a predator in america`s midst: a look at predatory lending

... Carr, James H. & Kolluri, Lopa, Predatory Lending: An Overview, 2001. ...

... Carr, James H. & Kolluri, Lopa, Predatory Lending: An Overview, 2001. ...

File - The Mortgage Collaborative

... Source: JCHS tabulations of 2010 Survey of Consumer Finances. ...

... Source: JCHS tabulations of 2010 Survey of Consumer Finances. ...

Eight Steps to Your New Front Door

... a borrower to repay a mortgage loan at a stated interest rate during a specified period of time. Origination Fee: A fee paid to a lender for processing a loan application. Prepayment Penalty: A fee that may be charged to a borrower who pays off a loan before it is due. Pre-Approval: The process of d ...

... a borrower to repay a mortgage loan at a stated interest rate during a specified period of time. Origination Fee: A fee paid to a lender for processing a loan application. Prepayment Penalty: A fee that may be charged to a borrower who pays off a loan before it is due. Pre-Approval: The process of d ...

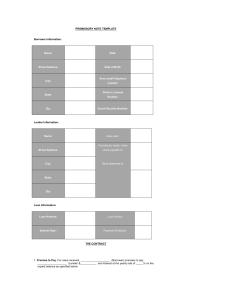

Promissory Note Template

... deed of trust covering the real estate commonly known as _________________ and more fully described as follows: ___________________________________ 8. Collection Costs. If Lender prevails in a lawsuit to collect on this note, Borrower will pay Lender's costs and lawyer's fees in an amount the court ...

... deed of trust covering the real estate commonly known as _________________ and more fully described as follows: ___________________________________ 8. Collection Costs. If Lender prevails in a lawsuit to collect on this note, Borrower will pay Lender's costs and lawyer's fees in an amount the court ...

PDF - Allen Tate Mortgage

... Paying off an old loan while simultaneously taking a new one. Refinancing a loan may help a borrower reduce monthly payment and life-of-loan costs by securing a lower interest rate, reducing the term of the loan, or obtaining cash as an alternative to a home equity loan. Reverse mortgage A loan to a ...

... Paying off an old loan while simultaneously taking a new one. Refinancing a loan may help a borrower reduce monthly payment and life-of-loan costs by securing a lower interest rate, reducing the term of the loan, or obtaining cash as an alternative to a home equity loan. Reverse mortgage A loan to a ...

SUBCHAPTER 03M – MORTGAGE LENDING SECTION .0100

... "Material" when used in connection with facts or information provided to the Commissioner by a licensee or applicant, means facts or information that a reasonable person knows, or should know, would be likely to influence a decision to grant, suspend, condition, limit, renew, or revoke a license or ...

... "Material" when used in connection with facts or information provided to the Commissioner by a licensee or applicant, means facts or information that a reasonable person knows, or should know, would be likely to influence a decision to grant, suspend, condition, limit, renew, or revoke a license or ...

General Information - Bank of Ireland Mortgage

... A mortgage of £90,000 payable over 15 years initially on a fixed rate for 3 years at 3.29% and then on our current variable rate of 4.49% (variable) for the remaining 12 years would require 33 monthly payments of £247 and 145 monthly payments of £337. The total amount payable would be £147,895 made ...

... A mortgage of £90,000 payable over 15 years initially on a fixed rate for 3 years at 3.29% and then on our current variable rate of 4.49% (variable) for the remaining 12 years would require 33 monthly payments of £247 and 145 monthly payments of £337. The total amount payable would be £147,895 made ...

questions in real estate finance

... “Payment shock” with dramatic increase in payment Appeal is the very low initial payment designed to help offset affordability problem Contract rate adjusts monthly with maybe no limits on size of interest rate changes ...

... “Payment shock” with dramatic increase in payment Appeal is the very low initial payment designed to help offset affordability problem Contract rate adjusts monthly with maybe no limits on size of interest rate changes ...

General information about AA mortgages

... A mortgage of £179,700 payable over 35 years initially on a fixed rate for 5 years at 2.19% and then on our current variable rate of 4.24% for the remaining 30 years would require 60 monthly payments of £613 and 360 monthly payments of £794. The total amount payable would be £324,431 made up of the ...

