Solvay Business School

... EuroCorp has an investment opportunity to produce DVD recorders. The required investment at the end of this year is € 800,000. This investment could be depreciated for tax purposes straight-line over 4 years. EuroCorp expects to terminate the project at the end of 4 years. The resale value of the ma ...

... EuroCorp has an investment opportunity to produce DVD recorders. The required investment at the end of this year is € 800,000. This investment could be depreciated for tax purposes straight-line over 4 years. EuroCorp expects to terminate the project at the end of 4 years. The resale value of the ma ...

T. Rowe Price Large Cap Growth Portfolio

... Variable life and annuity products are offered by prospectus only. Prospectuses for variable products issued by a MetLife insurance company, and for the investment portfolios offered thereunder, are available from your financial professional. The contract prospectus contains information about the co ...

... Variable life and annuity products are offered by prospectus only. Prospectuses for variable products issued by a MetLife insurance company, and for the investment portfolios offered thereunder, are available from your financial professional. The contract prospectus contains information about the co ...

Fiscal Incentives for Long Term Investments

... assets in their portfolios in times of crisis thus playing a countercyclical role in the financial markets); •they are able to spread risks between generations; •and finally have, generally, a clear social responsibility in their missions. This allows them to “accept” non speculative returns on thei ...

... assets in their portfolios in times of crisis thus playing a countercyclical role in the financial markets); •they are able to spread risks between generations; •and finally have, generally, a clear social responsibility in their missions. This allows them to “accept” non speculative returns on thei ...

Chapter 1, Answer to Questions

... 1. An investment is any asset into which funds can be placed with the expectation of preserving or increasing value and earning a positive rate of return. An investment can be a security or a property. Individuals invest because an investment has the potential to preserve or increase value and to ea ...

... 1. An investment is any asset into which funds can be placed with the expectation of preserving or increasing value and earning a positive rate of return. An investment can be a security or a property. Individuals invest because an investment has the potential to preserve or increase value and to ea ...

Q4 2010 Investor Fact Sheet

... This document, including any information incorporated by reference, contains “forward-looking statements” (within the meaning of Private Securities Litigation Reform Act of 1995). All statements trend analyses and other information relative to markets for our products and trends in our operations or ...

... This document, including any information incorporated by reference, contains “forward-looking statements” (within the meaning of Private Securities Litigation Reform Act of 1995). All statements trend analyses and other information relative to markets for our products and trends in our operations or ...

Working with the European Bankfor Reconstruction and

... Equity Investments and Guarantees: typically from 3 to 7 years Debt: public and private instruments, fixed and floating, syndicated loans, ...

... Equity Investments and Guarantees: typically from 3 to 7 years Debt: public and private instruments, fixed and floating, syndicated loans, ...

Test Presentation Line 2

... • Common Investment and Common Deposit Funds ◦ Affirmative Equity Fund ◦ Affirmative Fixed Interest Fund ◦ Affirmative Corporate Bond Fund ◦ Affirmative Deposit Fund • UCITS Umbrella Unit Trust Scheme ◦ Epworth UK Equity Fund ◦ Epworth European Fund ...

... • Common Investment and Common Deposit Funds ◦ Affirmative Equity Fund ◦ Affirmative Fixed Interest Fund ◦ Affirmative Corporate Bond Fund ◦ Affirmative Deposit Fund • UCITS Umbrella Unit Trust Scheme ◦ Epworth UK Equity Fund ◦ Epworth European Fund ...

press release text the wall street journal category kings

... average represents a universe of Funds with similar investment objectives. Rankings for the periods shown are based on Fund total returns with dividends and distributions reinvested and do not reflect sales charges. Please carefully consider the Fund’s investment objective, risks, charges, and expen ...

... average represents a universe of Funds with similar investment objectives. Rankings for the periods shown are based on Fund total returns with dividends and distributions reinvested and do not reflect sales charges. Please carefully consider the Fund’s investment objective, risks, charges, and expen ...

here

... Assets as of March 31, 2017. Total AUM may differ from the sum of the underlying business AUM due to rounding. Holdings are subject to change. Asset class breakdown is based on company estimates, and subject to change. 1 Includes all assets managed by PGIM, the principal asset management business of ...

... Assets as of March 31, 2017. Total AUM may differ from the sum of the underlying business AUM due to rounding. Holdings are subject to change. Asset class breakdown is based on company estimates, and subject to change. 1 Includes all assets managed by PGIM, the principal asset management business of ...

