This PDF is a selection from an out-of-print volume from... of Economic Research Volume Title: International Capital Flows

... experienced by financial markets during the fall of 1997 has raised the question of “contagion.” Analysts have wondered whether in an era of capital mobility rumors and changes in expectations in a particular country can spread to other nations with healthy fundamentals. This paper deals with Latin ...

... experienced by financial markets during the fall of 1997 has raised the question of “contagion.” Analysts have wondered whether in an era of capital mobility rumors and changes in expectations in a particular country can spread to other nations with healthy fundamentals. This paper deals with Latin ...

Educating Your Investment Committee on Behavioral Economics

... An investment in alternative investments can be highly illiquid, is speculative and not suitable for all investors. Investing in alternative investments is only intended for experienced and sophisticated investors who are willing to bear the high economic risks associated with such an investment. In ...

... An investment in alternative investments can be highly illiquid, is speculative and not suitable for all investors. Investing in alternative investments is only intended for experienced and sophisticated investors who are willing to bear the high economic risks associated with such an investment. In ...

Would a Stock By Any Other Ticker Smell as Sweet? Alex Head

... bullish on the Morgan Stanley Asia Pacific Fund, but the ticker symbol was misprinted as APB, ...

... bullish on the Morgan Stanley Asia Pacific Fund, but the ticker symbol was misprinted as APB, ...

View COLL 6.3 as PDF

... (1) In accordance with Principle 6, this section is intended to ensure that the authorised fund manager pays due regard to its clients' interests and treats them fairly. (2) An authorised fund manager is responsible for valuing the scheme property of the authorised fund it manages and for calculatin ...

... (1) In accordance with Principle 6, this section is intended to ensure that the authorised fund manager pays due regard to its clients' interests and treats them fairly. (2) An authorised fund manager is responsible for valuing the scheme property of the authorised fund it manages and for calculatin ...

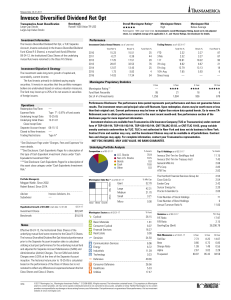

Invesco Diversified Dividend Ret Opt

... of the funds as they were at the time of the calculation. Percentile ranks within categories are most useful in those groups that have a large number of funds. For small universes, funds will be ranked at the highest percentage possible. For instance, if there are only two utility funds with 10-year ...

... of the funds as they were at the time of the calculation. Percentile ranks within categories are most useful in those groups that have a large number of funds. For small universes, funds will be ranked at the highest percentage possible. For instance, if there are only two utility funds with 10-year ...

Inflation and the Price of Real Assets ∗ Monika Piazzesi Martin Schneider

... The 1970s brought dramatic changes in the size and composition of US household sector wealth. Figure 1 shows that aggregate household net worth as a fraction of GDP fell by 25% during the 1970s, before recovering again to its late 1960s value. Figure 2 shows that the aggregate household portfolio sa ...

... The 1970s brought dramatic changes in the size and composition of US household sector wealth. Figure 1 shows that aggregate household net worth as a fraction of GDP fell by 25% during the 1970s, before recovering again to its late 1960s value. Figure 2 shows that the aggregate household portfolio sa ...

risk measurement for hedge fund portfolios

... significant amounts of capital to these investment vehicles. Several large institutions have received significant press lately for their planned investments into hedge funds. The California Public Employees’ Retirement System, CalPERS, for example has committed to invest one billion dollars to hedge ...

... significant amounts of capital to these investment vehicles. Several large institutions have received significant press lately for their planned investments into hedge funds. The California Public Employees’ Retirement System, CalPERS, for example has committed to invest one billion dollars to hedge ...

Angels, Entrepreneurship, and Employment

... financial intermediaries such as banks and professional venture capital firms undoubtedly play an important role, but much of the capital supplied to new firms takes place through a less formal channel of wealthy individuals investing their own funds, often termed angel finance. For example, Puri an ...

... financial intermediaries such as banks and professional venture capital firms undoubtedly play an important role, but much of the capital supplied to new firms takes place through a less formal channel of wealthy individuals investing their own funds, often termed angel finance. For example, Puri an ...

