Article: MFI lending rates: pass-through in the time of non

... more recent steep decline in lending rates. While the non-standard measures introduced by the ECB since June 2014 are relatively diverse in nature, the broad transmission channels through which they affect the economy are similar and relate to the bank funding cost wedge and bank capital charges. Th ...

... more recent steep decline in lending rates. While the non-standard measures introduced by the ECB since June 2014 are relatively diverse in nature, the broad transmission channels through which they affect the economy are similar and relate to the bank funding cost wedge and bank capital charges. Th ...

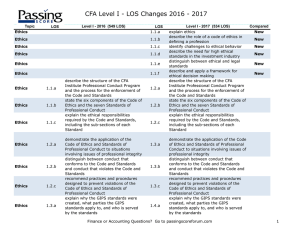

CFA Level I - LOS Changes 2016 - 2017

... describe the scope of the GIPS standards with respect to an investment firm’s definition and historical performance record explain how the GIPS standards are implemented in countries with existing standards for performance reporting and describe the appropriate response when the GIPS standards and l ...

... describe the scope of the GIPS standards with respect to an investment firm’s definition and historical performance record explain how the GIPS standards are implemented in countries with existing standards for performance reporting and describe the appropriate response when the GIPS standards and l ...

Report: Inquiry into Financial Products and Services in Australia

... 9. the need for any legislative or regulatory change. On 16 March 2009 the Senate agreed that the following additional matter be referred to the Parliamentary Joint Committee on Corporations and Financial Services as part of that committee's inquiry into financial products and services in Australia, ...

... 9. the need for any legislative or regulatory change. On 16 March 2009 the Senate agreed that the following additional matter be referred to the Parliamentary Joint Committee on Corporations and Financial Services as part of that committee's inquiry into financial products and services in Australia, ...

accounting standards and information: inferences from cross

... compared to other regulated industries, financial regulation (particularly capital adequacy standards), not only is typically couched in terms of accounting concepts, but tends to align regulators’ interests closely with those of at least some outside investors. Accordingly, interplay between regula ...

... compared to other regulated industries, financial regulation (particularly capital adequacy standards), not only is typically couched in terms of accounting concepts, but tends to align regulators’ interests closely with those of at least some outside investors. Accordingly, interplay between regula ...

unit 7 financial and operating leverage module - 2

... The use of the fixed-charges sources of funds, such as debt and preference capital along with the owners’ equity in the capital structure, is described as financial leverage or gearing or trading on equity. The use of the term trading on equity is derived from the fact that it is the owner’s equity ...

... The use of the fixed-charges sources of funds, such as debt and preference capital along with the owners’ equity in the capital structure, is described as financial leverage or gearing or trading on equity. The use of the term trading on equity is derived from the fact that it is the owner’s equity ...

Computershare Limited Securities Trading Policy

... Generally speaking, the Corporations Act 2001 (Cth) prohibits a person who has ‘inside information’ about an entity, that is not generally available to the market, from trading in the securities of that entity either personally or through another person (including a family member, friend, associate, ...

... Generally speaking, the Corporations Act 2001 (Cth) prohibits a person who has ‘inside information’ about an entity, that is not generally available to the market, from trading in the securities of that entity either personally or through another person (including a family member, friend, associate, ...

The Sukuk Market Comes of Age - Franklin Templeton Hong Kong

... product with the right value proposition over a conventional product.11 This rise in retail demand is reflected in doubledigit growth in the Islamic banking industry, and the increased appetite for investment-grade, Shariah-compliant, liquid securities among corporate treasurers, as well as fund man ...

... product with the right value proposition over a conventional product.11 This rise in retail demand is reflected in doubledigit growth in the Islamic banking industry, and the increased appetite for investment-grade, Shariah-compliant, liquid securities among corporate treasurers, as well as fund man ...

Primary Market

... High-quality firms were able to borrow cheaply in the commercial paper market rather than loans from commercial banks. ...

... High-quality firms were able to borrow cheaply in the commercial paper market rather than loans from commercial banks. ...

Transfers and Servicing (Topic 860)

... A discussion of the potential risks associated with the agreements and the related collateral pledged, including obligations arising from a decline in the fair value of the collateral pledged and how those risks are managed. ...

... A discussion of the potential risks associated with the agreements and the related collateral pledged, including obligations arising from a decline in the fair value of the collateral pledged and how those risks are managed. ...

More Mortgages, Lower Growth? - Economics of Credit And Debt

... as part of the the originate-to-distribute model of lending (Purnanandam, 2011). Softening of loan standard and securitization were amplified by low policy rates (Maddaloni, 2011), while house price declines and deteriorating underwriting standards triggered the exceptional rise in defaults from 200 ...

