DIRECTIONS - Seizert Capital Partners

... terrorism, slow worldwide economic growth, geopolitical tensions, low interest rates, a potential earnings recession… the list goes on. With all the information to absorb and confusion, it’s not difficult to see why the markets have experienced increased volatility. As investors interpret the daily ...

... terrorism, slow worldwide economic growth, geopolitical tensions, low interest rates, a potential earnings recession… the list goes on. With all the information to absorb and confusion, it’s not difficult to see why the markets have experienced increased volatility. As investors interpret the daily ...

the report of the Listing Department on the

... members of the managing bodies is sometimes ignored (only total sums of such payments or average amounts per person are disclosed). Generally, information only on current management members is provided, while the LSC Rules require to disclose information about previous members of the Supervisory Boa ...

... members of the managing bodies is sometimes ignored (only total sums of such payments or average amounts per person are disclosed). Generally, information only on current management members is provided, while the LSC Rules require to disclose information about previous members of the Supervisory Boa ...

worksheet 12 may

... _______________ = Accounting: (1) Combining assets, equity, liabilities and operating accounts of a parent firm and its subsidiaries into one financial statement. (2) Combining two or more firms through purchase, merger, or ownership transfer to form a new firm. ...

... _______________ = Accounting: (1) Combining assets, equity, liabilities and operating accounts of a parent firm and its subsidiaries into one financial statement. (2) Combining two or more firms through purchase, merger, or ownership transfer to form a new firm. ...

Oligopoly File

... charge the same prices without any formal collusion. • A firm may charge the same price as another by looking at the prices of a dominant firm in the industry, or at the prices of the main ...

... charge the same prices without any formal collusion. • A firm may charge the same price as another by looking at the prices of a dominant firm in the industry, or at the prices of the main ...

JPM US Value X (acc)

... http://www.jpmorganassetmanagement.lu/emea-remunerationpolicy . This policy includes details of how remuneration and benefits are calculated, including responsibilities and composition of the committee which oversees and controls the policy. A copy of this policy can be requested free of charge from ...

... http://www.jpmorganassetmanagement.lu/emea-remunerationpolicy . This policy includes details of how remuneration and benefits are calculated, including responsibilities and composition of the committee which oversees and controls the policy. A copy of this policy can be requested free of charge from ...

3.1 Sources of Financing Part 2

... Cannot raise money with sale of stock Unlikely to be able to issue a bond ...

... Cannot raise money with sale of stock Unlikely to be able to issue a bond ...

HSBC_KEB_LoneStar_presentation

... acquisition on the terms negotiated last year” --HSBC Asia’s chief executive, Sandy Flockhart ...

... acquisition on the terms negotiated last year” --HSBC Asia’s chief executive, Sandy Flockhart ...

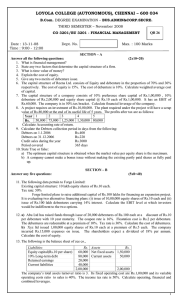

LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034

... Existing capital structure: 10 lakh equity shares of Rs.10 each. Tax rate: 50% Forge limited plans to raise additional capital of Rs.100 lakhs for financing an expansion project. It is evaluating two alternative financing plans: (i) issue of 10,00,000 equity shares of Rs.10 each and (ii) issue of Rs ...

... Existing capital structure: 10 lakh equity shares of Rs.10 each. Tax rate: 50% Forge limited plans to raise additional capital of Rs.100 lakhs for financing an expansion project. It is evaluating two alternative financing plans: (i) issue of 10,00,000 equity shares of Rs.10 each and (ii) issue of Rs ...

Alexey Nikolaevich Chubinov,

... was determined. If according to the legislation of the Russian Federation it is obligatory to evaluate the object, then no more than three months may pass from the date of appraisal before the ...

... was determined. If according to the legislation of the Russian Federation it is obligatory to evaluate the object, then no more than three months may pass from the date of appraisal before the ...

