k = D 0 (I +g)

... involved. These two factors can offset each other. Other things being equal, the greater the risk of a stock, the lower the P/E ratio; however, growth prospects may offset the risk and lead to a higher P/E ratio. The Internet companies that were so popular in the late 1990s were clearly very risky, ...

... involved. These two factors can offset each other. Other things being equal, the greater the risk of a stock, the lower the P/E ratio; however, growth prospects may offset the risk and lead to a higher P/E ratio. The Internet companies that were so popular in the late 1990s were clearly very risky, ...

Investors Rights Agreement

... Make and keep public information regarding the Company available as those terms are understood and defined in Rule 144 under the Securities Act, at all times from and after ...

... Make and keep public information regarding the Company available as those terms are understood and defined in Rule 144 under the Securities Act, at all times from and after ...

Exam_20131025bo Iv

... growth rate, the model can be used with little real effect on value. Thus, a cyclical firm that can be expected to have year-to-year swings in growth rates, but has an average growth rate that is 5%, can be valued using the Gordon growth model, without a significant loss of generality. There are two ...

... growth rate, the model can be used with little real effect on value. Thus, a cyclical firm that can be expected to have year-to-year swings in growth rates, but has an average growth rate that is 5%, can be valued using the Gordon growth model, without a significant loss of generality. There are two ...

Circular of the State Council Concerning Further Strengthening the

... share issuance and listing overseas. In the case of special requirements, a report thereon shall be submitted to the China Securities Supervisory and Regulatory Commission for verification and then subject to the examination and approval of the State Council Securities Commission. After the listing ...

... share issuance and listing overseas. In the case of special requirements, a report thereon shall be submitted to the China Securities Supervisory and Regulatory Commission for verification and then subject to the examination and approval of the State Council Securities Commission. After the listing ...

Irrational Exuberance - Mason Publishing Journals

... ago or even lower, then people are going to find themselves poorer, in the aggregate amount of trillions of dollars. The real losses could be comparable to the total destruction of all the schools, farms, or houses in the nation. One could say that such a fall is really harmless, since nothing is ph ...

... ago or even lower, then people are going to find themselves poorer, in the aggregate amount of trillions of dollars. The real losses could be comparable to the total destruction of all the schools, farms, or houses in the nation. One could say that such a fall is really harmless, since nothing is ph ...

Hedge against Rising Interest Rates with QAI

... Shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Total Returns are calculated using the daily 4:00 pm ET net asset value (NAV). The price used to calculate market return (“MP”) is determined by using the closing price listed on the NYSE Arca and d ...

... Shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Total Returns are calculated using the daily 4:00 pm ET net asset value (NAV). The price used to calculate market return (“MP”) is determined by using the closing price listed on the NYSE Arca and d ...

Trading activities after the abolition of the minimum brokerage

... securities, stockbrokers' commission income, and trading activity of securities investors after the abolition of the minimum brokerage commission rule on 1 April 2003, as compared to those before the abolition, as well as the numbers of securities companies which have wound up their businesses and o ...

... securities, stockbrokers' commission income, and trading activity of securities investors after the abolition of the minimum brokerage commission rule on 1 April 2003, as compared to those before the abolition, as well as the numbers of securities companies which have wound up their businesses and o ...

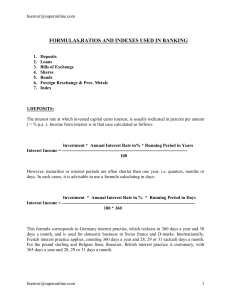

Formulas Ratios and Indexes Used in Banks

... deduction must be made, since in Switzerland interest income above Fr. 50.-is subject to 35% withholding tax authorities usually do not refund immediately. The taxed portion of interest income does not earn interest therefore until it is paid back and reinvested in the savings account. For investmen ...

