Invesco High Yield Municipal Fund fact sheet

... Derivatives may be more volatile and less liquid than traditional investments and are subject to market, interest rate, credit, leverage, counterparty and management risks. An investment in a derivative could lose more than the cash amount invested. Junk bonds have greater risk of default or price c ...

... Derivatives may be more volatile and less liquid than traditional investments and are subject to market, interest rate, credit, leverage, counterparty and management risks. An investment in a derivative could lose more than the cash amount invested. Junk bonds have greater risk of default or price c ...

How to Value Bonds

... False – investors demand higher expected rates of return on stocks with more non-diversifiable risk (market risk). b) The CAPM predicts that a security with a beta of 0 will offer zero expected return. False – a security with a beta of zero will offer the risk-free rate of return (see SML). c) An in ...

... False – investors demand higher expected rates of return on stocks with more non-diversifiable risk (market risk). b) The CAPM predicts that a security with a beta of 0 will offer zero expected return. False – a security with a beta of zero will offer the risk-free rate of return (see SML). c) An in ...

Relationship Between Trading Volume And

... investors are classified as either "optimists" or "pessimists". Again, short positions are assumed to be more costly than long positions. In such a market, investors with short positions would be less responsive to price changes. Jennings, Starks, and Fellingham (1981) show that (generally) when the ...

... investors are classified as either "optimists" or "pessimists". Again, short positions are assumed to be more costly than long positions. In such a market, investors with short positions would be less responsive to price changes. Jennings, Starks, and Fellingham (1981) show that (generally) when the ...

The hidden risks of going passive

... Important information: For professional investors only. Not suitable for retail clients. The views and opinions contained herein are those of the authors, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This document is intended ...

... Important information: For professional investors only. Not suitable for retail clients. The views and opinions contained herein are those of the authors, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This document is intended ...

Employing Finders and Solicitors

... managers), finders must comply with SEC Rule 206(4)-3 under the Advisers Act of 1940 (Advisers Act) regarding “solicitors.” Rule 206(4)-3 establishes a “safe harbor” from investment adviser registration for those persons who, on a recurrent basis and for compensation, refer potential clients to an i ...

... managers), finders must comply with SEC Rule 206(4)-3 under the Advisers Act of 1940 (Advisers Act) regarding “solicitors.” Rule 206(4)-3 establishes a “safe harbor” from investment adviser registration for those persons who, on a recurrent basis and for compensation, refer potential clients to an i ...

John Hancock International Value ADR Strategy

... and “Sovereign Asset Management.” We also may further describe each of these brands as “a division of Manulife Asset Management (US) LLC.” These are brand names only, not entities separate from Manulife AM (US). Certain of these companies within Manulife Financial may provide services to John Hancoc ...

... and “Sovereign Asset Management.” We also may further describe each of these brands as “a division of Manulife Asset Management (US) LLC.” These are brand names only, not entities separate from Manulife AM (US). Certain of these companies within Manulife Financial may provide services to John Hancoc ...

Contents Stock Market Indicators Measuring market bredth Sample

... Most analysts prefer the A/D ratio as an indicator, because it is more amenable to comparisons than the A-D line. The A/D ratio has an absolute value that does not vary in function of the number of components being analyzed – it remains constant, regardless of the number of stocks under considerati ...

... Most analysts prefer the A/D ratio as an indicator, because it is more amenable to comparisons than the A-D line. The A/D ratio has an absolute value that does not vary in function of the number of components being analyzed – it remains constant, regardless of the number of stocks under considerati ...

A Single Protocol for Clearing and Settlement?

... Moldova - National Securities Depository Republic of Belarus - Republican Central Securities Depository Russian Federation - DCC Russian Federation - NDC ...

... Moldova - National Securities Depository Republic of Belarus - Republican Central Securities Depository Russian Federation - DCC Russian Federation - NDC ...

Securities Trading Policy

... companies may have a material impact on the value of such securities even if those relationships are not material to Best Buy. (e) Trade within 24 hours after the public release of previously Material Nonpublic Information, such as Company earnings results. (f) ...

... companies may have a material impact on the value of such securities even if those relationships are not material to Best Buy. (e) Trade within 24 hours after the public release of previously Material Nonpublic Information, such as Company earnings results. (f) ...

8th Grade Stock Market Project Overview: This activity is designed to

... Overview: This activity is designed to make students aware of corporations and the stock market through Internet research, buying, recording, and selling stocks of their choice over a 2 week period. The stock market played an important role in the economy and lives of the people who lived in the 192 ...

