Paper Money Collapse

... Mankind has used money for more than 2500 years. For most of history money has been a commodity and most frequently gold or silver. There are good reasons why gold and silver have held this unique position. These precious metals possess some characteristics that make them particularly useful as mone ...

... Mankind has used money for more than 2500 years. For most of history money has been a commodity and most frequently gold or silver. There are good reasons why gold and silver have held this unique position. These precious metals possess some characteristics that make them particularly useful as mone ...

Marx`s Theory of Money: Modern Appraisals

... Marx argued that the quantity of money in circulation would adjust to the sum of prices (i.e., to the ‘needs of circulation’) by hoarding and dishoarding and/or by a change in the velocity of money.8 These quantitative conclusions are the basis of Marx’s critique of the quantity theory of money of H ...

... Marx argued that the quantity of money in circulation would adjust to the sum of prices (i.e., to the ‘needs of circulation’) by hoarding and dishoarding and/or by a change in the velocity of money.8 These quantitative conclusions are the basis of Marx’s critique of the quantity theory of money of H ...

The Ethics of Money Production

... hardly mentioned at all. For example, Catholic social teaching only vaguely says that economic activity presupposes a “stable currency”2 and that the “stability of the purchasing power of money [is] a major consideration in the orderly development of the entire economic system.”3 There are very deta ...

... hardly mentioned at all. For example, Catholic social teaching only vaguely says that economic activity presupposes a “stable currency”2 and that the “stability of the purchasing power of money [is] a major consideration in the orderly development of the entire economic system.”3 There are very deta ...

Monetary Economics

... money(M) would lead to a higher increase in price (P) or inflation in an economy. • Excess of money supply would caused to inflation. Take this note Azizah Isa ...

... money(M) would lead to a higher increase in price (P) or inflation in an economy. • Excess of money supply would caused to inflation. Take this note Azizah Isa ...

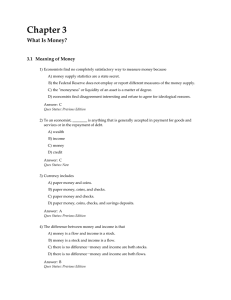

Economics of Money, Banking, and Financial Markets, 8e

... A) the value of money rises rapidly. B) money no longer functions as a good store of value and people may resort to barter transactions on a much larger scale. C) middle-class savers benefit as prices rise. D) moneyʹs value remains fixed to the price level; that is, if prices double so does the valu ...

... A) the value of money rises rapidly. B) money no longer functions as a good store of value and people may resort to barter transactions on a much larger scale. C) middle-class savers benefit as prices rise. D) moneyʹs value remains fixed to the price level; that is, if prices double so does the valu ...

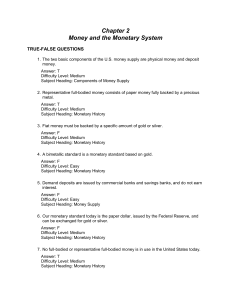

FREE Sample Here

... 11. “Continentals” were denominated in dollars and were backed by gold. Answer: F Difficulty Level: Easy Subject Heading: Monetary History 12. The use of “continentals” led to a long period of distrust of paper money. Answer: T Difficulty Level: Easy Subject Heading: Monetary History 13. The faster ...

... 11. “Continentals” were denominated in dollars and were backed by gold. Answer: F Difficulty Level: Easy Subject Heading: Monetary History 12. The use of “continentals” led to a long period of distrust of paper money. Answer: T Difficulty Level: Easy Subject Heading: Monetary History 13. The faster ...

introduction-to-finance-14th-edition-melicher-test-bank

... 11. “Continentals” were denominated in dollars and were backed by gold. Answer: F Difficulty Level: Easy Subject Heading: Monetary History 12. The use of “continentals” led to a long period of distrust of paper money. Answer: T Difficulty Level: Easy Subject Heading: Monetary History 13. The faster ...

... 11. “Continentals” were denominated in dollars and were backed by gold. Answer: F Difficulty Level: Easy Subject Heading: Monetary History 12. The use of “continentals” led to a long period of distrust of paper money. Answer: T Difficulty Level: Easy Subject Heading: Monetary History 13. The faster ...

