The required return on equity under a foundation model

... the computation of the allowed return on equity in the Australian regulatory setting. Specifically, we have been asked to: a. Review the AER’s concerns as to the use of dividend growth model (DGM) estimates to inform the MRP. b. Consider the criticism—that is made in the context of adjusting the Sha ...

... the computation of the allowed return on equity in the Australian regulatory setting. Specifically, we have been asked to: a. Review the AER’s concerns as to the use of dividend growth model (DGM) estimates to inform the MRP. b. Consider the criticism—that is made in the context of adjusting the Sha ...

simulating portfolios by using models of social networks

... involves choosing from different types of stochastic alternatives that are available over time. ...

... involves choosing from different types of stochastic alternatives that are available over time. ...

Man, Economy, and State with Power and Market

... Copyright 2004 by Ludwig von Mises Institute, third edition, Scholar’s Edition All rights reserved. Written permission must be secured from the publisher to use or reproduce any part of this book, except for brief quotations in critical reviews or articles. Published by the Ludwig von Mises Instit ...

... Copyright 2004 by Ludwig von Mises Institute, third edition, Scholar’s Edition All rights reserved. Written permission must be secured from the publisher to use or reproduce any part of this book, except for brief quotations in critical reviews or articles. Published by the Ludwig von Mises Instit ...

Man, Economy, and State with Power and Market

... second edition Man, Economy, and State: Copyright © 1962 by William Volker Fund and D. Van Nostrand Copyright © 1970 by Murray N. Rothbard Copyright © 1993 by Murray N. Rothbard, revised edition Copyright © 2001 by Ludwig von Mises Institute Power and Market: Copyright © 1970 by Institute for Humane ...

... second edition Man, Economy, and State: Copyright © 1962 by William Volker Fund and D. Van Nostrand Copyright © 1970 by Murray N. Rothbard Copyright © 1993 by Murray N. Rothbard, revised edition Copyright © 2001 by Ludwig von Mises Institute Power and Market: Copyright © 1970 by Institute for Humane ...

Market Sentiment and Paradigm Shifts in Equity Premium

... then becomes too weak to be restored by those remedies. In contrast, during low market sentiment periods, the predicting power of ECON variables is significant even without those remedies. This is because the fundamental link is not distorted when sentiment stays low. The predicting power now become ...

... then becomes too weak to be restored by those remedies. In contrast, during low market sentiment periods, the predicting power of ECON variables is significant even without those remedies. This is because the fundamental link is not distorted when sentiment stays low. The predicting power now become ...

CPB Discussion Paper

... composition in financing the firm. Higher risk and higher leverage imply higher returns on equity. As most authors use broad market portfolios, we will make no further distinction with regard to the portfolio in the meta-analysis. When using long time series one should furthermore be aware of the s ...

... composition in financing the firm. Higher risk and higher leverage imply higher returns on equity. As most authors use broad market portfolios, we will make no further distinction with regard to the portfolio in the meta-analysis. When using long time series one should furthermore be aware of the s ...

Risk, Uncertainty and Decision-making in the

... studies precluded them from providing any explanation into the reasons why some techniques fail to be implemented and others succeed (Clemen, 1999). Consequently, some writers, typically behavioural decision theorists such as Tocher (1976 and 1978 reprinted in French, 1989), have explained the resul ...

... studies precluded them from providing any explanation into the reasons why some techniques fail to be implemented and others succeed (Clemen, 1999). Consequently, some writers, typically behavioural decision theorists such as Tocher (1976 and 1978 reprinted in French, 1989), have explained the resul ...

Agricultural Cooperatives I: History, Theory and

... rural areas based on the idea of “self-help”. Raiffeisen is generally given credit for developing the rules that govern present-day credit unions (Ingalsbe & Groves, 1989). The development of cooperatives over time has been shaped by many factors and influences. Ingalsbe and Groves (1989) group thes ...

... rural areas based on the idea of “self-help”. Raiffeisen is generally given credit for developing the rules that govern present-day credit unions (Ingalsbe & Groves, 1989). The development of cooperatives over time has been shaped by many factors and influences. Ingalsbe and Groves (1989) group thes ...