EIF Presentation Template - EU Strategy for the Baltic Sea Region

... Co-investment 50/50: EIF/ERP (German Ministry BMWi) Size: € 1bn - € 642m committed in 20 funds LfA-EIF Germany Co-investment Bavarian Ministry of Economics LfA Förderbank, Bayern EIF. Size € 50m - € 26m committed in 4 funds NEOTEC: Spanish Technology Fund-of-Funds Tech fund in partnership wi ...

... Co-investment 50/50: EIF/ERP (German Ministry BMWi) Size: € 1bn - € 642m committed in 20 funds LfA-EIF Germany Co-investment Bavarian Ministry of Economics LfA Förderbank, Bayern EIF. Size € 50m - € 26m committed in 4 funds NEOTEC: Spanish Technology Fund-of-Funds Tech fund in partnership wi ...

The future of Turkey`s capital markets

... Around half of bank deposits in Turkey are currently lodged in deposit accounts holding more than TRY1 MM (around US$500,000), most with less than one-year maturity. These large accounts will be the prime targets of retail brokers and asset managers as they seek to expand their businesses. The segm ...

... Around half of bank deposits in Turkey are currently lodged in deposit accounts holding more than TRY1 MM (around US$500,000), most with less than one-year maturity. These large accounts will be the prime targets of retail brokers and asset managers as they seek to expand their businesses. The segm ...

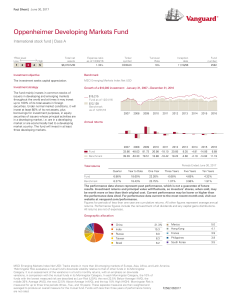

Oppenheimer Developing Markets Fund - Vanguard

... market as a whole. Smaller, less-seasoned companies may be subject to increased liquidity risk compared with mid- and large-cap companies and may experience greater price volatility than do those securities because of limited product lines, management experience, market share, or financial resources ...

... market as a whole. Smaller, less-seasoned companies may be subject to increased liquidity risk compared with mid- and large-cap companies and may experience greater price volatility than do those securities because of limited product lines, management experience, market share, or financial resources ...

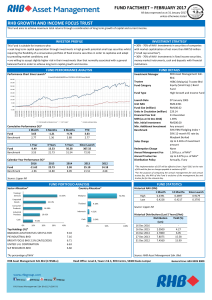

RHB Growth And Income Focus Trust

... A Product Highlights Sheet (“PHS”) highlighting the key features and risks of the Fund is available and investors have the right to request for a PHS. Investors are advised to obtain, read and understand the PHS and the contents of the Master Prospectus dated 3 August 2016 and its supplementary(ies) ...

... A Product Highlights Sheet (“PHS”) highlighting the key features and risks of the Fund is available and investors have the right to request for a PHS. Investors are advised to obtain, read and understand the PHS and the contents of the Master Prospectus dated 3 August 2016 and its supplementary(ies) ...

New York, New York TUESDAY, DECEMBER 8, 2009

... firms with regard to all aspects of their business. Immediately prior to joining K&L Gates in May 2007, Mr. Eisert was a Senior Vice President and the General Corporate Counsel of Fiduciary Trust Company International, a FDIC insured institution and subsidiary of Franklin Templeton, where he adv ...

... firms with regard to all aspects of their business. Immediately prior to joining K&L Gates in May 2007, Mr. Eisert was a Senior Vice President and the General Corporate Counsel of Fiduciary Trust Company International, a FDIC insured institution and subsidiary of Franklin Templeton, where he adv ...

June 13th 2008 - Neil H. Gendreau, CFP

... income producing agent. While less than investment grade corporate credit has a higher chance of default than investment grade debt, default risk can be more effectively managed through a mutual fund rather than purchasing individual bonds. 2. Loan Participation Notes – Issued by banks to non-public ...

... income producing agent. While less than investment grade corporate credit has a higher chance of default than investment grade debt, default risk can be more effectively managed through a mutual fund rather than purchasing individual bonds. 2. Loan Participation Notes – Issued by banks to non-public ...

Theme 3

... overall simpler than in the US: contracts rarely use contingent allocation of decision and cash-flow rights and contracts do not make much use of securities such as preferred convertible shares, featuring characteristics of both debt and equity, which the theoretical literature found as important in ...

... overall simpler than in the US: contracts rarely use contingent allocation of decision and cash-flow rights and contracts do not make much use of securities such as preferred convertible shares, featuring characteristics of both debt and equity, which the theoretical literature found as important in ...

D 1

... • The Company could lower its WACC, by increase its use of cheaper financing sources. For example, BHH Inc could issue more bonds instead of stocks so, the proportion of debt to equity will increase because the debt is cheaper than the equity so, the company's weighted average cost of capital would ...