... deduction must be made, since in Switzerland interest income above Fr. 50.-is subject to 35% withholding tax authorities usually do not refund immediately. The taxed portion of interest income does not earn interest therefore until it is paid back and reinvested in the savings account. For investmen ...

SCHEDULE 13G Amendment No. Alaska Air Group Incorporated

... Depending upon its future evaluations of the business and prospects of the Company and upon other developments, including, but not limited to, general economic and business conditions and money market and stock market conditions, FIL may determine to cease making additional purchases of shares or to ...

... Depending upon its future evaluations of the business and prospects of the Company and upon other developments, including, but not limited to, general economic and business conditions and money market and stock market conditions, FIL may determine to cease making additional purchases of shares or to ...

Income Solutions: The Case for Covered Calls

... Active Stock Selection – Madison starts with a growth-at-a-reasonable-price (GARP) approach to build the underlying covered call equity portfolio. The process seeks to select high-quality companies, which have solid balance sheets, excellent profitability, strong management and elicit confidence in ...

... Active Stock Selection – Madison starts with a growth-at-a-reasonable-price (GARP) approach to build the underlying covered call equity portfolio. The process seeks to select high-quality companies, which have solid balance sheets, excellent profitability, strong management and elicit confidence in ...

Available-for-Sale Securities

... from changes in their market prices. Trading securities are often held by banks, mutual funds, insurance companies, and other financial institutions. Because trading securities are held as a short-term investment, they are reported as a current asset on the balance sheet. ...

... from changes in their market prices. Trading securities are often held by banks, mutual funds, insurance companies, and other financial institutions. Because trading securities are held as a short-term investment, they are reported as a current asset on the balance sheet. ...

Invesco Comstock Fund fact sheet: Inst`l ret shares

... Source: ©2017 Morningstar Inc. All rights reserved. The information contained herein is proprietary to Morningstar and/or its content providers. It may not be copied or distributed and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible ...

... Source: ©2017 Morningstar Inc. All rights reserved. The information contained herein is proprietary to Morningstar and/or its content providers. It may not be copied or distributed and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible ...

MKTG 680 Chapter 11 Pricing Decisions Basic Pricing Concepts

... Occurs when imports sold in the US market are priced at either levels that represent less than the cost of production plus an 8% profit margin or at levels below those prevailing in the producing countries To prove, both price discrimination and injury must be shown ...

... Occurs when imports sold in the US market are priced at either levels that represent less than the cost of production plus an 8% profit margin or at levels below those prevailing in the producing countries To prove, both price discrimination and injury must be shown ...

Equities for Yield - Bermuda Investment Advisory Services

... history of maintaining and increasing income distributions to its shareholders. Fixed income securities should now be used only for capital preservation purposes, but dividend paying stocks, controlled for consistency of payment, do provide an opportunity for recovering income flow into the portfoli ...

... history of maintaining and increasing income distributions to its shareholders. Fixed income securities should now be used only for capital preservation purposes, but dividend paying stocks, controlled for consistency of payment, do provide an opportunity for recovering income flow into the portfoli ...

Risk Management

... barrels of July crude oil futures contracts. The crude oil futures price is $59.29/bbl. The options expire on 17 June, 2015. The strike price on the options is $62/bbl. The volatility of oil is 45 percent (annualized). The annualized continuously compounded two-month interest rate is 1.25 percent (a ...

... barrels of July crude oil futures contracts. The crude oil futures price is $59.29/bbl. The options expire on 17 June, 2015. The strike price on the options is $62/bbl. The volatility of oil is 45 percent (annualized). The annualized continuously compounded two-month interest rate is 1.25 percent (a ...

[TO BE PROVIDED BY HONG KONG INVESTORS] Letter of Hong

... Russian depositary receipts (state registration number: [ ]) representing ordinary shares of United Company RUSAL Plc issued by Sberbank of Russia This letter is delivered in connection with the proposed placement of Russian depositary receipts (state registration number: [ ]) (the "Securities") rep ...

