House Prices, Sales and Time on the Market: A Search

... captures the aforementioned illiquidity of housing assets and the fact that the degree of liquidity may change over time depending on market conditions. Anyone who has gone through the process knows it takes time and resources to buy and sell housing units. There are costs of acquiring relevant info ...

... captures the aforementioned illiquidity of housing assets and the fact that the degree of liquidity may change over time depending on market conditions. Anyone who has gone through the process knows it takes time and resources to buy and sell housing units. There are costs of acquiring relevant info ...

Investment Management Regulatory Update

... implementation. Rule 206(4)-7 also requires that a registered investment adviser designate a CCO. According to Ceresney, Rule 206(4)-7 was adopted after the SEC discovered that certain fund advisers, broker-dealers and other service providers were engaging in and/or facilitating market timing and la ...

... implementation. Rule 206(4)-7 also requires that a registered investment adviser designate a CCO. According to Ceresney, Rule 206(4)-7 was adopted after the SEC discovered that certain fund advisers, broker-dealers and other service providers were engaging in and/or facilitating market timing and la ...

Determinants of Firm`s Financial Leverage: A Critical

... affect firm’s financial leverage from the perspective of theoretical underpinnings. We reviewed 107 papers published from 1991 to 2005 in the core, non-core and other academic journals. On the basis of critical review, this research has identified a number of determinants of financial leverage based ...

... affect firm’s financial leverage from the perspective of theoretical underpinnings. We reviewed 107 papers published from 1991 to 2005 in the core, non-core and other academic journals. On the basis of critical review, this research has identified a number of determinants of financial leverage based ...

A Study on the Relationship between Relative Bargaining Power

... Since this research focus only in equity exchange M&A cases, we assume that the total debt value after combination is equal to the sum of participants’ debt values and it will keeps unchanged during our research period. ...

... Since this research focus only in equity exchange M&A cases, we assume that the total debt value after combination is equal to the sum of participants’ debt values and it will keeps unchanged during our research period. ...

a basic outlook on hedge fund structure and taxation issues

... Foreign personal holding company income is mostly gross income derived from passive investments such as dividends, interest, sale of property, rent, royalties and annuities.39 Although an exception exists for active financial service income, it does not apply in the case of hedge funds since most of ...

... Foreign personal holding company income is mostly gross income derived from passive investments such as dividends, interest, sale of property, rent, royalties and annuities.39 Although an exception exists for active financial service income, it does not apply in the case of hedge funds since most of ...

Financial Leverage and the Leverage Effect

... The leverage effect is that stock volatility is negatively correlated to stock returns—stock volatility tends to increase when stock prices drop. There are two common economic explanations for the leverage effect. The first explanation is based on the relationship between volatility and expected ret ...

... The leverage effect is that stock volatility is negatively correlated to stock returns—stock volatility tends to increase when stock prices drop. There are two common economic explanations for the leverage effect. The first explanation is based on the relationship between volatility and expected ret ...

Dynamic Volatility Targeting

... (for portfolio construction) based upon periods of stable historical correlation data to assess their risk exposure, significantly underestimating portfolio risk. The inherent instability of market relationships was revealed as correlations among global equity markets increased dramatically, all but ...

... (for portfolio construction) based upon periods of stable historical correlation data to assess their risk exposure, significantly underestimating portfolio risk. The inherent instability of market relationships was revealed as correlations among global equity markets increased dramatically, all but ...

Fees Eat Diversification`s Lunch

... asset classes and has been updated annually; see Shairp et al. (2012). Second, we have access to a biennial fee survey from a major institutional investment consulting firm with over $2 trillion in advised client assets. This data includes the average and distribution (i.e., several different percen ...

... asset classes and has been updated annually; see Shairp et al. (2012). Second, we have access to a biennial fee survey from a major institutional investment consulting firm with over $2 trillion in advised client assets. This data includes the average and distribution (i.e., several different percen ...

“Sell in May and Go Away” Just Won`t Go Away

... full exploitation of such anomalies requires frequent trading. For example, to fully exploit the turn-ofthe-month, Monday, and day-and-night effects, an investor would have to completely turn over a stock portfolio 12 times a year, 52 times a year, and 252 times a year, respectively.2 In contrast, t ...

... full exploitation of such anomalies requires frequent trading. For example, to fully exploit the turn-ofthe-month, Monday, and day-and-night effects, an investor would have to completely turn over a stock portfolio 12 times a year, 52 times a year, and 252 times a year, respectively.2 In contrast, t ...

