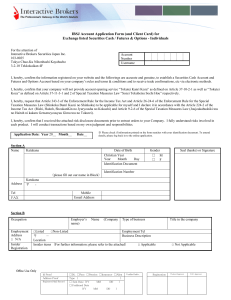

IBSJ Account Application Form (and Client Card) for Exchange listed

... by reason of forces beyond human control. IB is not liable for system or network failures, and customers who require the highest level of reliability, agree to maintain secondary trading facilities. Customers are responsible for protecting the secrecy of their usernames and passwords, and they will ...

... by reason of forces beyond human control. IB is not liable for system or network failures, and customers who require the highest level of reliability, agree to maintain secondary trading facilities. Customers are responsible for protecting the secrecy of their usernames and passwords, and they will ...

What is an Interest Rate Risk?

... underlying cash market while helping in evolving a better term structure as well as in price discovery. Interest rate futures can be used for three purposes: Hedging against interest rate risks, Arbitraging being a simultaneous buying and selling of futures taking advantage of a temporary price diff ...

... underlying cash market while helping in evolving a better term structure as well as in price discovery. Interest rate futures can be used for three purposes: Hedging against interest rate risks, Arbitraging being a simultaneous buying and selling of futures taking advantage of a temporary price diff ...

ETFs: A Call for Greater Transparency and Consistent

... exposure to asset classes that are very difficult to access or to complex investment strategies. These products are not funds and are instead unsecured debt issued by the sponsor. An investor in these products will thus have counterparty exposure to the issuer with the degree measured by the collate ...

... exposure to asset classes that are very difficult to access or to complex investment strategies. These products are not funds and are instead unsecured debt issued by the sponsor. An investor in these products will thus have counterparty exposure to the issuer with the degree measured by the collate ...

Document

... value of a tranche can either be quoted in terms of credit spread or in term of the correlation figure corresponding to such spread. This concept is known as implied correlation. Notice that the Gaussian copula plays the same role as the Black and Scholes formula in option prices. Since equity tranc ...

... value of a tranche can either be quoted in terms of credit spread or in term of the correlation figure corresponding to such spread. This concept is known as implied correlation. Notice that the Gaussian copula plays the same role as the Black and Scholes formula in option prices. Since equity tranc ...

EU Clearing Obligation for Interest Rate Swaps Set for June 2016

... There is an extension of the application of the clearing deadline date, subject to certain conditions being met, where one counterparty is established in the European Union and the other is established in a third country and both are part of the same group. This only applies if the counterparties fa ...

... There is an extension of the application of the clearing deadline date, subject to certain conditions being met, where one counterparty is established in the European Union and the other is established in a third country and both are part of the same group. This only applies if the counterparties fa ...

Foreign Exchange Management

... D. The seller has the right, but no obligation to execute the contract. 20. The following statement with respect to currency option is wrong A. Call option will be used by exporters. B. Put option gives the buyer the right to sell the foreign currency. C. Foreign currency- Rupee option is available ...

... D. The seller has the right, but no obligation to execute the contract. 20. The following statement with respect to currency option is wrong A. Call option will be used by exporters. B. Put option gives the buyer the right to sell the foreign currency. C. Foreign currency- Rupee option is available ...

What central banks can learn about default risk from credit markets

... The assessment of default probabilities. The raw credit spread is used in the assessment of the financial stability conjuncture and outlook as an indicator of credit risk. Absent taxation asymmetries between corporate and default-free bonds, the textbook treatment of corporate bonds assumes that som ...

... The assessment of default probabilities. The raw credit spread is used in the assessment of the financial stability conjuncture and outlook as an indicator of credit risk. Absent taxation asymmetries between corporate and default-free bonds, the textbook treatment of corporate bonds assumes that som ...

Risk and Return Analysis

... CAPM is however not a generally accepted model and the debate regarding it has raged ever since its inception almost 40 years ago. Finding the “market portfolio” is a difficult task, as it is supposed to include all risky assets in their relative proportion, of which only a fraction are traded and q ...