Va. bank deal punctuates push for scale and influence of activist

... the news as a profit-taking opportunity on a stock that had surged more than 20% over the previous 52 weeks. “But I don’t think it was about opposition to the deal itself,” Mealor said. Raymond James analyst William Wallace IV agreed that shares of Access likely took a hit from investors who have ow ...

... the news as a profit-taking opportunity on a stock that had surged more than 20% over the previous 52 weeks. “But I don’t think it was about opposition to the deal itself,” Mealor said. Raymond James analyst William Wallace IV agreed that shares of Access likely took a hit from investors who have ow ...

March 2016 - American Bar Association

... A New York-based company comes upon a software development entity in Germany that it is interested in acquiring. The parties conclude a letter of intent setting forth the basic terms of the acquisition – the New York entity will acquire 100% of the target company’s shares, the purchase price is cash ...

... A New York-based company comes upon a software development entity in Germany that it is interested in acquiring. The parties conclude a letter of intent setting forth the basic terms of the acquisition – the New York entity will acquire 100% of the target company’s shares, the purchase price is cash ...

1 – âmbito da informação

... in interest rates. Interest-bearing liabilities were down 43 million Euro to 436 million Euro, reflecting the disposal of financial investments and the working capital management. The group net profit came to a loss of 4.6 million Euro, almost 6.2 million Euro less than the figure for the same perio ...

... in interest rates. Interest-bearing liabilities were down 43 million Euro to 436 million Euro, reflecting the disposal of financial investments and the working capital management. The group net profit came to a loss of 4.6 million Euro, almost 6.2 million Euro less than the figure for the same perio ...

The more things change...

... small irony that central banks are an extension of the very governments themselves whose debt is being bought back). We now have a strange situation globally where something in the order of $5-7 trillion dollars’ worth of debt is trading on a negative yield. What does this mean for smaller cap inves ...

... small irony that central banks are an extension of the very governments themselves whose debt is being bought back). We now have a strange situation globally where something in the order of $5-7 trillion dollars’ worth of debt is trading on a negative yield. What does this mean for smaller cap inves ...

Price/Book and Price/Sales Ratios

... The strong effect of profit margins on P/S ratios is why they tend to vary tremendously across industries. For example, the retailers in Morningstar's stock database had an average P/S of just 0.8 at the end of 1999. That's because the average net margin for these companies is only 4%--only four cen ...

... The strong effect of profit margins on P/S ratios is why they tend to vary tremendously across industries. For example, the retailers in Morningstar's stock database had an average P/S of just 0.8 at the end of 1999. That's because the average net margin for these companies is only 4%--only four cen ...

International Financial Management Group Work

... acquisition and other similar situations. First of all, it’s the very way to control the foreign company occupying the Chinese market. In the Coca-Cola and Huiyuan case, as we all know, the Coca-Cola company is to some extent a monopoly enterprise of soft drinks in the world. If the M&A activity ca ...

... acquisition and other similar situations. First of all, it’s the very way to control the foreign company occupying the Chinese market. In the Coca-Cola and Huiyuan case, as we all know, the Coca-Cola company is to some extent a monopoly enterprise of soft drinks in the world. If the M&A activity ca ...

the secondary market - Sharemarket Game

... The lowest price a seller is willing to accept for their stock is sometimes called the “Ask” price (because that is the price that the seller is “asking” for the stock). Seller E has agreed to sell XYZ shares at the lowest price being $1 per share. Seller D and F are expecting to sell their shares a ...

... The lowest price a seller is willing to accept for their stock is sometimes called the “Ask” price (because that is the price that the seller is “asking” for the stock). Seller E has agreed to sell XYZ shares at the lowest price being $1 per share. Seller D and F are expecting to sell their shares a ...

Liquor Store Business Valuation

... page 78 and compare the adjusted book value of $248,544 ($175,968 + $5,376 + $67,200) for the total invested capital to the values concluded by the market approach (see Table 4-2 on page 79), and the concluded value of the income approach in Table 4-6 on page 84. It must be noted that not all compan ...

