Twitter Volume Spikes: Analysis and Application in Stock Trading

... $AAPL represents the stock of Apple Inc. and $GOOG represents the stock of Google Inc. When collecting public tweets on S&P 500 stocks, we only search for tweets that follow the above convention (i.e., having a dollar sign before a stock symbol). This is because many stock symbols (e.g., A, CAT, GAS ...

... $AAPL represents the stock of Apple Inc. and $GOOG represents the stock of Google Inc. When collecting public tweets on S&P 500 stocks, we only search for tweets that follow the above convention (i.e., having a dollar sign before a stock symbol). This is because many stock symbols (e.g., A, CAT, GAS ...

Market Segmentation, Information Asymmetry

... announced, the revision of investors to their prior beliefs and expected payoff causes a change in market price. The investors with more pre-disclosure information revise their belief less than the investors who have less pre-disclosure information. To examine this, we place our focus on market reac ...

... announced, the revision of investors to their prior beliefs and expected payoff causes a change in market price. The investors with more pre-disclosure information revise their belief less than the investors who have less pre-disclosure information. To examine this, we place our focus on market reac ...

on registration of movable property pledge

... Shareholder rights index Is it required for a Buyer to get shareholders ' approval every time it issues stock? ...

... Shareholder rights index Is it required for a Buyer to get shareholders ' approval every time it issues stock? ...

Form 8937 - Seventy Seven Energy

... Warrants, and Litigation Trust interests: a. Assuming the Reorganization qualifies as a recapitalization under section 368(a)(1)(E) of the Internal Revenue Code, a Senior Unsecured Noteholder’s aggregate tax basis in the shares of New Common Stock (and New A Warrants, as applicable) (other than any ...

... Warrants, and Litigation Trust interests: a. Assuming the Reorganization qualifies as a recapitalization under section 368(a)(1)(E) of the Internal Revenue Code, a Senior Unsecured Noteholder’s aggregate tax basis in the shares of New Common Stock (and New A Warrants, as applicable) (other than any ...

Anomaly Detection Using Unsupervised Profiling Method in Time

... will not only prevent the fraud but also alert the stock markets and broking houses to unusual movements in the markets. ...

... will not only prevent the fraud but also alert the stock markets and broking houses to unusual movements in the markets. ...

Cash flows from operating activities

... from operating activities uses the logic that a change in any balance sheet account (including Cash) can be analyzed in terms of changes in other balance sheet accounts. Any change in the Cash account can be determined by analyzing changes in liability, stockholders’ equity, and noncash asset ...

... from operating activities uses the logic that a change in any balance sheet account (including Cash) can be analyzed in terms of changes in other balance sheet accounts. Any change in the Cash account can be determined by analyzing changes in liability, stockholders’ equity, and noncash asset ...

Mergers and Acquisitions

... requires, for example, that all shareholders must be given the same information, and the target company should not take any action to frustrate an offer (e.g. use poison pills) without allowing shareholders to vote on it. The Code also sets time limits for various stages of a bid and rules concernin ...

... requires, for example, that all shareholders must be given the same information, and the target company should not take any action to frustrate an offer (e.g. use poison pills) without allowing shareholders to vote on it. The Code also sets time limits for various stages of a bid and rules concernin ...

IOSR Journal of Economics and Finance (IOSR-JEF)

... means of financing a business or as a means for companies to obtain funds from investors or investors that the fund as the expansion of the company. Both capital markets as a means for people to invest in financial instruments such as stocks, bonds, and others. In Indonesia, investors who want to in ...

... means of financing a business or as a means for companies to obtain funds from investors or investors that the fund as the expansion of the company. Both capital markets as a means for people to invest in financial instruments such as stocks, bonds, and others. In Indonesia, investors who want to in ...

Does Equity Derivatives Trading Affect the Systematic Risk of the

... the effect of stock index futures trading on the price volatility of the underlying assets has been widely examined in finance literature, SSFs, being newer derivatives products, have not received much attention—in particular, their effect in emerging markets.2 While SSFs are a useful addition to th ...

... the effect of stock index futures trading on the price volatility of the underlying assets has been widely examined in finance literature, SSFs, being newer derivatives products, have not received much attention—in particular, their effect in emerging markets.2 While SSFs are a useful addition to th ...

