NBER Reporter Summary of My Commodity Research

... which may originate from either supply shocks or trading in futures markets, affects the goods producers’ demand for the commodity. In contrast to the common wisdom that a higher commodity price leads to a lower quantity demanded by goods producers, our model shows that demand may increase with pric ...

... which may originate from either supply shocks or trading in futures markets, affects the goods producers’ demand for the commodity. In contrast to the common wisdom that a higher commodity price leads to a lower quantity demanded by goods producers, our model shows that demand may increase with pric ...

Name: JJJJJJJJJJJJJJJJJJJJJJJJJJJJJJJJJJJ Date: JJJJJJJJJJJJJJ

... A) There was an increase in demand and a decrease in supply. B) There was an increase in demand or an increase in supply. C) There was a decrease in demand and a decrease in supply. D) There was a decrease in demand or an increase in supply. 18. If a frost destroys much of the grapefruit crop, total ...

... A) There was an increase in demand and a decrease in supply. B) There was an increase in demand or an increase in supply. C) There was a decrease in demand and a decrease in supply. D) There was a decrease in demand or an increase in supply. 18. If a frost destroys much of the grapefruit crop, total ...

Ch10

... trader at Barings Bank, made poor and unauthorized investments in futures contracts. Through a combination of poor judgment, lack of oversight by the bank's management and by regulators, and unfortunate events like the Kobe earthquake, Leeson incurred a $1.3 billion loss that bankrupted the centurie ...

... trader at Barings Bank, made poor and unauthorized investments in futures contracts. Through a combination of poor judgment, lack of oversight by the bank's management and by regulators, and unfortunate events like the Kobe earthquake, Leeson incurred a $1.3 billion loss that bankrupted the centurie ...

Equity Quantitative Study - International Swaps and Derivatives

... to eliminate data-entry errors and certain trade-reporting idiosyncrasies. For example, when reporting conversion trades (buy a put and sell a call with the same strike) or “reverse conversions”, which have two legs, counterparties often tend to report a premium of 1 for each leg rather than the act ...

... to eliminate data-entry errors and certain trade-reporting idiosyncrasies. For example, when reporting conversion trades (buy a put and sell a call with the same strike) or “reverse conversions”, which have two legs, counterparties often tend to report a premium of 1 for each leg rather than the act ...

A financial derivative is a contract whose return depends on the

... A derivative is a contract whose return depends on the price movements of some underlying assets. There are three main families of derivative contracts: options, futures, and swaps. They all have the ability to reduce risk; thus, are widely used for hedging purposes. This course covers advanced topi ...

... A derivative is a contract whose return depends on the price movements of some underlying assets. There are three main families of derivative contracts: options, futures, and swaps. They all have the ability to reduce risk; thus, are widely used for hedging purposes. This course covers advanced topi ...

Enforcement of Promi..

... Note: The Seller is both a promisor and a promisee. Likewise, the Buyer is both a promisor and a promisee. ...

... Note: The Seller is both a promisor and a promisee. Likewise, the Buyer is both a promisor and a promisee. ...

"garden of the forking paths"? - Houston Business and Tax Law

... contracts . 20 Normally, if the futures markets were efficient then the price of a future would be very close to the price of the cash commodity to satisfy delivery. 21 However, if a speculator believed the price was to decrease, he would agree to a future sale at the current market price with the i ...

... contracts . 20 Normally, if the futures markets were efficient then the price of a future would be very close to the price of the cash commodity to satisfy delivery. 21 However, if a speculator believed the price was to decrease, he would agree to a future sale at the current market price with the i ...

synthetic zeros - SG Listed Products

... paid more than the Issue Price. This is because the amount repaid to you would be based on the Issue Price and not the price you paid. If for example Vodafone closed 34.8% below the Issue Price at £1.50 on the final Valuation Date, SZ30 would pay back £1.50, which is a 34.8% loss on the Issue Price ...

