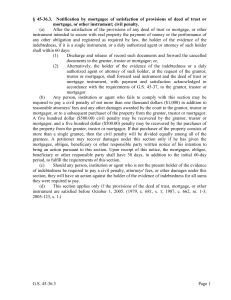

§ 45-36

... mortgagee, obligee, beneficiary or other responsible party written notice of his intention to bring an action pursuant to this section. Upon receipt of this notice, the mortgagee, obligee, beneficiary or other responsible party shall have 30 days, in addition to the initial 60-day period, to fulfill ...

... mortgagee, obligee, beneficiary or other responsible party written notice of his intention to bring an action pursuant to this section. Upon receipt of this notice, the mortgagee, obligee, beneficiary or other responsible party shall have 30 days, in addition to the initial 60-day period, to fulfill ...

529 - Supreme Court of Canada Judgments

... These were the periods of limitation according to English law in force on July 15th, 1870, which were introduced into the Territories. In 1874, however, another alteration was made. The Real Property Limitation Act, 1874 (Imp.), cap. 57, s. 8, enacted as follows:— No action or suit or other proceedi ...

... These were the periods of limitation according to English law in force on July 15th, 1870, which were introduced into the Territories. In 1874, however, another alteration was made. The Real Property Limitation Act, 1874 (Imp.), cap. 57, s. 8, enacted as follows:— No action or suit or other proceedi ...

mortgage loan terms - Yorkshire Building Society

... 6.4 Arrears Charges. If your Loan Account falls into arrears, then we will charge you arrears administration fees. The time from when we start charging these fees and the amount of these fees will be set out in our Tariff. Arrears administration fees are calculated to cover our administrative costs i ...

... 6.4 Arrears Charges. If your Loan Account falls into arrears, then we will charge you arrears administration fees. The time from when we start charging these fees and the amount of these fees will be set out in our Tariff. Arrears administration fees are calculated to cover our administrative costs i ...

CSS Slideshow for 1997-98 Counselor Workshops

... • Sign once during enrollment but may be used for multiple years • You will receive maximum Stafford funds each year, unless you cancel or decline a portion of the loan • DISCLOSURE STATEMENT • Received at first disbursement of each loan under the MPN ...

... • Sign once during enrollment but may be used for multiple years • You will receive maximum Stafford funds each year, unless you cancel or decline a portion of the loan • DISCLOSURE STATEMENT • Received at first disbursement of each loan under the MPN ...

Money Adviser Pack Update – Summary of main changes

... Where payments are being made in respect of the charging order, these should be reviewed as part of the holistic money advice offered and factored into the CFS. If it is not possible to negotiate or maintain agreed payments with the charging order this may trigger an application for order for sale - ...

... Where payments are being made in respect of the charging order, these should be reviewed as part of the holistic money advice offered and factored into the CFS. If it is not possible to negotiate or maintain agreed payments with the charging order this may trigger an application for order for sale - ...

New Hampshire Security Instrument for Bond

... TO SECURE TO LENDER the payment of the Indebtedness, including, without limitation, all sums owing or which become owing by Borrower to Lender under the Reimbursement Agreement and advanced by or on behalf of Lender to protect the security of this Instrument under Section 12, and the performance of ...

... TO SECURE TO LENDER the payment of the Indebtedness, including, without limitation, all sums owing or which become owing by Borrower to Lender under the Reimbursement Agreement and advanced by or on behalf of Lender to protect the security of this Instrument under Section 12, and the performance of ...

Code of Responsible Borrowing.dpp

... For example, a potential borrower who needs to get from point A to point B could consider other forms of transport, rescheduling their appointments, or a small vehicle like a scooter - all before buying a car on credit. Another example would be a potential borrower wanting to purchase non-urgent ret ...

... For example, a potential borrower who needs to get from point A to point B could consider other forms of transport, rescheduling their appointments, or a small vehicle like a scooter - all before buying a car on credit. Another example would be a potential borrower wanting to purchase non-urgent ret ...

Redline2011-00370 - Colorado Secretary of State

... 10% annual percentage rate" or "10% annual percentage rate mortgages available." a. All ads must state the annual percentage rate accurately. For example, some transactions include other components in the finance charge besides interest, such as "points" and mortgage insurance premiums paid by the b ...

... 10% annual percentage rate" or "10% annual percentage rate mortgages available." a. All ads must state the annual percentage rate accurately. For example, some transactions include other components in the finance charge besides interest, such as "points" and mortgage insurance premiums paid by the b ...

department of regulatory agencies

... "amount financed," "finance charge,' and "schedule of payments" are agreed upon by the lender and the customer. 9. "Consumer credit" may be either closed-end or open-end credit. It is credit that is extended primarily for personal, family, or household purposes. It excludes business and agricultural ...

