11 Investment in the public sector

... the finance or risk for very large projects. • Public sector investment can help regenerate parts of the economy which have suffered from restructuring. • Public sector investments can generate jobs when unemployment is high. © John Tribe ...

... the finance or risk for very large projects. • Public sector investment can help regenerate parts of the economy which have suffered from restructuring. • Public sector investments can generate jobs when unemployment is high. © John Tribe ...

Identify the right investments

... companies listed on AIM carry higher risk than those listed on the main stock market. For the investor, the drawback to investing in AIM stocks is their lack of liquidity. Market makers will constantly quote buy and sell prices for FTSE stocks, but as trading volumes on AIM are much lower, transacti ...

... companies listed on AIM carry higher risk than those listed on the main stock market. For the investor, the drawback to investing in AIM stocks is their lack of liquidity. Market makers will constantly quote buy and sell prices for FTSE stocks, but as trading volumes on AIM are much lower, transacti ...

Market Timing and the Debt-Equity Choice.

... available to the market at the time of issuance. There are three potential explanations for the perfect foresight model producing a valuation different from the current stock price. First, we cannot rule out the possibility of a misspecified model, and that the model merely produces a noisy estimat ...

... available to the market at the time of issuance. There are three potential explanations for the perfect foresight model producing a valuation different from the current stock price. First, we cannot rule out the possibility of a misspecified model, and that the model merely produces a noisy estimat ...

Award Winning Signature Team Joins R C Brown Investment

... RCBIM, a long established investment manager, has extensive research capabilities and ‘state of the art’ systems that complement its reputation for excellence. The rapid growth of its private client offering over the last few years has been overseen by the arrival of Alan Beaney as Investment Direct ...

... RCBIM, a long established investment manager, has extensive research capabilities and ‘state of the art’ systems that complement its reputation for excellence. The rapid growth of its private client offering over the last few years has been overseen by the arrival of Alan Beaney as Investment Direct ...

Commonwealth Global Fund

... Investments in emerging markets involve even greater risks. Focus on a single country involves higher risk than a more geographically diverse international fund. Exposure to companies engaged in the natural resource and commodities markets may increase volatility. Small cap stocks are more susceptib ...

... Investments in emerging markets involve even greater risks. Focus on a single country involves higher risk than a more geographically diverse international fund. Exposure to companies engaged in the natural resource and commodities markets may increase volatility. Small cap stocks are more susceptib ...

making use of home equity - Ministry of Social Development

... International comparisons of socio-economic levels are also fraught with difficulty. Bearing this in mind, however, it appears that equity release clients in both New Zealand and Britain are over-represented in the higher socio-economic groups, although they appear in all levels (Table 4). A compari ...

... International comparisons of socio-economic levels are also fraught with difficulty. Bearing this in mind, however, it appears that equity release clients in both New Zealand and Britain are over-represented in the higher socio-economic groups, although they appear in all levels (Table 4). A compari ...

CMU Briefing Paper - For Print

... repression” which – together with excessively high fees from financial institutions – currently too often destroy the real value of their savings. In particular, tax incentives for direct equity investments (e.g. share savings plans) would support further growth, especially if channelled to growth c ...

... repression” which – together with excessively high fees from financial institutions – currently too often destroy the real value of their savings. In particular, tax incentives for direct equity investments (e.g. share savings plans) would support further growth, especially if channelled to growth c ...

Stock Return Probabilities - The American Association of Individual

... marketing and finance decisions. The study also cited competition among firms and the structure of the capital markets, including pressure from, as well as competition for, investors. The study found that higher capital productivity in turn generated higher financial returns in the U.S., which showe ...

... marketing and finance decisions. The study also cited competition among firms and the structure of the capital markets, including pressure from, as well as competition for, investors. The study found that higher capital productivity in turn generated higher financial returns in the U.S., which showe ...

VIT Multi-Strategy Alternatives Portfolio

... tax opinions and other tax analyses) that are provided to you relating to such tax treatment and tax structure, without Goldman Sachs imposing any limitation of any kind. Investors should be aware that a determination of the tax consequences to them should take into account their specific circumstan ...

