presentation - Kinetics Mutual Funds

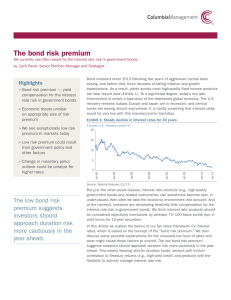

... outstanding par value of at least $100 million. The Barclays 1-3 U.S. Credit Bond Index is composed of investment grade United States credit securities with a maturity between one and three years. Both Barclays indices are trademarks of Barclays Bank PLC. An investor cannot invest directly in an ind ...

... outstanding par value of at least $100 million. The Barclays 1-3 U.S. Credit Bond Index is composed of investment grade United States credit securities with a maturity between one and three years. Both Barclays indices are trademarks of Barclays Bank PLC. An investor cannot invest directly in an ind ...

Soln Ch 21 Futures intro

... Inaccurate. According to the cost of carry model, the futures contract price is adjusted upward by the cost of carry for the underlying asset. Bonds (and other financial instruments), however, do not have any significant storage costs. Moreover, the cost of carry is reduced by any coupon payments pa ...

... Inaccurate. According to the cost of carry model, the futures contract price is adjusted upward by the cost of carry for the underlying asset. Bonds (and other financial instruments), however, do not have any significant storage costs. Moreover, the cost of carry is reduced by any coupon payments pa ...

markets work in war

... The analysis of break points undertaken here does not identify historical facts, but rather the acquisition and assessment of information relevant for bondholders. Wartime events are evaluated with respect to what the likelihood is that they affect the probability of having the government bonds corr ...

... The analysis of break points undertaken here does not identify historical facts, but rather the acquisition and assessment of information relevant for bondholders. Wartime events are evaluated with respect to what the likelihood is that they affect the probability of having the government bonds corr ...

CH06 - Class Index

... for an investment will be different from the expected return • Investors are concerned that the realized return will be less than the expected return • The greater the variability between the expected and realized return, the greater the risk • Although, investors may receive on average their expect ...

... for an investment will be different from the expected return • Investors are concerned that the realized return will be less than the expected return • The greater the variability between the expected and realized return, the greater the risk • Although, investors may receive on average their expect ...

Collect the Biggest Dividends In Stock Market History

... also why many investors blow their chance at making money from these large payout events. This is the single most important key to why this dividend strategy works… In short, stock exchange market makers drop the price commensurate with the per share dividend payout. Now, at first glance it makes se ...

... also why many investors blow their chance at making money from these large payout events. This is the single most important key to why this dividend strategy works… In short, stock exchange market makers drop the price commensurate with the per share dividend payout. Now, at first glance it makes se ...

Document

... • Universe of bonds is much broader than that of stocks • Range of bond quality varies from U.S. Treasury securities to bonds in default • Bond market changes constantly with new issues, maturities, calls, and sinking funds • Bond prices are affected by duration, which is dependent on maturity, coup ...

... • Universe of bonds is much broader than that of stocks • Range of bond quality varies from U.S. Treasury securities to bonds in default • Bond market changes constantly with new issues, maturities, calls, and sinking funds • Bond prices are affected by duration, which is dependent on maturity, coup ...

Growth and Optimal Intertemporal Allocation of Risks* It has been

... We consider first H and &‘. With the previous reasoning, and by analogy with stock-market analysis, it appears immediately that -H can be interpreted as the cost of risk taking at time t.S Then, 2 is the sum of the instantaneous profit L, of the expected infinitesimal increment of capital valued at ...

... We consider first H and &‘. With the previous reasoning, and by analogy with stock-market analysis, it appears immediately that -H can be interpreted as the cost of risk taking at time t.S Then, 2 is the sum of the instantaneous profit L, of the expected infinitesimal increment of capital valued at ...

Telefónica, SA

... TELEFÓNICA shares for the purpose of the Cash-Settlement Option (defined as Conversion Price in the terms of the Bonds) has been set at 11.9215 euros. This reference price for the purpose of the Cash-Settlement Option represents a premium of 20% to the arithmetic mean of the volume-weighted average ...

... TELEFÓNICA shares for the purpose of the Cash-Settlement Option (defined as Conversion Price in the terms of the Bonds) has been set at 11.9215 euros. This reference price for the purpose of the Cash-Settlement Option represents a premium of 20% to the arithmetic mean of the volume-weighted average ...

PDF

... when added back in, would bring the hedge and cash prices even closer together. The nominal variability of cash prices at Omaha was greater than for annual hedge prices as shown by the standard deviation of 113.4¢ compared to 79.5¢, respectively. An “F” test showed the variances were not significan ...

... when added back in, would bring the hedge and cash prices even closer together. The nominal variability of cash prices at Omaha was greater than for annual hedge prices as shown by the standard deviation of 113.4¢ compared to 79.5¢, respectively. An “F” test showed the variances were not significan ...

While technically an equity investment, shares of preferred stock pay

... Early callbacks -- Companies that issue preferred stock hold a call option, which allows them to redeem the securities at face value after a certain period, usually five years. Doing so can deprive investors holding those shares of additional years of guaranteed income they thought they had locked ...

... Early callbacks -- Companies that issue preferred stock hold a call option, which allows them to redeem the securities at face value after a certain period, usually five years. Doing so can deprive investors holding those shares of additional years of guaranteed income they thought they had locked ...

Solvency and Risk Based Supervision

... insurers document risks, measurement approaches used, assumptions made. insurers implement risk management policy outlining how risks managed. insurer describes relationship between tolerance limits, regulatory capital requirements, economic capital. insurers have asset-liability management ...

... insurers document risks, measurement approaches used, assumptions made. insurers implement risk management policy outlining how risks managed. insurer describes relationship between tolerance limits, regulatory capital requirements, economic capital. insurers have asset-liability management ...

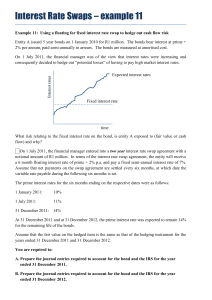

Plain-Vanilla Interest Rate Swap

... could be „delivered“ at lower prices. As this is not the case, after 4 days the game ends with a total loss of 6,400 Euro. ...

... could be „delivered“ at lower prices. As this is not the case, after 4 days the game ends with a total loss of 6,400 Euro. ...