dynamics of commodity market impact on indian investment sectors

... market comprises of trade instruments which derive their value from some underlying variable assets like food grains such as wheat, rice pulses etc. All commodity markets are based on some ‘cash’ products. The underlying asset of a commodity market instrument may be ...

... market comprises of trade instruments which derive their value from some underlying variable assets like food grains such as wheat, rice pulses etc. All commodity markets are based on some ‘cash’ products. The underlying asset of a commodity market instrument may be ...

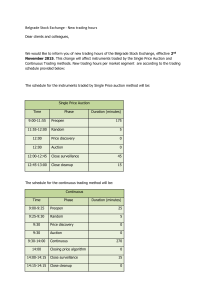

Belgrade Stock Exchange - New trading hours Dear clients and

... November 2015. This change will affect instruments traded by the Single Price Auction and Continuous Trading methods. New trading hours per market segment are according to the trading schedule provided below: ...

... November 2015. This change will affect instruments traded by the Single Price Auction and Continuous Trading methods. New trading hours per market segment are according to the trading schedule provided below: ...

Taking stock of Jignesh Shah - Sa-Dhan

... improve, money will come back into the economy.” In a few months time, there could be a large swell of capital in MCX’s favour. In September it announced its decision to float an initial public offer, to raise approximately Rs 330 crore to fund infrastructure expansion, making it only the third comm ...

... improve, money will come back into the economy.” In a few months time, there could be a large swell of capital in MCX’s favour. In September it announced its decision to float an initial public offer, to raise approximately Rs 330 crore to fund infrastructure expansion, making it only the third comm ...

URL - StealthSkater

... Prior to 1999, the so-called "Too Big To Fail" commercial banks were forbidden to invest in the commodities and stock markets by the Glass-Steagall Act of 1933. These banks were restricted to core banking activities of taking in deposits and making loans. After Glass-Steagall was repealed by Congres ...

... Prior to 1999, the so-called "Too Big To Fail" commercial banks were forbidden to invest in the commodities and stock markets by the Glass-Steagall Act of 1933. These banks were restricted to core banking activities of taking in deposits and making loans. After Glass-Steagall was repealed by Congres ...

Chapter 12.2 notes - Effingham County Schools

... • Putting money into different investments, different risk levels, etc. ...

... • Putting money into different investments, different risk levels, etc. ...

Financial activity in the oil markets

... Oil prices have experienced high volatility recently, reaching a peak of USD 147.5 in July 2008 before falling abruptly. Such sharp movements in oil prices naturally raise questions as to the reasons for such volatile developments. It is widely acknowledged that the physical oil market is very tight ...

... Oil prices have experienced high volatility recently, reaching a peak of USD 147.5 in July 2008 before falling abruptly. Such sharp movements in oil prices naturally raise questions as to the reasons for such volatile developments. It is widely acknowledged that the physical oil market is very tight ...

Programme

... policies, long-term trends and the sustainability of the production, distribution and use of commodities, performance of commodity supply chains, and the state of business practices and pertinent innovation. Themes of the second meeting of this Forum will include the following plenary and parallel s ...

... policies, long-term trends and the sustainability of the production, distribution and use of commodities, performance of commodity supply chains, and the state of business practices and pertinent innovation. Themes of the second meeting of this Forum will include the following plenary and parallel s ...

Bob Geldof`s private equity firm 8 Miles to make first investment

... vibrant exchanges across frontier economies, going beyond Africa and beyond agriculture, to transform not only commodity markets but also the livelihoods of millions of producers.” 8 Miles reached a $200m first close for its maiden fund in February last year. The fund, which is looking to raise abou ...

... vibrant exchanges across frontier economies, going beyond Africa and beyond agriculture, to transform not only commodity markets but also the livelihoods of millions of producers.” 8 Miles reached a $200m first close for its maiden fund in February last year. The fund, which is looking to raise abou ...

NBER Reporter Summary of My Commodity Research

... A compelling, alternative argument for the increased co-movements between commodity prices is the rapidly increasing commodity demands from fast-growing emerging economies such as China. 5 Indeed, there is evidence of an increasing return correlation between commodities and the Morgan Stanley emergi ...

... A compelling, alternative argument for the increased co-movements between commodity prices is the rapidly increasing commodity demands from fast-growing emerging economies such as China. 5 Indeed, there is evidence of an increasing return correlation between commodities and the Morgan Stanley emergi ...

What Trading Teaches Us About Life

... Note: This article first appeared on the TraderFeed site, 8/14/06 ...

... Note: This article first appeared on the TraderFeed site, 8/14/06 ...

New York Mercantile Exchange

... ACCESS® allows buyers and sellers to trade futures and options contracts for crude oil, heating oil, gasoline, natural gas, electricity, and platinum, and futures on gold, silver, copper, aluminum, palladium, and propane through a worldwide computer network. Electricity is traded on the system throu ...

... ACCESS® allows buyers and sellers to trade futures and options contracts for crude oil, heating oil, gasoline, natural gas, electricity, and platinum, and futures on gold, silver, copper, aluminum, palladium, and propane through a worldwide computer network. Electricity is traded on the system throu ...

Electronically Traded Funds

... • Each company in the index is weighted based on it’s value or “market capitalization.” • If a company has 35 million shares outstanding, each with a market value of $100, the company's market capitalization is ...

... • Each company in the index is weighted based on it’s value or “market capitalization.” • If a company has 35 million shares outstanding, each with a market value of $100, the company's market capitalization is ...

Slide 0 - E

... Commodities Derivatives Trading represents in comparison : $ 300 Bil turnover /day ...