... "amount financed," "finance charge,' and "schedule of payments" are agreed upon by the lender and the customer. 9. "Consumer credit" may be either closed-end or open-end credit. It is credit that is extended primarily for personal, family, or household purposes. It excludes business and agricultural ...

Working Paper 135/13 THE PSYCHOLOGY AND ECONOMICS OF

... interested in taking, once retired, a reverse mortgage loan. About 36 percent is neutral, which may imply that the potential interest is even higher. The interest in taking a reverse mortgage loan increases with age until reaching a maximum around 69, and falls afterwards. We interpret this as refle ...

... interested in taking, once retired, a reverse mortgage loan. About 36 percent is neutral, which may imply that the potential interest is even higher. The interest in taking a reverse mortgage loan increases with age until reaching a maximum around 69, and falls afterwards. We interpret this as refle ...

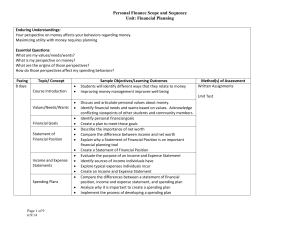

Personal Finance Scope and Sequence Unit: Financial Planning

... achieving it, including educational/training requirements, costs, and possible debt Give examples of how education and/or training can affect lifetime income Identify different types of financial aid and their costs/benefits Identify and locate jobs within a career field of interest ...

... achieving it, including educational/training requirements, costs, and possible debt Give examples of how education and/or training can affect lifetime income Identify different types of financial aid and their costs/benefits Identify and locate jobs within a career field of interest ...

Cooking the Books Workbook - Association of Certified Fraud

... The Armchair Investor This type of borrower is typically naïve and trusting, having been seduced into thinking that investing in real estate is quick, easy, and profitable. This type of borrower might have read a book on how to get rich quick by investing in real estate, or may know co-workers or fa ...

... The Armchair Investor This type of borrower is typically naïve and trusting, having been seduced into thinking that investing in real estate is quick, easy, and profitable. This type of borrower might have read a book on how to get rich quick by investing in real estate, or may know co-workers or fa ...

Federal Direct Loans (Cont`d) - Sam Houston State University

... Income Based Repayment Plan Deferment and Forbearance Loan Discharge Due to Death or Permanent Disability Fixed Interest Rate Tax Deductions for Loan Interest to Qualifying Borrowers ...

... Income Based Repayment Plan Deferment and Forbearance Loan Discharge Due to Death or Permanent Disability Fixed Interest Rate Tax Deductions for Loan Interest to Qualifying Borrowers ...

Carrying Mortgage Debt Into Retirement

... insurance (and all the upkeep that goes with owning a home), but if you can swing the cost, living mortgage free is a nice place to be. To see how much faster you can pay off your mortgage by making extra payments, check out AARP’s Mortgage Payoff Calculator at www.aarp.org/money. If you still have ...

... insurance (and all the upkeep that goes with owning a home), but if you can swing the cost, living mortgage free is a nice place to be. To see how much faster you can pay off your mortgage by making extra payments, check out AARP’s Mortgage Payoff Calculator at www.aarp.org/money. If you still have ...

PRODUCT GUIDELINES FHA STANDARD and HIGH BALANCE

... incur new credit obligations. If < 2 years, but not < 12 months, may be acceptable, if borrower can show that bankruptcy was caused by extenuating circumstances (must be approved by Underwriter Manager), and has exhibited a documented ability to manage his/her financial affairs. AUS Approve - Chapte ...

... incur new credit obligations. If < 2 years, but not < 12 months, may be acceptable, if borrower can show that bankruptcy was caused by extenuating circumstances (must be approved by Underwriter Manager), and has exhibited a documented ability to manage his/her financial affairs. AUS Approve - Chapte ...

Real Estate Retention Agreement 2.5" Margin

... of the title or deed to another owner, subject to certain exceptions outlined herein), an amount calculated by the Member via an FHLBI prescribed calculation and verified by the FHLBI, equal to a pro rata share of the direct Subsidy that financed the purchase, construction, or rehabilitation of this ...

... of the title or deed to another owner, subject to certain exceptions outlined herein), an amount calculated by the Member via an FHLBI prescribed calculation and verified by the FHLBI, equal to a pro rata share of the direct Subsidy that financed the purchase, construction, or rehabilitation of this ...

Guideline B-21 Residential Mortgage Insurance - OSFI-BSIF

... Under this option, OSFI would develop a separate guideline. It would consider recent international principles and recommendations in respect of mortgage insurance underwriting as well as OSFI’s findings from internal reviews. A separate guideline would more appropriately address the specific charact ...

... Under this option, OSFI would develop a separate guideline. It would consider recent international principles and recommendations in respect of mortgage insurance underwriting as well as OSFI’s findings from internal reviews. A separate guideline would more appropriately address the specific charact ...

