Entropy Measures in Finance and Risk Neutral Densities

... The mathematical description of the new entropy functions was in discrete case and for our problem we consider the continuous cases as an analogue of the discrete case: ...

... The mathematical description of the new entropy functions was in discrete case and for our problem we consider the continuous cases as an analogue of the discrete case: ...

La Cassa Controparte Centrale dei Mercati Cash Azionari US

... TIMS in fact determines Initial Margins for the Integrated Portfolio by algebraically summing the theoretical liquidation gains/loss of each position under the same hypothesis of underlying price variation within the Margin Interval. In such a way a full offset is obtained among positions that havin ...

... TIMS in fact determines Initial Margins for the Integrated Portfolio by algebraically summing the theoretical liquidation gains/loss of each position under the same hypothesis of underlying price variation within the Margin Interval. In such a way a full offset is obtained among positions that havin ...

Modeling Variance of Variance: The Square

... particularly in option pricing applications. On the discrete-time, empirical side, the success of the ARCH framework introduced by Engle [43] has led to explosive growth of another strand of the time-varying volatility literature3 . While much of the stochastic volatility option pricing theory follo ...

... particularly in option pricing applications. On the discrete-time, empirical side, the success of the ARCH framework introduced by Engle [43] has led to explosive growth of another strand of the time-varying volatility literature3 . While much of the stochastic volatility option pricing theory follo ...

Tails, volatility risk premium, and equity index returns - Aalto

... key variables in earlier studies. Particularly interesting is the robustness of the volatility risk premium and the jump and tail index to simultaneous inclusion of RND moments. Second, evidence is provided for a number of indexes, as opposed to the common focus on the U.S. stock market. For compari ...

... key variables in earlier studies. Particularly interesting is the robustness of the volatility risk premium and the jump and tail index to simultaneous inclusion of RND moments. Second, evidence is provided for a number of indexes, as opposed to the common focus on the U.S. stock market. For compari ...

Managerial incentives to increase firm volatility provided by debt

... opposing effects, whether stockholders prefer more volatility depends on the number of options outstanding and firm leverage, as we illustrate next. 2.1.1 Estimation of firm sensitivities To estimate the sensitivities described above, we calculate the value of debt and options using standard pricing ...

... opposing effects, whether stockholders prefer more volatility depends on the number of options outstanding and firm leverage, as we illustrate next. 2.1.1 Estimation of firm sensitivities To estimate the sensitivities described above, we calculate the value of debt and options using standard pricing ...

Price

... F.O.B. Common Geographic Pricing Policies F.O.B. means “free on board” (e.g., at some place such as a factory, warehouse, destination,etc.) Customer pay the freight and take risk of shipping product ...

... F.O.B. Common Geographic Pricing Policies F.O.B. means “free on board” (e.g., at some place such as a factory, warehouse, destination,etc.) Customer pay the freight and take risk of shipping product ...

Bank Indonesia Jakarta

... Before calculating the risk of a certain position, we need to identify the exposure of the position on a certain day when the risk is calculated. In general, the position consists of spot and forward elements. The identification of exposure for a spot position is straightforward: multiply the accoun ...

... Before calculating the risk of a certain position, we need to identify the exposure of the position on a certain day when the risk is calculated. In general, the position consists of spot and forward elements. The identification of exposure for a spot position is straightforward: multiply the accoun ...

Pricing and hedging interest rate caps

... The pricing of interest rate options is based on the area of dynamic term structure modelling. Interest rate caps and floors can be priced using a variety of different models but one model in particular (the LIBOR market model) has gained popularity due to an ability to encompass well-established ma ...

... The pricing of interest rate options is based on the area of dynamic term structure modelling. Interest rate caps and floors can be priced using a variety of different models but one model in particular (the LIBOR market model) has gained popularity due to an ability to encompass well-established ma ...

Heterogeneous Beliefs, Speculation, and the Equity Premium ∗

... likelihood that the current data on fundamentals was generated by the model of type 2 agents (for brevity I will simply refer to these agents collectively as agent 2) rather than agent 1. The level of this variable is shown to depend on the past performance of the two agents’ models. After a period ...

... likelihood that the current data on fundamentals was generated by the model of type 2 agents (for brevity I will simply refer to these agents collectively as agent 2) rather than agent 1. The level of this variable is shown to depend on the past performance of the two agents’ models. After a period ...

Download Dissertation

... This bound on the variability of IMRS has a natural connection to the variability of θ (X) in this paper. Therefore, the robust parametric estimator operationalizes the Hansen and Jagannathan (1991) volatility bound for investors who know their model is misspecified but have no better model at the t ...

