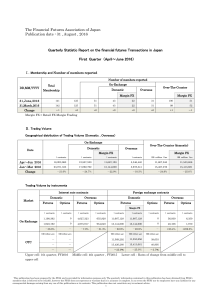

The Financial Futures Association of Japan Publication date : 31

... This publication has been prepared by the FFAJ and is provided for information purpose only. The quarterly information contained in this publication has been obtained from FFAJ's members that is believed to be reliable, however the FFAJ does not represent or warrant that it is accurate or complete. ...

... This publication has been prepared by the FFAJ and is provided for information purpose only. The quarterly information contained in this publication has been obtained from FFAJ's members that is believed to be reliable, however the FFAJ does not represent or warrant that it is accurate or complete. ...

Options/Futures Contracts on Ciba Shares: Takeover

... After the additional acceptance period has ended on November 14, 2008, trading in Eurex contracts will be put on “HALT. As of November 11, 2008 (T-3), exercises in options contracts on Ciba shares will be cash-settled. The price of the underlying instrument relevant for cash settlement corresponds t ...

... After the additional acceptance period has ended on November 14, 2008, trading in Eurex contracts will be put on “HALT. As of November 11, 2008 (T-3), exercises in options contracts on Ciba shares will be cash-settled. The price of the underlying instrument relevant for cash settlement corresponds t ...

Finding Your Way Through the Bond Market

... member of our fixed-income team—with a goal of generating maximum alpha, or return, from each pod. Individual pod decisions are then incorporated into the portfolio-building process. The objective is to extract alpha from each stage of the decision-making process, using a diversified source of alpha ...

... member of our fixed-income team—with a goal of generating maximum alpha, or return, from each pod. Individual pod decisions are then incorporated into the portfolio-building process. The objective is to extract alpha from each stage of the decision-making process, using a diversified source of alpha ...

Monthly Meat Lookout

... question of whether the beef industry should or wants to do anything about it. The cash market for live cattle has been declining for the past ten years. 2005 was the last year that more cattle (52.1%) sold on the national cash market than by any other means. Formula pricing that year was 33.2% and ...

... question of whether the beef industry should or wants to do anything about it. The cash market for live cattle has been declining for the past ten years. 2005 was the last year that more cattle (52.1%) sold on the national cash market than by any other means. Formula pricing that year was 33.2% and ...

NARRATOR (DILLY BARLOW): This is the story of a brilliant

... Bachelier’s dream of a perfect mathematical model of the markets. All this was about to change. PROF. MYRON SCHOLES (Stanford University): From an early age I was very, very fascinated by uncertainty. My parents having lived in a goldmining part of the world, in Northern Canada, would be always buyi ...

... Bachelier’s dream of a perfect mathematical model of the markets. All this was about to change. PROF. MYRON SCHOLES (Stanford University): From an early age I was very, very fascinated by uncertainty. My parents having lived in a goldmining part of the world, in Northern Canada, would be always buyi ...

ethiopian commodity exchange - Making The Connection: Value

... The initial idea behind ECX was to set up an Ethiopian Exchange tailored to the specificities of the country, instead of just replicating other international exchanges, e.g. Mumbai Commodity Exchange. ECX was set up as a Private-Public Partnership (PPP) non-profit entity, with a joint board of direc ...

... The initial idea behind ECX was to set up an Ethiopian Exchange tailored to the specificities of the country, instead of just replicating other international exchanges, e.g. Mumbai Commodity Exchange. ECX was set up as a Private-Public Partnership (PPP) non-profit entity, with a joint board of direc ...

High-Frequency Trading in the US Treasury Market

... in financial markets during the past decade. As reported in financial media, trading records have routinely been broken in recent years, and millions of data messages are regularly sent every second to various trading venues.2 This anecdotal evidence is coupled with the hard fact that trading latenc ...

... in financial markets during the past decade. As reported in financial media, trading records have routinely been broken in recent years, and millions of data messages are regularly sent every second to various trading venues.2 This anecdotal evidence is coupled with the hard fact that trading latenc ...

Document

... information memorandums and offering documents; licensing of market players; setting and enforcing various rules and requirements; conducting off-site and on-site inspection; etc. Such supervision builds investors’ confidence by limiting the opportunities for players to commit irregularities such as ...