Hybrid Securities: A Basic Look at Monthly Income Preferred

... stock with a comparable rating from Standard & Poor’s for both June and December 1996. In June 1996, MIPS offered yields approximately 0.50% higher than comparably rated corporate bonds. In December 1996, the yield spread between MIPS and corporate bonds widened to approximately 1.00%. MIPS offered ...

... stock with a comparable rating from Standard & Poor’s for both June and December 1996. In June 1996, MIPS offered yields approximately 0.50% higher than comparably rated corporate bonds. In December 1996, the yield spread between MIPS and corporate bonds widened to approximately 1.00%. MIPS offered ...

Shareholder Wealth and Volatility Effects of Stock Splits Some

... 711% indicating that Finnish companies have split quite radically. The original Swedish sample consists of 90 stock splits of which 89 are pure in the sense that they do not involve a simultaneous stock dividend. The average time interval between the announcement and exdate for the Swedish companies ...

... 711% indicating that Finnish companies have split quite radically. The original Swedish sample consists of 90 stock splits of which 89 are pure in the sense that they do not involve a simultaneous stock dividend. The average time interval between the announcement and exdate for the Swedish companies ...

FREE Sample Here - Find the cheapest test bank for your

... a. An open-market dividend reinvestment plan will be most attractive to companies that need new equity and would otherwise have to issue additional shares of common stock through investment bankers. b. Stock repurchases tend to reduce financial leverage. c. If a company declares a 2-for-1 stock spli ...

... a. An open-market dividend reinvestment plan will be most attractive to companies that need new equity and would otherwise have to issue additional shares of common stock through investment bankers. b. Stock repurchases tend to reduce financial leverage. c. If a company declares a 2-for-1 stock spli ...

Fear of the Unknown: Familiarity and Economic Decisions

... First, some of the important findings of previous studies are driven by the assumption that some assets have greater uncertainty than others—an assumption that is often reasonable. However, our main findings apply even when investors are equally uncertain about the returns of different assets. For e ...

... First, some of the important findings of previous studies are driven by the assumption that some assets have greater uncertainty than others—an assumption that is often reasonable. However, our main findings apply even when investors are equally uncertain about the returns of different assets. For e ...

IB Comment Letter to SEC Opposing New Margin Requirements for

... “pattern day trader”, the new rules will reduce the liquidity and efficiency of the market. Indeed, the rise of cheaper and more sophisticated electronic order routing systems -- like the one Interactive Brokers provides to its customers -- is providing to customers for the first time in history the ...

... “pattern day trader”, the new rules will reduce the liquidity and efficiency of the market. Indeed, the rise of cheaper and more sophisticated electronic order routing systems -- like the one Interactive Brokers provides to its customers -- is providing to customers for the first time in history the ...

CB(1)440/15-16(08)

... SFC would take to protect small investors given that short selling activities had a significant impact on share prices. 13. SFC advised that while short selling was a highly sophisticated investment activity which was undertaken mostly by large investment institutions and investors, it was a legitim ...

... SFC would take to protect small investors given that short selling activities had a significant impact on share prices. 13. SFC advised that while short selling was a highly sophisticated investment activity which was undertaken mostly by large investment institutions and investors, it was a legitim ...

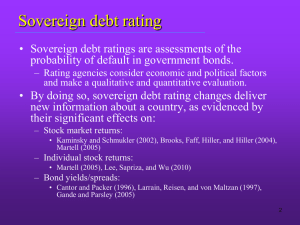

Sovereign Debt Rating and Stock Liquidity around the World

... • We study the impact of sovereign rating changes on stock liquidity for 40 countries for 1990-2009. • Our findings show that sovereign rating changes have a significant and robust impact on stock liquidity. – The impact is nonlinear and asymmetric and varies across stocks and countries. – In a cros ...

... • We study the impact of sovereign rating changes on stock liquidity for 40 countries for 1990-2009. • Our findings show that sovereign rating changes have a significant and robust impact on stock liquidity. – The impact is nonlinear and asymmetric and varies across stocks and countries. – In a cros ...