Statement of Financial Condition

... Cash and cash equivalents are defined as highly liquid investments, with an original maturity of three months or less when purchased. At June 30, 2016, the Company had cash equivalents of $9,656 in demand deposit accounts at cost, which approximates fair value. Financial Instruments Financial instru ...

... Cash and cash equivalents are defined as highly liquid investments, with an original maturity of three months or less when purchased. At June 30, 2016, the Company had cash equivalents of $9,656 in demand deposit accounts at cost, which approximates fair value. Financial Instruments Financial instru ...

Shadow Fed Funds Rate

... investments. This is often referred to as the “risk off” or “flight to quality trade”. Since the beginning of 2016 many bond investors have flocked into US Treasuries, Agency MBS, and Municipal Bonds. vs. Camp # 2 The contrarians. As Warren Buffet often says…”I want to be greedy when others are fear ...

... investments. This is often referred to as the “risk off” or “flight to quality trade”. Since the beginning of 2016 many bond investors have flocked into US Treasuries, Agency MBS, and Municipal Bonds. vs. Camp # 2 The contrarians. As Warren Buffet often says…”I want to be greedy when others are fear ...

Capital Flows to Asia and Latin America, 1950-2007

... II, despite the fact that economic growth and capital productivity were very high in this region. In contrast, considerable capital flowed to Latin America during this period, despite the fact that neither capital productivity nor economic growth was high. In fact, as discussed by Cole et al (2005), ...

... II, despite the fact that economic growth and capital productivity were very high in this region. In contrast, considerable capital flowed to Latin America during this period, despite the fact that neither capital productivity nor economic growth was high. In fact, as discussed by Cole et al (2005), ...

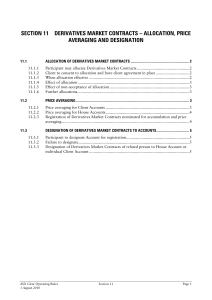

ASX Clear Section 11 - Derivatives Market Contracts – Allocation

... Participant may allocate Derivatives Market Contracts If a Derivatives Market Contract is reported to ASX Clear for registration in the name of a Participant (the “First Participant”), the First Participant may, before the Derivatives Market Contract is registered, allocate the contract to another P ...

... Participant may allocate Derivatives Market Contracts If a Derivatives Market Contract is reported to ASX Clear for registration in the name of a Participant (the “First Participant”), the First Participant may, before the Derivatives Market Contract is registered, allocate the contract to another P ...

Ownership structure and the performance of firms

... Some works showed a linear relation (Cole and Mehran, 1998) whereas other more recent studies highlighted a non-linear relation (Morck et al., 1988; McConnell and Servaes, 1990 and 1995; Kole, 1995; Short and Keasey, 1999). Using Tobin’s Q as a measurement of performance and the percentage of shares ...

... Some works showed a linear relation (Cole and Mehran, 1998) whereas other more recent studies highlighted a non-linear relation (Morck et al., 1988; McConnell and Servaes, 1990 and 1995; Kole, 1995; Short and Keasey, 1999). Using Tobin’s Q as a measurement of performance and the percentage of shares ...

Extraneous Risk: Pricing of Non-Systematic Risk

... lowed some other risk factors other than the market risk. However all of these models explicitly assume the rationality of economic agents. In this tradition, we have two main implications. First, all the economic agents look at the economic phenomena in the same way as they are all rational. Second ...

... lowed some other risk factors other than the market risk. However all of these models explicitly assume the rationality of economic agents. In this tradition, we have two main implications. First, all the economic agents look at the economic phenomena in the same way as they are all rational. Second ...

2015 Full Year Financial Report for Lend Lease Trust

... Rule 12 of the Trust’s Constitution provides for indemnification in favour of each of the Directors named on page one of this Report; the officers of the Responsible Entity or of wholly owned subsidiaries or related entities of the Responsible Entity (‘Officers’) to the extent permitted by the Corpo ...