... tax opinions and other tax analyses) that are provided to you relating to such tax treatment and tax structure, without Goldman Sachs imposing any limitation of any kind. Investors should be aware that a determination of the tax consequences to them should take into account their specific circumstan ...

Risk-Adjusted Performance of Private Equity Investments

... (1979). Martin and Petty (1983) rank publicly traded Venture Capital Trusts against other investment funds for the 1974-9 period. According to their Sharpe Ratios, while seven Venture Capital Trusts ranked in the top ten funds, two were in the middle and two were at the bottom, the first place was h ...

... (1979). Martin and Petty (1983) rank publicly traded Venture Capital Trusts against other investment funds for the 1974-9 period. According to their Sharpe Ratios, while seven Venture Capital Trusts ranked in the top ten funds, two were in the middle and two were at the bottom, the first place was h ...

Calculate Your Own Working Capital/Ratio

... total liabilities / owner’s equity – A leverage ratio used by lenders who base the calculation on the fair market value of the equity as opposed to book value ...

... total liabilities / owner’s equity – A leverage ratio used by lenders who base the calculation on the fair market value of the equity as opposed to book value ...

Weighted Average Cost of Capital (WACC)

... “Risk which is common to an entire class of assets or liabilities. The value of investments may decline over a given time period simply because of economic changes or other events that impact large portions of the market. Asset allocation and diversification can protect against undiversifiable risk ...

... “Risk which is common to an entire class of assets or liabilities. The value of investments may decline over a given time period simply because of economic changes or other events that impact large portions of the market. Asset allocation and diversification can protect against undiversifiable risk ...

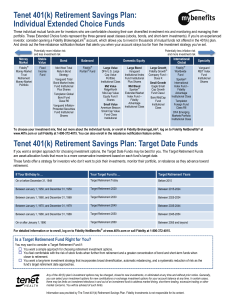

Tenet 401(k) Retirement Savings Plan: Individual Extended Choice

... Individual Extended Choice Funds ...

... Individual Extended Choice Funds ...

Ph.D. Course in International Finance Proposed By

... Proposed By Vihang R. Errunza Faculty of management, McGill University OBJECTIVES This is an advanced seminar with the following two objectives: 1. Students will understand and synthesize classic literature and recent advances in International Finance. 2. Students will develop a portfolio of potenti ...

... Proposed By Vihang R. Errunza Faculty of management, McGill University OBJECTIVES This is an advanced seminar with the following two objectives: 1. Students will understand and synthesize classic literature and recent advances in International Finance. 2. Students will develop a portfolio of potenti ...

AAPT taps a different funds pool for its domestic market return

... which hover on the cusp of investment grade find less volume of demand for their issuance because some investors do not want to hold paper that may be subject to a negative rating action. At the time KangaNews also learned that the issuer had been targeting an even-larger transaction than the eventu ...

... which hover on the cusp of investment grade find less volume of demand for their issuance because some investors do not want to hold paper that may be subject to a negative rating action. At the time KangaNews also learned that the issuer had been targeting an even-larger transaction than the eventu ...

Great Expectations

... Small Business Optimism index experienced a postelection spike in improvement to 98, just two points shy of this cycle’s all-time high of 100.3— largely on expectations for a relatively more ...

... Small Business Optimism index experienced a postelection spike in improvement to 98, just two points shy of this cycle’s all-time high of 100.3— largely on expectations for a relatively more ...

slovene capital market development strategy

... 1.2. Increased awareness of the importance of a well-functioning capital market The financial crisis and stock market crash have caused a general crisis of confidence in the domestic capital market, confidence being lost by the general public, companies and politicians. Investor confidence can only ...

... 1.2. Increased awareness of the importance of a well-functioning capital market The financial crisis and stock market crash have caused a general crisis of confidence in the domestic capital market, confidence being lost by the general public, companies and politicians. Investor confidence can only ...