6218 - Fannie Mae

... unsecured trade payables incurred in the ordinary course of the operation of the Mortgaged Property or the Disclosed Assets (exclusive of amounts for rehabilitation, restoration, repairs, or replacements of the Mortgaged Property or the Disclosed Assets) that (i) are not evidenced by a promissory no ...

... unsecured trade payables incurred in the ordinary course of the operation of the Mortgaged Property or the Disclosed Assets (exclusive of amounts for rehabilitation, restoration, repairs, or replacements of the Mortgaged Property or the Disclosed Assets) that (i) are not evidenced by a promissory no ...

Summer Parent PLUS Loan Extension Form

... Students may be subject to a reduction, repayment or cancellation of aid for courses they do NOT complete. Students will be responsible for any institutional charges related to their summer enrollment if such charges are not fully covered by financial aid. ...

... Students may be subject to a reduction, repayment or cancellation of aid for courses they do NOT complete. Students will be responsible for any institutional charges related to their summer enrollment if such charges are not fully covered by financial aid. ...

Mortgage Loans

... Annual Percentage Rate (APR) — The cost of credit expressed as a yearly rate. This includes any finance charges and additional fees. Application Fee — A fee to cover the costs of processing the application, documentation and verification. Arbitration Clause — A provision in the contract that states ...

... Annual Percentage Rate (APR) — The cost of credit expressed as a yearly rate. This includes any finance charges and additional fees. Application Fee — A fee to cover the costs of processing the application, documentation and verification. Arbitration Clause — A provision in the contract that states ...

Complete Transcript

... This right is one of the most important ones that the lender has that is relevant to the remedies it can use when the borrower defaults. And notice it is a right to possession. It is not a remedy. Why? Well because this is because a lender has or is treated as having a legal estate in the land. And ...

... This right is one of the most important ones that the lender has that is relevant to the remedies it can use when the borrower defaults. And notice it is a right to possession. It is not a remedy. Why? Well because this is because a lender has or is treated as having a legal estate in the land. And ...

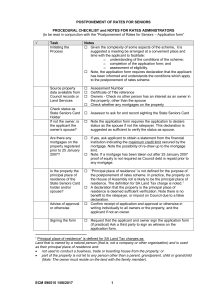

postponement of rates for seniors

... If yes, ask applicant to obtain a statement from the financial institution indicating the maximum credit limit secured by the mortgage. Note the possibility of re-draw up to the mortgage limit. Note: If a mortgage has been taken out after 25 January 2007 proof of equity is not required as Counci ...

... If yes, ask applicant to obtain a statement from the financial institution indicating the maximum credit limit secured by the mortgage. Note the possibility of re-draw up to the mortgage limit. Note: If a mortgage has been taken out after 25 January 2007 proof of equity is not required as Counci ...

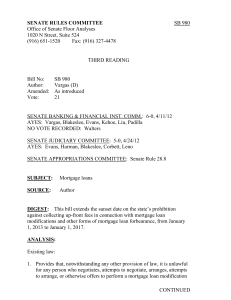

SENATE RULES COMMITTEE >

... consultants, real estate brokers, and then many predatory people impersonating one of those three, out there collecting advance fees under the false promise of providing a loan modification... what we found is since October 11th, most of the complaints are still about prior activity taking place. We ...

... consultants, real estate brokers, and then many predatory people impersonating one of those three, out there collecting advance fees under the false promise of providing a loan modification... what we found is since October 11th, most of the complaints are still about prior activity taking place. We ...

An Introduction - The Mortgage and Insurance Bureau

... We pride ourselves on the services we provide Every client will have a dedicated mortgage adviser and case administrator to ensure that their mortgage is efficiently processed from application to completion. We will liaise with your lender, the valuer and your legal representative, saving you time a ...

... We pride ourselves on the services we provide Every client will have a dedicated mortgage adviser and case administrator to ensure that their mortgage is efficiently processed from application to completion. We will liaise with your lender, the valuer and your legal representative, saving you time a ...

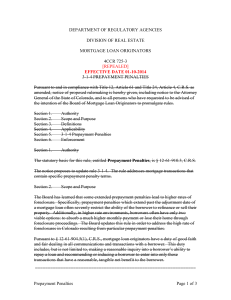

4 ccr 725-3 mortgage loan originators and mortgage companies 1

... 4. “Payment rate” means the rate used to determine a borrower’s monthly payment. 5. “Teaser rate” means a temporary and often low introductory rate on an adjustable rate mortgage. 6. “Prepayment Penalty” means a fee assessed pursuant to the terms of the loan on a borrower who repays all or part of t ...

... 4. “Payment rate” means the rate used to determine a borrower’s monthly payment. 5. “Teaser rate” means a temporary and often low introductory rate on an adjustable rate mortgage. 6. “Prepayment Penalty” means a fee assessed pursuant to the terms of the loan on a borrower who repays all or part of t ...