... paid more than the Issue Price. This is because the amount repaid to you would be based on the Issue Price and not the price you paid. If for example Vodafone closed 34.8% below the Issue Price at £1.50 on the final Valuation Date, SZ30 would pay back £1.50, which is a 34.8% loss on the Issue Price ...

18-43 18.7 Forward Rate Agreements (FRAs)

... • A futures contract is the right to buy or sell a specific item at a specified future date at a price determined today • The change in the market price of a commodity or security is offset by a profit or loss on the futures contract ...

... • A futures contract is the right to buy or sell a specific item at a specified future date at a price determined today • The change in the market price of a commodity or security is offset by a profit or loss on the futures contract ...

Circular 2013/8 Market conduct rules Supervisory rules on

... supervised institutions ensure that the individuals with the power of decision over trading in securities and derivatives about which the supervised institution possesses insider information have no knowledge of this insider information. They also ensure that individuals who do have knowledge of ins ...

... supervised institutions ensure that the individuals with the power of decision over trading in securities and derivatives about which the supervised institution possesses insider information have no knowledge of this insider information. They also ensure that individuals who do have knowledge of ins ...

Effect of Nonbinding Price Controls In Double Auction Trading

... The research task is to isolate the treatment effect of nonbinding price controls on competitive market outcomes including market dynamics. The design used for this exercise has the following key features. 1. All experiments use an electronic (computerized) DA mechanism characterized by a bid/ask co ...

... The research task is to isolate the treatment effect of nonbinding price controls on competitive market outcomes including market dynamics. The design used for this exercise has the following key features. 1. All experiments use an electronic (computerized) DA mechanism characterized by a bid/ask co ...

First North Price List

... Advisers shall pay a single and non-refundable contract fee of 1,500 euros* upon receiving the status of an Adviser. The contract fee shall be paid by the due date specified by the Exchange in the invoice, but not later than on the date of and before signing the agreement with the Exchange. ...

... Advisers shall pay a single and non-refundable contract fee of 1,500 euros* upon receiving the status of an Adviser. The contract fee shall be paid by the due date specified by the Exchange in the invoice, but not later than on the date of and before signing the agreement with the Exchange. ...

(Debt/Equity Swap)? - G. William Schwert

... •66% of these bonds are still outstanding •given the waiting period and the stock price drop after the call is announced, these bonds may not remain "in-the-money" when the call would be exercised ...

... •66% of these bonds are still outstanding •given the waiting period and the stock price drop after the call is announced, these bonds may not remain "in-the-money" when the call would be exercised ...

Why YOU Should Trade CME Currency Futures Instead

... They say: The cash currency market averages over $13 trillion a day This apparently implies that the total volume traded in the cash currency markets works in your favor. But the truth is in the actual execution. What do I mean by that? Just this: Will YOU get better prices and have your limit orde ...

... They say: The cash currency market averages over $13 trillion a day This apparently implies that the total volume traded in the cash currency markets works in your favor. But the truth is in the actual execution. What do I mean by that? Just this: Will YOU get better prices and have your limit orde ...

Does Equity Derivatives Trading Affect the Systematic Risk of the

... has been written on the volatility effects of futures trading. Numerous empirical studies have found that beta estimates can be biased because of nonsynchronous trading and market frictions such as thin trading, trading delays, and price adjustment delays. This can cause the beta estimate to be bias ...

... has been written on the volatility effects of futures trading. Numerous empirical studies have found that beta estimates can be biased because of nonsynchronous trading and market frictions such as thin trading, trading delays, and price adjustment delays. This can cause the beta estimate to be bias ...

FINANCIAL MARKETS AND INSTITIUTIONS: A Modern Perspective

... • the risk that the cost of rolling over or re-borrowing funds will rise above the returns being earned on asset investments ...

... • the risk that the cost of rolling over or re-borrowing funds will rise above the returns being earned on asset investments ...

FINANCIAL MARKETS AND INSTITIUTIONS: A Modern Perspective

... • the risk that the cost of rolling over or re-borrowing funds will rise above the returns being earned on asset investments ...

... • the risk that the cost of rolling over or re-borrowing funds will rise above the returns being earned on asset investments ...

