Global Fixed Income Portfolio

... Inflation risk is the risk that the purchasing power of the cash flows received from a bond (interest and principal) will decline over time because of inflation Event risk is the risk that some unusual event could cause the price of bonds to decrease (e.g. natural disaster, corporate takeover, a reg ...

... Inflation risk is the risk that the purchasing power of the cash flows received from a bond (interest and principal) will decline over time because of inflation Event risk is the risk that some unusual event could cause the price of bonds to decrease (e.g. natural disaster, corporate takeover, a reg ...

ACCA F9 Workbook Questions 1

... B. By providing insurance on transactions for buyers and sellers. C. By providing finance to enable transactions to take place. D. By selling foreign currency on the currencies exchange. Short Form Questions 1. What are the 4 targets of economic policy? 2. Name 2 examples of cost-push inflation. 3. ...

... B. By providing insurance on transactions for buyers and sellers. C. By providing finance to enable transactions to take place. D. By selling foreign currency on the currencies exchange. Short Form Questions 1. What are the 4 targets of economic policy? 2. Name 2 examples of cost-push inflation. 3. ...

Chapter 7 Bequests and the modified golden rule

... bt+1 to maximize Ut ; taking into account the descendants’optimal responses to the received bequest, bt+1 . In this perspective it might seem inadequate that we have considered only the partial derivative of Ut w.r.t. bt+1 ; not the total derivative. Fortunately, in view of the envelope theorem our ...

... bt+1 to maximize Ut ; taking into account the descendants’optimal responses to the received bequest, bt+1 . In this perspective it might seem inadequate that we have considered only the partial derivative of Ut w.r.t. bt+1 ; not the total derivative. Fortunately, in view of the envelope theorem our ...

Two Essays on Adverse Selection in Annuity Markets

... an insurance market. However, their result relies heavily on the assumption that customers can buy only one insurance contract such that the insurer sets both price and quantity. They admit themselves that this may be an objectionable assumption in some cases, and Walliser (2000) argues that it inde ...

... an insurance market. However, their result relies heavily on the assumption that customers can buy only one insurance contract such that the insurer sets both price and quantity. They admit themselves that this may be an objectionable assumption in some cases, and Walliser (2000) argues that it inde ...

Sample Chapter - McGraw Hill Higher Education

... The holding-period return is a simple and unambiguous measure of investment return over a single period. But often you will be interested in average returns over longer periods of time. For example, you might want to measure how well a mutual fund has performed over the preceding five-year period. I ...

... The holding-period return is a simple and unambiguous measure of investment return over a single period. But often you will be interested in average returns over longer periods of time. For example, you might want to measure how well a mutual fund has performed over the preceding five-year period. I ...

managing foreign exchange risk with derivatives

... The firm operates in a highly competitive industry with numerous large and small competitors. Competition comes from both US-based and foreign manufacturers. HDG is tightly focused in its primary industry which is a growing market and highly dependent on technological innovation. “Flexibility in all ...

... The firm operates in a highly competitive industry with numerous large and small competitors. Competition comes from both US-based and foreign manufacturers. HDG is tightly focused in its primary industry which is a growing market and highly dependent on technological innovation. “Flexibility in all ...

2013-2 ESMA Report - Review of practices related to

... discount rates as well as sensitivity analysis where a reasonable change in a key assumption would lead to impairment. 17. European enforcers have frequently encountered enforcement issues related to impairment testing of goodwill and the lack of robust disclosures about management judgments and par ...

... discount rates as well as sensitivity analysis where a reasonable change in a key assumption would lead to impairment. 17. European enforcers have frequently encountered enforcement issues related to impairment testing of goodwill and the lack of robust disclosures about management judgments and par ...

