Using Cash Flow Dynamics to Price Thinly Traded Assets

... approach, focusing on cash flow dynamics to account for risk. This is not a new concept, although, as far as we are aware, so far this approach has not been used to explicitly infer cash flow yields of untraded investment assets. In the literature so far, for example, Da and Warachka (2009) show tha ...

... approach, focusing on cash flow dynamics to account for risk. This is not a new concept, although, as far as we are aware, so far this approach has not been used to explicitly infer cash flow yields of untraded investment assets. In the literature so far, for example, Da and Warachka (2009) show tha ...

print_voiceover_financialMarket

... In this financial market model, we will follow the traditional approach to the supply of money. This implies that the money supply is controlled by the central bank. In South Africa, the Central Bank is the South African Reserve Bank. An exogenously controlled money supply also implies that the mone ...

... In this financial market model, we will follow the traditional approach to the supply of money. This implies that the money supply is controlled by the central bank. In South Africa, the Central Bank is the South African Reserve Bank. An exogenously controlled money supply also implies that the mone ...

Ch13.pps

... Remember, each short-run Phillips curve is defined by the presence of fixed expectations. Suppose there is an increase in the rate of growth of the money supply causing LM and AD to shift out resulting in an unexpected increase in inflation. The Phillips curve equation = e – b(u-un) + v implies t ...

... Remember, each short-run Phillips curve is defined by the presence of fixed expectations. Suppose there is an increase in the rate of growth of the money supply causing LM and AD to shift out resulting in an unexpected increase in inflation. The Phillips curve equation = e – b(u-un) + v implies t ...

Week 10

... This has become central to policy-making and is the result of the debate on expectations. Because the Phillips and AS curves depend on expectation, their location can shift just by shifting people’s beliefs! ...

... This has become central to policy-making and is the result of the debate on expectations. Because the Phillips and AS curves depend on expectation, their location can shift just by shifting people’s beliefs! ...

Risk Cannot Explain the Muni Puzzle

... of tax-exempt and taxable bonds. More specifically, long-term taxexempt bond yields appear to be too high relative to yields on taxable bonds, while short-term tax-exempt yields are generally consistent with financial theory. The following excerpt from The Wall Street Journal describes a typical com ...

... of tax-exempt and taxable bonds. More specifically, long-term taxexempt bond yields appear to be too high relative to yields on taxable bonds, while short-term tax-exempt yields are generally consistent with financial theory. The following excerpt from The Wall Street Journal describes a typical com ...

Three Essays in Monetary Economics

... relevant and may become of particular importance in the coming years. Quantitative easing has inflated reserves banks hold with the Fed to unprecedented levels. At the same time, short-term interest rates have been lowered to essentially zero. In the weak economic environment, however, growth rates o ...

... relevant and may become of particular importance in the coming years. Quantitative easing has inflated reserves banks hold with the Fed to unprecedented levels. At the same time, short-term interest rates have been lowered to essentially zero. In the weak economic environment, however, growth rates o ...

week3-1 - GEOCITIES.ws

... • The best method of production is the one that minimizes cost, thus maximizing profit. ...

... • The best method of production is the one that minimizes cost, thus maximizing profit. ...

The Aggregate Demand for Treasury Debt

... Sections 2, 3, and 5 present these results relating the aggregate supply of Treasury securities to the spread between corporate and Treasury bond yields. We show that the results are robust to adding controls for corporate default risk. We also show the results hold when the dependent variable is th ...

... Sections 2, 3, and 5 present these results relating the aggregate supply of Treasury securities to the spread between corporate and Treasury bond yields. We show that the results are robust to adding controls for corporate default risk. We also show the results hold when the dependent variable is th ...

elasticity - Together We Pass

... – In elastic section of demand curve – a price decrease leads to an increase in total revenue – In inelastic section of demand curve – a price decrease leads to a decrease in total revenue ...

... – In elastic section of demand curve – a price decrease leads to an increase in total revenue – In inelastic section of demand curve – a price decrease leads to a decrease in total revenue ...

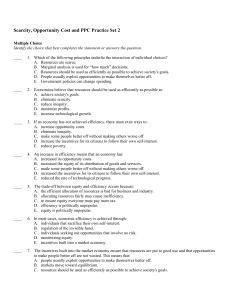

Scarcity, Opportunity cost and PPC

... B. is unattainable due to excessive government gun regulation. C. has no meaning since it does not relate to the preferences of consumers. D. is attainable but would increase unemployment. E. cannot be attained, given the level of technology and the factors of production available. ...

... B. is unattainable due to excessive government gun regulation. C. has no meaning since it does not relate to the preferences of consumers. D. is attainable but would increase unemployment. E. cannot be attained, given the level of technology and the factors of production available. ...