... CAPM is however not a generally accepted model and the debate regarding it has raged ever since its inception almost 40 years ago. Finding the “market portfolio” is a difficult task, as it is supposed to include all risky assets in their relative proportion, of which only a fraction are traded and q ...

Risk parity - The Tel-Aviv Institutional Investment Conference

... any investment decisions. The information contained in this document can be changed any time and without prior notice. 1741 Asset Management Ltd., Wegelin Asset Management Funds SICAV and Wegelin Specialised Investment Funds SICAV accept no liability for any damages whatsoever arising from action ta ...

... any investment decisions. The information contained in this document can be changed any time and without prior notice. 1741 Asset Management Ltd., Wegelin Asset Management Funds SICAV and Wegelin Specialised Investment Funds SICAV accept no liability for any damages whatsoever arising from action ta ...

May 2016 Factsheet Monthly

... Currency risk: The fund can be exposed to different currencies. Changes in foreign exchange rates could create losses. Derivatives risk: A derivative may not perform as expected, and may create losses greater than the cost of the derivative. Equity risk: Equity prices fluctuate daily, based on many ...

... Currency risk: The fund can be exposed to different currencies. Changes in foreign exchange rates could create losses. Derivatives risk: A derivative may not perform as expected, and may create losses greater than the cost of the derivative. Equity risk: Equity prices fluctuate daily, based on many ...

Slide 1 - OECD.org

... • For enterprises, which according to the government decision mainly act as providers of goods and services not for profit, but where the activity is market production – one should use the multiplier method as done for other market producers - except the comparison of profitability between enterpris ...

... • For enterprises, which according to the government decision mainly act as providers of goods and services not for profit, but where the activity is market production – one should use the multiplier method as done for other market producers - except the comparison of profitability between enterpris ...

Reference manual - Index derivatives

... market indices largely results from the increasing popularity of the “index” portfolio management style, which consists in building portfolios that mirror stock market indices. For example, in Canada there are several Canadian equity mutual funds that reproduce the leading stock market indices such ...

... market indices largely results from the increasing popularity of the “index” portfolio management style, which consists in building portfolios that mirror stock market indices. For example, in Canada there are several Canadian equity mutual funds that reproduce the leading stock market indices such ...

Int`l Trade

... market for that good. We will assume that, because Isoland would be such a small part of the market for steel, they will be price takers in the world economy. This implies that they take the world price as given and must sell (or by) at that price. a) The first issue is to decide whether Isoland sho ...

... market for that good. We will assume that, because Isoland would be such a small part of the market for steel, they will be price takers in the world economy. This implies that they take the world price as given and must sell (or by) at that price. a) The first issue is to decide whether Isoland sho ...

Haksoz Kadam SPR Feb2009

... Most recently, this trend is becoming more pronounced in steel markets. According to Matthews (2008b), ArcelorMittal, the largest global steelmaker, sells only 20% of her steel via contracts, the rest of the capacity is sold directly to the spot market where higher profit opportunities lie. In such ...

... Most recently, this trend is becoming more pronounced in steel markets. According to Matthews (2008b), ArcelorMittal, the largest global steelmaker, sells only 20% of her steel via contracts, the rest of the capacity is sold directly to the spot market where higher profit opportunities lie. In such ...

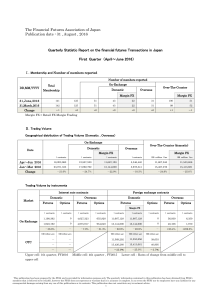

The Financial Futures Association of Japan Publication date : 31

... the previous term. Trading volume of On-exchange financial futures transactions decreased by 21.0% and OTC financial futures transactions declined by 24.9% for a sluggish FX margin trading. While the overall trading volume in the current term decreased, the trading volume of currency related transac ...

... the previous term. Trading volume of On-exchange financial futures transactions decreased by 21.0% and OTC financial futures transactions declined by 24.9% for a sluggish FX margin trading. While the overall trading volume in the current term decreased, the trading volume of currency related transac ...

download

... trading the mispriced security and then waiting for the market to recognize its "mistake" and reprice the security. 2. Technical analysis maintains that all information is reflected already in the stock price. Trends 'are your friend' and sentiment changes predate and predict trend changes. Investor ...

