Issuer Guide German Bundesländer 2015

... The German Bundesländer segment is the biggest sub-sovereign market in Europe. No other sub-national level has a similarly high volume outstanding or annual issuance volume as the Bundesländer segment. Traditionally characterised by a high degree of stability in terms of funding volume, low spread v ...

... The German Bundesländer segment is the biggest sub-sovereign market in Europe. No other sub-national level has a similarly high volume outstanding or annual issuance volume as the Bundesländer segment. Traditionally characterised by a high degree of stability in terms of funding volume, low spread v ...

Issuer Guide Government Bonds Eurozone (EU19)

... corner. Last year, it posted economic growth of 4.8% and, in this respect, was only exceeded by Luxembourg (5.5%) within the eurozone. However, the burdens resulting from the measures to rescue the country’s banks are making themselves felt in the Irish budget, which is creaking under a heavy debt b ...

... corner. Last year, it posted economic growth of 4.8% and, in this respect, was only exceeded by Luxembourg (5.5%) within the eurozone. However, the burdens resulting from the measures to rescue the country’s banks are making themselves felt in the Irish budget, which is creaking under a heavy debt b ...

The relevance of the value-relevance literature for financial

... of interest is helpful in explaining value or returns (over long windows) given other specified variables. That accounting number is typically deemed to be value relevant if its estimated regression coefficient is significantly different from zero. For example, Venkatachalam (1996) examines the increment ...

... of interest is helpful in explaining value or returns (over long windows) given other specified variables. That accounting number is typically deemed to be value relevant if its estimated regression coefficient is significantly different from zero. For example, Venkatachalam (1996) examines the increment ...

13EXPENDITURE MULTIPLIERS: THE KEYNESIAN MODEL*

... 45) If an increase in a household’s disposable income from $10,000 to $12,000 boosts its consumption expenditure from $8,000 to $9,000, the A) household is dissaving. B) slope of the consumption function is 0.2 C) slope of the consumption function is 0.5 D) slope of the consumption function is 1000. ...

... 45) If an increase in a household’s disposable income from $10,000 to $12,000 boosts its consumption expenditure from $8,000 to $9,000, the A) household is dissaving. B) slope of the consumption function is 0.2 C) slope of the consumption function is 0.5 D) slope of the consumption function is 1000. ...

(PPT, 467KB)

... called Gross Domestic Income (GDI), or GDP(I). GDI should provide the same amount as the expenditure method described below. (By definition, GDI = GDP. In practice, however, measurement errors will make the two figures slightly off when https://store.theartofservice.com/the-gross-domestic-product-to ...

... called Gross Domestic Income (GDI), or GDP(I). GDI should provide the same amount as the expenditure method described below. (By definition, GDI = GDP. In practice, however, measurement errors will make the two figures slightly off when https://store.theartofservice.com/the-gross-domestic-product-to ...

full paper - Brookings Institution

... concepts of saving, we alter the treatment of durable goods, inflation, retirement accounts, and tax accruals. We also show that the distinctions between personal and corporate saving are thin and somewhat arbitrary, and thus we tend to focus on private (personal plus corporate) saving. We find that ...

... concepts of saving, we alter the treatment of durable goods, inflation, retirement accounts, and tax accruals. We also show that the distinctions between personal and corporate saving are thin and somewhat arbitrary, and thus we tend to focus on private (personal plus corporate) saving. We find that ...

Issuer Guide 2016 Eurozone – EU(19)

... not exceeded by any other country within the eurozone. However, the burdens resulting from the measures to rescue the country’s banks made themselves felt in the Irish budget, which is continuing to creak under a heavy debt burden. For this reason, Ireland was unable to fulfil either of the two Maas ...

... not exceeded by any other country within the eurozone. However, the burdens resulting from the measures to rescue the country’s banks made themselves felt in the Irish budget, which is continuing to creak under a heavy debt burden. For this reason, Ireland was unable to fulfil either of the two Maas ...

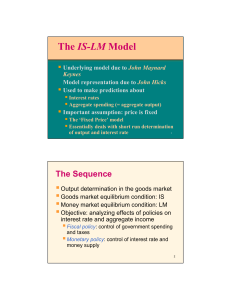

Lecture 5: Aggregate Expenditure and Output in the Short Run

... Determining the Level of Aggregate Expenditure in the Economy Discuss the determinants of the four components of aggregate expenditure and define the marginal propensity to consume and marginal propensity to save. ...

