Slide 1 - UTA.edu

... • Consider a trader that wishes to short yen. They can use a put option. Suppose they have access to an August put with a strike price of 100.00 (all contracts are listed as cents per unit of foreign currency…except ¥, which is listed as cents per 100 units of foreign currency). Trader wishes to sel ...

... • Consider a trader that wishes to short yen. They can use a put option. Suppose they have access to an August put with a strike price of 100.00 (all contracts are listed as cents per unit of foreign currency…except ¥, which is listed as cents per 100 units of foreign currency). Trader wishes to sel ...

Determinants of stock-bond market comovement in the Eurozone

... two asset classes for the US or the major developed markets. In the European context, Kim et al (2006) find that real economic integration and the absence of currency risk induce increased stock-bond comovement. However, monetary policy convergence have created uncertainty about the economic prospec ...

... two asset classes for the US or the major developed markets. In the European context, Kim et al (2006) find that real economic integration and the absence of currency risk induce increased stock-bond comovement. However, monetary policy convergence have created uncertainty about the economic prospec ...

$33,250,000 3,500,000 Common Shares Price $9.50 per Common

... Subscriptions for Offered Shares will be received subject to rejection or allotment in whole or in part and the right is reserved to close the subscription books at any time without notice. The Offered Shares shall be taken up by the Underwriters, if at all, on or before a date not later than 42 day ...

... Subscriptions for Offered Shares will be received subject to rejection or allotment in whole or in part and the right is reserved to close the subscription books at any time without notice. The Offered Shares shall be taken up by the Underwriters, if at all, on or before a date not later than 42 day ...

An Indirect Impact of the Price to Book Value to the Stock Returns

... improve providing a conducive environment for ...

... improve providing a conducive environment for ...

Qualified Small Business Stock: Planning Opportunities

... •• You must acquire QSB stock as part of an original issuance, either directly through the corporation or an underwriter, in exchange for money, property (other than stock), or as compensation for services provided to the corporation (other than as an underwriter). ...

... •• You must acquire QSB stock as part of an original issuance, either directly through the corporation or an underwriter, in exchange for money, property (other than stock), or as compensation for services provided to the corporation (other than as an underwriter). ...

EMPLOYEE STOCK OWNERSHIP PLANS (“ESOPs”)

... ESOPs - Non-Tax Advantages Allow owner of closely held business to sell interest. Raise capital by selling newly issued shares. Improve company’s cash flow because sponsor contributes company shares, rather than cash. Provides employees with both retirement benefits and added incentives fro ...

... ESOPs - Non-Tax Advantages Allow owner of closely held business to sell interest. Raise capital by selling newly issued shares. Improve company’s cash flow because sponsor contributes company shares, rather than cash. Provides employees with both retirement benefits and added incentives fro ...

Policies and Procedures

... trades / deals actions of the client, the same shall borne by the client.The right to sell client’s securities or close client’s positions, without giving notice to the client, on account of non payment of client’s due. Without prejudice to the stock brokers other right (Including the right to refer ...

... trades / deals actions of the client, the same shall borne by the client.The right to sell client’s securities or close client’s positions, without giving notice to the client, on account of non payment of client’s due. Without prejudice to the stock brokers other right (Including the right to refer ...

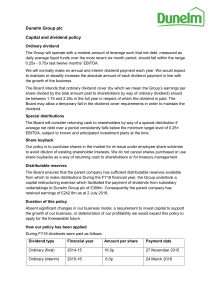

Dunelm Group plc Capital and dividend policy

... be between 1.75 and 2.25x in the full year in respect of which the dividend is paid. The Board may allow a temporary fall in the dividend cover requirements in order to maintain the dividend. Special distributions The Board will consider returning cash to shareholders by way of a special distributio ...

... be between 1.75 and 2.25x in the full year in respect of which the dividend is paid. The Board may allow a temporary fall in the dividend cover requirements in order to maintain the dividend. Special distributions The Board will consider returning cash to shareholders by way of a special distributio ...

Contributed Capital

... Recognition of compensation expense. The total compensation cost under the fair value method is the total fair value of the stock options that actually become vested. Stock options become vested on the date the employee's right to exercise the stock options is no longer contingent on remaining in th ...

... Recognition of compensation expense. The total compensation cost under the fair value method is the total fair value of the stock options that actually become vested. Stock options become vested on the date the employee's right to exercise the stock options is no longer contingent on remaining in th ...

words

... Value on any date shall be the average of the highest bid and lowest asked prices of the Shares on such system during the regular trading session on such date or on the last day preceding such date on which a sale was reported during the regular trading session; or (d) if (a), (b) and (c) do not app ...

... Value on any date shall be the average of the highest bid and lowest asked prices of the Shares on such system during the regular trading session on such date or on the last day preceding such date on which a sale was reported during the regular trading session; or (d) if (a), (b) and (c) do not app ...

Introducing the benefits of the capital markets to small and medium

... The Corporate Advisor will be responsible to ensure that the company achieves the right levels of corporate governance and transparency. The Corporate Advisor will also assist with applying for admission to Prospects through the completion of the relevant application forms, business plans, and other ...

... The Corporate Advisor will be responsible to ensure that the company achieves the right levels of corporate governance and transparency. The Corporate Advisor will also assist with applying for admission to Prospects through the completion of the relevant application forms, business plans, and other ...

Share reform and the performance of China`s listed companies

... reduction in government ownership might alleviate the multiple-principal problem, there are again some potentially offsetting considerations. In China, close government ties can provide firms with numerous benefits such as preferential access to production inputs and a smoothing or even a bypass of ...

... reduction in government ownership might alleviate the multiple-principal problem, there are again some potentially offsetting considerations. In China, close government ties can provide firms with numerous benefits such as preferential access to production inputs and a smoothing or even a bypass of ...

