February 26, 2001

... MTAS legal consultant, Sid Hemsley advised that TCA 7-34-115 (a) (9) is the statute on water and wastewater and that absent a formula or method in this statute, a city can use some “reasonable” method for determining such payments that are not to “exceed the amount of taxes payable privately owned ...

... MTAS legal consultant, Sid Hemsley advised that TCA 7-34-115 (a) (9) is the statute on water and wastewater and that absent a formula or method in this statute, a city can use some “reasonable” method for determining such payments that are not to “exceed the amount of taxes payable privately owned ...

National Retail Sales Tax as a Replacement for Income Tax

... stated “Under our historic reform bill, American workers will take home 100 percent of their pay — less FICA withholding — and then they would decide how much they want to be taxed by how much they consume.” Some of the other benefits of this tax system, highlighted by Representatives Schaefer and T ...

... stated “Under our historic reform bill, American workers will take home 100 percent of their pay — less FICA withholding — and then they would decide how much they want to be taxed by how much they consume.” Some of the other benefits of this tax system, highlighted by Representatives Schaefer and T ...

Energy Taxes and the Pretense of Knowledge

... function of such taxes is to make the economy function more efficiently. Through their use we have the opportunity to employ the tax system, not only to raise revenues but also to enhance the operations of the economy.”2 There are serious flaws in this entire approach to both environmental and tax p ...

... function of such taxes is to make the economy function more efficiently. Through their use we have the opportunity to employ the tax system, not only to raise revenues but also to enhance the operations of the economy.”2 There are serious flaws in this entire approach to both environmental and tax p ...

PowerPoint Slides are available here

... jurisdictions that offer more favorable tax conditions, a relatively unfavorable tax will cause gross wages to adjust until the resulting net wage is equal to that available elsewhere. The current empirical findings go beyond confirming this long-run tendency and show that gross wages adjust rapidly ...

... jurisdictions that offer more favorable tax conditions, a relatively unfavorable tax will cause gross wages to adjust until the resulting net wage is equal to that available elsewhere. The current empirical findings go beyond confirming this long-run tendency and show that gross wages adjust rapidly ...

Name:Period:Percent Review Yellow Side – If you are feeling not as

... Green Side – If you are feeling confident with percent (sales tax, tips, and discounts), complete this side. When you finish, check in with Mrs. Allison. 1. The total bill for drinks and a pizza for three people is $17.50 before tax. a. The sales tax is 5%. What will be the amount added to the bill ...

... Green Side – If you are feeling confident with percent (sales tax, tips, and discounts), complete this side. When you finish, check in with Mrs. Allison. 1. The total bill for drinks and a pizza for three people is $17.50 before tax. a. The sales tax is 5%. What will be the amount added to the bill ...

Dias nummer 1

... No increase in work incentive for low-income earner Work incentive of high-income earner increases from 80 to 100 = 25% Reform 2: In-work benefit = 20% of earnings with cap at 20 and gradual phase-out at earnings between 100 and 200 Revenue cost = 20% of 100 = 20 (note: no benefit to high-income ear ...

... No increase in work incentive for low-income earner Work incentive of high-income earner increases from 80 to 100 = 25% Reform 2: In-work benefit = 20% of earnings with cap at 20 and gradual phase-out at earnings between 100 and 200 Revenue cost = 20% of 100 = 20 (note: no benefit to high-income ear ...

Submission to Australia`s Future Tax System from John Passant

... Prime Minister Kevin Rudd assures us that the problem is a lack of demand in the economy. My proposals would increase aggregate demand. We could couple these suggestions with real wage increases for workers to also boost aggregate demand. As I am sure your are aware, the amount of the national incom ...

... Prime Minister Kevin Rudd assures us that the problem is a lack of demand in the economy. My proposals would increase aggregate demand. We could couple these suggestions with real wage increases for workers to also boost aggregate demand. As I am sure your are aware, the amount of the national incom ...

Fact Sheet #3: How Progressive is Canada`s Tax System?