... Determining the Level of Aggregate Expenditure in the Economy Discuss the determinants of the four components of aggregate expenditure and define the marginal propensity to consume and marginal propensity to save. ...

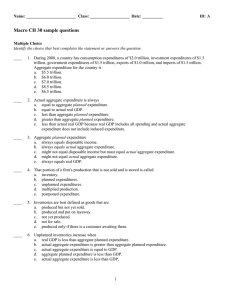

Macro CH 30 sample questions

... ____ 14. Induced expenditure includes a. consumption expenditures, government expenditures on goods and services, and imports. b. investment, consumption expenditures, and exports. c. consumption expenditures and imports. d. consumption expenditures and exports. e. consumption expenditures and gover ...

... ____ 14. Induced expenditure includes a. consumption expenditures, government expenditures on goods and services, and imports. b. investment, consumption expenditures, and exports. c. consumption expenditures and imports. d. consumption expenditures and exports. e. consumption expenditures and gover ...

13EXPENDITURE MULTIPLIERS: THE KEYNESIAN MODEL*

... 1. Data for the United States show that the U.S. consumption function has shifted upward over time because economic growth has created greater wealth and higher expected future income. 2. Figure 13.4 illustrates for 1961 to 2003; the assumed MPC in the figure is 0.9. H. Consumption as a Function of ...

... 1. Data for the United States show that the U.S. consumption function has shifted upward over time because economic growth has created greater wealth and higher expected future income. 2. Figure 13.4 illustrates for 1961 to 2003; the assumed MPC in the figure is 0.9. H. Consumption as a Function of ...

Week 17 - Lancaster University

... go bankrupt – then they would not be able to pay off their debts in one year. So, if there is some chance that the final payment of €1060 will not be made, then financial investors will not be willing to pay €1000 for the bond, because they know they can earn 6% without risk by holding the debt of t ...

... go bankrupt – then they would not be able to pay off their debts in one year. So, if there is some chance that the final payment of €1060 will not be made, then financial investors will not be willing to pay €1000 for the bond, because they know they can earn 6% without risk by holding the debt of t ...

This PDF is a selection from a published volume from... National Bureau of Economic Research

... the current paper, this integration is being referred to as “partial integration” and is the first tangible result of the initiative to reach the BEA’s data users. This partial integration could have been achieved through a variety of methods. For example, many countries produce integrated annual I- ...

... the current paper, this integration is being referred to as “partial integration” and is the first tangible result of the initiative to reach the BEA’s data users. This partial integration could have been achieved through a variety of methods. For example, many countries produce integrated annual I- ...

E Economic and Social Council United Nations Statistical Commission

... (a) Expressed its sincere appreciation to the Intersecretariat Working Group on National Accounts for its high-quality work in steering the development of the System of National Accounts 2008 (2008 SNA) to a successful conclusion; (b) Welcomed the finalization of the English version of the 2008 SNA ...

... (a) Expressed its sincere appreciation to the Intersecretariat Working Group on National Accounts for its high-quality work in steering the development of the System of National Accounts 2008 (2008 SNA) to a successful conclusion; (b) Welcomed the finalization of the English version of the 2008 SNA ...

Chapter 30

... The size of the multiplier depends not only on consumption decisions but also on imports and income taxes. Imports make the multiplier smaller than it otherwise would be because only expenditure on U.S.-made goods and services increases U.S. real GDP. The larger the marginal propensity to import, th ...

... The size of the multiplier depends not only on consumption decisions but also on imports and income taxes. Imports make the multiplier smaller than it otherwise would be because only expenditure on U.S.-made goods and services increases U.S. real GDP. The larger the marginal propensity to import, th ...

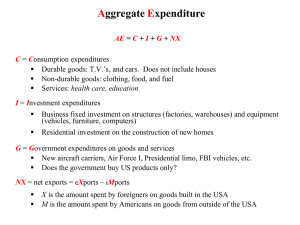

Chapter 25(10): Expenditure Multipliers

... The aggregate planned expenditure schedule shows how aggregate expenditure depends on real GDP. The aggregate expenditure curve plots the aggregate planned expenditure schedule. Figure 10.2 illustrates an aggregate expenditure curve, AE = C + I + G + NX, where NX is exports minus imports. ♦ Induced ...

