This PDF is a selection from an out-of-print volume from... Bureau of Economic Research

... of equivalent variations from each period, we have an argument analogous to that of John Kay (1980). The EV is preferred to the CV for comparing alternative replacement policies, since the CV are each measured in the new prices of each different replacement equilibrium. Third, suppose that our model ...

... of equivalent variations from each period, we have an argument analogous to that of John Kay (1980). The EV is preferred to the CV for comparing alternative replacement policies, since the CV are each measured in the new prices of each different replacement equilibrium. Third, suppose that our model ...

Tanzi

... A value added tax is a much better instrument, for both stabilization policy and for the allocation of resources, than the taxes that it replaced. However, its increasing importance is not likely to have made the tax systems more progressive than they were, in spite of attempts by several government ...

... A value added tax is a much better instrument, for both stabilization policy and for the allocation of resources, than the taxes that it replaced. However, its increasing importance is not likely to have made the tax systems more progressive than they were, in spite of attempts by several government ...

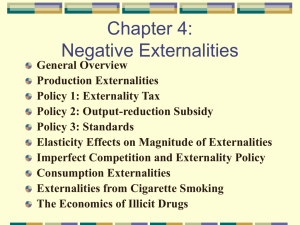

Negative Externalities

... externality may be small, and it may not be worth regulating the externality. When demand is elastic, the socially optimal level of production, Qe, is farther away from the competitive level, Qc. In this case, the inefficiency associated with the production externality may be relatively large, and r ...

... externality may be small, and it may not be worth regulating the externality. When demand is elastic, the socially optimal level of production, Qe, is farther away from the competitive level, Qc. In this case, the inefficiency associated with the production externality may be relatively large, and r ...

Chapter 11

... Taxation, Prices Efficiency, and the Distribution of Income Copyright © 2002 Thomson Learning, Inc. Thomson Learning™ is a trademark used herein under license. ALL RIGHTS RESERVED. Instructors of classes adopting PUBLIC FINANCE: A CONTEMPORARY APPLICATION OF THEORY TO POLICY, Seventh Edition by Davi ...

... Taxation, Prices Efficiency, and the Distribution of Income Copyright © 2002 Thomson Learning, Inc. Thomson Learning™ is a trademark used herein under license. ALL RIGHTS RESERVED. Instructors of classes adopting PUBLIC FINANCE: A CONTEMPORARY APPLICATION OF THEORY TO POLICY, Seventh Edition by Davi ...

Market Imperfections - (Welch, Chapter 11)

... If you run a fund, make some of your money through liquidity provision—but do not go overboard, or you will end up bankrupt. ...

... If you run a fund, make some of your money through liquidity provision—but do not go overboard, or you will end up bankrupt. ...

Tax Rates, Tax Evasion, and Growth in a Multi

... Lee (2001) considers the possibility of self-insurance against possible penalties. Chen (2003) introduces transaction costs associated with tax evasion. Finally, Panadés (2004) departs from the standard model by making taxpayers’ utility depend on the relative tax contribution. We will consider a ca ...

... Lee (2001) considers the possibility of self-insurance against possible penalties. Chen (2003) introduces transaction costs associated with tax evasion. Finally, Panadés (2004) departs from the standard model by making taxpayers’ utility depend on the relative tax contribution. We will consider a ca ...

Tax Rates, Tax Evasion, and Growth in a Multi

... Lee (2001) considers the possibility of self-insurance against possible penalties. Chen (2003) introduces transaction costs associated with tax evasion. Finally, Panadés (2004) departs from the standard model by making taxpayers’ utility depend on the relative tax contribution. We will consider a ca ...

... Lee (2001) considers the possibility of self-insurance against possible penalties. Chen (2003) introduces transaction costs associated with tax evasion. Finally, Panadés (2004) departs from the standard model by making taxpayers’ utility depend on the relative tax contribution. We will consider a ca ...

Lecture 13

... DEADWEIGHT LOSS AND TAX REVENUE AS TAXES VARY • For the small tax, tax revenue is small. • As the size of the tax rises, tax revenue grows. • But as the size of the tax continues to rise, tax revenue falls because the higher tax reduces the size of the market. ...

... DEADWEIGHT LOSS AND TAX REVENUE AS TAXES VARY • For the small tax, tax revenue is small. • As the size of the tax rises, tax revenue grows. • But as the size of the tax continues to rise, tax revenue falls because the higher tax reduces the size of the market. ...

Document

... its value often cannot be captured by any one firm. As a result, the U.S. university system subsidizes much basic (and applied) research. Government funding for chip research and funding for research on the human genome are other recent examples. a. Are Market Externalities Bounded by Borders? Some ...

... its value often cannot be captured by any one firm. As a result, the U.S. university system subsidizes much basic (and applied) research. Government funding for chip research and funding for research on the human genome are other recent examples. a. Are Market Externalities Bounded by Borders? Some ...

Taxation and Development: It’s not just that counts

... to enforce tax rules – If poor, then modest turnover tax as a back-up, may be good ...

... to enforce tax rules – If poor, then modest turnover tax as a back-up, may be good ...

At P*MKT

... In either case, the quantity exchanged is always LESS THAN the true equilibrium quantity. Hence, if a market is not in equilibrium, further benefit-enhancing transactions are always ...

... In either case, the quantity exchanged is always LESS THAN the true equilibrium quantity. Hence, if a market is not in equilibrium, further benefit-enhancing transactions are always ...

BOOK REVIEWS

... theoretical alternative to Keynesianism, and second, by providing politically attractive policy recommendations. The first objective has surely been accomplished, as evidenced by the collection of articles in The Supply-Side Solution, edited by Bruce Bartlett and Timothy P. Roth. But the second obje ...