... Rule 12 of the Trust’s Constitution provides for indemnification in favour of each of the Directors named on page one of this Report; the officers of the Responsible Entity or of wholly owned subsidiaries or related entities of the Responsible Entity (‘Officers’) to the extent permitted by the Corpo ...

"The Alpha and Omega of Hedge Fund Performance Measurement"

... Sound investment decisions rest on identifying and selecting portfolio managers who are expected to deliver superior performance. There is ample evidence that portfolio managers following traditional active strategies on average under-perform passive investment strategies (see for example Jensen (19 ...

... Sound investment decisions rest on identifying and selecting portfolio managers who are expected to deliver superior performance. There is ample evidence that portfolio managers following traditional active strategies on average under-perform passive investment strategies (see for example Jensen (19 ...

Hanke-Guttridge Discounted Cash Flow Methodology

... yield. A five-year graph of the firm’s stock performance is incorporated as it allows the investor to have a visual representation of clear trends in the stock price, understand its volatility and risk, and evaluate how the stock price reacted to any large macro events, such as the financial crisis ...

... yield. A five-year graph of the firm’s stock performance is incorporated as it allows the investor to have a visual representation of clear trends in the stock price, understand its volatility and risk, and evaluate how the stock price reacted to any large macro events, such as the financial crisis ...

Corporate capital structure choice: does

... corporate capital structure, in particular firm specific (firm size, past profitability, industry class, effective tax rate, tangibility of assets, firm growth, etc.) and manager’s (education, ownership share, etc.) characteristics. In recent years the determinants of the corporate capital structure ...

... corporate capital structure, in particular firm specific (firm size, past profitability, industry class, effective tax rate, tangibility of assets, firm growth, etc.) and manager’s (education, ownership share, etc.) characteristics. In recent years the determinants of the corporate capital structure ...

Hedge Funds and the Technology Bubble

... Database maintained by Thomson Financial, which is based on 13F filings with the SEC. Since 1978 all institutions with more than $100 million under discretionary management are required to disclose their holdings to the SEC each quarter on form 13F. This concerns all long positions in section 13(f) ...

... Database maintained by Thomson Financial, which is based on 13F filings with the SEC. Since 1978 all institutions with more than $100 million under discretionary management are required to disclose their holdings to the SEC each quarter on form 13F. This concerns all long positions in section 13(f) ...

Prospectus SEB Green Bond Fund

... No information or statements that deviate from the Prospectus or Management Regulations may be given. SEB Investment Management AB shall not be liable for any information provided or statements given that deviate from this Prospectus. Information and statements in this Prospectus are based on the cu ...

... No information or statements that deviate from the Prospectus or Management Regulations may be given. SEB Investment Management AB shall not be liable for any information provided or statements given that deviate from this Prospectus. Information and statements in this Prospectus are based on the cu ...

Private equity secondary market

In finance, the private equity secondary market (also often called private equity secondaries or secondaries) refers to the buying and selling of pre-existing investor commitments to private equity and other alternative investment funds. Given the absence of established trading markets for these interests, the transfer of interests in private equity funds as well as hedge funds can be more complex and labor-intensive.Sellers of private equity investments sell not only the investments in the fund but also their remaining unfunded commitments to the funds. By its nature, the private equity asset class is illiquid, intended to be a long-term investment for buy-and-hold investors, including ""pension funds, endowments and wealthy families selling off their private equity funds before the pools have sold off all their assets."" For the vast majority of private equity investments, there is no listed public market; however, there is a robust and maturing secondary market available for sellers of private equity assets.Buyers seek to acquire private equity interests in the secondary market for multiple reasons. For example, the duration of the investment may be much shorter than an investment in the private equity fund initially. Likewise, the buyer may be able to acquire these interests at an attractive price. Finally, the buyer can evaluate the fund's holdings before deciding to purchase an interest in the fund. Conversely, sellers may seek to sell interest for various reasons, including the need to raise capital, the desire to avoid future capital calls, the need to reduce an over-allocation to the asset class or for regulatory reasons.Driven by strong demand for private equity exposure over the past decade, a significant amount of capital has been committed to secondary market funds from investors looking to increase and diversify their private equity exposure.