Business Cycles and Financial Intermediation in Emerging Economies ∗ Christoph Große Steffen

... there is vast empirical literature on sudden stops of capital inflows during systemic crisis episodes (Calvo et al., 2008; Reinhart and Reinhart, 2009, among many others), there is only limited research on the patterns of capital flows to emerging markets during regular times. Broner et al. (2010) ...

... there is vast empirical literature on sudden stops of capital inflows during systemic crisis episodes (Calvo et al., 2008; Reinhart and Reinhart, 2009, among many others), there is only limited research on the patterns of capital flows to emerging markets during regular times. Broner et al. (2010) ...

高盛汉英词典 - 深圳市均达会计师事务所

... A monthly meeting, taking place in Paris, between the creditors of 19 countries for the purpose of discussing debt issues. Among other things, the Paris Club addresses the issue of coordinated debt relief for developing countries that cannot service their debt. ...

... A monthly meeting, taking place in Paris, between the creditors of 19 countries for the purpose of discussing debt issues. Among other things, the Paris Club addresses the issue of coordinated debt relief for developing countries that cannot service their debt. ...

1. The person generally directly responsible for

... A. doing so guarantees the company will grow in size at the maximum possible rate. B. doing so increases the salaries of all the employees. C. the current stockholders are the owners of the corporation. D. doing so means the firm is growing in size faster than its competitors. E. the managers often ...

... A. doing so guarantees the company will grow in size at the maximum possible rate. B. doing so increases the salaries of all the employees. C. the current stockholders are the owners of the corporation. D. doing so means the firm is growing in size faster than its competitors. E. the managers often ...

Financial Ratios

... allow us to get a better view of the firm’s financial health than just looking at the raw financial statements Ratios are used by both internal and external analysts • Internal uses planning evaluation of management ...

... allow us to get a better view of the firm’s financial health than just looking at the raw financial statements Ratios are used by both internal and external analysts • Internal uses planning evaluation of management ...

1 CORPORATE GOVERNANCE PATTERNS IN OECD

... to control the behaviour of management.7 Indeed, as recently as the late 1980s, many analysts had concluded that the agency problems that characterised outsider systems might inevitably lead to poor corporate performance.8 Management was thought to have effectively shielded itself from accountabilit ...

... to control the behaviour of management.7 Indeed, as recently as the late 1980s, many analysts had concluded that the agency problems that characterised outsider systems might inevitably lead to poor corporate performance.8 Management was thought to have effectively shielded itself from accountabilit ...

USING VARIABLE LIFE INSURANCE AS AN INVESTMENT

... because of the huge tax savings. But things get more complicated when comparing these two situations for those who wish to use equity and balanced investing because the taxation on accumulations and withdrawals is far more complex. Thus, this column deals only with equity and balanced investing avai ...

... because of the huge tax savings. But things get more complicated when comparing these two situations for those who wish to use equity and balanced investing because the taxation on accumulations and withdrawals is far more complex. Thus, this column deals only with equity and balanced investing avai ...

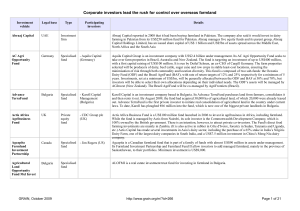

The new farm owners table

... Agrifirma was launched in 2008 to acquire land in Brazil and bring it into agricultural production. The principal shareholders formerly managed the mining investment company Galahad Gold plc from 2003 to 2007. "We are building a portfolio of land where we can successfully apply our capital, technolo ...

... Agrifirma was launched in 2008 to acquire land in Brazil and bring it into agricultural production. The principal shareholders formerly managed the mining investment company Galahad Gold plc from 2003 to 2007. "We are building a portfolio of land where we can successfully apply our capital, technolo ...

4. S D

... faster increase in the last quarter. As for the components of the final domestic demand, the private sector demand continued with a mild course across 2013, while the public sector demand, which registered a fluctuating course, proved to be the main driver of growth in the domestic demand. Imports l ...

... faster increase in the last quarter. As for the components of the final domestic demand, the private sector demand continued with a mild course across 2013, while the public sector demand, which registered a fluctuating course, proved to be the main driver of growth in the domestic demand. Imports l ...

