Chapter 15

... Chapters 11 – 14 examined the role of accounting information in planning business investing and financing activities. Chapter 11 introduced the time value of money and showed how it is used to make financial decisions. Chapter 12 used the time value of money concept to determine if business investme ...

... Chapters 11 – 14 examined the role of accounting information in planning business investing and financing activities. Chapter 11 introduced the time value of money and showed how it is used to make financial decisions. Chapter 12 used the time value of money concept to determine if business investme ...

presentation - Kinetics Mutual Funds

... Unlike other investment companies that directly acquire and manage their own portfolios of securities, the Alternative Income Fund pursues its investment objective by investing all of its investable assets in a corresponding portfolio series of Kinetics Portfolio Trust. The Barclays U.S. Aggregate B ...

... Unlike other investment companies that directly acquire and manage their own portfolios of securities, the Alternative Income Fund pursues its investment objective by investing all of its investable assets in a corresponding portfolio series of Kinetics Portfolio Trust. The Barclays U.S. Aggregate B ...

Transaction in the share market

... Shareholders would prefer to receive a dividend and then have management file a prospectus, justifying investment in projects and the need to raise the capital that was just distributed as a dividend. Shareholders are prepared to pay those additional underwriting costs as an agency cost incurred to ...

... Shareholders would prefer to receive a dividend and then have management file a prospectus, justifying investment in projects and the need to raise the capital that was just distributed as a dividend. Shareholders are prepared to pay those additional underwriting costs as an agency cost incurred to ...

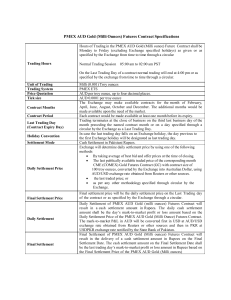

PMEX AUD Gold Futures Contract

... AUD per troy ounce, up to four decimal places. AUD 0.0001 per troy ounce The Exchange may make available contracts for the month of February, April, June, August, October and December. The additional months would be made available upon the need of the market. Each contract would be made available at ...

... AUD per troy ounce, up to four decimal places. AUD 0.0001 per troy ounce The Exchange may make available contracts for the month of February, April, June, August, October and December. The additional months would be made available upon the need of the market. Each contract would be made available at ...

the investment position of the major players in the ukrainian`s grain

... expectations. Over the last two years, we added about 160,000 hectares of land, tripling our operations. Though we continue to invest in people and in the organizational turnover at acquired companies improving their operations to the standards of our ‘old’ enterprises, we understand that the integr ...

... expectations. Over the last two years, we added about 160,000 hectares of land, tripling our operations. Though we continue to invest in people and in the organizational turnover at acquired companies improving their operations to the standards of our ‘old’ enterprises, we understand that the integr ...

Commercial paper Davenport

... participants are referred. This material is based on public information as of the specified date, and may be stale thereafter. We have no obligation to tell you when information herein may change. We make no representation or warranty with respect to the completeness of this material. Davenport has ...

... participants are referred. This material is based on public information as of the specified date, and may be stale thereafter. We have no obligation to tell you when information herein may change. We make no representation or warranty with respect to the completeness of this material. Davenport has ...

Intraday Returns and the Day-end Effect: Evidence from

... The Capital Market Board of Turkey defines manipulation in two different types; Rule 47/A2 prohibits Trade-based manipulation where a trader affects prices by significantly changing his order, like buying at low and selling at high. Rule 47/A-3 prohibits Action-based manipulation where the manipulat ...

... The Capital Market Board of Turkey defines manipulation in two different types; Rule 47/A2 prohibits Trade-based manipulation where a trader affects prices by significantly changing his order, like buying at low and selling at high. Rule 47/A-3 prohibits Action-based manipulation where the manipulat ...

A How To Read Performance Report Guide

... fixed-rate coupons and weighted average lives between one and three years. ...

... fixed-rate coupons and weighted average lives between one and three years. ...

Is it Overreaction? The Long-Horizon Performance of Value and

... assuming that they already achieved ‘old economy’ profit margins – Zero percent cost of capital for ten years ...

... assuming that they already achieved ‘old economy’ profit margins – Zero percent cost of capital for ten years ...

