NBER WORKING PAPER SERIES RATIONAL ADDICTION, PEER EXTERNALITIES Donald S. Kenkel

... consumption of the addictive good raises the marginal utility of addictive consumption when old (an addiction effect), but also lowers overall utility in the future due to a detrimental health effect. Since individuals make consumption and savings choices simultaneously, an individual’s choice of ad ...

... consumption of the addictive good raises the marginal utility of addictive consumption when old (an addiction effect), but also lowers overall utility in the future due to a detrimental health effect. Since individuals make consumption and savings choices simultaneously, an individual’s choice of ad ...

TRP99-3 -The Case for Payroll Tax

... individuals regardless of their legal incidence. Analysis of payroll tax must recognise the ways in which the burden of the tax ultimately flows through to individuals, and this can only be done by drawing on economic literature, such as tax incidence analysis, as is done in Section 2. In order to a ...

... individuals regardless of their legal incidence. Analysis of payroll tax must recognise the ways in which the burden of the tax ultimately flows through to individuals, and this can only be done by drawing on economic literature, such as tax incidence analysis, as is done in Section 2. In order to a ...

Slides2

... As long as the tax rate on capital gains is less than that on ordinary income, it makes sense for the firm to buy back shares rather than pay out dividends, even though this generates capital gains. Copyright © by Houghton Mifflin Company. All rights reserved. ...

... As long as the tax rate on capital gains is less than that on ordinary income, it makes sense for the firm to buy back shares rather than pay out dividends, even though this generates capital gains. Copyright © by Houghton Mifflin Company. All rights reserved. ...

Flat Tax Reforms in the U.S.: A Boon for the Income Poor Javier D

... dimensions. First, it allows for mobility in the earnings and wealth distribution. This should make changes in welfare due to changes in inequality less dramatic since, at least at the dynasty level, the income process is mean reverting. Second, it considers uninsurable labor market uncertainty. As ...

... dimensions. First, it allows for mobility in the earnings and wealth distribution. This should make changes in welfare due to changes in inequality less dramatic since, at least at the dynasty level, the income process is mean reverting. Second, it considers uninsurable labor market uncertainty. As ...

This PDF is a selection from an out-of-print volume from... Bureau of Economic Research

... some private schools) and all public libraries receive a subsidy for their purchase of Internet access. While the subsidy scheme is progressive, over 97 percent of schools receive at least a 40 percent discount and over 67 percent of schools receive at least a 50 percent ...

... some private schools) and all public libraries receive a subsidy for their purchase of Internet access. While the subsidy scheme is progressive, over 97 percent of schools receive at least a 40 percent discount and over 67 percent of schools receive at least a 50 percent ...

Deficit Reduction and Carbon Taxes

... we account for an accumulation of debt and anticipate the eventual impact that debt would have on the economy. Second, the assumptions in other models imply infinitely elastic capital supply, whereas an OLG model enables a more realistic analysis of the effects of tax policy on capital accumulation. ...

... we account for an accumulation of debt and anticipate the eventual impact that debt would have on the economy. Second, the assumptions in other models imply infinitely elastic capital supply, whereas an OLG model enables a more realistic analysis of the effects of tax policy on capital accumulation. ...

Corporate Tax Policy and Unemployment in Europe

... labour hours, households receive unemployment benefits, which are indexed to the aftertax wage. The net replacement rate is set at 50%. We assume that households take into account the risk that they will be unemployed when deciding about their labour hours.4 Labour supply decisions are governed by t ...

... labour hours, households receive unemployment benefits, which are indexed to the aftertax wage. The net replacement rate is set at 50%. We assume that households take into account the risk that they will be unemployed when deciding about their labour hours.4 Labour supply decisions are governed by t ...

Document

... The firm pays workers 50¢ less than the original $5.15, but must send $1 to the government. In effect, they are paying a wage of $5.65. As in output markets, the tax incidence of a payroll tax shows that it makes no difference on which side of the market it is levied, and the economic burden can ...

... The firm pays workers 50¢ less than the original $5.15, but must send $1 to the government. In effect, they are paying a wage of $5.65. As in output markets, the tax incidence of a payroll tax shows that it makes no difference on which side of the market it is levied, and the economic burden can ...