Capital Market Review - Allegheny Financial Group

... quarter, with five outperforming the broad market. Financial Services was the strongest at 21.1%. Energy followed at 7.3% and Industrials at 7.2%. Telecom returned 4.8% and the final sector to outperform the market was Materials, returning 4.7%. The other positive, but underperforming sectors were C ...

... quarter, with five outperforming the broad market. Financial Services was the strongest at 21.1%. Energy followed at 7.3% and Industrials at 7.2%. Telecom returned 4.8% and the final sector to outperform the market was Materials, returning 4.7%. The other positive, but underperforming sectors were C ...

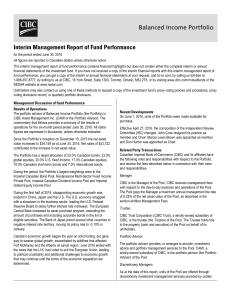

Balanced Income Portfolio Interim Management Report of Fund

... From income (excluding dividends) From dividends From capital gains Return of capital Total Distributions3 ...

... From income (excluding dividends) From dividends From capital gains Return of capital Total Distributions3 ...

Short-term Expectations in Listed Firms: The Effects of Different

... both transient and more long-term owners.8 Many institutional investors such as mutual fund managers face short-term compensation schemes tied to recent fund performance, and are involved in active trading, elements which can make their focus rather short-term, such as on returns from daily up to a ...

... both transient and more long-term owners.8 Many institutional investors such as mutual fund managers face short-term compensation schemes tied to recent fund performance, and are involved in active trading, elements which can make their focus rather short-term, such as on returns from daily up to a ...

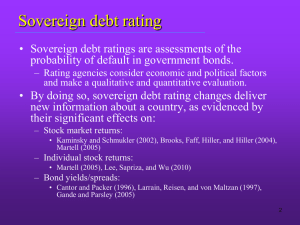

Sovereign Debt Rating and Stock Liquidity around the World

... • We study the impact of sovereign rating changes on stock liquidity for 40 countries for 1990-2009. • Our findings show that sovereign rating changes have a significant and robust impact on stock liquidity. – The impact is nonlinear and asymmetric and varies across stocks and countries. – In a cros ...

... • We study the impact of sovereign rating changes on stock liquidity for 40 countries for 1990-2009. • Our findings show that sovereign rating changes have a significant and robust impact on stock liquidity. – The impact is nonlinear and asymmetric and varies across stocks and countries. – In a cros ...

IOSR Journal of Humanities and Social Science (JHSS)

... years. These debate covers both the developed and underdeveloped economies. However, a lot more has been put into the study of domestic investment since it seems that a sustainable domestic private investment will reduce widespread poverty in the economy. In developing country like Nigeria, private ...

... years. These debate covers both the developed and underdeveloped economies. However, a lot more has been put into the study of domestic investment since it seems that a sustainable domestic private investment will reduce widespread poverty in the economy. In developing country like Nigeria, private ...

Musharaka-by-Muhammad-Zubair-Usmani-

... determined in proportion to the actual profit accrued to the business, and not in proportion to the capital invested by him. It is not allowed to fix a lump sum amount for any one of the partners, or any rate of profit tied up with his investment. ...

... determined in proportion to the actual profit accrued to the business, and not in proportion to the capital invested by him. It is not allowed to fix a lump sum amount for any one of the partners, or any rate of profit tied up with his investment. ...

The Role of Private Investment in Meeting U.S. Transportation

... With the U.S. Congress now developing legislation to reauthorize the federal highway and transit programs, ARTBA believed it was an ideal time to take an objective look at where the P3 market stands today after almost two decades of active promotion and assistance at the federal level. This is parti ...

... With the U.S. Congress now developing legislation to reauthorize the federal highway and transit programs, ARTBA believed it was an ideal time to take an objective look at where the P3 market stands today after almost two decades of active promotion and assistance at the federal level. This is parti ...

Multi-Seller Commercial Paper - Dorris - Artic

... in 1985. Since then it has burgeoned into a major financing tool. At the end of 2002, $715 billion in assetbacked commercial paper notes was outstanding. Assetbacked commercial paper outstanding at June 30, 2003 dropped to $683 billion, reflecting, among other matters, the impact of new regulatory a ...