Monetary Policy Expectations at the Zero Lower Bound

... of central banks. Gaussian affine dynamic term structure models (DTSMs) are the standard representation in finance used to extract such short-rate expectations (e.g., Piazzesi, 2010). However, while these models have provided good empirical representations of yield curves in the past, they may be il ...

... of central banks. Gaussian affine dynamic term structure models (DTSMs) are the standard representation in finance used to extract such short-rate expectations (e.g., Piazzesi, 2010). However, while these models have provided good empirical representations of yield curves in the past, they may be il ...

Presentation title here in Arial 32pt

... – Your asset allocation is what matters most – so make it your main focus – Be obsessive about risk, and the returns will look after themselves – Risk and return objectives should be ‘real’, not ‘relative’ – Be capital efficient when matching your liabilities ...

... – Your asset allocation is what matters most – so make it your main focus – Be obsessive about risk, and the returns will look after themselves – Risk and return objectives should be ‘real’, not ‘relative’ – Be capital efficient when matching your liabilities ...

The Treasury Bill Futures Market and Market Expectations of Interest

... This premium is considered to he a return to speculators for assuming the risk of possible future price fluctuations, and is larger for delivery dates which extend further into the future, This implies, in turn, that the price of the futures contract will tend to rise (the yield will fall) as the de ...

... This premium is considered to he a return to speculators for assuming the risk of possible future price fluctuations, and is larger for delivery dates which extend further into the future, This implies, in turn, that the price of the futures contract will tend to rise (the yield will fall) as the de ...

The High Dividend Yield Return Advantage

... Southampton also found a return premium associated with higher dividend yield securities, but their data rejected a tax-based explanation since in the UK dividend income is taxed more favorably than capital gains. Using data from the London Share Price Database (LSPD), they examined the relationship ...

... Southampton also found a return premium associated with higher dividend yield securities, but their data rejected a tax-based explanation since in the UK dividend income is taxed more favorably than capital gains. Using data from the London Share Price Database (LSPD), they examined the relationship ...

Aggregate Supply

... The two terms in this equation are explained as follows: 1) When firms expect a high price level, they expect high costs. Those firms that fix prices in advance set their prices high. These high prices cause the other firms to set high prices also. Hence, a high expected price level E leads to a hig ...

... The two terms in this equation are explained as follows: 1) When firms expect a high price level, they expect high costs. Those firms that fix prices in advance set their prices high. These high prices cause the other firms to set high prices also. Hence, a high expected price level E leads to a hig ...

Yield curve

In finance, the yield curve is a curve showing several yields or interest rates across different contract lengths (2 month, 2 year, 20 year, etc...) for a similar debt contract. The curve shows the relation between the (level of) interest rate (or cost of borrowing) and the time to maturity, known as the ""term"", of the debt for a given borrower in a given currency. For example, the U.S. dollar interest rates paid on U.S. Treasury securities for various maturities are closely watched by many traders, and are commonly plotted on a graph such as the one on the right which is informally called ""the yield curve"". More formal mathematical descriptions of this relation are often called the term structure of interest rates.The shape of the yield curve indicates the cumulative priorities of all lenders relative to a particular borrower, (such as the US Treasury or the Treasury of Japan) or the priorities of a single lender relative to all possible borrowers. With other factors held equal, lenders will prefer to have funds at their disposal, rather than at the disposal of a third party. The interest rate is the ""price"" paid to convince them to lend. As the term of the loan increases, lenders demand an increase in the interest received. In addition, lenders may be concerned about future circumstances, e.g. a potential default (or rising rates of inflation), so they offer higher interest rates on long-term loans than they offer on shorter-term loans to compensate for the increased risk. Occasionally, when lenders are seeking long-term debt contracts more aggressively than short-term debt contracts, the yield curve ""inverts"", with interest rates (yields) being lower for the longer periods of repayment so that lenders can attract long-term borrowing.The yield of a debt instrument is the overall rate of return available on the investment. In general the percentage per year that can be earned is dependent on the length of time that the money is invested. For example, a bank may offer a ""savings rate"" higher than the normal checking account rate if the customer is prepared to leave money untouched for five years. Investing for a period of time t gives a yield Y(t).This function Y is called the yield curve, and it is often, but not always, an increasing function of t. Yield curves are used by fixed income analysts, who analyze bonds and related securities, to understand conditions in financial markets and to seek trading opportunities. Economists use the curves to understand economic conditions.The yield curve function Y is actually only known with certainty for a few specific maturity dates, while the other maturities are calculated by interpolation (see Construction of the full yield curve from market data below).