Does tax evasion modify the redistributive effect of tax progressivity?∗

... c(y) and h(y) with respect to y, and see which of them is larger. The Appendix proves that the Lorenz curve of c(y) lies above the Lorenz curve of h(y), under some conditions. More precisely, Proposition 3 gives the conditions ensuring that the after-tax income without evasion is more equally distri ...

... c(y) and h(y) with respect to y, and see which of them is larger. The Appendix proves that the Lorenz curve of c(y) lies above the Lorenz curve of h(y), under some conditions. More precisely, Proposition 3 gives the conditions ensuring that the after-tax income without evasion is more equally distri ...

ZE 05-2012.indd - Open Access Agricultural Journals

... AGRIC. ECON. CZECH, 58, 2012 (5): 239–248 ...

... AGRIC. ECON. CZECH, 58, 2012 (5): 239–248 ...

Progressive taxation and equal sacrifice

... of each person towards the expenses of government so that he shall feel neither more nor less inconvenience from his share of the payment than every other person experiences from his. This standard, like other standards of perfection, but the first object in every practical cannot be completely real ...

... of each person towards the expenses of government so that he shall feel neither more nor less inconvenience from his share of the payment than every other person experiences from his. This standard, like other standards of perfection, but the first object in every practical cannot be completely real ...

CAPITAL AND WEALTH TAXATION IN THE 21sT

... III. ON THE OPTIMAL PROGRESSIVE TAXATION OF INCOME, WEALTH, AND CONSUMPTION I now move to the issue of optimal taxation. The theory of capital taxation that I present in Capital is largely based upon joint work with Emmanuel Saez (Piketty and Saez, 2013a). In this paper, we develop a model wher ...

... III. ON THE OPTIMAL PROGRESSIVE TAXATION OF INCOME, WEALTH, AND CONSUMPTION I now move to the issue of optimal taxation. The theory of capital taxation that I present in Capital is largely based upon joint work with Emmanuel Saez (Piketty and Saez, 2013a). In this paper, we develop a model wher ...

Slides 1

... Janeba, E., Peters, W., 1999. Tax evasion, tax competition and the gains from nondiscrimination: The case of interest taxation in Europe. Economic Journal 109, 93-101. Johannesen, N., 2010. Imperfect Tax Competition for Pro…ts, Asymmetric Equilibria and Bene…cial Tax Havens”. Journal of Internationa ...

... Janeba, E., Peters, W., 1999. Tax evasion, tax competition and the gains from nondiscrimination: The case of interest taxation in Europe. Economic Journal 109, 93-101. Johannesen, N., 2010. Imperfect Tax Competition for Pro…ts, Asymmetric Equilibria and Bene…cial Tax Havens”. Journal of Internationa ...

Evaluating the effectiveness of state film tax credit programs

... industries and from statewide multiplier activity associated with production in these industries. The multiplier activity accounts for jobs and incomes earned from in-state suppliers to the industry and from the spending and respending of the additional earnings of employees throughout the state eco ...

... industries and from statewide multiplier activity associated with production in these industries. The multiplier activity accounts for jobs and incomes earned from in-state suppliers to the industry and from the spending and respending of the additional earnings of employees throughout the state eco ...

Defending the Articles of Confederation: A Reply to

... As Joel Slemrod points out in his 1990 article “Optimal Taxation and Optimal Tax Systems,” “[O]ptimal tax theory is incomplete as a guide to action . . . and for other critical issues in tax policy . . . because it has yet to come to terms with taxation as a system of coercively collecting revenues ...

... As Joel Slemrod points out in his 1990 article “Optimal Taxation and Optimal Tax Systems,” “[O]ptimal tax theory is incomplete as a guide to action . . . and for other critical issues in tax policy . . . because it has yet to come to terms with taxation as a system of coercively collecting revenues ...

Raw Material Inventories - Edwards School of Business

... but the personal taxes on dividends will only be paid when the company actually declares and distributes them to the shareholders. If Peaco shareholders are not in need of current dividends or if Peaco wants to use profits to finance growth in the company, then personal taxes can be deferred. This m ...