... This bound on the variability of IMRS has a natural connection to the variability of θ (X) in this paper. Therefore, the robust parametric estimator operationalizes the Hansen and Jagannathan (1991) volatility bound for investors who know their model is misspecified but have no better model at the t ...

Pricing and Hedging Volatility Derivatives

... variance swaps. Since the price of both variance swaps and volatility swaps depend on the realized variance of the underlying asset, there must be a relationship between their prices to avoid arbitrage. Since variance swaps can be priced and hedged using actively traded European call and put options ...

... variance swaps. Since the price of both variance swaps and volatility swaps depend on the realized variance of the underlying asset, there must be a relationship between their prices to avoid arbitrage. Since variance swaps can be priced and hedged using actively traded European call and put options ...

NBER WORKING PAPER SERIES SIMPLE VARIANCE SWAPS Ian Martin Working Paper 16884

... Equation (3) follows by put-call parity, which is the relationship callt (K) = putt (K) + S0 − Ke−rt . Although (3) is less concise than (5), it has the appealing feature that it expresses Π(t) in terms of out-of-the-money options only. The most important aspect of Result 1 is that it does not requi ...

... Equation (3) follows by put-call parity, which is the relationship callt (K) = putt (K) + S0 − Ke−rt . Although (3) is less concise than (5), it has the appealing feature that it expresses Π(t) in terms of out-of-the-money options only. The most important aspect of Result 1 is that it does not requi ...

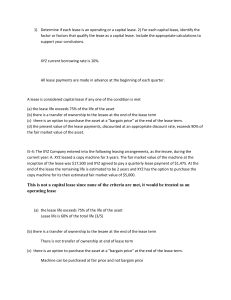

CHapter 11 1. The portfolio weight of an asset is total investment in

... 13. The CAPM states the relationship between the risk of an asset and its expected return. The CAPM is: E(Ri) = Rf + [E(RM) – Rf] × i Substituting the values we are given, we find: E(Ri) = .045 + (.1170 – .045)(1.25) E(Ri) = .1350 or 13.50% 14. We are given the values for the CAPM except for the ...

... 13. The CAPM states the relationship between the risk of an asset and its expected return. The CAPM is: E(Ri) = Rf + [E(RM) – Rf] × i Substituting the values we are given, we find: E(Ri) = .045 + (.1170 – .045)(1.25) E(Ri) = .1350 or 13.50% 14. We are given the values for the CAPM except for the ...

Derivatives Trading and Its Impact on the Volatility of NSE, India

... In recent past, the volatility of stock returns has been a major topic in finance literature. Empirical researchers have tried to find a pattern in stock return movements or factors determining these movements. Generally, volatility is considered as a measurement of risk in the stock market return a ...

... In recent past, the volatility of stock returns has been a major topic in finance literature. Empirical researchers have tried to find a pattern in stock return movements or factors determining these movements. Generally, volatility is considered as a measurement of risk in the stock market return a ...

RW7eCh13 - U of L Class Index

... The return given for Stock Z is 12.1 percent, but according to the CAPM the expected return of the stock should be 13.25 percent based on its level of risk. Stock Z plots below the SML and is overvalued. In other words, its price must decrease to increase the expected return to 13.25 percent. We can ...

... The return given for Stock Z is 12.1 percent, but according to the CAPM the expected return of the stock should be 13.25 percent based on its level of risk. Stock Z plots below the SML and is overvalued. In other words, its price must decrease to increase the expected return to 13.25 percent. We can ...

Dealing With High Volatility “Low Volatility Folios”

... market, as well as using screens on volatility. During periods when the S&P500 increases or decreases significantly, these portfolios likely will not increase or decrease as much. The lower volatility means the maximum returns and losses in any given period are likely to be of lower magnitude than t ...

... market, as well as using screens on volatility. During periods when the S&P500 increases or decreases significantly, these portfolios likely will not increase or decrease as much. The lower volatility means the maximum returns and losses in any given period are likely to be of lower magnitude than t ...

Specifying and managing tail risk in portfolios a practical approach

... Parameter uncertainty is of course only one of the possible extensions of the model (3.3) which has implications for intra-horizon risk. Other directions which have been investigated in the literature include non-normal return distributions, event risk, time-varying volatility, autocorrelation in re ...

... Parameter uncertainty is of course only one of the possible extensions of the model (3.3) which has implications for intra-horizon risk. Other directions which have been investigated in the literature include non-normal return distributions, event risk, time-varying volatility, autocorrelation in re ...