... The aggregate planned expenditure schedule shows how aggregate expenditure depends on real GDP. The aggregate expenditure curve plots the aggregate planned expenditure schedule. Figure 10.2 illustrates an aggregate expenditure curve, AE = C + I + G + NX, where NX is exports minus imports. ♦ Induced ...

SAVING IS THE ACCOUNTING RECORD OF INVESTMENT

... units is a spectacular macroeconomic illustration of the “fallacy of composition”. This fallacy has been reinforced by the unfortunate use of the colloquial verb “to save”, with its very powerful transitive volitional connotations for an economic term which is simply an intransitive accounting defin ...

... units is a spectacular macroeconomic illustration of the “fallacy of composition”. This fallacy has been reinforced by the unfortunate use of the colloquial verb “to save”, with its very powerful transitive volitional connotations for an economic term which is simply an intransitive accounting defin ...

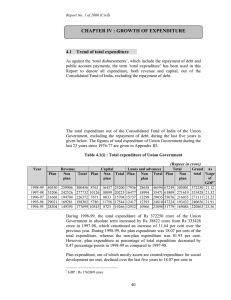

CHAPTER IV : GROWTH OF EXPENDITURE

... the previous year. The non-plan revenue expenditure increased by 7.17 per cent in 1998-99 over the previous year, whereas the plan expenditure increased by 15.18 per cent over the same period. During the last five years, the revenue expenditure registered an increase of Rs 122757 crore, which consti ...

... the previous year. The non-plan revenue expenditure increased by 7.17 per cent in 1998-99 over the previous year, whereas the plan expenditure increased by 15.18 per cent over the same period. During the last five years, the revenue expenditure registered an increase of Rs 122757 crore, which consti ...

15.1 expenditure plans and real gdp

... The multiplier depends, in general, not only on consumption decisions but also on imports and income taxes. Imports make the multiplier smaller that it otherwise would be because only expenditure on U.S.-made goods and services increases U.S. real GDP. The larger the marginal propensity to import, t ...

... The multiplier depends, in general, not only on consumption decisions but also on imports and income taxes. Imports make the multiplier smaller that it otherwise would be because only expenditure on U.S.-made goods and services increases U.S. real GDP. The larger the marginal propensity to import, t ...

Chapter 30

... Example: Suppose consumer wealth is $8 trillion, expected future income is $12 trillion, the price level is $14.5 thousand, the real rate of interest is 3.5 percent, net tax revenue is $3 trillion, government expenditure is $3 trillion, and the marginal propensity to consume is 0.75. Derive the cons ...

... Example: Suppose consumer wealth is $8 trillion, expected future income is $12 trillion, the price level is $14.5 thousand, the real rate of interest is 3.5 percent, net tax revenue is $3 trillion, government expenditure is $3 trillion, and the marginal propensity to consume is 0.75. Derive the cons ...

CA DISCLOSURE.xls - ECB Banking Supervision

... • The selection of asset classes for portfolio review was based on an approach aimed at identifying those portfolios with the highest risk of misclassification. Therefore, extrapolation of results to the nonselected portfolios would be incorrect from a statistical stand-point. • The asset quality in ...

... • The selection of asset classes for portfolio review was based on an approach aimed at identifying those portfolios with the highest risk of misclassification. Therefore, extrapolation of results to the nonselected portfolios would be incorrect from a statistical stand-point. • The asset quality in ...

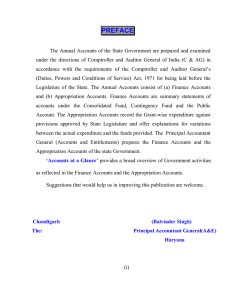

PREFACE

... section 'Expenditure Heads (Capital Account)' deals with expenditure met usually from borrowed funds with the object of increasing concrete assets of a material and permanent character. It also includes receipts of a capital nature intended to be applied as a set off to capital expendi ...