Impact of Macroeconomic Factors on Share Price Index

... of money supply will lead to the more stable development of stock market. 2.1.5 Exchange rate and stock market Exchange rate helps adjust and balance supply and demand of assets. Investors will sell some foreign assets which currently make them less interesting, if they want to purchase more domesti ...

... of money supply will lead to the more stable development of stock market. 2.1.5 Exchange rate and stock market Exchange rate helps adjust and balance supply and demand of assets. Investors will sell some foreign assets which currently make them less interesting, if they want to purchase more domesti ...

CEE Trader - Wiener Börse

... Wiener Börse AG provides the new, powerful and easy-to-use trading front-end, CEE Trader, to the members of the Vienna Stock Exchange and its partner exchanges. Banks and brokers can use this tool for multi-market trading on the stock exchanges of Budapest, Ljubljana, Prague and V ienna. The new s ...

... Wiener Börse AG provides the new, powerful and easy-to-use trading front-end, CEE Trader, to the members of the Vienna Stock Exchange and its partner exchanges. Banks and brokers can use this tool for multi-market trading on the stock exchanges of Budapest, Ljubljana, Prague and V ienna. The new s ...

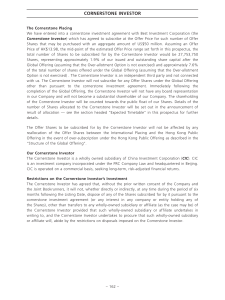

Cornerstone Investor

... The Cornerstone Placing We have entered into a cornerstone investment agreement with Best Investment Corporation (the Cornerstone Investor) which has agreed to subscribe at the Offer Price for such number of Offer Shares that may be purchased with an aggregate amount of US$50 million. Assuming an Of ...

... The Cornerstone Placing We have entered into a cornerstone investment agreement with Best Investment Corporation (the Cornerstone Investor) which has agreed to subscribe at the Offer Price for such number of Offer Shares that may be purchased with an aggregate amount of US$50 million. Assuming an Of ...

CAS Presentation, Nov. 2014

... Low-income customers – Price optimization works at a rating factor level and income is not a rating factor. – Low income customers do not all have the same price sensitivity. – For a given company, price sensitivity exhibited by customers to that company is heavily dependent on that company’s prices ...

... Low-income customers – Price optimization works at a rating factor level and income is not a rating factor. – Low income customers do not all have the same price sensitivity. – For a given company, price sensitivity exhibited by customers to that company is heavily dependent on that company’s prices ...

How the Stock Market Works 2

... – Bond is a type of debt that a company issues to investors for a specified amount of time. – Stock Market is a general term used to describe all transactions involving the buying and selling of stocks and bonds issued by a company © Family Economics & Financial Education – Revised November 2004 – I ...

... – Bond is a type of debt that a company issues to investors for a specified amount of time. – Stock Market is a general term used to describe all transactions involving the buying and selling of stocks and bonds issued by a company © Family Economics & Financial Education – Revised November 2004 – I ...

1740-06 Varsity Rules - JSE Investment Challenge

... could not be financed or managed easily within the organisations which existed at that time – sole traders, partnerships and guilds. A new type of organisation had to be found which could access the savings of the public at large. One person or even a group of partners were not able to finance large ...

... could not be financed or managed easily within the organisations which existed at that time – sole traders, partnerships and guilds. A new type of organisation had to be found which could access the savings of the public at large. One person or even a group of partners were not able to finance large ...

Growth Investing: Defensive for Now, But Focused on Long

... substantially if their growth potential is underestimated by the market. Growth stocks that appear attractively valued may f all hard if their growth disappoints. When this happens, it is of ten because of a change in the business that will likely endure. The momentum of ...

... substantially if their growth potential is underestimated by the market. Growth stocks that appear attractively valued may f all hard if their growth disappoints. When this happens, it is of ten because of a change in the business that will likely endure. The momentum of ...

Exploiting Market Anomalies in the Saudi Stock

... Strategy: A short-term gain is likely if one invests in the market before the Ramadan period and sells in the subsequent month, and increase positions during the end of March and October, where the TASI always showed the worst performance during these mentioned months and then recovered significantl ...