... information memorandums and offering documents; licensing of market players; setting and enforcing various rules and requirements; conducting off-site and on-site inspection; etc. Such supervision builds investors’ confidence by limiting the opportunities for players to commit irregularities such as ...

Risk Management in Financial Markets

... I have office hours on Tuesday afternoon. If you cannot see me during the scheduled window, you need to make an appointment to see me on Thursday afternoons. For part time students, perhaps you can call me in my office during office hours and I can respond to your questions on the phone. In addition ...

... I have office hours on Tuesday afternoon. If you cannot see me during the scheduled window, you need to make an appointment to see me on Thursday afternoons. For part time students, perhaps you can call me in my office during office hours and I can respond to your questions on the phone. In addition ...

Filistrucchi, Klein and Michielsen: Merger simulation in a two

... – More advertisements will lead to more (or less) demand from readers – More readers will lead to more demand from advertisers ...

... – More advertisements will lead to more (or less) demand from readers – More readers will lead to more demand from advertisers ...

Stock prices volatility and trading volume

... how the volatility of lower or higher stocks’ volume affects development of stock returns’ volatility. 4. Discussion on empirical results In Appendix of the paper we can see output of selected financial companies’ GARCH models. It was reached statistically significant positive coefficients of prices ...

... how the volatility of lower or higher stocks’ volume affects development of stock returns’ volatility. 4. Discussion on empirical results In Appendix of the paper we can see output of selected financial companies’ GARCH models. It was reached statistically significant positive coefficients of prices ...

April 18

... They must be worth the same at time T so that c+Xe-rT=p+Fe-rT Introduction to Futures and Options Markets, 3rd Edition ...

... They must be worth the same at time T so that c+Xe-rT=p+Fe-rT Introduction to Futures and Options Markets, 3rd Edition ...

2010 Flash Crash

The May 6, 2010, Flash Crash also known as The Crash of 2:45, the 2010 Flash Crash or simply the Flash Crash, was a United States trillion-dollar stock market crash, which started at 2:32 and lasted for approximately 36 minutes. Stock indexes, such as the S&P 500, Dow Jones Industrial Average and Nasdaq 100, collapsed and rebounded very rapidly.The Dow Jones Industrial Average had its biggest intraday point drop (from the opening) up to that point, plunging 998.5 points (about 9%), most within minutes, only to recover a large part of the loss. It was also the second-largest intraday point swing (difference between intraday high and intraday low) up to that point, at 1,010.14 points. The prices of stocks, stock index futures, options and ETFs were volatile, thus trading volume spiked. A CFTC 2014 report described it as one of the most turbulent periods in the history of financial markets.On April 21, 2015, nearly five years after the incident, the U.S. Department of Justice laid ""22 criminal counts, including fraud and market manipulation"" against Navinder Singh Sarao, a trader. Among the charges included was the use of spoofing algorithms; just prior to the Flash Crash, he placed thousands of E-mini S&P 500 stock index futures contracts which he planned on canceling later. These orders amounting to about ""$200 million worth of bets that the market would fall"" were ""replaced or modified 19,000 times"" before they were canceled. Spoofing, layering and front-running are now banned.The Commodity Futures Trading Commission (CFTC) investigation concluded that Sarao ""was at least significantly responsible for the order imbalances"" in the derivatives market which affected stock markets and exacerbated the flash crash. Sarao began his alleged market manipulation in 2009 with commercially available trading software whose code he modified ""so he could rapidly place and cancel orders automatically."" Traders Magazine journalist, John Bates, argued that blaming a 36-year-old small-time trader who worked from his parents' modest stucco house in suburban west London for sparking a trillion-dollar stock market crash is a little bit like blaming lightning for starting a fire"" and that the investigation was lengthened because regulators used ""bicycles to try and catch Ferraris."" Furthermore, he concluded that by April 2015, traders can still manipulate and impact markets in spite of regulators and banks' new, improved monitoring of automated trade systems.As recently as May 2014, a CFTC report concluded that high-frequency traders ""did not cause the Flash Crash, but contributed to it by demanding immediacy ahead of other market participants.""Recent research shows that Flash Crashes are not isolated occurrences, but have occurred quite often over the past century. For instance, Irene Aldridge, the author of High-Frequency Trading: A Practical Guide to Algorithmic Strategies and Trading Systems, 2nd ed., Wiley & Sons, shows that Flash Crashes have been frequent and their causes predictable in market microstructure analysis.