Top 10 Stock Screening Strategies That Make

... (portfolio) is generated. The period’s returns are calculated using the % change in price from the beginning of the holding period to the end of the holding period, plus any applicable dividends. The returns for the portfolio is the arithmetic mean of the returns for the individual companies in the ...

... (portfolio) is generated. The period’s returns are calculated using the % change in price from the beginning of the holding period to the end of the holding period, plus any applicable dividends. The returns for the portfolio is the arithmetic mean of the returns for the individual companies in the ...

What Does Average Directional Index - ADX Mean

... Buy signal is triggered when there is a crossover ie +DI line moves above DI line and sell signal when +DI line moves below -DI line. The time periods most commonly used are 10 or 14 days. I prefer to use 10 days since the signal can be triggered sooner and can use it to confirm with other indicator ...

... Buy signal is triggered when there is a crossover ie +DI line moves above DI line and sell signal when +DI line moves below -DI line. The time periods most commonly used are 10 or 14 days. I prefer to use 10 days since the signal can be triggered sooner and can use it to confirm with other indicator ...

Spillover Effect of Disagreement

... A growing body of research has recently highlighted that investor heterogeneity can play an important role in understanding the behavior of asset prices (see, e.g., Basak (2005) for a recent survey). These studies have focused on the case of a single risky asset and examined how investor disagreemen ...

... A growing body of research has recently highlighted that investor heterogeneity can play an important role in understanding the behavior of asset prices (see, e.g., Basak (2005) for a recent survey). These studies have focused on the case of a single risky asset and examined how investor disagreemen ...

Trading Volume Reaction to the Earnings Reconciliation from IFRS

... from IFRS to U.S. GAAP for all IFRS-based foreign firms from 2005 to 2006. As noted by Holthausen and Watts (2001, 3), “Unless those underlying theories are descriptive of accounting, the value-relevance literature’s reported associations between accounting numbers and common equity valuations have ...

... from IFRS to U.S. GAAP for all IFRS-based foreign firms from 2005 to 2006. As noted by Holthausen and Watts (2001, 3), “Unless those underlying theories are descriptive of accounting, the value-relevance literature’s reported associations between accounting numbers and common equity valuations have ...

Did Stop Signs Stop Investor Trading?

... Leuz 2005). This led the number of PS firms to double yet these firms, which are known for their illiquidity, have been largely overlooked by prior research.2 Finally, our study extends the line of research that addresses the role of mandated disclosures in improving market efficiency. Bushee and L ...

... Leuz 2005). This led the number of PS firms to double yet these firms, which are known for their illiquidity, have been largely overlooked by prior research.2 Finally, our study extends the line of research that addresses the role of mandated disclosures in improving market efficiency. Bushee and L ...

Make and Take Fees in the US Equity Market

... Colliard and Foucault (2012) show that an increase in the total fee can be associated with increased trading activity due to heterogeneous patience across investors. With a fee increase, patient investors submit more aggressive quotes, increasing the likelihood of a transaction. We assess empiricall ...

... Colliard and Foucault (2012) show that an increase in the total fee can be associated with increased trading activity due to heterogeneous patience across investors. With a fee increase, patient investors submit more aggressive quotes, increasing the likelihood of a transaction. We assess empiricall ...

Chapter 22: Credit Risk Modeling

... policies and generate a profit. For institutions such as banks and thrifts, funds are obtained from the issuance of certificates of deposit, short-term money market instruments, or floating-rate notes. These funds are then invested in loans and marketable securities. The objective in this case is ...

... policies and generate a profit. For institutions such as banks and thrifts, funds are obtained from the issuance of certificates of deposit, short-term money market instruments, or floating-rate notes. These funds are then invested in loans and marketable securities. The objective in this case is ...

Criminal Complaint

... or about April 2014, SARAO spoofed the market and manipulated the intra-day price for near month E-Mini S&P 500 futures contracts ("E-Minis") on the Chicago ...

... or about April 2014, SARAO spoofed the market and manipulated the intra-day price for near month E-Mini S&P 500 futures contracts ("E-Minis") on the Chicago ...

UBS ATS Monthly Volume Summary – November 2016 (restated 1

... United States Electronic Trading - Equities ...