Privatization CP - Open Evidence Archive

... subsidize them. Outside of New York City, rail transit makes little economic sense. The federal government should end its transit subsidies, and American cities should focus on more economically sound and consumer-driven approaches to easing congestion. Policymakers at all levels should work to revi ...

... subsidize them. Outside of New York City, rail transit makes little economic sense. The federal government should end its transit subsidies, and American cities should focus on more economically sound and consumer-driven approaches to easing congestion. Policymakers at all levels should work to revi ...

Disclaimer CAVENDISH IMPACT CAPITAL: IMPORTANT NOTICES

... It is the responsibility of the relevant parties to carry out any filing, registration or other local formality necessary to comply with applicable laws and regulations. Interests in the relevant investment vehicle are not registered under the U.S. Securities Act of 1933, as amended, and the rules a ...

... It is the responsibility of the relevant parties to carry out any filing, registration or other local formality necessary to comply with applicable laws and regulations. Interests in the relevant investment vehicle are not registered under the U.S. Securities Act of 1933, as amended, and the rules a ...

Domestic Competition and Export Performance of Manufacturing

... these countries rely on exporting a small number of primary commodities on highly volatile markets. A recent series of case studies has shown how the resulting trade shocks are liable to destabilise these economies, especially when the government responds by inappropriate policies (Collier, Gunning ...

... these countries rely on exporting a small number of primary commodities on highly volatile markets. A recent series of case studies has shown how the resulting trade shocks are liable to destabilise these economies, especially when the government responds by inappropriate policies (Collier, Gunning ...

Mankiw 6e PowerPoints

... depreciation cost is measured using current price of capital, and the CIT would not affect investment But, the legal definition uses the historical price of capital. If PK rises over time, then the legal definition understates the true cost and overstates profit, so firms could be taxed even if ...

... depreciation cost is measured using current price of capital, and the CIT would not affect investment But, the legal definition uses the historical price of capital. If PK rises over time, then the legal definition understates the true cost and overstates profit, so firms could be taxed even if ...

Investment Portfolio Review - Christian Brothers Investment Services

... sense the global economy has shrugged off the deflation threat that spooked markets last year. Analysts also viewed March’s Dutch election result as a rejection of populism and potential sign of European political stability. Nevertheless, upcoming elections in France and Germany and a restless Italy ...

... sense the global economy has shrugged off the deflation threat that spooked markets last year. Analysts also viewed March’s Dutch election result as a rejection of populism and potential sign of European political stability. Nevertheless, upcoming elections in France and Germany and a restless Italy ...

FREE Sample Here - Find the cheapest test bank for your

... 18. Secondary markets help support primary markets because secondary markets I. Offer primary market purchasers liquidity for their holdings II. Update the price or value of the primary market claims III. Reduce the cost of trading the primary market claims A. I only B. II only C. I and II only D. I ...

... 18. Secondary markets help support primary markets because secondary markets I. Offer primary market purchasers liquidity for their holdings II. Update the price or value of the primary market claims III. Reduce the cost of trading the primary market claims A. I only B. II only C. I and II only D. I ...

The Phoenix CFA Society Wendell Licon, CFA

... • Idea: instead of assuming a reinvestment rate = IRR, use reinvestment rate = k (kind of do this manually), then solve for rate of return. • 1st: separate outflows and inflows – Take outflows back to present at a k discount rate – Roll inflows forward - “reinvest” them - at the cost of capital, unt ...

... • Idea: instead of assuming a reinvestment rate = IRR, use reinvestment rate = k (kind of do this manually), then solve for rate of return. • 1st: separate outflows and inflows – Take outflows back to present at a k discount rate – Roll inflows forward - “reinvest” them - at the cost of capital, unt ...

Slide 1 - JRDeLisle

... Intermediaries will raise capital but struggle to deploy Infrastructure not in place to deal with sheer volume of deals ...

... Intermediaries will raise capital but struggle to deploy Infrastructure not in place to deal with sheer volume of deals ...

