pdf file - NYU Stern

... a. Financial flexibility is higher with low leverage in several ways: one, the firm can use retained earnings for whatever purposes it chooses: it is not forced to pay out funds as debt service. Also, with low leverage and high debt capacity, the firm can tap into this debt capacity if funds are urg ...

... a. Financial flexibility is higher with low leverage in several ways: one, the firm can use retained earnings for whatever purposes it chooses: it is not forced to pay out funds as debt service. Also, with low leverage and high debt capacity, the firm can tap into this debt capacity if funds are urg ...

Revision 1 – Financial Management, Financial Objectives and

... In the case of a not-for-profit (NFP) organisation, the limit on the services that can be provided is the amount of funds that are available in a given period. A key financial objective for an NFP organisation such as a charity is therefore to raise as much funds as possible. The fund-raising effort ...

... In the case of a not-for-profit (NFP) organisation, the limit on the services that can be provided is the amount of funds that are available in a given period. A key financial objective for an NFP organisation such as a charity is therefore to raise as much funds as possible. The fund-raising effort ...

Sources of Financing: Debt and Equity

... Sources of Financing: Debt and Equity If you don’t know who the fool is on the deal, it’s you!...Michael Wolff ...

... Sources of Financing: Debt and Equity If you don’t know who the fool is on the deal, it’s you!...Michael Wolff ...

Chapter 13 - Corporate Financing and Market Efficiency (pages 321

... investors don’t know which security has which value. What is the post-announcement (pre-issue) market value of the security selected by management? ...

... investors don’t know which security has which value. What is the post-announcement (pre-issue) market value of the security selected by management? ...

13 Law, finance, and growth

... – Share of foreign investors in trading volume / ownership – Correlation (degree of co-integration) between Russian and foreign indices NES FF 2005/06 ...

... – Share of foreign investors in trading volume / ownership – Correlation (degree of co-integration) between Russian and foreign indices NES FF 2005/06 ...

derivatives

... Many of the details of these agreements are minor, such as an agreement to combine offsetting payments due on the same day into a single net payment. More significant from the perspective of risk are agreements as to the circumstances under which all the transactions will be terminated, regardless o ...

... Many of the details of these agreements are minor, such as an agreement to combine offsetting payments due on the same day into a single net payment. More significant from the perspective of risk are agreements as to the circumstances under which all the transactions will be terminated, regardless o ...

Portfolio Perspectives - Ryan Wealth Management

... is priced similar to a company with lower profitability. That indicates that either there is something about the higher profitability company that the market has deemed more risky, or there is some reason that analysts do not believe the profitability will continue into the future. As with all inves ...

... is priced similar to a company with lower profitability. That indicates that either there is something about the higher profitability company that the market has deemed more risky, or there is some reason that analysts do not believe the profitability will continue into the future. As with all inves ...

lecture 1

... • Dell left design, marketing, sales and support in Alienware’s hands; manufacturing, however, was taken over by Dell. • With its manufacturing expertise, Dell was able to build Alienware’s computers at a much lower cost ...

... • Dell left design, marketing, sales and support in Alienware’s hands; manufacturing, however, was taken over by Dell. • With its manufacturing expertise, Dell was able to build Alienware’s computers at a much lower cost ...

Summary Report on OECD-China Events on Intellectual Property

... owner and the extractor in proportion to shares of resource rent Some unease with sharing ownership of an asset This issue is still to be decided in light of discussion on leases and licences ...

... owner and the extractor in proportion to shares of resource rent Some unease with sharing ownership of an asset This issue is still to be decided in light of discussion on leases and licences ...

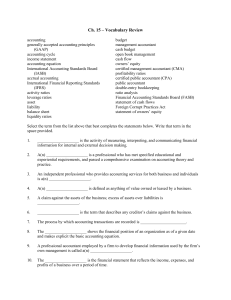

Ch. 15 – Vocabulary Review accounting generally accepted

... operating expenses, cash receipts, and outlays for a future time period. ...

... operating expenses, cash receipts, and outlays for a future time period. ...

maximizing the financial value of ip assets

... been structured to reduce risk by enabling safe, dependable securities transactions. These safeguards, together with established financial exchanges, have led to an increase in financial asset transactions, which allow companies to more competently exchange market information and determine the value ...

... been structured to reduce risk by enabling safe, dependable securities transactions. These safeguards, together with established financial exchanges, have led to an increase in financial asset transactions, which allow companies to more competently exchange market information and determine the value ...

Chapter 6

... 1. Are we satisfied with the quality of the value that our present suppliers and distributors are providing? 2. Are there activities in our industry value chain presently being outsourced or performed independently by others that are a viable source of future profits? 3. Is there a high level of sta ...

... 1. Are we satisfied with the quality of the value that our present suppliers and distributors are providing? 2. Are there activities in our industry value chain presently being outsourced or performed independently by others that are a viable source of future profits? 3. Is there a high level of sta ...

stocks and shares

... money → issues a bond and receives the money as a loan from the institution or an individual who buys it (BONDHOLDER) → the principal paid back over a fixed period of time (MATURITY) → the bondholder receives interest (COUPON) their price goes up or down over the term of the loan → INFLATION (the ...

... money → issues a bond and receives the money as a loan from the institution or an individual who buys it (BONDHOLDER) → the principal paid back over a fixed period of time (MATURITY) → the bondholder receives interest (COUPON) their price goes up or down over the term of the loan → INFLATION (the ...