... fair tax system is a progressive tax system, where people with higher incomes pay a greater share of their income in taxes. Growing evidence demonstrates that “fair is smart, that progressive taxes, where those who benefit most pay the greatest share, make good economic sense.”16 Fairness and equity ...

... fair tax system is a progressive tax system, where people with higher incomes pay a greater share of their income in taxes. Growing evidence demonstrates that “fair is smart, that progressive taxes, where those who benefit most pay the greatest share, make good economic sense.”16 Fairness and equity ...

C.E.11c The government taxes, borrows, and spends to influence

... The student will demonstrate knowledge of the role of government in the United States economy by : c) describing the impact of taxation, including an understanding of the reasons for the 16th Amendment, spending and borrowing ...

... The student will demonstrate knowledge of the role of government in the United States economy by : c) describing the impact of taxation, including an understanding of the reasons for the 16th Amendment, spending and borrowing ...

TAXES.ppt

... the taxing jurisdiction (government). The economic incidence [economic burden] of a tax falls on the entity (or entities) that incurs economic costs as a result of the tax. Tax shifting refers to the phenomenon in which the economic burden of a tax is borne by an entity other than the one on which t ...

... the taxing jurisdiction (government). The economic incidence [economic burden] of a tax falls on the entity (or entities) that incurs economic costs as a result of the tax. Tax shifting refers to the phenomenon in which the economic burden of a tax is borne by an entity other than the one on which t ...

Pamela-Item-Pricing

... increased costs for the consumer – a hidden tax. • Researchers found that prices in markets subject to IPLs were between 20-25 cents higher than prices for similar items in other markets • IPLs impede large retailers’ abilities to change prices. • There are further advances in item-pricing, like Rad ...

... increased costs for the consumer – a hidden tax. • Researchers found that prices in markets subject to IPLs were between 20-25 cents higher than prices for similar items in other markets • IPLs impede large retailers’ abilities to change prices. • There are further advances in item-pricing, like Rad ...

It`s Not all Negative in Michigan

... block with property tax burdens varying by 100% or more, depending on how long the resident has lived there. ...

... block with property tax burdens varying by 100% or more, depending on how long the resident has lived there. ...

Review

... (A) Setting before-tax demand equal to supply gives X* = 24, with P* = $50. (B) The after tax analysis: new equilibrium price after a $3 consumer tax: 49-P/2=S98-(P+3)=P-2; 98-3-P=P-2; P=48.5; Substitute this price into the supply ftn: X=48.5/2-1 X=23.25 or a more tedious approach of first solving ...

... (A) Setting before-tax demand equal to supply gives X* = 24, with P* = $50. (B) The after tax analysis: new equilibrium price after a $3 consumer tax: 49-P/2=S98-(P+3)=P-2; 98-3-P=P-2; P=48.5; Substitute this price into the supply ftn: X=48.5/2-1 X=23.25 or a more tedious approach of first solving ...

Course Outline

... Prof. Fullerton will provide a mini-course for economics graduate students about how to build and use analytical general equilibrium models. The “log-linearization” method provides a remarkably easy and useful way to analyze topics in applied areas such as public, environmental, development, and tra ...

... Prof. Fullerton will provide a mini-course for economics graduate students about how to build and use analytical general equilibrium models. The “log-linearization” method provides a remarkably easy and useful way to analyze topics in applied areas such as public, environmental, development, and tra ...

Thomas A. Barthold, "How Economics Can Inform Tax Policy

... virtually immutable short-run supply of oil, the proposed policy would have increased the profits of suppliers with no change in price at the pump. • However, over longer periods, economists generally estimate that motor fuel taxes are borne largely by consumers. • Incidence is all about “elasticity ...

... virtually immutable short-run supply of oil, the proposed policy would have increased the profits of suppliers with no change in price at the pump. • However, over longer periods, economists generally estimate that motor fuel taxes are borne largely by consumers. • Incidence is all about “elasticity ...

agrarian reform

... “redistribution of lands, regardless of crops or fruits produced, to farmers and regular farm workers who are landless, irrespective of tenurial arrangement, to include the totality of factors and support services designed to lift the economic status of the beneficiaries and all other arrangements a ...