... • The Company could lower its WACC, by increase its use of cheaper financing sources. For example, BHH Inc could issue more bonds instead of stocks so, the proportion of debt to equity will increase because the debt is cheaper than the equity so, the company's weighted average cost of capital would ...

press release

... About the Institutional Investors Group on Climate Change (IIGCC) The Institutional Investors Group on Climate Change (IIGCC) is a forum for collaboration on climate change for European investors. It provides investors with a collaborative platform to encourage public policies, investment practices, ...

... About the Institutional Investors Group on Climate Change (IIGCC) The Institutional Investors Group on Climate Change (IIGCC) is a forum for collaboration on climate change for European investors. It provides investors with a collaborative platform to encourage public policies, investment practices, ...

RBC Multi-Strategy Alpha Fund

... their professional advisors and consultants regarding any tax, accounting, legal or financial considerations before making a decision as to whether the funds mentioned in this material are a suitable investment for them. Commissions, trailing commissions, management fees and expenses all may be asso ...

... their professional advisors and consultants regarding any tax, accounting, legal or financial considerations before making a decision as to whether the funds mentioned in this material are a suitable investment for them. Commissions, trailing commissions, management fees and expenses all may be asso ...

FINANCING WORKING CAPITAL The financing of working capital is

... only long-term financing. The financing mix of the working capital depends upon the risk preferences of the management. Cost of different type of funds, the long-term and short-term, the return on different type of current assets, risk-bearing ability of the concern, liquidity, levels etc., have to ...

... only long-term financing. The financing mix of the working capital depends upon the risk preferences of the management. Cost of different type of funds, the long-term and short-term, the return on different type of current assets, risk-bearing ability of the concern, liquidity, levels etc., have to ...

Read More - Consonance Capital

... -For Immediate ReleaseEnclara Health, in Partnership with Consonance Capital Partners, Purchases excelleRx / Hospice Pharmacia and PBM Plus Combination Creates Premier Comprehensive Mail Order and Pharmacy Benefit Management Offering Addressing Increasingly Complex Clinical, Financial, and Regulator ...

... -For Immediate ReleaseEnclara Health, in Partnership with Consonance Capital Partners, Purchases excelleRx / Hospice Pharmacia and PBM Plus Combination Creates Premier Comprehensive Mail Order and Pharmacy Benefit Management Offering Addressing Increasingly Complex Clinical, Financial, and Regulator ...

Sample: EBC*L Exam Level A KNOWLEDGE QUESTIONS (4 points

... a) What are the likely fixed costs of a fitness centre? b) Should the fitness centre reduce its price below its long-term cost of sales (summer special) to improve capacity utilisation during the summer months? (Argue the case from a business management perspective.) c) If the fitness centre were to ...

... a) What are the likely fixed costs of a fitness centre? b) Should the fitness centre reduce its price below its long-term cost of sales (summer special) to improve capacity utilisation during the summer months? (Argue the case from a business management perspective.) c) If the fitness centre were to ...

Tengion Inc. Completes $50 Million Series "B

... comprised of funds from Bain Capital Ventures and Brookside Capital. All previous venture investors, Oak Investment Partners, Johnson and Johnson Development Corporation, HealthCap, and L Capital Partners, participated in the round. Tengion plans to use the proceeds to fund human clinical trials to ...

... comprised of funds from Bain Capital Ventures and Brookside Capital. All previous venture investors, Oak Investment Partners, Johnson and Johnson Development Corporation, HealthCap, and L Capital Partners, participated in the round. Tengion plans to use the proceeds to fund human clinical trials to ...

Investment Guidelines

... • Where products with underlying capital guarantees are chosen, i.e. Structured Notes, these will be permitted up to a maximum of 66% of the portfolio’s values, with no more than one quarter of the portfolio to be subject to the same issuer / guarantor default risk • Where no such capital guarantee ...

... • Where products with underlying capital guarantees are chosen, i.e. Structured Notes, these will be permitted up to a maximum of 66% of the portfolio’s values, with no more than one quarter of the portfolio to be subject to the same issuer / guarantor default risk • Where no such capital guarantee ...

Private equity

In finance, private equity is an asset class consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange.A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture expansion, new-product development, or restructuring of the company’s operations, management, or ownership.Bloomberg Businessweek has called private equity a rebranding of leveraged-buyout firms after the 1980s. Common investment strategies in private equity include: leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged-buyout transaction, a private-equity firm buys majority control of an existing or mature firm. This is distinct from a venture-capital or growth-capital investment, in which the investors (typically venture-capital firms or angel investors) invest in young, growing or emerging companies, and rarely obtain majority control.Private equity is also often grouped into a broader category called private capital, generally used to describe capital supporting any long-term, illiquid investment strategy.