NBER WORKING PAPER SERIES AMBIGUITY AVERSION AND HOUSEHOLD PORTFOLIO CHOICE: EMPIRICAL EVIDENCE

... To our knowledge, we are the first to empirically test these predictions. We find evidence consistent with both predictions. Ambiguity aversion is negatively related to foreign stock ownership, but positively related to own-company stock ownership. This pattern holds both in the overall sample, and ...

... To our knowledge, we are the first to empirically test these predictions. We find evidence consistent with both predictions. Ambiguity aversion is negatively related to foreign stock ownership, but positively related to own-company stock ownership. This pattern holds both in the overall sample, and ...

How Deep is the Annuity Market Participation Puzzle

... spouses is a hurdle for voluntary annuitization. In all regressions, we …nd that the annuitization behavior of stock market participants is better explained by a reduced form model than the behavior of stock market non-participants. We view these empirical …ndings as interesting in their own right s ...

... spouses is a hurdle for voluntary annuitization. In all regressions, we …nd that the annuitization behavior of stock market participants is better explained by a reduced form model than the behavior of stock market non-participants. We view these empirical …ndings as interesting in their own right s ...

behavioural assumptions in labour economics

... Although it’s hard to deny that it takes quite some time, effort and endurance to write a dissertation, I have to admit that I enjoyed the past years working on my research and did not experience major setbacks during the process. But without the support and guidance of several people, this project ...

... Although it’s hard to deny that it takes quite some time, effort and endurance to write a dissertation, I have to admit that I enjoyed the past years working on my research and did not experience major setbacks during the process. But without the support and guidance of several people, this project ...

NBER WORKING PAPER SERIES INTERNATIONAL CONSUMPTION RISK IS SHARED AFTER ALL:

... How much welfare improvement can be generated by optimal international consumption risksharing? The obvious importance of this question has motivated a significant body of research.1 As this literature shows, international risk-sharing gains depend directly upon the value of consumption risk and the ...

... How much welfare improvement can be generated by optimal international consumption risksharing? The obvious importance of this question has motivated a significant body of research.1 As this literature shows, international risk-sharing gains depend directly upon the value of consumption risk and the ...

Chapter 10 Arbitrage Pricing Theory and Multifactor Models of Risk

... 39. An important difference between CAPM and APT is A. CAPM depends on risk-return dominance; APT depends on a no arbitrage condition. B. CAPM assumes many small changes are required to bring the market back to equilibrium; APT assumes a few large changes are required to bring the market back to equ ...

... 39. An important difference between CAPM and APT is A. CAPM depends on risk-return dominance; APT depends on a no arbitrage condition. B. CAPM assumes many small changes are required to bring the market back to equilibrium; APT assumes a few large changes are required to bring the market back to equ ...

Evidence from when-issued transactions

... the role of the depth of the when-issued market as represented by the size and frequency of trades. The depth of the market also allows us to examine the presence of strategic behavior in the Treasury auctions more precisely than in previous studies. Much emphasis has been placed by previous work on ...

... the role of the depth of the when-issued market as represented by the size and frequency of trades. The depth of the market also allows us to examine the presence of strategic behavior in the Treasury auctions more precisely than in previous studies. Much emphasis has been placed by previous work on ...

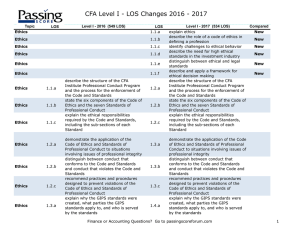

CFA Level I - LOS Changes 2016 - 2017

... of a random variable and of returns on a portfolio calculate and interpret covariance given a joint probability function calculate and interpret an updated probability using Bayes’ formula identify the most appropriate method to solve a particular counting problem and solve counting problems using f ...

... of a random variable and of returns on a portfolio calculate and interpret covariance given a joint probability function calculate and interpret an updated probability using Bayes’ formula identify the most appropriate method to solve a particular counting problem and solve counting problems using f ...

sam IAL - Edexcel

... Section A: Answer all the questions in this section. You should spend 35 minutes on this section. Use the data to support your answers where relevant. You may annotate and include diagrams in your answers. 1 In 2012, the French President, François Hollande, proposed a top marginal tax rate of 75% o ...

... Section A: Answer all the questions in this section. You should spend 35 minutes on this section. Use the data to support your answers where relevant. You may annotate and include diagrams in your answers. 1 In 2012, the French President, François Hollande, proposed a top marginal tax rate of 75% o ...

predictions, projections, and precautions: conveying cautionary

... created when corporate insiders make public predictions about the future prospects of their business. Investors crave these types of forward-looking corporate disclosures because investors use them to make judgments about the future profitability of companies. Corporations, however, are often reluct ...