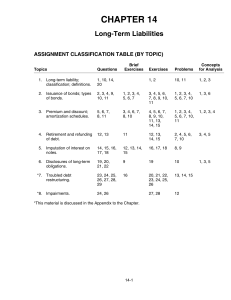

FREE Sample Here - Find the cheapest test bank for your

... A. does not effect the present value of the future amount. B. increases the present value of a future amount. C. decreases the present value of a future amount. D. none of the statements associated with this question are correct. ...

... A. does not effect the present value of the future amount. B. increases the present value of a future amount. C. decreases the present value of a future amount. D. none of the statements associated with this question are correct. ...

THE MIRAGE OF TRIANGULAR ARBITRAGE IN THE SPOT

... transaction data is used. Indicative data seem particularly unsuitable to many market analyses today because banks are now able to provide their clients with automated executable prices through an electronic trading platform so there is even less incentive for them to make their indicative quotes ac ...

... transaction data is used. Indicative data seem particularly unsuitable to many market analyses today because banks are now able to provide their clients with automated executable prices through an electronic trading platform so there is even less incentive for them to make their indicative quotes ac ...

Estimating the Private Sector Rental Vacancy Rate for Canterbury

... We measure the private sector rental vacancy rate in the DBH Tenancy Bond database. It is a high frequency measure with the potential to replicate this at a regional level. We do not count every property in the housing stock and their nature of tenure. Our calculations should be interpreted as an es ...

... We measure the private sector rental vacancy rate in the DBH Tenancy Bond database. It is a high frequency measure with the potential to replicate this at a regional level. We do not count every property in the housing stock and their nature of tenure. Our calculations should be interpreted as an es ...

Economics of Money, Banking, and Financial Markets, 8e

... A) A liquid asset is one that can be quickly and cheaply converted into cash. B) The demand for a bond declines when it becomes less liquid, decreasing the interest rate spread between it and relatively more liquid bonds. C) The differences in bond interest rates reflect differences in default risk ...

... A) A liquid asset is one that can be quickly and cheaply converted into cash. B) The demand for a bond declines when it becomes less liquid, decreasing the interest rate spread between it and relatively more liquid bonds. C) The differences in bond interest rates reflect differences in default risk ...

5. The impact of real interest rates in the euro area

... order to obtain the corresponding real interest rate. Several approaches to this estimation are possible, but there is no agreement on which one is more appropriate in general, with each possessing advantages and disadvantages. Another difficulty is due to the fact that economic agents are heterogen ...

... order to obtain the corresponding real interest rate. Several approaches to this estimation are possible, but there is no agreement on which one is more appropriate in general, with each possessing advantages and disadvantages. Another difficulty is due to the fact that economic agents are heterogen ...

Sustainable Withdrawal Rates From Your Retirement Portfolio

... year’s percentage change in the consumer price index. The objective of inflation adjustment in Equation (2) is to maintain the purchasing power of the monthly withdrawal amount. As an alternative to the portfolio success rate analysis, we revised the methodology so that the withdrawal rate is the op ...

... year’s percentage change in the consumer price index. The objective of inflation adjustment in Equation (2) is to maintain the purchasing power of the monthly withdrawal amount. As an alternative to the portfolio success rate analysis, we revised the methodology so that the withdrawal rate is the op ...

The Liquidity Premium of Near-Money Assets

... Gertler (1995) note that the CD rate/T-bill spread rises during periods of monetary tightening. They interpret this finding as indicative of an imperfectly elastic demand for bank liabilities when banks respond to monetary tightening by looking for non-deposit funding. The results in this paper sugg ...

... Gertler (1995) note that the CD rate/T-bill spread rises during periods of monetary tightening. They interpret this finding as indicative of an imperfectly elastic demand for bank liabilities when banks respond to monetary tightening by looking for non-deposit funding. The results in this paper sugg ...

Interest rate swap

An interest rate swap (IRS) is a liquid financial derivative instrument in which two parties agree to exchange interest rate cash flows, based on a specified notional amount from a fixed rate to a floating rate (or vice versa) or from one floating rate to another. Interest rate swaps can be used for both hedging and speculating.