... section 'Expenditure Heads (Capital Account)' deals with expenditure met usually from borrowed funds with the object of increasing concrete assets of a material and permanent character. It also includes receipts of a capital nature intended to be applied as a set off to capital expendi ...

Chapter 15

... the right places and in the right way. Look for a major construction project that is going on near your home or school. What supplies do you see being delivered to the site? How many workers are employed on the site? Where do the supplies and workers come from? Whose income is higher because of the ...

... the right places and in the right way. Look for a major construction project that is going on near your home or school. What supplies do you see being delivered to the site? How many workers are employed on the site? Where do the supplies and workers come from? Whose income is higher because of the ...

Chapter 30

... the right places and in the right way. Look for a major construction project that is going on near your home or school. What supplies do you see being delivered to the site? How many workers are employed on the site? Where do the supplies and workers come from? Whose income is higher because of the ...

... the right places and in the right way. Look for a major construction project that is going on near your home or school. What supplies do you see being delivered to the site? How many workers are employed on the site? Where do the supplies and workers come from? Whose income is higher because of the ...

The Safety Trap - The Review of Economic Studies

... of safe assets shrinks relative to demand, a shortage of safe assets develops. The safe interest rate drops and the risk premium rises. This mechanism transfers resources from Knightians to Neutrals, reduces the demand for safe assets, and restores equilibrium in the safe asset market. However, onc ...

... of safe assets shrinks relative to demand, a shortage of safe assets develops. The safe interest rate drops and the risk premium rises. This mechanism transfers resources from Knightians to Neutrals, reduces the demand for safe assets, and restores equilibrium in the safe asset market. However, onc ...

Gross fixed capital formation

Gross fixed capital formation (GFCF) is a macroeconomic concept used in official national accounts such as the United Nations System of National Accounts (UNSNA), National Income and Product Accounts (NIPA) and the European System of Accounts (ESA). The concept dates back to the National Bureau of Economic Research (NBER) studies of Simon Kuznets of capital formation in the 1930s, and standard measures for it were adopted in the 1950s. Statistically it measures the value of acquisitions of new or existing fixed assets by the business sector, governments and ""pure"" households (excluding their unincorporated enterprises) less disposals of fixed assets. GFCF is a component of the expenditure on gross domestic product (GDP), and thus shows something about how much of the new value added in the economy is invested rather than consumed.GFCF is called ""gross"" because the measure does not make any adjustments to deduct the consumption of fixed capital (depreciation of fixed assets) from the investment figures. For the analysis of the development of the productive capital stock, it is important to measure the value of the acquisitions less disposals of fixed assets beyond replacement for obsolescence of existing assets due to normal wear and tear. ""Net fixed investment"" includes the depreciation of existing assets from the figures for new fixed investment, and is called net fixed capital formation.GFCF is not a measure of total investment, because only the value of net additions to fixed assets is measured, and all kinds of financial assets are excluded, as well as stocks of inventories and other operating costs (the latter included in intermediate consumption). If, for example, one examines a company balance sheet, it is easy to see that fixed assets are only one component of the total annual capital outlay.The most important exclusion from GFCF is land sales and purchases. The original reason, leaving aside complex valuation problems involved in estimating the value of land in a standard way, was that if a piece of land is sold, the total amount of land already in existence, is not regarded as being increased thereby; all that happens is that the ownership of the same land changes. Therefore, only the value of land improvement is included in the GFCF measure as a net addition to wealth. In special cases, such as land reclamation from the sea, a river or a lake (e.g. a polder), new land can indeed be created and sold where it did not exist before, adding to fixed assets. The GFCF measure always applies to the resident enterprises of a national territory, and thus if e.g. oil exploration occurs in the open seas, the associated new fixed investment is allocated to the national territory in which the relevant enterprises are resident. Data is usually provided by statistical agencies annually and quarterly, but only within a certain time-lag. Fluctuations in this indicator are often considered to show something about future business activity, business confidence and the pattern of economic growth. In times of economic uncertainty or recession, typically business investment in fixed assets will be reduced, since it ties up additional capital for a longer interval of time, with a risk that it will not pay itself off (and fixed assets may therefore also be scrapped faster). Conversely, in times of robust economic growth, fixed investment will increase across the board, because the observed market expansion makes it likely that such investment will be profitable in the future.