... A mortgage of £179,700 payable over 35 years initially on a fixed rate for 5 years at 2.19% and then on our current variable rate of 4.24% for the remaining 30 years would require 60 monthly payments of £613 and 360 monthly payments of £794. The total amount payable would be £324,431 made up of the ...

Consumer Loan Scavenger Hunt

... APR and interest rate are different because the APR includes fees and penalties Discount Method – Interest payable is deducted from lending amount ...

... APR and interest rate are different because the APR includes fees and penalties Discount Method – Interest payable is deducted from lending amount ...

Frequently Asked Questions

... How is the program structured? The Wellesley College Faculty Mortgage program combines a five-year variable rate first mortgage and a deferred-interest second mortgage at 2 percent. The second mortgage minimum is one-quarter the value of the house, while the maximum is two-thirds of the loan value ( ...

... How is the program structured? The Wellesley College Faculty Mortgage program combines a five-year variable rate first mortgage and a deferred-interest second mortgage at 2 percent. The second mortgage minimum is one-quarter the value of the house, while the maximum is two-thirds of the loan value ( ...

Personal Financial Literacy - Warren Hills Regional School District

... • Establish credit so it will be available in the future. • Pay bills on time to build a solid credit history. • Pay entire balance monthly to avoid interest charges. • Establish a cash fund (savings account) and have unused credit. ...

... • Establish credit so it will be available in the future. • Pay bills on time to build a solid credit history. • Pay entire balance monthly to avoid interest charges. • Establish a cash fund (savings account) and have unused credit. ...

More... - Kevin Kavakeb

... higher amount of interest. Of course, you can always refinance a fixed-rate loan in order to get down to the best fixed rate mortgage but this may not always be an option. Over the life of your fixed-rate loan, you will pay a substantial amount of interest. In fact, ...

... higher amount of interest. Of course, you can always refinance a fixed-rate loan in order to get down to the best fixed rate mortgage but this may not always be an option. Over the life of your fixed-rate loan, you will pay a substantial amount of interest. In fact, ...

Interest rates on mortgages 2. Fixed Rate Mortgage

... The higher the loan-to-value ratio, the more risky it is deemed by lenders. If the risk is deemed to be higher, the borrower will probably have to pay higher rates of interest. It is normally calculated as a percentage: ...

... The higher the loan-to-value ratio, the more risky it is deemed by lenders. If the risk is deemed to be higher, the borrower will probably have to pay higher rates of interest. It is normally calculated as a percentage: ...

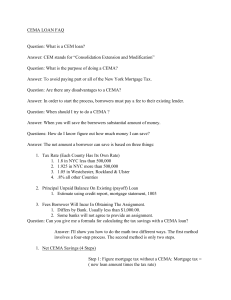

CEMA LOAN FAQ - Adams Law Group LLC

... 192,153.35. So that's why the shortcut works, because the more direct way to derive the tax savings is with the pub, which is referred to as the old money. Question: How does the process work exactly? Answer: The mortgage tax is asseessed at the time a mortgage is recorded. In most refinance transac ...

... 192,153.35. So that's why the shortcut works, because the more direct way to derive the tax savings is with the pub, which is referred to as the old money. Question: How does the process work exactly? Answer: The mortgage tax is asseessed at the time a mortgage is recorded. In most refinance transac ...

Everett mortgage email e-mail

... phone number lookup, address lookup, and more. Use your Microsoft account. What's this? Email, phone, or Skype. No account? Create one! Kiel Mortgage Home Loans “Big enough to do the job. Small enough to care.” Over the last three decades, Kiel Mortgage has been serving the home lending needs of. Ab ...

... phone number lookup, address lookup, and more. Use your Microsoft account. What's this? Email, phone, or Skype. No account? Create one! Kiel Mortgage Home Loans “Big enough to do the job. Small enough to care.” Over the last three decades, Kiel Mortgage has been serving the home lending needs of. Ab ...