... Commodities Derivatives Trading represents in comparison : $ 300 Bil turnover /day ...

David Sobotka

... TRADING AND THE DEVELOPMENT OF FUTURES MARKETS FOR CRUDE OIL AND REFINED PRODUCTS. BASED ON THE VOLATILITY PRESENT IN THE ENERGY MARKETS AT THAT TIME, IT DID NOT TAKE FINANCIAL INSTITUTIONS LONG TO FIGURE OUT THAT 1) THERE WERE PROFITABLE TRADING OPPORTUNITIES AVAILABLE AND 2) THEIR CUSTOMERS WERE I ...

... TRADING AND THE DEVELOPMENT OF FUTURES MARKETS FOR CRUDE OIL AND REFINED PRODUCTS. BASED ON THE VOLATILITY PRESENT IN THE ENERGY MARKETS AT THAT TIME, IT DID NOT TAKE FINANCIAL INSTITUTIONS LONG TO FIGURE OUT THAT 1) THERE WERE PROFITABLE TRADING OPPORTUNITIES AVAILABLE AND 2) THEIR CUSTOMERS WERE I ...

Mr. Lawrence Eagles, Global President-Oil

... the Chinese Securities Regulatory Commission. Clients should contact their sales representative for clarification on the range of financial instruments available in the abovementioned jurisdictions and should execute transactions through a J.P. Morgan entity in their home jurisdiction unless governi ...

... the Chinese Securities Regulatory Commission. Clients should contact their sales representative for clarification on the range of financial instruments available in the abovementioned jurisdictions and should execute transactions through a J.P. Morgan entity in their home jurisdiction unless governi ...

May 14, 2007 - Harvard University

... rates remained so low, even as shortterm rates rose 2004-2006 • spreads on high-income corporate debt in particular have been inexplicably low. • Implied options price volatilities have been too low. • Private equity may also be overdone. • Part of a general pattern: private markets are underestimat ...

... rates remained so low, even as shortterm rates rose 2004-2006 • spreads on high-income corporate debt in particular have been inexplicably low. • Implied options price volatilities have been too low. • Private equity may also be overdone. • Part of a general pattern: private markets are underestimat ...

Leveraged ETF credit risks

... these funds to lose some of their returns, although fortunately the principal would remain secure. Commodities ETFs Commodities ETFs also frequently use derivatives rather than directly investing in the underlying assets. This is because it would not be practical to take custody of millions of barre ...

... these funds to lose some of their returns, although fortunately the principal would remain secure. Commodities ETFs Commodities ETFs also frequently use derivatives rather than directly investing in the underlying assets. This is because it would not be practical to take custody of millions of barre ...

Conventional Wisdom and the Impact of Market Volatility

... contracts to farmers in some areas unless they could deliver grain to the elevator within 60 days, eliminating an important tool for farmers to hedge their risks against grain prices plummeting... Rival Archer-Daniels-Midland also has limited some of its contracts to farmers…Moves like those have cr ...

... contracts to farmers in some areas unless they could deliver grain to the elevator within 60 days, eliminating an important tool for farmers to hedge their risks against grain prices plummeting... Rival Archer-Daniels-Midland also has limited some of its contracts to farmers…Moves like those have cr ...

the golden ticket gold day-trading system

... that can ensure returns or prevent losses. No representation or implication is being made that using the systems or signals described in this document will generate returns or ensure against losses. We do not and cannot give individual investment advice. U.S. Government Required Disclaimer - Commodi ...

... that can ensure returns or prevent losses. No representation or implication is being made that using the systems or signals described in this document will generate returns or ensure against losses. We do not and cannot give individual investment advice. U.S. Government Required Disclaimer - Commodi ...

FREE Sample Here

... Which of the following are advantages of derivatives? a. lower transaction costs than securities and commodities b. reveal information about expected prices and volatility c. help control risk d. make spot prices stay closer to their true values e. all of the above ...

... Which of the following are advantages of derivatives? a. lower transaction costs than securities and commodities b. reveal information about expected prices and volatility c. help control risk d. make spot prices stay closer to their true values e. all of the above ...

Commodity market

A 'commodity market' is a market that trades in primary rather than manufactured products. Soft commodities are agricultural products such as wheat, coffee, cocoa and sugar. Hard commodities are mined, such as gold and oil. Investors access about 50 major commodity markets worldwide with purely financial transactions increasingly outnumbering physical trades in which goods are delivered. Futures contracts are the oldest way of investing in commodities. Futures are secured by physical assets. Commodity markets can include physical trading and derivatives trading using spot prices, forwards, futures, and options on futures. Farmers have used a simple form of derivative trading in the commodity market for centuries for price risk management.A financial derivative is a financial instrument whose value is derived from a commodity termed an underlier. Derivatives are either exchange-traded or over-the-counter (OTC). An increasing number of derivatives are traded via clearing houses some with Central Counterparty Clearing, which provide clearing and settlement services on a futures exchange, as well as off-exchange in the OTC market.Derivatives such as futures contracts, Swaps (1970s-), Exchange-traded Commodities (ETC) (2003-), forward contracts have become the primary trading instruments in commodity markets. Futures are traded on regulated commodities exchanges. Over-the-counter (OTC) contracts are ""privately negotiated bilateral contracts entered into between the contracting parties directly"".Exchange-traded funds (ETFs) began to feature commodities in 2003. Gold ETFs are based on ""electronic gold"" that does not entail the ownership of physical bullion, with its added costs of insurance and storage in repositories such as the London bullion market. According to the World Gold Council, ETFs allow investors to be exposed to the gold market without the risk of price volatility associated with gold as a physical commodity.