacks by these firms consumed a mere 2 percent of net income. Between 1984 and 1993, ...

DOC - ContraVir Pharmaceuticals

... Voting Rights. Except as otherwise provided therein and as otherwise prohibited by law, the Preferred Stock shall have voting rights on an as converted basis. So long as any shares of Preferred Stock are outstanding, the Company shall not, without the affirmative vote of the Holders of the shares o ...

... Voting Rights. Except as otherwise provided therein and as otherwise prohibited by law, the Preferred Stock shall have voting rights on an as converted basis. So long as any shares of Preferred Stock are outstanding, the Company shall not, without the affirmative vote of the Holders of the shares o ...

Carolinas Corporate Update

... 2015 was a record year for M&A and a record year for the K&L Gates Carolinas corporate practice. We are pleased to have partnered with our clients to advise them on a variety of notable strategic transactions, investments, and capital market offerings in this active and dynamic market. Our Carolinas ...

... 2015 was a record year for M&A and a record year for the K&L Gates Carolinas corporate practice. We are pleased to have partnered with our clients to advise them on a variety of notable strategic transactions, investments, and capital market offerings in this active and dynamic market. Our Carolinas ...

Glossary of the Capital Market

... (4) Risk arbitrage applies the principles of risk offset to mergers and other major corporate developments. The risk offsetting position(s) do not insulate the investor from certain event risks (such as termination of a merger agreement on the risk of completion of a transaction within a certain tim ...

... (4) Risk arbitrage applies the principles of risk offset to mergers and other major corporate developments. The risk offsetting position(s) do not insulate the investor from certain event risks (such as termination of a merger agreement on the risk of completion of a transaction within a certain tim ...

ch.11

... the market value of a mutual fund share found by dividing the net value of the fund by the number of shares issued ...

... the market value of a mutual fund share found by dividing the net value of the fund by the number of shares issued ...

Free Writing Prospectus Filed Pursuant to Rule 433 To Prospectus

... *Note: A securities rating is not a recommendation to buy, sell or hold securities and may be subject to review, revision, suspension, reduction or withdrawal at any time by the assigning rating agency. The issuer has filed a registration statement (including a prospectus), as amended, with the SEC ...

... *Note: A securities rating is not a recommendation to buy, sell or hold securities and may be subject to review, revision, suspension, reduction or withdrawal at any time by the assigning rating agency. The issuer has filed a registration statement (including a prospectus), as amended, with the SEC ...

4028-10-Syllabus

... – Market orders are executed immediately when a matching order(s) arrives irrespective of the stock price – The price may change during the waiting time ...

... – Market orders are executed immediately when a matching order(s) arrives irrespective of the stock price – The price may change during the waiting time ...

Exam Code - OoCities

... before, etc.), the company will have more money left over after making its investments to pay out as dividends. Statement b is false. If the company increases the proportion of equity financing in its target capital structure, it will need to either increase the proportion of equity (by increasing r ...

... before, etc.), the company will have more money left over after making its investments to pay out as dividends. Statement b is false. If the company increases the proportion of equity financing in its target capital structure, it will need to either increase the proportion of equity (by increasing r ...

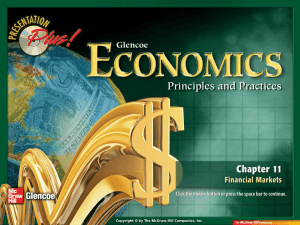

One Person Company •Limited Liability Partnership •Private

... “Public Company” A company : which is not a private company; private company which is Subsidiary of a Public Company ...

... “Public Company” A company : which is not a private company; private company which is Subsidiary of a Public Company ...

securities and exchange commission

... Not Applicable. Item 4. Ownership Provide the following information regarding the aggregate number and percentage of the class of securities of the issuer identified in Item 1. (a) Amount Beneficially Owned as of December 31, 2002: 1,200,439 (includes 374,000 shares purchasable under options exercis ...

... Not Applicable. Item 4. Ownership Provide the following information regarding the aggregate number and percentage of the class of securities of the issuer identified in Item 1. (a) Amount Beneficially Owned as of December 31, 2002: 1,200,439 (includes 374,000 shares purchasable under options exercis ...

Fair Market Value and Blockage Discounts: When the Market Doesn

... Dyl, “When an investor sells 100 shares of firm X to a dealer, the dealer reports a 100-share transaction; when another investor buys the 100 shares of firm X from the dealer, he reports another 100-share transaction. Only 100 shares of firm X have changed hands between the two investors, but tradin ...

... Dyl, “When an investor sells 100 shares of firm X to a dealer, the dealer reports a 100-share transaction; when another investor buys the 100 shares of firm X from the dealer, he reports another 100-share transaction. Only 100 shares of firm X have changed hands between the two investors, but tradin ...

Money Laundering in Securities Markets

... employee of a U.S. broker-dealer shutdown by regulators for fraudulent practices. The few securities that traded through the account are subject of various Securities Exchange Commission (S.E.C.) hearings and criminal investigations. Figure 1 shows only one month’s transactions, however it is repres ...

... employee of a U.S. broker-dealer shutdown by regulators for fraudulent practices. The few securities that traded through the account are subject of various Securities Exchange Commission (S.E.C.) hearings and criminal investigations. Figure 1 shows only one month’s transactions, however it is repres ...