0000950123-06-011711 - Investor Relations

... These forward looking statements are identified by their use of terms and phrases such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “should,” “will” and similar terms and phrases, including references to assumptions. Such statements are ba ...

... These forward looking statements are identified by their use of terms and phrases such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “should,” “will” and similar terms and phrases, including references to assumptions. Such statements are ba ...

CHAPTER 7

... disclose information as to their riskiness, in order that investors may make informed purchase decisions. While the chapter clearly focuses on shares of a corporation, students must bear in mind that “securities” are broadly defined and can include not only shares and debt instruments, but many “non ...

... disclose information as to their riskiness, in order that investors may make informed purchase decisions. While the chapter clearly focuses on shares of a corporation, students must bear in mind that “securities” are broadly defined and can include not only shares and debt instruments, but many “non ...

english,

... and RTS (for Russia). Days with no trading in any of the observed market were left out. Returns (and all other variables, i.e. covariates) were calculated as two-day rollingaverage logarithmic returns (or changes) in order to control for the fact of the different open hours of the markets on which t ...

... and RTS (for Russia). Days with no trading in any of the observed market were left out. Returns (and all other variables, i.e. covariates) were calculated as two-day rollingaverage logarithmic returns (or changes) in order to control for the fact of the different open hours of the markets on which t ...

5N Plus Completes the Acquisition of MCP Group SA and a $125

... of MCP is approximately €235.2 million or CDN$317.3 million. In addition, 5N Plus assumed the net debt of MCP, which represented €65.6 million as at December 31, 2010, most of which is comprised of short‐term debt used to fund MCP’s working‐capital requirements. The promissory notes in the amoun ...

... of MCP is approximately €235.2 million or CDN$317.3 million. In addition, 5N Plus assumed the net debt of MCP, which represented €65.6 million as at December 31, 2010, most of which is comprised of short‐term debt used to fund MCP’s working‐capital requirements. The promissory notes in the amoun ...

Lecture 15

... funds, is that the company incurs issuing costs or flotation costs when new securities are issued. These include any fees paid to the investment dealer and/or any discounts provided to investors to entice them to purchase the securities. As a result, the cost of issuing new securities will be hi ...

... funds, is that the company incurs issuing costs or flotation costs when new securities are issued. These include any fees paid to the investment dealer and/or any discounts provided to investors to entice them to purchase the securities. As a result, the cost of issuing new securities will be hi ...

As filed with the Securities and Exchange Commission

... Statement by the Registrant pursuant to Section 13(a), 13(c), 14 and 15(d) of the Exchange Act and prior to the filing of a posteffective amendment that indicates that all shares of Common Stock offered hereunder have been sold or which deregisters all shares of Common Stock remaining unsold shall b ...

... Statement by the Registrant pursuant to Section 13(a), 13(c), 14 and 15(d) of the Exchange Act and prior to the filing of a posteffective amendment that indicates that all shares of Common Stock offered hereunder have been sold or which deregisters all shares of Common Stock remaining unsold shall b ...

Financial Market Shocks and the Macroeconomy

... risk aversion R. Informed agents learn the realization of the technology shock θ perfectly after date 0 and prior to trade at date 1. We also assume that there is an exogenous shock which influences participation in the financial market, and, in turn, affects the supply of shares available to the inf ...

... risk aversion R. Informed agents learn the realization of the technology shock θ perfectly after date 0 and prior to trade at date 1. We also assume that there is an exogenous shock which influences participation in the financial market, and, in turn, affects the supply of shares available to the inf ...

Train Travel Holdings, Inc.

... Swartz was appointed as president, chief executive officer and director on October 31, 2014. Previously he was the president, chief executive officer and director of our company from January 23, 2014 to October 3, 2014. Swartz’s business experience includes titles as Managing Director of Sunbelt So ...

... Swartz was appointed as president, chief executive officer and director on October 31, 2014. Previously he was the president, chief executive officer and director of our company from January 23, 2014 to October 3, 2014. Swartz’s business experience includes titles as Managing Director of Sunbelt So ...

50 The LC Gupta Committee Report: Some Observations

... India has seen significant improvements during the nineties with the introduction of screen-based trading, creation of depositories, and dematerialisation of some of the shares; the participants in equity trading have had long exposures to this activity and hence have a fairly good understanding of ...

... India has seen significant improvements during the nineties with the introduction of screen-based trading, creation of depositories, and dematerialisation of some of the shares; the participants in equity trading have had long exposures to this activity and hence have a fairly good understanding of ...

Derivatives Chapter 2

... What options are and where they come from Why options are a good idea Where and how options trade Components of the option premium Where profits and losses come from with options ...

... What options are and where they come from Why options are a good idea Where and how options trade Components of the option premium Where profits and losses come from with options ...

Commercial law (sometimes known as business law) is the body of

... In the United States, a company may or may not be a separate legal entity. Any business or for profit economic activity may be referred to as a company, examples of this include my company, our company, the company, and their company. A corporation may accurately be called a company. However, a comp ...

... In the United States, a company may or may not be a separate legal entity. Any business or for profit economic activity may be referred to as a company, examples of this include my company, our company, the company, and their company. A corporation may accurately be called a company. However, a comp ...

No securities regulatory authority has expressed an opinion about

... This short form prospectus contains forward-looking statements within the meaning of applicable Canadian securities laws. Forward-looking statements may include estimates, plans, expectations, opinions, forecasts, projections, guidance or other statements that are not statements of fact. When used i ...

... This short form prospectus contains forward-looking statements within the meaning of applicable Canadian securities laws. Forward-looking statements may include estimates, plans, expectations, opinions, forecasts, projections, guidance or other statements that are not statements of fact. When used i ...