... but the personal taxes on dividends will only be paid when the company actually declares and distributes them to the shareholders. If Peaco shareholders are not in need of current dividends or if Peaco wants to use profits to finance growth in the company, then personal taxes can be deferred. This m ...

The Economics of Taxes

... The incidence of the tax—how the burden of the tax is divided between consumers and producers—does not depend on who officially pays the tax. 2. The incidence of an excise tax depends on the price elasticities of supply and demand. If the price elasticity of demand is higher than the price elasticit ...

... The incidence of the tax—how the burden of the tax is divided between consumers and producers—does not depend on who officially pays the tax. 2. The incidence of an excise tax depends on the price elasticities of supply and demand. If the price elasticity of demand is higher than the price elasticit ...

Chapter 7 Problem 2 - the School of Economics and Finance

... • In economics, efficiency denotes a state at which all potential gains from exchange have been captured. • Recall that the definition of Pareto Optimality is “a state at which one cannot be made better off without making others worse off”. • Any pollution or by-products related to exchange or prod ...

... • In economics, efficiency denotes a state at which all potential gains from exchange have been captured. • Recall that the definition of Pareto Optimality is “a state at which one cannot be made better off without making others worse off”. • Any pollution or by-products related to exchange or prod ...

NBER WORKING PAPER SERIES FREE TRADE TAXATION AND PROTECTIOMST TAXATION Joel Slemrod

... support unilateral strategic use of commercial policies, such as countervailing duties and antidumping actions, designed to induce other countries to adopt free tradepolicies. Foreign countries adopting free trade will generally beneilt one's own country, so it is worthwhile to encourage those polic ...

... support unilateral strategic use of commercial policies, such as countervailing duties and antidumping actions, designed to induce other countries to adopt free tradepolicies. Foreign countries adopting free trade will generally beneilt one's own country, so it is worthwhile to encourage those polic ...

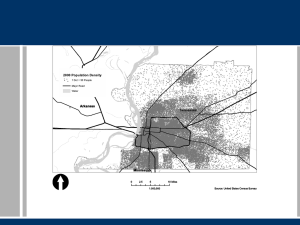

Impact of Agriculture Prices on Sales Tax Revenue, House

... agricultural prices there is a corresponding $7,794,029 decrease (increase) in state sales tax receipts, all else being Energy prices and sales tax receipts exhibit a negative, but statistically insignificant relationship at the state level. Intuitively, when the equal. negative relationship is appa ...

... agricultural prices there is a corresponding $7,794,029 decrease (increase) in state sales tax receipts, all else being Energy prices and sales tax receipts exhibit a negative, but statistically insignificant relationship at the state level. Intuitively, when the equal. negative relationship is appa ...

general equilibrium tax incidence

... fell dramatically. Doesn’t this decrease in consumption make consumers worse off? If so, shouldn’t that be taken into account when determining tax incidence? The answer to both questions is “no” because, at both the old and new equilibria, consumers in this case are indifferent between buying the ga ...

... fell dramatically. Doesn’t this decrease in consumption make consumers worse off? If so, shouldn’t that be taken into account when determining tax incidence? The answer to both questions is “no” because, at both the old and new equilibria, consumers in this case are indifferent between buying the ga ...

Why Do Americans Work So Much More Than Europeans?

... Europeans. Using labor market statistics from the Organisation for Economic Co-operation and Development, I find that Americans on a per person aged 15-64 basis work in the market sector 50 percent more than do the French. This was not always the case. In the early 1970s, Americans allocated less ti ...

... Europeans. Using labor market statistics from the Organisation for Economic Co-operation and Development, I find that Americans on a per person aged 15-64 basis work in the market sector 50 percent more than do the French. This was not always the case. In the early 1970s, Americans allocated less ti ...

measuring the impact of tax reform

... policies by some (the so-called differences-in-differences approach). But, because they do not use all available data, these approaches sacrifice some of the available information. Moreover, they do not offer a complete solution to the problem of endogeneity. There is no guarantee that our choice of ...

... policies by some (the so-called differences-in-differences approach). But, because they do not use all available data, these approaches sacrifice some of the available information. Moreover, they do not offer a complete solution to the problem of endogeneity. There is no guarantee that our choice of ...