The Greek Letters

... A portfolio manager is often interested in acquiring a put option on his or her portfolio. The provides protection against market declines while preserving the potential for a gain if the market does well. Options markets don’t always have the liquidity to absorb the trades required by managers of l ...

... A portfolio manager is often interested in acquiring a put option on his or her portfolio. The provides protection against market declines while preserving the potential for a gain if the market does well. Options markets don’t always have the liquidity to absorb the trades required by managers of l ...

stock market transactions

... average daily trading volume over a recent period. The higher the ratio, the higher the level of short sales. A short interest ratio of 2.0 for a particular stock indicates that the number of shares currently sold short is two times the number of shares traded per day, on average. A short interest r ...

... average daily trading volume over a recent period. The higher the ratio, the higher the level of short sales. A short interest ratio of 2.0 for a particular stock indicates that the number of shares currently sold short is two times the number of shares traded per day, on average. A short interest r ...

GNRX VanEck Vectors Generic Drugs ETF

... from what is shown because of differences in timing, the amount invested and fees and expenses. Index returns assume that dividends have been reinvested. Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, ...

... from what is shown because of differences in timing, the amount invested and fees and expenses. Index returns assume that dividends have been reinvested. Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, ...

19 PART II - PRICING IN PUBLIC ISSUE Pricing. 28. (1) An issuer

... (4) The cap on the price band shall be less than or equal to one hundred and twenty per cent. of the floor price. (5) The floor price or the final price shall not be less than the face value of the specified securities. Explanation: For the purposes of sub-regulation (4), the “cap on the price band ...

... (4) The cap on the price band shall be less than or equal to one hundred and twenty per cent. of the floor price. (5) The floor price or the final price shall not be less than the face value of the specified securities. Explanation: For the purposes of sub-regulation (4), the “cap on the price band ...

table 1 - private companies

... Private Companies pay a fixed revenue each turn to their owner who may be either a player or a Corporation. The location of these companies is shown on the board by the letters of the initials of their name. Unlike Corporations, Private Companies do not place tiles on the board or purchase trains. A ...

... Private Companies pay a fixed revenue each turn to their owner who may be either a player or a Corporation. The location of these companies is shown on the board by the letters of the initials of their name. Unlike Corporations, Private Companies do not place tiles on the board or purchase trains. A ...

SECURITIES AND EXCHANGE COMMISSION Washington, DC

... takeover tactics such as partial tender offers, selective open-market purchases and offers for all the shares of the Company made at less than full value or at an inappropriate time. The new Rights are intended to assure that the board of directors has the continued ability to protect shareholders a ...

... takeover tactics such as partial tender offers, selective open-market purchases and offers for all the shares of the Company made at less than full value or at an inappropriate time. The new Rights are intended to assure that the board of directors has the continued ability to protect shareholders a ...

Chap025 - U of L Class Index

... Difference between Warrants and Call Options • To a firm, a warrant is substantially different from a call option. - A call option sold on the firm’s stock is a private transaction between investors, in which the firm is not directly involved. - When a call option is exercised, existing stock merely ...

... Difference between Warrants and Call Options • To a firm, a warrant is substantially different from a call option. - A call option sold on the firm’s stock is a private transaction between investors, in which the firm is not directly involved. - When a call option is exercised, existing stock merely ...

1. Application for quotation of added securities

... acquisition of assets, clearly identify those assets.) ...

... acquisition of assets, clearly identify those assets.) ...

Macroeconomic Factors and the Pakistani Equity

... between behavior of stock prices and macroeconomic forces in developed countries. Now they have started to analyze these trends in the developing countries due to their significant and attractive profit potentials. The study has analyzed the impact of selected macroeconomic variables (exchange rate, ...

... between behavior of stock prices and macroeconomic forces in developed countries. Now they have started to analyze these trends in the developing countries due to their significant and attractive profit potentials. The study has analyzed the impact of selected macroeconomic variables (exchange rate, ...

Armour Residential REIT, Inc.

... Reference is made to our opinion dated December 7, 2010 and included as Exhibit 5.1 to the Registration Statement on Form S-3 (Registration No. 333-170646) (the "Registration Statement") filed with the Securities and Exchange Commission (the "Commission") on December 7, 2010 by ARMOUR Residential RE ...

... Reference is made to our opinion dated December 7, 2010 and included as Exhibit 5.1 to the Registration Statement on Form S-3 (Registration No. 333-170646) (the "Registration Statement") filed with the Securities and Exchange Commission (the "Commission") on December 7, 2010 by ARMOUR Residential RE ...

Form S-1/A Radius Health, Inc. - RDUS Filed: October 06, 2011

... issued in exchange for all of the shares of the Former Operating Company’s (defined below) common stock, par value $.01 per share (the “ Former Operating Company Common Stock ”), and shares of the Former Operating Company’s preferred stock, par value $.01 per share (the “ Former Operating Company Pr ...

... issued in exchange for all of the shares of the Former Operating Company’s (defined below) common stock, par value $.01 per share (the “ Former Operating Company Common Stock ”), and shares of the Former Operating Company’s preferred stock, par value $.01 per share (the “ Former Operating Company Pr ...