... trading the mispriced security and then waiting for the market to recognize its "mistake" and reprice the security. 2. Technical analysis maintains that all information is reflected already in the stock price. Trends 'are your friend' and sentiment changes predate and predict trend changes. Investor ...

Strategic Challenges Facing HKEx

... Current usage of IP services is low and inactive Trading process via IP not very convenient IPs are not direct registered members of the companies ...

... Current usage of IP services is low and inactive Trading process via IP not very convenient IPs are not direct registered members of the companies ...

Introduction to Financial Management

... • Risk that can be eliminated by combining assets into portfolios • “Unique risk” • “Asset-specific risk” • Examples: labor strikes, part shortages, etc. Return to Quick Quiz ...

... • Risk that can be eliminated by combining assets into portfolios • “Unique risk” • “Asset-specific risk” • Examples: labor strikes, part shortages, etc. Return to Quick Quiz ...

Morgan Stanley

... Derivative contracts – Dealer in OTC derivatives – “Generally represent future commitments to swap interest payment streams, exchange currencies, or purchase or sell commodities and other financial instruments on specific terms at specified future dates” ...

... Derivative contracts – Dealer in OTC derivatives – “Generally represent future commitments to swap interest payment streams, exchange currencies, or purchase or sell commodities and other financial instruments on specific terms at specified future dates” ...

PSF Floating Rate Loan - Pacific Life Annuities

... value or underperform investments with similar objectives and strategies or the market in general. Bank Loans Investments in bank loans, also known as senior loans or floating-rate loans, are rated below-investment grade and may be subject to a greater risk of default than are investment-grade loans ...

... value or underperform investments with similar objectives and strategies or the market in general. Bank Loans Investments in bank loans, also known as senior loans or floating-rate loans, are rated below-investment grade and may be subject to a greater risk of default than are investment-grade loans ...

June 2015 - NigeriaTravelsMart

... Inflation increased to 16.8% from 16.6% March Ghana is currently running a three-year aid program worth $918m with the International Monetary Fund ...

... Inflation increased to 16.8% from 16.6% March Ghana is currently running a three-year aid program worth $918m with the International Monetary Fund ...

trading hours euronext amsterdam, brussels, lisbon and

... Trading arrangements for the period 24 December 2013 to 3 January 2014 for the Amsterdam, Brussels, Lisbon and Paris Derivatives Markets are detailed below. The trading hours of the Amsterdam, Brussels, Lisbon and Paris Derivatives Markets during the period of 24 December 2013 to 3 January 2014, inc ...

... Trading arrangements for the period 24 December 2013 to 3 January 2014 for the Amsterdam, Brussels, Lisbon and Paris Derivatives Markets are detailed below. The trading hours of the Amsterdam, Brussels, Lisbon and Paris Derivatives Markets during the period of 24 December 2013 to 3 January 2014, inc ...

Lecture 09: Multi-period Model Fixed Income, Futures, Swaps

... The term structure are bond prices at a particular point in time. This is a cross section of prices. • time series properties: how do interest rates evolve as time goes by? • Time series view is the relevant view for an investor how tries to decide what kind of bonds to invest into, or what kind of ...

... The term structure are bond prices at a particular point in time. This is a cross section of prices. • time series properties: how do interest rates evolve as time goes by? • Time series view is the relevant view for an investor how tries to decide what kind of bonds to invest into, or what kind of ...

Midterm Exam answers and practice questions

... shares when the price is high. As a result, the average dollar amount paid, or the average cost per share, is always lower than the average price per share. Dollar-cost averaging will result in the greatest discount from the average share price in the most volatile market environments. Therefore, do ...

... shares when the price is high. As a result, the average dollar amount paid, or the average cost per share, is always lower than the average price per share. Dollar-cost averaging will result in the greatest discount from the average share price in the most volatile market environments. Therefore, do ...