S0110843_en.pdf

... • Net bond flows are of relatively minor significance and one country, Jamaica, accounted for the majority of these flows. However, in recent years, with the Bahamas, Barbados and Trinidad & Tobago achieving investment grade credit ratings, bonds have become a more significant source of external cap ...

... • Net bond flows are of relatively minor significance and one country, Jamaica, accounted for the majority of these flows. However, in recent years, with the Bahamas, Barbados and Trinidad & Tobago achieving investment grade credit ratings, bonds have become a more significant source of external cap ...

ion beam applications

... Interim consolidated Income Statement for the six months ended June 30, 2016 ....................................... 6 Interim consolidated statement of Comprehensive Income for the six months ended June 30, 2016.......... 7 Interim consolidated statement of changes in Shareholder’s Equity.......... ...

... Interim consolidated Income Statement for the six months ended June 30, 2016 ....................................... 6 Interim consolidated statement of Comprehensive Income for the six months ended June 30, 2016.......... 7 Interim consolidated statement of changes in Shareholder’s Equity.......... ...

The Industry Life Cycle and Acquisitions and Investment: Does Firm

... industries - significantly increase in productivity post-acquisition. These results are consistent with Stein’s (1997) model of the benefits of internal capital markets and the predictions about the reallocations of assets within conglomerate firms in Maksimovic and Phillips (2002). Third, we also f ...

... industries - significantly increase in productivity post-acquisition. These results are consistent with Stein’s (1997) model of the benefits of internal capital markets and the predictions about the reallocations of assets within conglomerate firms in Maksimovic and Phillips (2002). Third, we also f ...

Analysis of stock performance based on

... efficient market hypothesis,10 there have been a number of papers assessing whether the outperformance is due to excessive risk, data mining, or if the strategy genuinely creates alpha. The results show that although there is an outperformance, it is not statistically significant when adjusting the ...

... efficient market hypothesis,10 there have been a number of papers assessing whether the outperformance is due to excessive risk, data mining, or if the strategy genuinely creates alpha. The results show that although there is an outperformance, it is not statistically significant when adjusting the ...

with greater power comes greater responsibility

... residual profits and assets (Easterbrook and Fischel, 1991; Williamson, 1985). Hence, management should attend to shareholders’ interests that are not protected otherwise. The second theoretical assumption underlying the shareholder view suggests that focusing directly on more than one stakeholder r ...

... residual profits and assets (Easterbrook and Fischel, 1991; Williamson, 1985). Hence, management should attend to shareholders’ interests that are not protected otherwise. The second theoretical assumption underlying the shareholder view suggests that focusing directly on more than one stakeholder r ...

GENERAL ELECTRIC CO (Form: 10-K405, Received: 03

... reactors, nuclear power support services and fuel assemblies; commercial and military aircraft jet engines; materials, including plastics, silicones and superabrasives; and a wide variety of high-technology products, including products used in medical diagnostic applications. The Company also offers ...

... reactors, nuclear power support services and fuel assemblies; commercial and military aircraft jet engines; materials, including plastics, silicones and superabrasives; and a wide variety of high-technology products, including products used in medical diagnostic applications. The Company also offers ...

NBER WORKING PAPER SERIES RISK SHIFTING VERSUS RISK MANAGEMENT:

... respect to the management of cash flow risks. On the one hand, shocks to cash flows for financially constrained firms can lead to bankruptcy (Smith and Stulz (1985)) or to the inability to take profitable investment projects in the future (Mayers and Smith (1987), Froot, Scharfstein, and Stein (1993 ...

... respect to the management of cash flow risks. On the one hand, shocks to cash flows for financially constrained firms can lead to bankruptcy (Smith and Stulz (1985)) or to the inability to take profitable investment projects in the future (Mayers and Smith (1987), Froot, Scharfstein, and Stein (1993 ...

Black Box Corporation

... assessment, used to identify potential impairment, resulted in a surplus of fair value over carrying amount for each of our new reporting units, thus the new reporting units are considered not impaired and the second step of the impairment test is not necessary. At June 30, 2013 , the Company's stoc ...

... assessment, used to identify potential impairment, resulted in a surplus of fair value over carrying amount for each of our new reporting units, thus the new reporting units are considered not impaired and the second step of the impairment test is not necessary. At June 30, 2013 , the Company's stoc ...

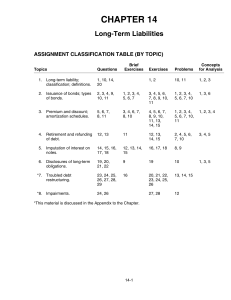

chapter 2 - Test Bank Answers

... of the following could explain these changes in its cash position? a. The company had a sharp increase in its depreciation and amortization expenses. b. The company had a sharp increase in its inventories. c. The company issued new common stock. d. Statements a and b are correct. e. Statements a and ...

... of the following could explain these changes in its cash position? a. The company had a sharp increase in its depreciation and amortization expenses. b. The company had a sharp increase in its inventories. c. The company issued new common stock. d. Statements a and b are correct. e. Statements a and ...

Cypress Capital Management, LLC 1 FIRM

... company within an industry. For example, major drilling companies depend on finding oil and then refining it, a lengthy process, before they can generate a profit. They carry a higher risk of profitability than a utility company, which generates its income from a steady stream of customers who buy p ...

... company within an industry. For example, major drilling companies depend on finding oil and then refining it, a lengthy process, before they can generate a profit. They carry a higher risk of profitability than a utility company, which generates its income from a steady stream of customers who buy p ...

5 Prior research about earning management and joint audits

... limited empirical research has performed regarding the influence of joint audits on the use of earnings management in the consolidated financial statements compared to a single audit approach. Most literature ends with a suggestion to further empirical research regarding this topic. However, opponen ...

... limited empirical research has performed regarding the influence of joint audits on the use of earnings management in the consolidated financial statements compared to a single audit approach. Most literature ends with a suggestion to further empirical research regarding this topic. However, opponen ...

Global Intangible Financial Tracker 2016 An annual

... marketing communications, with a well-earned reputation for international thought leadership, best practice and continuous professional development. Our 311 agencies lead 4,300 brands, employ over 25,000 staff and contribute £17bn in UK spend. The mission of IPA member agencies is to help client org ...

... marketing communications, with a well-earned reputation for international thought leadership, best practice and continuous professional development. Our 311 agencies lead 4,300 brands, employ over 25,000 staff and contribute £17bn in UK spend. The mission of IPA member agencies is to help client org ...

The Essays of Warren Buffett: Lessons for

... According to Buffett, one of the greatest problems among boards in corporate America is that members are selected for other reasons, such as adding diversity or prominence to a board. Most reforms are painted with a broad brush, without noting the major differences among types of board situations th ...

... According to Buffett, one of the greatest problems among boards in corporate America is that members are selected for other reasons, such as adding diversity or prominence to a board. Most reforms are painted with a broad brush, without noting the major differences among types of board situations th ...

lloyds investment funds limited

... sterling interest rates. This policy will result in a gradual reduction in the capital value of the shares, except when bond prices generally are rising. The Fund will normally hold a relatively wide range of securities in order to keep a low level of exposure to individual bond issues other than go ...

... sterling interest rates. This policy will result in a gradual reduction in the capital value of the shares, except when bond prices generally are rising. The Fund will normally hold a relatively wide range of securities in order to keep a low level of exposure to individual bond issues other than go ...