Ph - Edelweiss Financial Services

... and interest policies of India, inflation, deflation, unanticipated turbulence in interest rates, foreign exchange rates, equity prices or rates or prices, the performance of the financial markets in India and globally, changes in domestic and foreign laws, regulations and taxes and changes in compe ...

... and interest policies of India, inflation, deflation, unanticipated turbulence in interest rates, foreign exchange rates, equity prices or rates or prices, the performance of the financial markets in India and globally, changes in domestic and foreign laws, regulations and taxes and changes in compe ...

Equity Returns and Business Cycles in Small Open Economies Mohammad R. Jahan-Parvar

... If we assume that the subjective discount factor is constant, then balanced growth is admissible. ...

... If we assume that the subjective discount factor is constant, then balanced growth is admissible. ...

From Start-up to Scale-up - Centre for Economic Policy Research

... does not try to characterise the challenges of company growth in general, it only focuses on the scaleup challenges of technology-based start-ups broadly defined. Second, this paper provides descriptive statistics, but it does not perform any econometric analysis to explain specific causal relations ...

... does not try to characterise the challenges of company growth in general, it only focuses on the scaleup challenges of technology-based start-ups broadly defined. Second, this paper provides descriptive statistics, but it does not perform any econometric analysis to explain specific causal relations ...

print to PDF - Willis Owen

... Where investors are increasingly searching for income in a low interest environment, we will have a look at the sector that is designed to meet the needs of providing income. What is the UK equity income sector? The UK Equity Income sector is part of the Investment Association (IA) and was establish ...

... Where investors are increasingly searching for income in a low interest environment, we will have a look at the sector that is designed to meet the needs of providing income. What is the UK equity income sector? The UK Equity Income sector is part of the Investment Association (IA) and was establish ...

PNC Large Cap Value Fund

... please see the expense table in the prospectus. If the waivers or reimbursements were not in effect the Fund’s performance would have been lower. 2 The Russell 1000 Value Index, an unmanaged index of 1,000 largest U.S. companies with lower price-to-book ratios and lower forecasted growth values, is ...

... please see the expense table in the prospectus. If the waivers or reimbursements were not in effect the Fund’s performance would have been lower. 2 The Russell 1000 Value Index, an unmanaged index of 1,000 largest U.S. companies with lower price-to-book ratios and lower forecasted growth values, is ...

Capital Structure: Basic Concepts

... Some of the increase in equity risk and return is offset by the interest tax shield RS = R0 + (B/S)×(1-TC)×(R0 - RB) RB is the interest rate (cost of debt) RS is the return on equity (cost of equity) R0 is the return on unlevered equity (cost of capital) B is the value of debt S is the value of leve ...

... Some of the increase in equity risk and return is offset by the interest tax shield RS = R0 + (B/S)×(1-TC)×(R0 - RB) RB is the interest rate (cost of debt) RS is the return on equity (cost of equity) R0 is the return on unlevered equity (cost of capital) B is the value of debt S is the value of leve ...

a company announcement

... San Francisco – April 27, 2015 – TPG Growth, the middle market and growth equity investment platform of TPG, announced today the closing of TPG Growth III, its largest fund dedicated to investments in small- and mid-sized growth companies. The fund reached over $3 billion in aggregate capital commit ...

... San Francisco – April 27, 2015 – TPG Growth, the middle market and growth equity investment platform of TPG, announced today the closing of TPG Growth III, its largest fund dedicated to investments in small- and mid-sized growth companies. The fund reached over $3 billion in aggregate capital commit ...

Private equity in the 2000s

Private equity in the 2000s relates to one of the major periods in the history of private equity and venture capital. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital experienced growth along parallel although interrelated tracks.The development of the private equity and venture capital asset classes has occurred through a series of boom and bust cycles since the middle of the 20th century. As the 20th century ended, so, too, did the dot-com bubble and the tremendous growth in venture capital that had marked the previous five years. In the wake of the collapse of the dot-com bubble, a new ""Golden Age"" of private equity ensued, as leveraged buyouts reach unparalleled size and the private equity firms achieved new levels of scale and institutionalization, exemplified by the initial public offering of the Blackstone Group in 2007.