prospectus - Cullen Funds

... can confront the global economy such as declining consumer and business confidence, malfunctioning credit markets, increased unemployment, reduced levels of capital expenditures, fluctuating commodity prices, bankruptcies, and other circumstances, all of which can individually and collectively have ...

... can confront the global economy such as declining consumer and business confidence, malfunctioning credit markets, increased unemployment, reduced levels of capital expenditures, fluctuating commodity prices, bankruptcies, and other circumstances, all of which can individually and collectively have ...

This PDF is a selection from an out-of-print volume from... of Economic Research

... There were brief periods in which some Communist regimes tolerated a vibrant private sector, most notably during the New Economic Policy of the 1920s in the Soviet Union (Ball 1987; Kaufman 1962). There were also episodes of relative liberalization for private business, although these were usually f ...

... There were brief periods in which some Communist regimes tolerated a vibrant private sector, most notably during the New Economic Policy of the 1920s in the Soviet Union (Ball 1987; Kaufman 1962). There were also episodes of relative liberalization for private business, although these were usually f ...

Capital Flows to Central and Eastern Europe Philip R. Lane

... expected rates of return on a country’s foreign assets and liabilities, which will be heavily influenced by the composition of its international balance sheet. A second important issue for an indebted economy is an assessment of its degree of vulnerability to financial shocks. For instance, the inte ...

... expected rates of return on a country’s foreign assets and liabilities, which will be heavily influenced by the composition of its international balance sheet. A second important issue for an indebted economy is an assessment of its degree of vulnerability to financial shocks. For instance, the inte ...

Co-operative Capital - Saint Mary`s University

... natural and human resources in the pursuit of profit – are becoming more recognised and better understood.” 15 “While this ownership model provides a powerful driver, it also creates a problem. Being effective at delivering private benefit is all very well, but an economy based on the quest for the ...

... natural and human resources in the pursuit of profit – are becoming more recognised and better understood.” 15 “While this ownership model provides a powerful driver, it also creates a problem. Being effective at delivering private benefit is all very well, but an economy based on the quest for the ...

Stock Market Liquidity and the Cost of Issuing Equity

... Our results indicate that stock market liquidity is a major determinant of total investment banking fees (i.e., the gross spread or gross fees) in SEOs. We show that there is a surprisingly large and robust inverse relationship between the total fees paid to investment banks and the stock market li ...

... Our results indicate that stock market liquidity is a major determinant of total investment banking fees (i.e., the gross spread or gross fees) in SEOs. We show that there is a surprisingly large and robust inverse relationship between the total fees paid to investment banks and the stock market li ...

Learning from stock prices and economic growth

... Stiglitz (1980) is embedded into a neoclassical growth economy. The economy is composed of firms that raise capital on the stock market, and overlapping generations of workers who invest their labor income in them. Firms’ productivity is unknown but agents can collect private signals about it at a c ...

... Stiglitz (1980) is embedded into a neoclassical growth economy. The economy is composed of firms that raise capital on the stock market, and overlapping generations of workers who invest their labor income in them. Firms’ productivity is unknown but agents can collect private signals about it at a c ...

2nd DFD_Beikos - Institutional capacity and cooperation

... EIB Group: EIB : European Union’s financing institution Created by the Treaty of Rome in 1958 as the long-term lending bank of the EU Shareholders are the 27 Member States of the EU Policy driven Bank: raises funds on the capital markets which it lends on favourable terms to projects furthering EU ...

... EIB Group: EIB : European Union’s financing institution Created by the Treaty of Rome in 1958 as the long-term lending bank of the EU Shareholders are the 27 Member States of the EU Policy driven Bank: raises funds on the capital markets which it lends on favourable terms to projects furthering EU ...

How to close the European investment gap?

... between the proposals analyzed here are notable but the majority of them share a large common ground regarding size, financing, institutional set-up and areas to invest in. Most proposals want to mobilize between 100 and 300 bn€ p.a. of private capital by leveraging funds from either the EU or gover ...

... between the proposals analyzed here are notable but the majority of them share a large common ground regarding size, financing, institutional set-up and areas to invest in. Most proposals want to mobilize between 100 and 300 bn€ p.a. of private capital by leveraging funds from either the EU or gover ...