... United States Electronic Trading - Equities ...

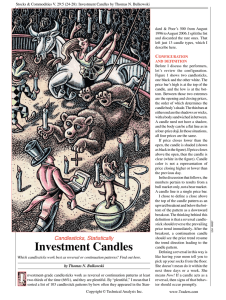

Investment Candles I

... and definition Before I discuss the performers, let’s review the configuration. Figure 1 shows two candlesticks, one black and the other white. The price bar’s high is at the top of the candle, and the low is at the bottom. Between those two extremes are the opening and closing prices, the order of ...

... and definition Before I discuss the performers, let’s review the configuration. Figure 1 shows two candlesticks, one black and the other white. The price bar’s high is at the top of the candle, and the low is at the bottom. Between those two extremes are the opening and closing prices, the order of ...

The Role of Size and Book-to-Market Ratio as Proxies for

... factors are proxies for firm-specific and/or macroeconomic risk in the ISE. We believe that the ISE is a suitable market to test the size and book-to-market effects and their rational risk explanation. First, it is still not fully integrated with the world markets, is in a stage of institutional dev ...

... factors are proxies for firm-specific and/or macroeconomic risk in the ISE. We believe that the ISE is a suitable market to test the size and book-to-market effects and their rational risk explanation. First, it is still not fully integrated with the world markets, is in a stage of institutional dev ...

Policies and Procedures

... every month and those clients who have not traded even a single time will be considered as inactive, the shares/credit ledger balance if any will be transferred to the client within one week of the identifying the client as inactive. The client has to make written request for reactivation of their a ...

... every month and those clients who have not traded even a single time will be considered as inactive, the shares/credit ledger balance if any will be transferred to the client within one week of the identifying the client as inactive. The client has to make written request for reactivation of their a ...

SA BlackRock VCP Global Multi Asset Portfolio Summary

... Derivatives Risk. A derivative is any financial instrument whose value is based on, and determined by, another security, index, rate or benchmark (i.e., stock options, futures, caps, floors, etc.). To the extent a derivative contract is used to hedge another position in the Portfolio, the Portfolio ...

... Derivatives Risk. A derivative is any financial instrument whose value is based on, and determined by, another security, index, rate or benchmark (i.e., stock options, futures, caps, floors, etc.). To the extent a derivative contract is used to hedge another position in the Portfolio, the Portfolio ...

The Myths and Fallacies about Diversified Portfolios

... market index fund. Their reasons for this dismissal are vague. Some cite the Roll critique set forth in a 1977 article, which simply says there is no such thing as the “total market portfolio,” because it would have to include all global assets – including a vast amount of local real estate, and per ...

... market index fund. Their reasons for this dismissal are vague. Some cite the Roll critique set forth in a 1977 article, which simply says there is no such thing as the “total market portfolio,” because it would have to include all global assets – including a vast amount of local real estate, and per ...

What is an Exchange Traded Fund? How are ETFs bought and sold

... systems which are embedded into capital market workflows, exchanges and financial products across the globe. As part of London Stock Exchange Group, FTSE sits at the heart of Europe’s most liquid and diverse ETF marketplace. ...

... systems which are embedded into capital market workflows, exchanges and financial products across the globe. As part of London Stock Exchange Group, FTSE sits at the heart of Europe’s most liquid and diverse ETF marketplace. ...

Challenges arising from alternative investment management

... technique employed is “capital structure arbitrage”, whose objective is to exploit any differences in the pricing of an issuer’s liabilities (between its debts according to their ranking, or between debt and equity securities). As different as they may be, these strategies share one common feature: ...

... technique employed is “capital structure arbitrage”, whose objective is to exploit any differences in the pricing of an issuer’s liabilities (between its debts according to their ranking, or between debt and equity securities). As different as they may be, these strategies share one common feature: ...

TRANSMISSION OF INFORMATION ACROSS INTERNATIONAL

... from Canada to other Countries ............................................................. 147 Table 5.6: The Dynamics of Return Spillovers (in relation to Trading Volume) from Japan to other Countries ................................................................ 148 Table 5.7: The Dynamics of ...