DRONE VOLT Raises € 1.8 million, is adopting a funding line of € 5

... published by Bloomberg) to ten (10) trading days preceding (i) the date of issue of Emission Coupons for the first tranche and (ii) the exercise of Warrants Issue request that led to the issuance of the warrants OCABSA which are seconded to the following tranches, being specified that the subscripti ...

... published by Bloomberg) to ten (10) trading days preceding (i) the date of issue of Emission Coupons for the first tranche and (ii) the exercise of Warrants Issue request that led to the issuance of the warrants OCABSA which are seconded to the following tranches, being specified that the subscripti ...

PRESS RELEASE UniCredit Board approves rights issue terms and

... or solicitation of an offer to purchase securities, in the United States, Australia, Canada or Japan or any other jurisdiction where such an offer or solicitation would require the approval of local authorities or otherwise be unlawful (the “Other Countries”). Any public offering will be conducted i ...

... or solicitation of an offer to purchase securities, in the United States, Australia, Canada or Japan or any other jurisdiction where such an offer or solicitation would require the approval of local authorities or otherwise be unlawful (the “Other Countries”). Any public offering will be conducted i ...

share issuance and equity returns in the istanbul stock exchange

... after year t; ME is the natural logarithm of market equity measured at the end of previous June; BM is the natural logarithm of the ratio of book value of equity to market value of equity measured at the end of the previous calendar year; MOM is the equity returns for the past 6 months and ISSUEt-6, ...

... after year t; ME is the natural logarithm of market equity measured at the end of previous June; BM is the natural logarithm of the ratio of book value of equity to market value of equity measured at the end of the previous calendar year; MOM is the equity returns for the past 6 months and ISSUEt-6, ...

Corporate Actions Policy 5.0

... means (a) a cash and/or scrip dividend, a bonus or scrip issue, a rights issue, a share split, subdivision or consolidation, a demerger or any other event affecting or giving rise to a right or entitlement attaching or accruing to the shares of, or ownership of shares in, a company; or (b) a takeove ...

... means (a) a cash and/or scrip dividend, a bonus or scrip issue, a rights issue, a share split, subdivision or consolidation, a demerger or any other event affecting or giving rise to a right or entitlement attaching or accruing to the shares of, or ownership of shares in, a company; or (b) a takeove ...

Prediction of Stock Market Shift using Sentiment Analysis of Twitter

... today. People like to post minutiae of their lives on such networks. While some people might argue that this is irritating and a waste of bandwidth, time and who knows what else, many entities certainly use it to their advantage. For example, such details of people's lives gives a rare insight into ...

... today. People like to post minutiae of their lives on such networks. While some people might argue that this is irritating and a waste of bandwidth, time and who knows what else, many entities certainly use it to their advantage. For example, such details of people's lives gives a rare insight into ...

Implications of Proposed Bank Capital Regulations for Investors in

... replace called TruPS quickly. As reflected in Exhibit 1, there has been more than $24 billion in redemptions since the NPR was published. We also have seen increased issuance of traditional preferred stock this year. However, many banks are shrinking their balance sheets and have plenty of common eq ...

... replace called TruPS quickly. As reflected in Exhibit 1, there has been more than $24 billion in redemptions since the NPR was published. We also have seen increased issuance of traditional preferred stock this year. However, many banks are shrinking their balance sheets and have plenty of common eq ...

preferred securities - Janney Montgomery Scott LLC

... restrictions forced some recipients of government assistance to suspend preferred dividends. Even without an outright suspension, as perceptions of an issuer’s credit quality change over time, credit/suspension risk may increase or decrease, harming or benefiting an issue’s market value. An issuer t ...

... restrictions forced some recipients of government assistance to suspend preferred dividends. Even without an outright suspension, as perceptions of an issuer’s credit quality change over time, credit/suspension risk may increase or decrease, harming or benefiting an issue’s market value. An issuer t ...

Accounting Fraud: Learning from the Wrongs

... on such fraud cases as MiniScribe and Phar-Mor. "Overstating revenues and concealing obsolete inventory happen in a majority of misstated financial statements," he adds. "You see it particularly in instances where there is major financial statement manipulation involving products or services, includ ...

... on such fraud cases as MiniScribe and Phar-Mor. "Overstating revenues and concealing obsolete inventory happen in a majority of misstated financial statements," he adds. "You see it particularly in instances where there is major financial statement manipulation involving products or services, includ ...