... in 1985. Since then it has burgeoned into a major financing tool. At the end of 2002, $715 billion in assetbacked commercial paper notes was outstanding. Assetbacked commercial paper outstanding at June 30, 2003 dropped to $683 billion, reflecting, among other matters, the impact of new regulatory a ...

I_Ch05

... The HPR is a simple and unambiguous measure of investment return over a single period However, investors are often interested in average returns over longer periods of time In this case, return measurement is more ambiguous, i.e., there may be different methods to measure multi-period returns – Arit ...

... The HPR is a simple and unambiguous measure of investment return over a single period However, investors are often interested in average returns over longer periods of time In this case, return measurement is more ambiguous, i.e., there may be different methods to measure multi-period returns – Arit ...

Competition for market services—trading in listed securities

... The markets to be operated by AXE and Liquidnet will, if approved, be the first licensed securities markets to provide an Australian domestic alternative for transactions in equity securities listed on ASX’s market. ...

... The markets to be operated by AXE and Liquidnet will, if approved, be the first licensed securities markets to provide an Australian domestic alternative for transactions in equity securities listed on ASX’s market. ...

East Carolina University Basic Spending Guidelines by

... Expenditure account codes are codes that must be used when processing financial transactions to identify various classes of expenditures, for example, salaries, travel, supplies, equipment, etc. The actual codes will provide even more detailed breakdowns of these groupings. This coding scheme gives ...

... Expenditure account codes are codes that must be used when processing financial transactions to identify various classes of expenditures, for example, salaries, travel, supplies, equipment, etc. The actual codes will provide even more detailed breakdowns of these groupings. This coding scheme gives ...

How working capital management affects the profitability of Afriland

... management on the profitability of small and medium sized export companies in Tunisia. , the result show a negative relationship between corporate profitability and the different working capital components which reveals that Tunisian export small and medium sized enterprises should shorten their cas ...

... management on the profitability of small and medium sized export companies in Tunisia. , the result show a negative relationship between corporate profitability and the different working capital components which reveals that Tunisian export small and medium sized enterprises should shorten their cas ...

Understanding Secular Stock Market Cycles

... Over complete business cycles, earnings growth for a market index like the S&P 500 Index will be slightly slower on a nominal basis than the overall economy (reflecting that larger, public companies generally have slightly slower average growth than the economy with its new start-ups and sometimes f ...

... Over complete business cycles, earnings growth for a market index like the S&P 500 Index will be slightly slower on a nominal basis than the overall economy (reflecting that larger, public companies generally have slightly slower average growth than the economy with its new start-ups and sometimes f ...

Ironbark Waverton Concentrated Global Share Fund

... Cycle approach. We believe the strategy uses a long-term, repeatable and robust investment process. • Risk-controlled framework: The Fund benefits from a disciplined risk management construct and is overseen by the performance and risk team. • Access to investment opportunities and overseas markets: ...

... Cycle approach. We believe the strategy uses a long-term, repeatable and robust investment process. • Risk-controlled framework: The Fund benefits from a disciplined risk management construct and is overseen by the performance and risk team. • Access to investment opportunities and overseas markets: ...

Private equity secondary market

In finance, the private equity secondary market (also often called private equity secondaries or secondaries) refers to the buying and selling of pre-existing investor commitments to private equity and other alternative investment funds. Given the absence of established trading markets for these interests, the transfer of interests in private equity funds as well as hedge funds can be more complex and labor-intensive.Sellers of private equity investments sell not only the investments in the fund but also their remaining unfunded commitments to the funds. By its nature, the private equity asset class is illiquid, intended to be a long-term investment for buy-and-hold investors, including ""pension funds, endowments and wealthy families selling off their private equity funds before the pools have sold off all their assets."" For the vast majority of private equity investments, there is no listed public market; however, there is a robust and maturing secondary market available for sellers of private equity assets.Buyers seek to acquire private equity interests in the secondary market for multiple reasons. For example, the duration of the investment may be much shorter than an investment in the private equity fund initially. Likewise, the buyer may be able to acquire these interests at an attractive price. Finally, the buyer can evaluate the fund's holdings before deciding to purchase an interest in the fund. Conversely, sellers may seek to sell interest for various reasons, including the need to raise capital, the desire to avoid future capital calls, the need to reduce an over-allocation to the asset class or for regulatory reasons.Driven by strong demand for private equity exposure over the past decade, a significant amount of capital has been committed to secondary market funds from investors looking to increase and diversify their private equity exposure.