... Overview: This activity is designed to make students aware of corporations and the stock market through Internet research, buying, recording, and selling stocks of their choice over a 2 week period. The stock market played an important role in the economy and lives of the people who lived in the 192 ...

File: ch10 Type: Multiple Choice 1. Which are the two major

... b) The discounted value of all the dividends from year 7 on, because that is the value a potential buyer will pay when the Joneses sell in year 7. c) The discounted value all dividends from year 1 on, because that the value the Joneses will get back is included in the value they will pay. d) Whateve ...

... b) The discounted value of all the dividends from year 7 on, because that is the value a potential buyer will pay when the Joneses sell in year 7. c) The discounted value all dividends from year 1 on, because that the value the Joneses will get back is included in the value they will pay. d) Whateve ...

SEC amends Rule 2a-7 to eliminate dependency on NRSRO ratings

... security is an Eligible Security (not to mention, whether it is a First Tier or Second Tier security), money market funds will now be required to make a determination that a security presents minimal credit risks based on analysis of the capacity of the security’s issuer or guarantor to meet its fin ...

... security is an Eligible Security (not to mention, whether it is a First Tier or Second Tier security), money market funds will now be required to make a determination that a security presents minimal credit risks based on analysis of the capacity of the security’s issuer or guarantor to meet its fin ...

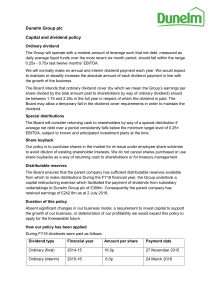

Dunelm Group plc Capital and dividend policy

... Special distributions The Board will consider returning cash to shareholders by way of a special distribution if average net debt over a period consistently falls below the minimum target level of 0.25× EBITDA, subject to known and anticipated investment plans at the time. Share buyback Our policy i ...

... Special distributions The Board will consider returning cash to shareholders by way of a special distribution if average net debt over a period consistently falls below the minimum target level of 0.25× EBITDA, subject to known and anticipated investment plans at the time. Share buyback Our policy i ...

6 - Holy Family University

... entire economy such as a change in interest rates or GDP or a financial crisis such as occurred in 2007and 2008. • If a well diversified portfolio has no unsystematic risk then any risk that remains must be systematic. • That is, the variation in returns of a well diversified portfolio must be due t ...

... entire economy such as a change in interest rates or GDP or a financial crisis such as occurred in 2007and 2008. • If a well diversified portfolio has no unsystematic risk then any risk that remains must be systematic. • That is, the variation in returns of a well diversified portfolio must be due t ...

CHAPTER 18

... When a business is sold to a purchaser who has limited resources, it may require that the vendor finance a large portion of the purchase price by granting deferred payment terms. Therefore, security for the vendor becomes a primary issue. It is recognized that in order to own and operate a business ...

... When a business is sold to a purchaser who has limited resources, it may require that the vendor finance a large portion of the purchase price by granting deferred payment terms. Therefore, security for the vendor becomes a primary issue. It is recognized that in order to own and operate a business ...

Short (finance)

.png?width=300)

In finance, short selling (also known as shorting or going short) is the practice of selling securities or other financial instruments that are not currently owned, and subsequently repurchasing them (""covering""). In the event of an interim price decline, the short seller will profit, since the cost of (re)purchase will be less than the proceeds which were received upon the initial (short) sale. Conversely, the short position will be closed out at a loss in the event that the price of a shorted instrument should rise prior to repurchase. The potential loss on a short sale is theoretically unlimited in the event of an unlimited rise in the price of the instrument, however in practice the short seller will be required to post margin or collateral to cover losses, and any inability to do so on a timely basis would cause its broker or counterparty to liquidate the position. In the securities markets, the seller generally must borrow the securities in order to effect delivery in the short sale. In some cases, the short seller must pay a fee to borrow the securities and must additionally reimburse the lender for cash returns the lender would have received had the securities not been loaned out.Short selling is most commonly done with instruments traded in public securities, futures or currency markets, due to the liquidity and real-time price dissemination characteristic of such markets and because the instruments defined within each class are fungible.In practical terms, going short can be considered the opposite of the conventional practice of ""going long"", whereby an investor profits from an increase in the price of the asset. Mathematically, the return from a short position is equivalent to that of owning (being ""long"") a negative amount of the instrument. A short sale may be motivated by a variety of objectives. Speculators may sell short in the hope of realizing a profit on an instrument which appears to be overvalued, just as long investors or speculators hope to profit from a rise in the price of an instrument which appears undervalued. Traders or fund managers may hedge a long position or a portfolio through one or more short positions.