CALCULATING MATURITY VALUE

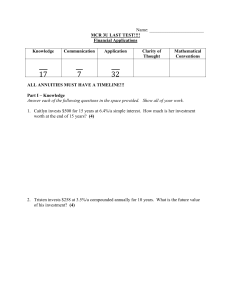

... EXAMPLE 9.3A Find the maturity value (accumulated value) for an investment of $10,000 for 10 months at 6.7% p.a. simple interest. ...

... EXAMPLE 9.3A Find the maturity value (accumulated value) for an investment of $10,000 for 10 months at 6.7% p.a. simple interest. ...

F.IF.B.4: Evaluating Exponential Expressions

... 8 The number of bacteria that grow in a petri dish is approximated by the function G(t) = 500e 0.216t , where t is time, in minutes. Use this model to approximate, to the nearest integer, the number of bacteria present after one half-hour. ...

... 8 The number of bacteria that grow in a petri dish is approximated by the function G(t) = 500e 0.216t , where t is time, in minutes. Use this model to approximate, to the nearest integer, the number of bacteria present after one half-hour. ...

MBS Note

... – CPR grows 0.2% per month before the loan/pool reaches 30 month / 6% – Then CPR will stay flat at 6% for the remaining life of the loan/pool – CPR = 6% * min (t / 30, 1) ...

... – CPR grows 0.2% per month before the loan/pool reaches 30 month / 6% – Then CPR will stay flat at 6% for the remaining life of the loan/pool – CPR = 6% * min (t / 30, 1) ...

Notes chapter 5

... Amortization tables are widely used for home mortgages, auto loans, business loans, retirement plans, etc. EXAMPLE: Construct an amortization schedule for a $1,000, 10% annual rate loan with 3 equal payments. ...

... Amortization tables are widely used for home mortgages, auto loans, business loans, retirement plans, etc. EXAMPLE: Construct an amortization schedule for a $1,000, 10% annual rate loan with 3 equal payments. ...

Chapter 7

... 4. Advertise “Notice of Sale” with date, time and place of sale (Borrower has limited right to reinstate) 5. Sale to highest bidder for cash (loan amount + costs) 6. Trustee’s deed is issued (all sales final; borrower has no right of redemption) 7. Disbursement of funds ...

... 4. Advertise “Notice of Sale” with date, time and place of sale (Borrower has limited right to reinstate) 5. Sale to highest bidder for cash (loan amount + costs) 6. Trustee’s deed is issued (all sales final; borrower has no right of redemption) 7. Disbursement of funds ...

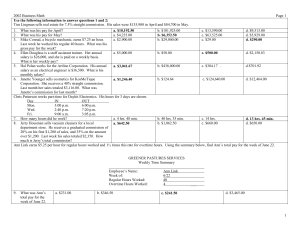

Sample Questions

... 8. The Howe family recently bought a house. The house has a 30-year, $165,000 mortgage with monthly payments and a nominal (annual) interest rate of 8 percent. What is the total dollar amount of interest the family will pay during the first three years of their mortgage? (Assume that all payments ar ...

... 8. The Howe family recently bought a house. The house has a 30-year, $165,000 mortgage with monthly payments and a nominal (annual) interest rate of 8 percent. What is the total dollar amount of interest the family will pay during the first three years of their mortgage? (Assume that all payments ar ...

Monthly meeting_2010..

... Note 1: Stock market return calculated from 31/5 to 21/6. Note 2: VIX is a proxy for market volatility (risk). ...

... Note 1: Stock market return calculated from 31/5 to 21/6. Note 2: VIX is a proxy for market volatility (risk). ...

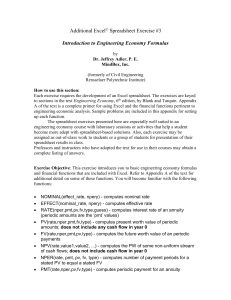

Additional Computer Exercise 3

... Number of periods (nper) – the total number of payments or periods of an investment. (n) Payment (pmt) – the amount paid periodically to an investment or loan. (A) Present value (pv) – the value of an investment or loan at the beginning of the investment period. For example, the present value of a l ...

... Number of periods (nper) – the total number of payments or periods of an investment. (n) Payment (pmt) – the amount paid periodically to an investment or loan. (A) Present value (pv) – the value of an investment or loan at the beginning of the investment period. For example, the present value of a l ...

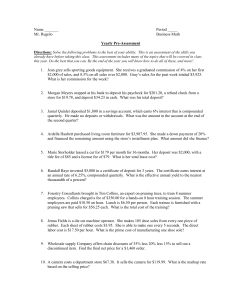

PSSA 1.8 Percent and Simple Interest PSSA PREP

... In Chicago the sales tax on clothing is 8%. In Philadelphia there is no sales tax on clothing. How much more would you pay at a store in Chicago for a sweater that costs $79.99? ...

... In Chicago the sales tax on clothing is 8%. In Philadelphia there is no sales tax on clothing. How much more would you pay at a store in Chicago for a sweater that costs $79.99? ...

Chapter 19 Residential Real Estate Finance: Mortgage

... way home purchases are financed today is the emergence of a dominant secondary market for home mortgage loans and the securitization of these loans “Real Estate Principles for the New Economy”: Norman G. Miller and David M. Geltner ...

... way home purchases are financed today is the emergence of a dominant secondary market for home mortgage loans and the securitization of these loans “Real Estate Principles for the New Economy”: Norman G. Miller and David M. Geltner ...

Simple Interest:

... Principal (P) is the sum of money you borrow from or lend to a person. The Interest rate (r) is the fee you earn from lending money or a fee you pay for borrowing money. The interest rate, unless otherwise stated, is an annual rate. Simple Interest I Prt where P = Principal r = Annual simple inter ...

... Principal (P) is the sum of money you borrow from or lend to a person. The Interest rate (r) is the fee you earn from lending money or a fee you pay for borrowing money. The interest rate, unless otherwise stated, is an annual rate. Simple Interest I Prt where P = Principal r = Annual simple inter ...

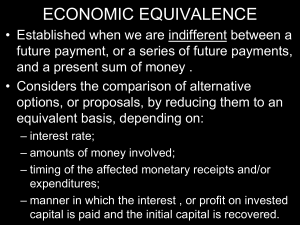

Annual percentage rate

The term annual percentage rate of charge (APR), corresponding sometimes to a nominal APR and sometimes to an effective APR (or EAPR), describes the interest rate for a whole year (annualized), rather than just a monthly fee/rate, as applied on a loan, mortgage loan, credit card, etc. It is a finance charge expressed as an annual rate. Those terms have formal, legal definitions in some countries or legal jurisdictions, but in general: The nominal APR is the simple-interest rate (for a year). The effective APR is the fee+compound interest rate (calculated across a year).In some areas, the annual percentage rate (APR) is the simplified counterpart to the effective interest rate that the borrower will pay on a loan. In many countries and jurisdictions, lenders (such as banks) are required to disclose the ""cost"" of borrowing in some standardized way as a form of consumer protection. APR is intended to make it easier to compare lenders and loan options.