... created when corporate insiders make public predictions about the future prospects of their business. Investors crave these types of forward-looking corporate disclosures because investors use them to make judgments about the future profitability of companies. Corporations, however, are often reluct ...

General account of selection

... operant learning as exemplifying selection processes in the same sense of this term. However, as obvious as this claim may seem on the surface, setting out an account of “selection” that is general enough to incorporate all three of these processes without becoming so general as to be vacuous is far ...

... operant learning as exemplifying selection processes in the same sense of this term. However, as obvious as this claim may seem on the surface, setting out an account of “selection” that is general enough to incorporate all three of these processes without becoming so general as to be vacuous is far ...

Download paper (PDF)

... normal or log-normal distributions, within a regime. This makes asset pricing under regime switching analytically tractable. In particular, regimes introduced into linear asset pricing models can often be solved in closed form because conditional on the underlying regime, normality (or log-normality ...

... normal or log-normal distributions, within a regime. This makes asset pricing under regime switching analytically tractable. In particular, regimes introduced into linear asset pricing models can often be solved in closed form because conditional on the underlying regime, normality (or log-normality ...

Investor Sentiment and the Mean-Variance Relation

... One striking feature of our empirical results is their robustness across four widely used volatility models. In particular, we conduct our empirical tests using the rolling window model, the mixed data sampling approach, GARCH, and asymmetric GARCH. In previous studies these models often yield diffe ...

... One striking feature of our empirical results is their robustness across four widely used volatility models. In particular, we conduct our empirical tests using the rolling window model, the mixed data sampling approach, GARCH, and asymmetric GARCH. In previous studies these models often yield diffe ...

The Capital Asset Pricing Model

... Thus, according to the CAPM: 1. Only assets with random returns that are positively correlated with the market return earn expected returns above the risk free rate. They must, in order to induce investors to take on more aggregate risk. ...

... Thus, according to the CAPM: 1. Only assets with random returns that are positively correlated with the market return earn expected returns above the risk free rate. They must, in order to induce investors to take on more aggregate risk. ...

Target price forecasts: Fundamentals and behavioural factor

... they make a reduced contribution to the optimistic bias in target price. Arguably, this is as expected given that there is little theoretical basis for a relation between the behavioral factors and future returns. Overall, we view our results as consistent with the nature of a target price, which is ...

... they make a reduced contribution to the optimistic bias in target price. Arguably, this is as expected given that there is little theoretical basis for a relation between the behavioral factors and future returns. Overall, we view our results as consistent with the nature of a target price, which is ...

Financial Intermediation as a Beliefs

... is that borrowers have insufficient net worth, which creates severe (asset-substitution) moral hazard problems. This suggests a greater role for intermediaries to resolve moral hazard, and hence predicts that Þnancial intermediation should be a higher percentage of GDP in emerging economies than in de ...

... is that borrowers have insufficient net worth, which creates severe (asset-substitution) moral hazard problems. This suggests a greater role for intermediaries to resolve moral hazard, and hence predicts that Þnancial intermediation should be a higher percentage of GDP in emerging economies than in de ...

Investor Behaviour and Lottery Stocks

... unconditionally risk averse. However, the behavioural finance literature has presented models of investor behavior in which risk preference is changing. The prospect theory of Kahneman and Tversky (1979) predicts that investors are risk averse following gains and risk seeking following losses. Speci ...

... unconditionally risk averse. However, the behavioural finance literature has presented models of investor behavior in which risk preference is changing. The prospect theory of Kahneman and Tversky (1979) predicts that investors are risk averse following gains and risk seeking following losses. Speci ...

D E EPARTMENT OF

... (M.B.A.), Public Administration (M.P.A.), or Health Policy and Management (M.S.) provide students of recognized academic ability and educational maturity the opportunity to fulfill integrated requirements for the undergraduate and graduate degrees. With careful planning, it is possible to earn both ...

... (M.B.A.), Public Administration (M.P.A.), or Health Policy and Management (M.S.) provide students of recognized academic ability and educational maturity the opportunity to fulfill integrated requirements for the undergraduate and graduate degrees. With careful planning, it is possible to earn both ...