US Money Market Reform: The Scandi angle

... If we take a step back, Swedish banks have historically been large issuers of USD-denominated CPs and have no doubt been impacted by the upcoming regulatory changes. One reason for the significant issuance of USD denominated papers is the structural demand from SEK-based investors for USD funding. S ...

... If we take a step back, Swedish banks have historically been large issuers of USD-denominated CPs and have no doubt been impacted by the upcoming regulatory changes. One reason for the significant issuance of USD denominated papers is the structural demand from SEK-based investors for USD funding. S ...

Leverage, Risk and Regulatory Capital in Latin

... induce increases in loan rates with negative effects on firms and consumers. Other authors point that these effects are negligible and the benefits are extensive, asking for more capital to be raised. In theory, more capital can decrease the bank risk, which is followed by a reduction in the cost of ...

... induce increases in loan rates with negative effects on firms and consumers. Other authors point that these effects are negligible and the benefits are extensive, asking for more capital to be raised. In theory, more capital can decrease the bank risk, which is followed by a reduction in the cost of ...

NBER WORKING PAPER SERIES INFLATION, TAX RULES, AND THE STOCK MARKET

... size of the corporate capital stock and thereby raise the pretax return until the share price per dollar of capital returned to its initial equilibrium. l The current paper presents some illustrative calculations of the magnitude of the fall in the equilibrium capital stock that would result under c ...

... size of the corporate capital stock and thereby raise the pretax return until the share price per dollar of capital returned to its initial equilibrium. l The current paper presents some illustrative calculations of the magnitude of the fall in the equilibrium capital stock that would result under c ...

NBER WORKING PAPER SERIES QUANTITATIVE IMPLICATION OF A DEBT-DEFLATION

... East Asia in 1997, even in countries where there was no devaluation of the currency, as in Hong Kong where equity prices fell by 20 percent. Sudden Stops also induced higher asset price volatility. The volatility of weekly emerging-market dollar returns doubled from 2 to 4 percent during the 1997 Ea ...

... East Asia in 1997, even in countries where there was no devaluation of the currency, as in Hong Kong where equity prices fell by 20 percent. Sudden Stops also induced higher asset price volatility. The volatility of weekly emerging-market dollar returns doubled from 2 to 4 percent during the 1997 Ea ...

NBER WORKING PAPER SERIES RESTRICTION OF INTERNATIONAL PRODUCTION: David G. Hartman

... interest. For that reason, the individual firm's decision on how to finance its investment is not of concern here. Furthermore, even the observed aggregate financial behavior of multinational firms may not have relevance in this context. For example, if there were compensating long-term portfolio ca ...

... interest. For that reason, the individual firm's decision on how to finance its investment is not of concern here. Furthermore, even the observed aggregate financial behavior of multinational firms may not have relevance in this context. For example, if there were compensating long-term portfolio ca ...

Private equity secondary market

In finance, the private equity secondary market (also often called private equity secondaries or secondaries) refers to the buying and selling of pre-existing investor commitments to private equity and other alternative investment funds. Given the absence of established trading markets for these interests, the transfer of interests in private equity funds as well as hedge funds can be more complex and labor-intensive.Sellers of private equity investments sell not only the investments in the fund but also their remaining unfunded commitments to the funds. By its nature, the private equity asset class is illiquid, intended to be a long-term investment for buy-and-hold investors, including ""pension funds, endowments and wealthy families selling off their private equity funds before the pools have sold off all their assets."" For the vast majority of private equity investments, there is no listed public market; however, there is a robust and maturing secondary market available for sellers of private equity assets.Buyers seek to acquire private equity interests in the secondary market for multiple reasons. For example, the duration of the investment may be much shorter than an investment in the private equity fund initially. Likewise, the buyer may be able to acquire these interests at an attractive price. Finally, the buyer can evaluate the fund's holdings before deciding to purchase an interest in the fund. Conversely, sellers may seek to sell interest for various reasons, including the need to raise capital, the desire to avoid future capital calls, the need to reduce an over-allocation to the asset class or for regulatory reasons.Driven by strong demand for private equity exposure over the past decade, a significant amount of capital has been committed to secondary market funds from investors looking to increase and diversify their private equity exposure.