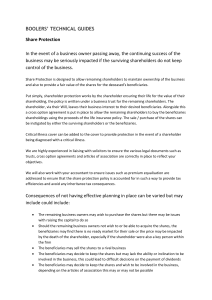

Shareholder and Partnership Protection Guide new

... In the event of a business owner passing away, the continuing success of the business may be seriously impacted if the surviving shareholders do not keep control of the business. Share Protection is designed to allow remaining shareholders to maintain ownership of the business and also to provide a ...

... In the event of a business owner passing away, the continuing success of the business may be seriously impacted if the surviving shareholders do not keep control of the business. Share Protection is designed to allow remaining shareholders to maintain ownership of the business and also to provide a ...

Explanation and Benefits of Fair Value Accounting

... Fair value is an estimate of the price an entity would realize if it were to sell an asset, or the price it would pay to relieve a liability. Many financial instruments – such as shares traded on an exchange, debt securities (U.S. Treasury bonds), and derivatives – are measured and reported at fair ...

... Fair value is an estimate of the price an entity would realize if it were to sell an asset, or the price it would pay to relieve a liability. Many financial instruments – such as shares traded on an exchange, debt securities (U.S. Treasury bonds), and derivatives – are measured and reported at fair ...

Document

... How much would the stock cost after the transaction? Imagine after the announcement the stock price would be $x. The firm can repurchase 80 mln/x shares. The stock price after the transaction must be equal $x too (investors are forward looking) 50 mln – 80 mln/x has left. Their total value should be ...

... How much would the stock cost after the transaction? Imagine after the announcement the stock price would be $x. The firm can repurchase 80 mln/x shares. The stock price after the transaction must be equal $x too (investors are forward looking) 50 mln – 80 mln/x has left. Their total value should be ...

VCA INC FORM 8-K - VCA Investor Relations

... transaction on the Company’s business relationships, operating results and business generally; (v) risks that the proposed transaction disrupts current plans and operations of the Company, including the risk of adverse reactions or changes to business relationships with customers, suppliers and oth ...

... transaction on the Company’s business relationships, operating results and business generally; (v) risks that the proposed transaction disrupts current plans and operations of the Company, including the risk of adverse reactions or changes to business relationships with customers, suppliers and oth ...

financial and legal constraints to firm growth: does size matter?

... • Corporate finance literature suggests that – financial and legal institutions could affect firm size in opposing ways • If institutions are underdeveloped, firms’ internal markets may be more efficient than public markets – inverse relationship. • But large firms are also subject to agency problem ...

... • Corporate finance literature suggests that – financial and legal institutions could affect firm size in opposing ways • If institutions are underdeveloped, firms’ internal markets may be more efficient than public markets – inverse relationship. • But large firms are also subject to agency problem ...

Additional charges for dealing in international markets

... If you invest in ADRs or GDRs you may have to pay additional charges which are levied by the Depositary agent and passed onto us by the custodian who holds the security, normally DTCC, Euroclear or Clearstream. These charges will typically be in the range of USD $0.02 to USD $0.05, payable per annum ...

... If you invest in ADRs or GDRs you may have to pay additional charges which are levied by the Depositary agent and passed onto us by the custodian who holds the security, normally DTCC, Euroclear or Clearstream. These charges will typically be in the range of USD $0.02 to USD $0.05, payable per annum ...

The Relationship between Share Price Gains, Corporate

... This paper chose to use the business performance of the most important indicators—Return of Equity(ROE). Return on equity is the company's profit after tax divided by the percentage rate of net assets. The indicators reflect the level of shareholders ' equity income, measuring the shareholders into ...

... This paper chose to use the business performance of the most important indicators—Return of Equity(ROE). Return on equity is the company's profit after tax divided by the percentage rate of net assets. The indicators reflect the level of shareholders ' equity income, measuring the shareholders into ...

RTF format

... enter each other’s market segments without incurring substantial costs. 9 In this regard, the long-term insurance licence issued to the long-term insurer by the FSB does not restrict the insurer as to which kind of cover it could provide. The insurer concerned is therefore free to choose whether it ...

... enter each other’s market segments without incurring substantial costs. 9 In this regard, the long-term insurance licence issued to the long-term insurer by the FSB does not restrict the insurer as to which kind of cover it could provide. The insurer concerned is therefore free to choose whether it ...

Environmentally responsible firms experience lower stock market

... Up to 80% of firms’ stock price instability is based on risks that affect a particular firm, such as negative earnings reports, labour strikes and oil spills. Firms with high risk have trouble earning stable cash flows and entering new markets. Firms often try and manage this risk by issuing press r ...

... Up to 80% of firms’ stock price instability is based on risks that affect a particular firm, such as negative earnings reports, labour strikes and oil spills. Firms with high risk have trouble earning stable cash flows and entering new markets. Firms often try and manage this risk by issuing press r ...

2017.03 Economic Advantage ProcessFINALv2[17156].ai

... We evaluate companies in the UK stock market for their possession of durable Economic Advantage. Companies must possess at least one of the main advantages: intellectual property, strong distribution or recurring business (at least 70% of annual turnover). We believe that investing only in these com ...

... We evaluate companies in the UK stock market for their possession of durable Economic Advantage. Companies must possess at least one of the main advantages: intellectual property, strong distribution or recurring business (at least 70% of annual turnover). We believe that investing only in these com ...

![2017.03 Economic Advantage ProcessFINALv2[17156].ai](http://s1.studyres.com/store/data/019095547_1-a901fcc214a4c2f19d62e00613571f15-300x300.png)