... Russian depositary receipts (state registration number: [ ]) representing ordinary shares of United Company RUSAL Plc issued by Sberbank of Russia This letter is delivered in connection with the proposed placement of Russian depositary receipts (state registration number: [ ]) (the "Securities") rep ...

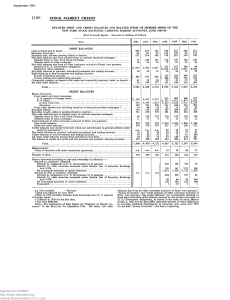

Detailed Debit and Credit Balances and Related Items of Member

... "money borrowed," and "credit balances of other customers exclusive of firms' own partners—free credit balances" are conceptually identical to these items (including debit balances secured by and money borrowed on U. S. Government obligations), as shown in the table on Stock Market Credit, p. 1069, ...

... "money borrowed," and "credit balances of other customers exclusive of firms' own partners—free credit balances" are conceptually identical to these items (including debit balances secured by and money borrowed on U. S. Government obligations), as shown in the table on Stock Market Credit, p. 1069, ...

Factsheet 2014 Annual

... Securities business – robust growth in Mr. Dehua Wang brokerage commission income In 2014, Zheshang Securities experienced significant growth in market share and trading volume, riding on the 63.8% increase in trading volume of stock markets in China. ...

... Securities business – robust growth in Mr. Dehua Wang brokerage commission income In 2014, Zheshang Securities experienced significant growth in market share and trading volume, riding on the 63.8% increase in trading volume of stock markets in China. ...

fhipo makes available to its investors the report about the accrued

... Mexico City, September 21st, 2016 – Fideicomiso Hipotecario (BMV: FHIPO) (“FHipo”), the first Mexican real estate investment trust specialized in the acquisition, origination, co-participation, management and operation of mortgage portfolios, announces today that according to past statements by the ...

... Mexico City, September 21st, 2016 – Fideicomiso Hipotecario (BMV: FHIPO) (“FHipo”), the first Mexican real estate investment trust specialized in the acquisition, origination, co-participation, management and operation of mortgage portfolios, announces today that according to past statements by the ...

Short (finance)

.png?width=300)

In finance, short selling (also known as shorting or going short) is the practice of selling securities or other financial instruments that are not currently owned, and subsequently repurchasing them (""covering""). In the event of an interim price decline, the short seller will profit, since the cost of (re)purchase will be less than the proceeds which were received upon the initial (short) sale. Conversely, the short position will be closed out at a loss in the event that the price of a shorted instrument should rise prior to repurchase. The potential loss on a short sale is theoretically unlimited in the event of an unlimited rise in the price of the instrument, however in practice the short seller will be required to post margin or collateral to cover losses, and any inability to do so on a timely basis would cause its broker or counterparty to liquidate the position. In the securities markets, the seller generally must borrow the securities in order to effect delivery in the short sale. In some cases, the short seller must pay a fee to borrow the securities and must additionally reimburse the lender for cash returns the lender would have received had the securities not been loaned out.Short selling is most commonly done with instruments traded in public securities, futures or currency markets, due to the liquidity and real-time price dissemination characteristic of such markets and because the instruments defined within each class are fungible.In practical terms, going short can be considered the opposite of the conventional practice of ""going long"", whereby an investor profits from an increase in the price of the asset. Mathematically, the return from a short position is equivalent to that of owning (being ""long"") a negative amount of the instrument. A short sale may be motivated by a variety of objectives. Speculators may sell short in the hope of realizing a profit on an instrument which appears to be overvalued, just as long investors or speculators hope to profit from a rise in the price of an instrument which appears undervalued. Traders or fund managers may hedge a long position or a portfolio through one or more short positions.

![[TO BE PROVIDED BY HONG KONG INVESTORS] Letter of Hong](http://s1.studyres.com/store/data/011247457_1-7ad2d7c8862abf73ac216623a0603c8d-300x300.png)