... Strategy: A short-term gain is likely if one invests in the market before the Ramadan period and sells in the subsequent month, and increase positions during the end of March and October, where the TASI always showed the worst performance during these mentioned months and then recovered significantl ...

Solactive US Quality Dividend Low Volatility Index

... 1: Source: Henderson Global Investors – Henderson Global Dividend Index, Edition 9, February 2016 Historical data do not provide any indication of future developments. ...

... 1: Source: Henderson Global Investors – Henderson Global Dividend Index, Edition 9, February 2016 Historical data do not provide any indication of future developments. ...

xerium technologies, inc. - corporate

... Common Stock needed exceeds the number of shares then available under the EIP, or exceeds any limit established by the Board on the number of shares delivered in the same fiscal year, the Company will pay out the value of any share that was not delivered in cash on the date otherwise scheduled for ...

... Common Stock needed exceeds the number of shares then available under the EIP, or exceeds any limit established by the Board on the number of shares delivered in the same fiscal year, the Company will pay out the value of any share that was not delivered in cash on the date otherwise scheduled for ...

Assignment-77 - The complete management portal

... 23) A secured instrument usually secured by a charge on the immovable properties of the company where there is a promise to pay interest and repay principal at a stipulated period of time is known as=> Debentures ** Assgn :3: 24) Return of Shareholders funds being much higher than the overall return ...

... 23) A secured instrument usually secured by a charge on the immovable properties of the company where there is a promise to pay interest and repay principal at a stipulated period of time is known as=> Debentures ** Assgn :3: 24) Return of Shareholders funds being much higher than the overall return ...

A Statistical Analysis of a Stock`s Volatility

... This chart clearly depicts the inconsistency associated with estimating β. For a value that is commonly referred to in the investing world, there is no standard set of data to be used for the estimation of β, so numerous possibilities exist such as daily prices for the past two years, monthly prices ...

... This chart clearly depicts the inconsistency associated with estimating β. For a value that is commonly referred to in the investing world, there is no standard set of data to be used for the estimation of β, so numerous possibilities exist such as daily prices for the past two years, monthly prices ...

Securities - State Bank of Pakistan

... (iii) In case shares are to be issued to non-resident sponsors against the value of plant and machinery supplied by them, an application should be submitted to the area office of the Foreign Exchange Operations Department for issue of an Exchange Entitlement Certificate along with the relative impo ...

... (iii) In case shares are to be issued to non-resident sponsors against the value of plant and machinery supplied by them, an application should be submitted to the area office of the Foreign Exchange Operations Department for issue of an Exchange Entitlement Certificate along with the relative impo ...

Short (finance)

.png?width=300)

In finance, short selling (also known as shorting or going short) is the practice of selling securities or other financial instruments that are not currently owned, and subsequently repurchasing them (""covering""). In the event of an interim price decline, the short seller will profit, since the cost of (re)purchase will be less than the proceeds which were received upon the initial (short) sale. Conversely, the short position will be closed out at a loss in the event that the price of a shorted instrument should rise prior to repurchase. The potential loss on a short sale is theoretically unlimited in the event of an unlimited rise in the price of the instrument, however in practice the short seller will be required to post margin or collateral to cover losses, and any inability to do so on a timely basis would cause its broker or counterparty to liquidate the position. In the securities markets, the seller generally must borrow the securities in order to effect delivery in the short sale. In some cases, the short seller must pay a fee to borrow the securities and must additionally reimburse the lender for cash returns the lender would have received had the securities not been loaned out.Short selling is most commonly done with instruments traded in public securities, futures or currency markets, due to the liquidity and real-time price dissemination characteristic of such markets and because the instruments defined within each class are fungible.In practical terms, going short can be considered the opposite of the conventional practice of ""going long"", whereby an investor profits from an increase in the price of the asset. Mathematically, the return from a short position is equivalent to that of owning (being ""long"") a negative amount of the instrument. A short sale may be motivated by a variety of objectives. Speculators may sell short in the hope of realizing a profit on an instrument which appears to be overvalued, just as long investors or speculators hope to profit from a rise in the price of an instrument which appears undervalued. Traders or fund managers may hedge a long position or a portfolio through one or more short positions.