... “redistribution of lands, regardless of crops or fruits produced, to farmers and regular farm workers who are landless, irrespective of tenurial arrangement, to include the totality of factors and support services designed to lift the economic status of the beneficiaries and all other arrangements a ...

FORM 941 FILING REQUIREMENTS

... Make checks payable to “United States Treasury”. File only one form per quarter, even if your church has multiple locations or divisions Make dollar entries without the dollar sign and comma — 1000.00; show negative amounts in parentheses (1000.00). Line 1 is for the number of employees. Line 2 is f ...

... Make checks payable to “United States Treasury”. File only one form per quarter, even if your church has multiple locations or divisions Make dollar entries without the dollar sign and comma — 1000.00; show negative amounts in parentheses (1000.00). Line 1 is for the number of employees. Line 2 is f ...

Business Expenses

... Number of km drove in the tax year Number of km drove to earn business income Fuel Insurance License plate sticker Vehicle maintenance and repair Annual leasing charges Parking 407ETR & Tolls If vehicle purchased in the year – cost before taxes Purchase date Home office Total area of home Area of ho ...

... Number of km drove in the tax year Number of km drove to earn business income Fuel Insurance License plate sticker Vehicle maintenance and repair Annual leasing charges Parking 407ETR & Tolls If vehicle purchased in the year – cost before taxes Purchase date Home office Total area of home Area of ho ...

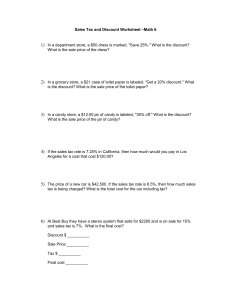

Sales Tax and Discount Worksheet

... 4) If the sales tax rate is 7.25% in California, then how much would you pay in Los Angeles for a coat that cost $120.00? ...

... 4) If the sales tax rate is 7.25% in California, then how much would you pay in Los Angeles for a coat that cost $120.00? ...

Chapter 5 US Economy system

... • The Profit Motive= earnings after all costs of production have been paid • Factors of Production= types of resources needed to produce goods and services Land Labor Capital Entrepreneurship Technology ...

... • The Profit Motive= earnings after all costs of production have been paid • Factors of Production= types of resources needed to produce goods and services Land Labor Capital Entrepreneurship Technology ...

Download

... infrastructure against the need to pay down the debt against the desire for more after-tax incomes in the pockets of Canadians. Choices that balance the legitimate claims for tax relief from low, middle, and high income groups as well as the corporate sector. The final decisions will determine how h ...

... infrastructure against the need to pay down the debt against the desire for more after-tax incomes in the pockets of Canadians. Choices that balance the legitimate claims for tax relief from low, middle, and high income groups as well as the corporate sector. The final decisions will determine how h ...

Submission to Australia`s Future Tax System from Paul Loring

... of $4 for the $10 diary; the next band 501 – 1500 maybe 30%, 20%, 10% and so on until reaching a point, a ceiling, where no further tax relief would apply. The number of marginal rates and their respective % would need to be calculated by an Actuary, based on the coffer requirements of the governmen ...

... of $4 for the $10 diary; the next band 501 – 1500 maybe 30%, 20%, 10% and so on until reaching a point, a ceiling, where no further tax relief would apply. The number of marginal rates and their respective % would need to be calculated by an Actuary, based on the coffer requirements of the governmen ...

Economics 324

... which we assume to be interested in maximizing profits.” Are these two statements consistent with each other? Explain. ...

... which we assume to be interested in maximizing profits.” Are these two statements consistent with each other? Explain. ...

Discount and Sales Tax 1) In a department store, there is a sale of

... to buy a dress that is originally $40. What is the discount? What is the sale price of the dress? ...

... to buy a dress that is originally $40. What is the discount? What is the sale price of the dress? ...