... theoretical alternative to Keynesianism, and second, by providing politically attractive policy recommendations. The first objective has surely been accomplished, as evidenced by the collection of articles in The Supply-Side Solution, edited by Bruce Bartlett and Timothy P. Roth. But the second obje ...

Incidence of a tax

... Interpretation: "consumers pay four times as much as the decrease in price producers receive. Hence, an excise tax of $1 results in an increase in consumer price of $.8 and a decrease in price received by producers of $.2“ ...

... Interpretation: "consumers pay four times as much as the decrease in price producers receive. Hence, an excise tax of $1 results in an increase in consumer price of $.8 and a decrease in price received by producers of $.2“ ...

THE MIDDLE-CLASS SQUEEZE: DC`s Tax System Falls Most

... Families in the District with incomes of $20,000 to $60,000 pay one-tenth of their incomes in DC property, sales, and income taxes, according to a new study by the Institute on Taxation & Economic Policy.1 This is much higher than the share of income the city’s richest families pay in DC taxes. The ...

... Families in the District with incomes of $20,000 to $60,000 pay one-tenth of their incomes in DC property, sales, and income taxes, according to a new study by the Institute on Taxation & Economic Policy.1 This is much higher than the share of income the city’s richest families pay in DC taxes. The ...

MODULE 50: Efficiency and Deadweight Loss AP Microeconomics

... market. When a market is in equilibrium, there is no way to increase the gains from trade; any other outcome reduces total surplus, therefore the equilibrium market outcome is usually (2) ____________. There are three caveats to the conclusion that market equilibrium maximizes the gains from trade. ...

... market. When a market is in equilibrium, there is no way to increase the gains from trade; any other outcome reduces total surplus, therefore the equilibrium market outcome is usually (2) ____________. There are three caveats to the conclusion that market equilibrium maximizes the gains from trade. ...

public consultation on tax and entrepreneurship

... There is a risk associated with equating self-employment and SMEs with entrepreneurship. While there is considerable overlap between the two areas, Fianna Fáil believes that in order to maximise the potential of both sectors they need to be treated as distinct policy streams. While self-employment c ...

... There is a risk associated with equating self-employment and SMEs with entrepreneurship. While there is considerable overlap between the two areas, Fianna Fáil believes that in order to maximise the potential of both sectors they need to be treated as distinct policy streams. While self-employment c ...

Chapter 8 Application

... ANSWER: The best predictor is the elasticity of supply and the elasticity of demand in the market. The more elastic supply and demand are in a market, the more taxes in that market distort behavior, and the more likely it is that a tax cut will raise tax revenue. Suppose that a tax is imposed on the ...

... ANSWER: The best predictor is the elasticity of supply and the elasticity of demand in the market. The more elastic supply and demand are in a market, the more taxes in that market distort behavior, and the more likely it is that a tax cut will raise tax revenue. Suppose that a tax is imposed on the ...

We Pay the Tax-3

... I would keep reading until we reach the point in the story where Mohammed and his friend show the cashier their calculations because they were determined that their calculations were correct. I would then invite the students to continue reading on their own, (this book is available to download for g ...

... I would keep reading until we reach the point in the story where Mohammed and his friend show the cashier their calculations because they were determined that their calculations were correct. I would then invite the students to continue reading on their own, (this book is available to download for g ...

29 April 2009 AFTS Secretariat The Treasury Langton Crescent

... Thank you for the opportunity to contribute to the Review of Australia’s Future Tax System. A successful review of Australia’s current taxation system will provide mechanisms and outcomes that will greatly assist in meeting the economic, social and environmental challenges we face as a nation. What ...

... Thank you for the opportunity to contribute to the Review of Australia’s Future Tax System. A successful review of Australia’s current taxation system will provide mechanisms and outcomes that will greatly assist in meeting the economic, social and environmental challenges we face as a nation. What ...

Principles of Taxation - Kellogg School of Management

... Illustrate with example of two goods that differ only in their demand elasticities. ...

... Illustrate with example of two goods that differ only in their demand elasticities. ...

Lesson 7 - Consumer and Producer Surplus

... • Willingness to Pay – The demand curve is based on the individual choices of the people that make it up, and each individual is willing to pay a different price. – While Consumer A might be willing to pay $500 for a new television, Consumer B might only pay $300. – If the Television costs $250, bot ...

... • Willingness to Pay – The demand curve is based on the individual choices of the people that make it up, and each individual is willing to pay a different price. – While Consumer A might be willing to pay $500 for a new television, Consumer B might only pay $300. – If the Television costs $250, bot ...

Lead Remediation Grant Scheme

... standard of workmanship has been applied. Note : It is the applicant’s responsibility to satisfy themselves that any contractor engaged is competent to carry out the works required and that suitable materials are used. ...

... standard of workmanship has been applied. Note : It is the applicant’s responsibility to satisfy themselves that any contractor engaged is competent to carry out the works required and that suitable materials are used. ...

Current Food Taxes in BC

... foods, carbonated and most other beverages (except dairy), confec8onery and candies, will see tax increase from 5% to 12% – A rather broad tax that does include more than junk foods, but it does t ...

... foods, carbonated and most other beverages (except dairy), confec8onery and candies, will see tax increase from 5% to 12% – A rather broad tax that does include more than junk foods, but it does t ...

Project Cost Report at 3.85%

... Documentation is required to support all figures reported on the Project Cost Report. Items purchased for use on this project (such as tools and supplies) are subject to City sales and use tax. If a City sales tax was not paid on these items at the time of purchase, you are required to remit a use t ...

... Documentation is required to support all figures reported on the Project Cost Report. Items purchased for use on this project (such as tools and supplies) are subject to City sales and use tax. If a City sales tax was not paid on these items at the time of purchase, you are required to remit a use t ...