Strategic commitment and pricing dynamics

... many small buyers than when each sells to a few large buyers. This is because a buyer who receives a price concession from one buyer has an incentive to inform other sellers and attract more favourable concessions. Price cutting is harder to detect when market demand conditions are volatile. If the ...

... many small buyers than when each sells to a few large buyers. This is because a buyer who receives a price concession from one buyer has an incentive to inform other sellers and attract more favourable concessions. Price cutting is harder to detect when market demand conditions are volatile. If the ...

Global Unconstrained Bond a sub-fund of Schroder

... Credit risk: A decline in the financial health of an issuer could cause the value of its bonds to fall or become worthless. Currency risk: The fund can be exposed to different currencies. Changes in foreign exchange rates could create losses. Derivatives risk: A derivative may not perform as expecte ...

... Credit risk: A decline in the financial health of an issuer could cause the value of its bonds to fall or become worthless. Currency risk: The fund can be exposed to different currencies. Changes in foreign exchange rates could create losses. Derivatives risk: A derivative may not perform as expecte ...

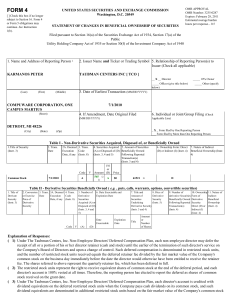

TAUBMAN CENTERS INC (Form: 4, Received: 07/01/2010 16:04:49)

... ( 1) Under The Taubman Centers, Inc. Non-Employee Directors' Deferred Compensation Plan, each non-employee director may defer the receipt of all or a portion of his or her director retainer (cash and stock) until the earlier of the termination of such director's service on the Company's Board of Dir ...

... ( 1) Under The Taubman Centers, Inc. Non-Employee Directors' Deferred Compensation Plan, each non-employee director may defer the receipt of all or a portion of his or her director retainer (cash and stock) until the earlier of the termination of such director's service on the Company's Board of Dir ...

Shephard`s lemma

... demand for each good in the market with respect to that level of utility and those prices: the derivative of the expenditure function E(PX, PY, U) with respect to that price. ...

... demand for each good in the market with respect to that level of utility and those prices: the derivative of the expenditure function E(PX, PY, U) with respect to that price. ...

Structured Asset Management

... Active management can add significant value in inefficient asset classes by exploiting superior information. ...

... Active management can add significant value in inefficient asset classes by exploiting superior information. ...

PDF

... analyze the data set. Growers age (in years), education (in years), risk aversion level, risk perception, location, income, farm size and the ability to expand the farm if required are included as explanatory variables in the analysis. The selection of these explanatory variables is based on previo ...

... analyze the data set. Growers age (in years), education (in years), risk aversion level, risk perception, location, income, farm size and the ability to expand the farm if required are included as explanatory variables in the analysis. The selection of these explanatory variables is based on previo ...

Risks Underlying Islamic Modes of Financing

... • Renting an asset to the party who sold it, has been questioned by scholars. 3. Pricing of Sukuk • Muslim economists and Shariah scholars have not come up with an alternative to the interest rate as a readily available indicator of profitability. Hence the use of LIBOR/KIBOR as a benchmark has beco ...

... • Renting an asset to the party who sold it, has been questioned by scholars. 3. Pricing of Sukuk • Muslim economists and Shariah scholars have not come up with an alternative to the interest rate as a readily available indicator of profitability. Hence the use of LIBOR/KIBOR as a benchmark has beco ...

QFI CORE Model Solutions Fall 2014

... Calculate the change in σ 22 when σ 02 is decreased from 8% to 7%. Commentary on Question: A good number of candidates did well on this question. Other candidates who calculated the % change instead of arithmetic change were given full credit as long as they demonstrated clear understanding of the t ...

... Calculate the change in σ 22 when σ 02 is decreased from 8% to 7%. Commentary on Question: A good number of candidates did well on this question. Other candidates who calculated the % change instead of arithmetic change were given full credit as long as they demonstrated clear understanding of the t ...