... from Canada to other Countries ............................................................. 147 Table 5.6: The Dynamics of Return Spillovers (in relation to Trading Volume) from Japan to other Countries ................................................................ 148 Table 5.7: The Dynamics of ...

TRADING PLAN TEMPLATE

... Towards the end of 2004, a thread entitled ‘A Trading Plan – You MUST Have One!’ on the ‘Trading for a Living’ forum was started on The purpose of the thread was to produce a template by which all traders regardless of experience, instruments traded, timeframes and brokers etc. - could create a prof ...

... Towards the end of 2004, a thread entitled ‘A Trading Plan – You MUST Have One!’ on the ‘Trading for a Living’ forum was started on The purpose of the thread was to produce a template by which all traders regardless of experience, instruments traded, timeframes and brokers etc. - could create a prof ...

Price Discrimination - Department of Economics

... to the understanding of the discriminatory practices which are based on directly observable characteristics such as age, departure location, and time and date of the journey. On the other hand, second-degree discrimination only seems to be a particular case of third-degree discrimination which, as w ...

... to the understanding of the discriminatory practices which are based on directly observable characteristics such as age, departure location, and time and date of the journey. On the other hand, second-degree discrimination only seems to be a particular case of third-degree discrimination which, as w ...

pressrelease

... Tech Trade AB (shortname: CBTT B) shares commenced today on First North at Nasdaq Stockholm. Christian Berner Tech Trade belongs to the Industrials sector and is the 35th company to be admitted to trading on First North’s Nordic markets (Stockholm, Helsinki, Copenhagen and Iceland) in 2014. Chris ...

... Tech Trade AB (shortname: CBTT B) shares commenced today on First North at Nasdaq Stockholm. Christian Berner Tech Trade belongs to the Industrials sector and is the 35th company to be admitted to trading on First North’s Nordic markets (Stockholm, Helsinki, Copenhagen and Iceland) in 2014. Chris ...

Morningstar Strategic Beta Guide

... Some portfolios emphasize multiple factors. For those products tracking multifactor benchmarks, Morningstar helps investors “look through” to the individual factors combined within the benchmark index. Indexes tagged with multiple secondary attributes (e.g., value, size, and momentum) will “roll up” ...

... Some portfolios emphasize multiple factors. For those products tracking multifactor benchmarks, Morningstar helps investors “look through” to the individual factors combined within the benchmark index. Indexes tagged with multiple secondary attributes (e.g., value, size, and momentum) will “roll up” ...

Seasons Series Trust - Mid Cap Value Portfolio - Annuities

... investing in the Portfolio with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Portfolio for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each ...

... investing in the Portfolio with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Portfolio for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each ...

A Model of Intertemporal Asset Prices Under Asymmetric

... expectations about future cash flows and noise trading. When investors are less informed about the true growth rate of dividends, their expectation about future cash flows becomes less variable. This has the effect of reducing price volatility. On the other hand, there is more uncertainty in the sto ...

... expectations about future cash flows and noise trading. When investors are less informed about the true growth rate of dividends, their expectation about future cash flows becomes less variable. This has the effect of reducing price volatility. On the other hand, there is more uncertainty in the sto ...

short term patterns

... Outside Bars can be either Bullish or Bearish depending on the direction of the inbound trend. If the inbound price trend is down, then upon identification of an Outside Bar, taking a long position or closing a short position is recommended. Conversely, if the inbound price trend is up, then upon id ...

... Outside Bars can be either Bullish or Bearish depending on the direction of the inbound trend. If the inbound price trend is down, then upon identification of an Outside Bar, taking a long position or closing a short position is recommended. Conversely, if the inbound price trend is up, then upon id ...

Financial Liberalization and Emerging Stock Market Volatility

... pre and post-change. Aggarwal et al. (1999) follow a different route and, instead of specifying a priori the dates of the breaks, they detect shifts in volatility from the data by using an iterated cumulative sum of squares (ICSS) algorithm. This procedure identifies the points of shocks or sudden ch ...

... pre and post-change. Aggarwal et al. (1999) follow a different route and, instead of specifying a priori the dates of the breaks, they detect shifts in volatility from the data by using an iterated cumulative sum of squares (ICSS) algorithm. This procedure identifies the points of shocks or sudden ch ...