Can Jane Get a Mortgage Loan? Depends on When

... combat these implications (Cheston and Kuhn, 2002). Similarly, in countries as developed as the US, lending discrimination against minorities caused a severe urban decay and deterioration of neighborhoods during the 1970s (Werner et al., 1976). In this paper, we examine how the probability of gettin ...

... combat these implications (Cheston and Kuhn, 2002). Similarly, in countries as developed as the US, lending discrimination against minorities caused a severe urban decay and deterioration of neighborhoods during the 1970s (Werner et al., 1976). In this paper, we examine how the probability of gettin ...

The role of information asymmetry and financial reporting quality in

... privately held debt and equity securities to qualified institutional buyers (QIB) (Allen et al., 2004; Hugh and Wang, 2004; Yago and McCarty, 2004). QIB is defined as an institution that owns and manages $100 million ($10 million in the case of a registered broker-dealer) or more in qualifying secur ...

... privately held debt and equity securities to qualified institutional buyers (QIB) (Allen et al., 2004; Hugh and Wang, 2004; Yago and McCarty, 2004). QIB is defined as an institution that owns and manages $100 million ($10 million in the case of a registered broker-dealer) or more in qualifying secur ...

Analyzing Yield, Duration and Convexity of Mortgage Loans under

... Recent literature using mortgage market data demonstrates that individual characteristics are related to prepayment and default risks. Some studies use empirical analyses to express relationships between the mortgage risk premium and various observable variables specific to the borrower, such as loa ...

... Recent literature using mortgage market data demonstrates that individual characteristics are related to prepayment and default risks. Some studies use empirical analyses to express relationships between the mortgage risk premium and various observable variables specific to the borrower, such as loa ...

Peer-to-Peer Loan Data Update

... across terms for loans initiated since 2009. Coupons for lower graded loans disperse somewhat, with Prosper’s being higher on average for both. For example, the weighted average coupon spread between 3-year Prosper AA and Lending Club As is near 0%, but that difference grows to 4% for Prosper Es ver ...

... across terms for loans initiated since 2009. Coupons for lower graded loans disperse somewhat, with Prosper’s being higher on average for both. For example, the weighted average coupon spread between 3-year Prosper AA and Lending Club As is near 0%, but that difference grows to 4% for Prosper Es ver ...

What is Lender`s Mortgage insurance (“LMI”)

... There are two privately owned LMI companies in Australia that are writing new business, GE Mortgage Insurance Services and the PMI Group. Royal & Sun Alliance ceased writing new LMI business in April 2003 and is currently in run-off. CGU’s LMI business was acquired by PMI in 2001. In additional to t ...

... There are two privately owned LMI companies in Australia that are writing new business, GE Mortgage Insurance Services and the PMI Group. Royal & Sun Alliance ceased writing new LMI business in April 2003 and is currently in run-off. CGU’s LMI business was acquired by PMI in 2001. In additional to t ...

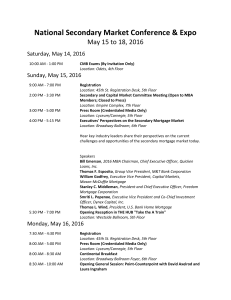

Editable Agenda - Mortgage Bankers Association

... Michael Fratantoni, Chief Economist and Senior Vice President, Research and Industry Technology, Mortgage Bankers Association Lunch in THE HUB Location: Westside Ballroom, 5th Floor Women in Real Estate Finance Lunch and Networking Event Location: Astor Ballroom, 7th Floor Speakers Kim Azzarelli, Ch ...

... Michael Fratantoni, Chief Economist and Senior Vice President, Research and Industry Technology, Mortgage Bankers Association Lunch in THE HUB Location: Westside Ballroom, 5th Floor Women in Real Estate Finance Lunch and Networking Event Location: Astor Ballroom, 7th Floor Speakers Kim Azzarelli, Ch ...

The Hazard Rates of First and Second Default

... The specific set of variables used here is described in Ambrose and Capone (1997). We capture the dynamics of borrower equity and default-option value with the probability that an individual property may have negative equity in each month. The potential for prepayment is estimated each month as the ...

... The specific set of variables used here is described in Ambrose and Capone (1997). We capture the dynamics of borrower equity and default-option value with the probability that an individual property may have negative equity in each month. The potential for prepayment is estimated each month as the ...

MORTGAGE TERMINATIONS, HETEROGENEITY AND THE EXERCISE OF MORTGAGE OPTIONS B Y

... Epperson Ž1992.., and ‘‘ruthless’’ exercise of both options. The second case, Model II, emphasizes transactions costs, particularly in exercise of the default option. It is assumed that transactions costs are sufficiently high that default requires, not only negative equity, but also a ‘‘trigger eve ...

... Epperson Ž1992.., and ‘‘ruthless’’ exercise of both options. The second case, Model II, emphasizes transactions costs, particularly in exercise of the default option. It is assumed that transactions costs are sufficiently high that default requires, not only negative equity, but also a ‘‘trigger eve ...

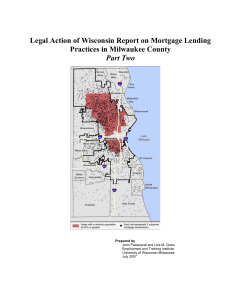

Legal Action of Wisconsin Report on Mortgage Lending

... or lengthen the time of their mortgages, or to move from an adjustable-rate mortgage to a fixed-rate loan. Refinancing activity increased in 1998 and again in 2003 and 2004 as interest rates dropped below the levels in place when many homeowners had previously purchased their homes. ...

... or lengthen the time of their mortgages, or to move from an adjustable-rate mortgage to a fixed-rate loan. Refinancing activity increased in 1998 and again in 2003 and 2004 as interest rates dropped below the levels in place when many homeowners had previously purchased their homes. ...

Temi di Discussione

... Banks should therefore closely monitor this information both when deciding whether to grant a loan to a household and when specifying the price and nonprice terms of the contract. In order to estimate the probability of households being delinquent on their mortgages, we use the most recent waves of ...

... Banks should therefore closely monitor this information both when deciding whether to grant a loan to a household and when specifying the price and nonprice terms of the contract. In order to estimate the probability of households being delinquent on their mortgages, we use the most recent waves of ...

When are consumer loans collateralized in emerging markets

... determinants of collateral using cross-sectional data on 32,655 consumer loans granted between 2007 and 2011 to Vietnamese borrowers. In line with the major empirical findings for commercial loans in developed markets we find, first, that the likelihood of pledging collateral is higher among borrow ...

... determinants of collateral using cross-sectional data on 32,655 consumer loans granted between 2007 and 2011 to Vietnamese borrowers. In line with the major empirical findings for commercial loans in developed markets we find, first, that the likelihood of pledging collateral is higher among borrow ...

Manual for municipalities: Part 1: Becoming creditworthy

... Any growing urban area requires substantial investments in infrastructure, and there are very few municipalities who receive enough in capital grants from national governments to finance all their requirements. This shortfall requires that municipalities look for alternative funding sources, or face ...

... Any growing urban area requires substantial investments in infrastructure, and there are very few municipalities who receive enough in capital grants from national governments to finance all their requirements. This shortfall requires that municipalities look for alternative funding sources, or face ...