Enhanced-Supervision-for-U.S.-Operations-of-Foreign

... New Capital Requirements and Broker-Dealers (continued) • SEC-registered broker-dealers, as an example of nonbank subsidiaries that might be included in an IHC, are already subject to separate capital requirements. • The SEC has a robust and extensive capital regulatory structure for SEC- registere ...

... New Capital Requirements and Broker-Dealers (continued) • SEC-registered broker-dealers, as an example of nonbank subsidiaries that might be included in an IHC, are already subject to separate capital requirements. • The SEC has a robust and extensive capital regulatory structure for SEC- registere ...

Atlantia Low risk, high return

... However, the two alternative systems (i.e. status quo, represented by the 1997 Concession Contract as integrated by the 2002 Supplementary Agreement, or the Single Concession Contract) are substantially on a par from a financial viewpoint, suggesting a fair valuation for Atlantia in the range of EUR ...

... However, the two alternative systems (i.e. status quo, represented by the 1997 Concession Contract as integrated by the 2002 Supplementary Agreement, or the Single Concession Contract) are substantially on a par from a financial viewpoint, suggesting a fair valuation for Atlantia in the range of EUR ...

To hedge or not to hedge? Evaluating currency

... resulting in greater currency exposure; (4) a portfolio objective specifically targeting volatility. ...

... resulting in greater currency exposure; (4) a portfolio objective specifically targeting volatility. ...

Open Research Online How Might We Create a Secondary Annuity

... Effective competition is vital in creating a secondary annuity market that offers reasonable value-formoney to pensioners. This is not to argue that perfect competition in the strict economic sense is necessary or feasible. It isn’t: no real market meets all the criteria and there are particular fla ...

... Effective competition is vital in creating a secondary annuity market that offers reasonable value-formoney to pensioners. This is not to argue that perfect competition in the strict economic sense is necessary or feasible. It isn’t: no real market meets all the criteria and there are particular fla ...

Financial Flows to Developing Countries: Recent Trends and Prospects

... made slow progress in fulfilling their commitments to enrich development assistance. Although private capital flows to developing countries have surged over the past few years, most of the flows have gone to just a few large countries. Many developing countries still depend heavily on concessionary ...

... made slow progress in fulfilling their commitments to enrich development assistance. Although private capital flows to developing countries have surged over the past few years, most of the flows have gone to just a few large countries. Many developing countries still depend heavily on concessionary ...

Systemic risk of UCITS investment funds and financial market

... On the other hand, the measures used to capture systemic risk of institutional investors' sector, investment funds especially, are underrepresented. Within the Financial Soundness Indicators – FSI, considered being indicators of financial stability and resilience, not a single one out of 40 indicato ...

... On the other hand, the measures used to capture systemic risk of institutional investors' sector, investment funds especially, are underrepresented. Within the Financial Soundness Indicators – FSI, considered being indicators of financial stability and resilience, not a single one out of 40 indicato ...

Why is long-horizon equity less risky? A duration-based

... assets while value firms are low-duration assets. We model how investors perceive the risks of these cash f lows by specifying a stochastic discount factor for the economy, or equivalently, an intertemporal marginal rate of substitution for the representative agent. Two properties of the stochastic ...

... assets while value firms are low-duration assets. We model how investors perceive the risks of these cash f lows by specifying a stochastic discount factor for the economy, or equivalently, an intertemporal marginal rate of substitution for the representative agent. Two properties of the stochastic ...

DT - European Parliament

... Why did investors decide on a massive scale to abandon a product that withstood the crisis reasonably well in Europe? And, even more intriguing, why did the EU market not recover (whereas the US market did)? The explanation of stigma on securitisation is far from satisfying, since we are talking abo ...

... Why did investors decide on a massive scale to abandon a product that withstood the crisis reasonably well in Europe? And, even more intriguing, why did the EU market not recover (whereas the US market did)? The explanation of stigma on securitisation is far from satisfying, since we are talking abo ...

The Market for Foreign Investment in Microfinance: Opportunities

... the private funds. In addition to raising capital from the IFIs, the private funds attract funding from private socially-motivated investors and NGOs, as well as from bilateral donor agencies and government lottery programs. CGAP estimates the amount of this non-IFI contribution to the private funds ...

... the private funds. In addition to raising capital from the IFIs, the private funds attract funding from private socially-motivated investors and NGOs, as well as from bilateral donor agencies and government lottery programs. CGAP estimates the amount of this non-IFI contribution to the private funds ...