Why you need to shop around for a mortgage

... “For instance, some lenders are offering incredibly low interest rates at the moment—as low as 2.74 per cent for a fiveyear fixed term,” she notes. “A client may see this rate and not ask any further questions only to find out later that the penalty on this mortgage is much higher than that of a tr ...

... “For instance, some lenders are offering incredibly low interest rates at the moment—as low as 2.74 per cent for a fiveyear fixed term,” she notes. “A client may see this rate and not ask any further questions only to find out later that the penalty on this mortgage is much higher than that of a tr ...

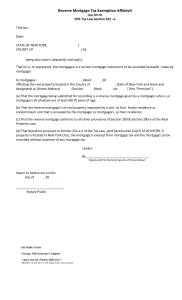

Reverse Mortgage Tax Exemption Affidavit

... attorneys and associations are unhappy with the rules as they are now. There are important differences between the state and federal programs. Under the federal requirements, a borrower must be 62 years of age or older whereas under state law, a borrower only has to be 60 years of age. As to propert ...

... attorneys and associations are unhappy with the rules as they are now. There are important differences between the state and federal programs. Under the federal requirements, a borrower must be 62 years of age or older whereas under state law, a borrower only has to be 60 years of age. As to propert ...

reported - protect consumer justice.org

... was sentenced today to 85 months in federal prison. Terral Toole, 42, of Lake Elsinore, was sentenced by United States District Judge John F. Walter, who also ordered the defendant to pay $291,055 in restitution to three financial institutions. Toole pleaded guilty last November to four counts of wi ...

... was sentenced today to 85 months in federal prison. Terral Toole, 42, of Lake Elsinore, was sentenced by United States District Judge John F. Walter, who also ordered the defendant to pay $291,055 in restitution to three financial institutions. Toole pleaded guilty last November to four counts of wi ...

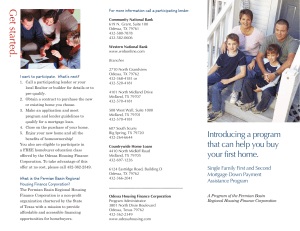

Permian Basin Brochure Lenders.indd

... moderate income homebuyers purchase a home. All mortgages are fixed rate 30-year loans. ...

... moderate income homebuyers purchase a home. All mortgages are fixed rate 30-year loans. ...

New Economic Bubbles

... Property Taxes in California = $500 per month on $500,000 home Both interest & property taxes are tax deductible (lower your income tax) ...

... Property Taxes in California = $500 per month on $500,000 home Both interest & property taxes are tax deductible (lower your income tax) ...

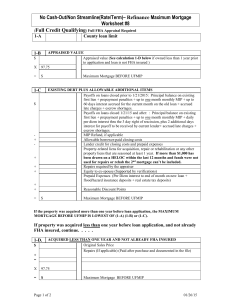

No Cash-Out/Non Streamline(Rate/Term)– Refinance Maximum

... Payoffs on loans closed prior to 1/21/2015: Principal balance on existing first lien + prepayment penalties + up to one month monthly MIP + up to 60 days interest accrued for the current month on the old loan + accrued late charges + escrow shortages. Payoffs on loans closed 1/21/15 and after: : Pri ...

... Payoffs on loans closed prior to 1/21/2015: Principal balance on existing first lien + prepayment penalties + up to one month monthly MIP + up to 60 days interest accrued for the current month on the old loan + accrued late charges + escrow shortages. Payoffs on loans closed 1/21/15 and after: : Pri ...

If you have Mortgage Interest “rate envy”, does it make sense to

... consumers are looking at some of the lowest rates in history, and many homeowners with existing fixed-term mortgages are experiencing some “rate envy” about today’s rock bottom rates. It may be worth a conversation about your options. Typically, we think of a fixed term mortgage as a non-negotiable ...

... consumers are looking at some of the lowest rates in history, and many homeowners with existing fixed-term mortgages are experiencing some “rate envy” about today’s rock bottom rates. It may be worth a conversation about your options. Typically, we think of a fixed term mortgage as a non-negotiable ...