... as part of the the originate-to-distribute model of lending (Purnanandam, 2011). Softening of loan standard and securitization were amplified by low policy rates (Maddaloni, 2011), while house price declines and deteriorating underwriting standards triggered the exceptional rise in defaults from 200 ...

Mortgages and Monetary Policy

... and the one-period bond market (a real shock)—are estimated by matching the volatility and persistence of the long-term nominal interest rate and the long-short spread. Similarly to Atkeson and Kehoe (2009), the nominal shock turns out to be highly persistent, shifting the level of the nominal yield ...

... and the one-period bond market (a real shock)—are estimated by matching the volatility and persistence of the long-term nominal interest rate and the long-short spread. Similarly to Atkeson and Kehoe (2009), the nominal shock turns out to be highly persistent, shifting the level of the nominal yield ...

Mortgages and Monetary Policy

... mortgage debt to (annual) GDP ratio in developed economies has reached on average 70% in 2009, although there is a large cross-country variation (International Monetary Fund, 2011, Chapter 3). In some countries outstanding mortgage debt is even larger than government debt and its maturity is longer ...

... mortgage debt to (annual) GDP ratio in developed economies has reached on average 70% in 2009, although there is a large cross-country variation (International Monetary Fund, 2011, Chapter 3). In some countries outstanding mortgage debt is even larger than government debt and its maturity is longer ...

EU Clearing Obligation for Interest Rate Swaps Set for June 2016

... Delegated Regulation does not specifically state that the clearing obligation for IRS applies to third country entities and does not include them in the categories of counterparties. As a result, it could be argued that no effective deadline is established under the Delegated Regulation for the clea ...

... Delegated Regulation does not specifically state that the clearing obligation for IRS applies to third country entities and does not include them in the categories of counterparties. As a result, it could be argued that no effective deadline is established under the Delegated Regulation for the clea ...

Intermediary Asset Pricing

... mortgages, etc., and that all investment in these assets is made by intermediaries. While clearly in practice there are investments in risky assets that do not require the expertise of an intermediary, the exercise provides a benchmark for our intermediation model. As noted above, over 50% of financ ...

... mortgages, etc., and that all investment in these assets is made by intermediaries. While clearly in practice there are investments in risky assets that do not require the expertise of an intermediary, the exercise provides a benchmark for our intermediation model. As noted above, over 50% of financ ...

Model Special Purpose Financial Statements

... In May 2015 the Government charged the Board of Taxation (BoT) with the task of leading the development of a code that promotes greater public disclosure of tax information by large corporates. The BoT released a consultation paper containing its preliminary findings and recommendations to Governmen ...

... In May 2015 the Government charged the Board of Taxation (BoT) with the task of leading the development of a code that promotes greater public disclosure of tax information by large corporates. The BoT released a consultation paper containing its preliminary findings and recommendations to Governmen ...

printmgr file - Goldman Sachs

... corporation, together with its consolidated subsidiaries (collectively, the firm), is a leading global investment banking, securities and investment management firm that provides a wide range of financial services to a substantial and diversified client base that includes corporations, financial ins ...

... corporation, together with its consolidated subsidiaries (collectively, the firm), is a leading global investment banking, securities and investment management firm that provides a wide range of financial services to a substantial and diversified client base that includes corporations, financial ins ...

annual report 2015 - RHB Banking Group

... The diamond represents RHB’s clarity of focus towards achieving its vision of being a leading multinational financial services group. The wire links further symbolise our commitment to fostering greater ties with our customers and key stakeholders by placing them at the centre of what we do, as desc ...

... The diamond represents RHB’s clarity of focus towards achieving its vision of being a leading multinational financial services group. The wire links further symbolise our commitment to fostering greater ties with our customers and key stakeholders by placing them at the centre of what we do, as desc ...

SHERWIN WILLIAMS CO (Form: 10-K, Received: 03

... States, 5 in Canada and 2 in Puerto Rico. In 2004, there were 296 net new stores opened or acquired (294 in the United States). In 2003, there were 45 net new stores opened or acquired (41 in the United States). This Segment also manufactures OEM product finishes that are sold through the Segment’s ...

... States, 5 in Canada and 2 in Puerto Rico. In 2004, there were 296 net new stores opened or acquired (294 in the United States). In 2003, there were 45 net new stores opened or acquired (41 in the United States). This Segment also manufactures OEM product finishes that are sold through the Segment’s ...