Determinants of Going-Public Decision in an Emerging

... Their survey sample of 336 CFOs was the result of a response rate of 18.1 percent. The survey revealed that: the acquisition purpose was a major factor that motivated the US companies to do IPO; issuers timed their IPOs to take advantage of prevailing market conditions; and preservation of decision- ...

... Their survey sample of 336 CFOs was the result of a response rate of 18.1 percent. The survey revealed that: the acquisition purpose was a major factor that motivated the US companies to do IPO; issuers timed their IPOs to take advantage of prevailing market conditions; and preservation of decision- ...

NBER WORKING PAPER SERIES CAPITAL FLOWS AND CONTROLS Ilan Goldfajn

... To analyze the current account performance in a broader macroeconomic context, internationally as well as domestically, including the effect of policy decisions, we subdivide the current account performance into five phases since the mid-1970s: 1974–1982: the second National Development Plan (II PND ...

... To analyze the current account performance in a broader macroeconomic context, internationally as well as domestically, including the effect of policy decisions, we subdivide the current account performance into five phases since the mid-1970s: 1974–1982: the second National Development Plan (II PND ...

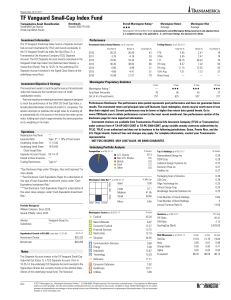

TF Vanguard Small-Cap Index Fund

... of the funds as they were at the time of the calculation. Percentile ranks within categories are most useful in those groups that have a large number of funds. For small universes, funds will be ranked at the highest percentage possible. For instance, if there are only two utility funds with 10-year ...

... of the funds as they were at the time of the calculation. Percentile ranks within categories are most useful in those groups that have a large number of funds. For small universes, funds will be ranked at the highest percentage possible. For instance, if there are only two utility funds with 10-year ...

Mutual Fund Performance and the Incentive to Generate Alpha

... allow flow-performance sensitivities to vary across segments, we find that only self-directed investors chase alpha. We find no significant relation between flows into broker-sold funds and their alphas, but find instead a strong relation between flows and raw returns. Thus, direct-sold funds face a ...

... allow flow-performance sensitivities to vary across segments, we find that only self-directed investors chase alpha. We find no significant relation between flows into broker-sold funds and their alphas, but find instead a strong relation between flows and raw returns. Thus, direct-sold funds face a ...

decentralized trade mitigates the lemons problem

... Markets differ in the degree to which trade is centralized. Call markets, used to set opening prices on the NYSE, are highly centralized, and all trade takes place at a single price (the market clearing price). In contrast, in housing, labor, or used car markets, trade is highly decentralized, and p ...

... Markets differ in the degree to which trade is centralized. Call markets, used to set opening prices on the NYSE, are highly centralized, and all trade takes place at a single price (the market clearing price). In contrast, in housing, labor, or used car markets, trade is highly decentralized, and p ...

Private equity secondary market

In finance, the private equity secondary market (also often called private equity secondaries or secondaries) refers to the buying and selling of pre-existing investor commitments to private equity and other alternative investment funds. Given the absence of established trading markets for these interests, the transfer of interests in private equity funds as well as hedge funds can be more complex and labor-intensive.Sellers of private equity investments sell not only the investments in the fund but also their remaining unfunded commitments to the funds. By its nature, the private equity asset class is illiquid, intended to be a long-term investment for buy-and-hold investors, including ""pension funds, endowments and wealthy families selling off their private equity funds before the pools have sold off all their assets."" For the vast majority of private equity investments, there is no listed public market; however, there is a robust and maturing secondary market available for sellers of private equity assets.Buyers seek to acquire private equity interests in the secondary market for multiple reasons. For example, the duration of the investment may be much shorter than an investment in the private equity fund initially. Likewise, the buyer may be able to acquire these interests at an attractive price. Finally, the buyer can evaluate the fund's holdings before deciding to purchase an interest in the fund. Conversely, sellers may seek to sell interest for various reasons, including the need to raise capital, the desire to avoid future capital calls, the need to reduce an over-allocation to the asset class or for regulatory reasons.Driven by strong demand for private equity exposure over the past decade, a significant amount of capital has been committed to secondary market funds from investors looking to increase and diversify their private equity exposure.