... page 78 and compare the adjusted book value of $248,544 ($175,968 + $5,376 + $67,200) for the total invested capital to the values concluded by the market approach (see Table 4-2 on page 79), and the concluded value of the income approach in Table 4-6 on page 84. It must be noted that not all compan ...

1.1 organizing a business

... thereby garner substantial resources. Corporations also have greater organizational and legal costs, and are more likely to raise capital in financial markets. D. Shareholder owners have limited liability; their personal assets are free from the obligations of the corporations. Sometimes, shareholde ...

... thereby garner substantial resources. Corporations also have greater organizational and legal costs, and are more likely to raise capital in financial markets. D. Shareholder owners have limited liability; their personal assets are free from the obligations of the corporations. Sometimes, shareholde ...

FA2: Module 9 Tangible and intangible capital assets

... on the investee balance sheet; or unrecorded goodwill. The investor must attribute the purchase discrepancy to depreciable assets (and then amortize it), non-depreciable identifiable assets/liabilities, or goodwill. Example: A11-23 ...

... on the investee balance sheet; or unrecorded goodwill. The investor must attribute the purchase discrepancy to depreciable assets (and then amortize it), non-depreciable identifiable assets/liabilities, or goodwill. Example: A11-23 ...

HELBOR EMPREENDIMENTOS S.A. Publicly

... profits and/or capital reserve to realize the buyback program of the book-entry registered common shares with no par value issued by the Company, in one trade or one series of trades, in accordance to Article 26, item (xvii) of the Company’s Bylaws and ICVM 567/15, complying with the conditions list ...

... profits and/or capital reserve to realize the buyback program of the book-entry registered common shares with no par value issued by the Company, in one trade or one series of trades, in accordance to Article 26, item (xvii) of the Company’s Bylaws and ICVM 567/15, complying with the conditions list ...

fact sheet

... Corporate Profile: Founded in 1841, Aker ASA is a Norwegian industrial investment company that creates shareholder value through active ownership. Business model: Our ownership interests are concentrated on key Norwegian industries that are international in scope and of which we have in-depth knowle ...

... Corporate Profile: Founded in 1841, Aker ASA is a Norwegian industrial investment company that creates shareholder value through active ownership. Business model: Our ownership interests are concentrated on key Norwegian industries that are international in scope and of which we have in-depth knowle ...

Master in Finance Thesis Economic Nationalism

... tried to acquire control should stay on the sample. This means that only those acquirers who cross either the 20% or the 50% ownership stake remained on the sample. After sorting by this criterion, I excluded those bids without the relevant financial information for the analysis, namely both the tar ...

... tried to acquire control should stay on the sample. This means that only those acquirers who cross either the 20% or the 50% ownership stake remained on the sample. After sorting by this criterion, I excluded those bids without the relevant financial information for the analysis, namely both the tar ...

Summary - sistemas

... After that, Williamson (1985) defined transaction costs as "the costs ex-ante preparing, negotiating and safeguarding an agreement, as well as the costs ex-post of the adjustments and adaptations which derive from the execution of a contract affected by flaws, mistakes, omissions and unexpected alte ...

... After that, Williamson (1985) defined transaction costs as "the costs ex-ante preparing, negotiating and safeguarding an agreement, as well as the costs ex-post of the adjustments and adaptations which derive from the execution of a contract affected by flaws, mistakes, omissions and unexpected alte ...

Business Ethics Read the article Governance in the Spotlight: What

... penalty to those who engage in fraudulent financial activity. Do small businesses and privately held companies have ethical duties? Yes they are supposed to because the Code of Ethics and business standards sets out the minimum ethical standards, which organizations must adhere to when conducting th ...

... penalty to those who engage in fraudulent financial activity. Do small businesses and privately held companies have ethical duties? Yes they are supposed to because the Code of Ethics and business standards sets out the minimum ethical standards, which organizations must adhere to when conducting th ...