Introduction to an Alternative History of Money

... Heterodox economists have mounted a several-pronged attack on this methodology and its conclusions. First, Institutionalists (in particular) have rejected the formalist methodology adopted by orthodox economists in favor of a substantivist methodology (Stanfield 1986). In the formalist methodology, ...

... Heterodox economists have mounted a several-pronged attack on this methodology and its conclusions. First, Institutionalists (in particular) have rejected the formalist methodology adopted by orthodox economists in favor of a substantivist methodology (Stanfield 1986). In the formalist methodology, ...

Introduction to an Alternative History of Money

... Heterodox economists have mounted a several-pronged attack on this methodology and its conclusions. First, Institutionalists (in particular) have rejected the formalist methodology adopted by orthodox economists in favor of a substantivist methodology (Stanfield 1986). In the formalist methodology, ...

... Heterodox economists have mounted a several-pronged attack on this methodology and its conclusions. First, Institutionalists (in particular) have rejected the formalist methodology adopted by orthodox economists in favor of a substantivist methodology (Stanfield 1986). In the formalist methodology, ...

Working Paper No. 86 - Levy Economics Institute of Bard College

... transactions costs. Further, “fairground barter” replaced “isolated barter” because this ...

... transactions costs. Further, “fairground barter” replaced “isolated barter” because this ...

Central banking in an open economy: Rist and

... underlines the risk faced by banks when they over-issue bank notes, because they have to convert, on demand, bank notes against gold: From this point of view a banker‟s business may be regarded as composed chiefly of dealings in “options” and “futures” in gold. A bank credit is an option to buy gold ...

... underlines the risk faced by banks when they over-issue bank notes, because they have to convert, on demand, bank notes against gold: From this point of view a banker‟s business may be regarded as composed chiefly of dealings in “options” and “futures” in gold. A bank credit is an option to buy gold ...

1 David Hume and Irving Fisher on the Quantity Theory of Money in

... expensive, imports would rise to the disadvantage of exports and our money would be spread among all our neighbours. It does not seem that money, any more than water, can be raised or lowered much beyond the level it has in places where communication is open, but that it must rise and fall in pro ...

... expensive, imports would rise to the disadvantage of exports and our money would be spread among all our neighbours. It does not seem that money, any more than water, can be raised or lowered much beyond the level it has in places where communication is open, but that it must rise and fall in pro ...

and Quantity Theory of Money

... The immediate effect of an increase in the money supply is to create an excess supply of money. (Once again, please be reminded that increase in money supply does not mean that it automatically increases the money holding by the people. It must go through the process that interest rates lower and mo ...

... The immediate effect of an increase in the money supply is to create an excess supply of money. (Once again, please be reminded that increase in money supply does not mean that it automatically increases the money holding by the people. It must go through the process that interest rates lower and mo ...

“Neutrality of money” versus “stability of the price level” – issues of

... “Those who try to define the monetary requirements of an economy either by the value of the turn-over of commodities in a certain period, or by the maximum amount of payments which have to be met (simultaneously!) within any one period, or finally by the „velocity‟ of circulation of money, misjudge ...

... “Those who try to define the monetary requirements of an economy either by the value of the turn-over of commodities in a certain period, or by the maximum amount of payments which have to be met (simultaneously!) within any one period, or finally by the „velocity‟ of circulation of money, misjudge ...

Mankiw 5/e Chapter 18: Money Supply & Money Demand

... 4. Portfolio theories of money demand stress the store of value function posit that money demand depends on risk/return of money & alternative assets 5. The Baumol-Tobin model is an example of the transactions theories of money demand, stresses “medium of ...

... 4. Portfolio theories of money demand stress the store of value function posit that money demand depends on risk/return of money & alternative assets 5. The Baumol-Tobin model is an example of the transactions theories of money demand, stresses “medium of ...

File - Business at Sias

... • If interest rates are below this normal level, then individuals will expect them to rise – As interest rates rise, the price of bonds will decrease and they will suffer a capital loss – Individuals are more likely to hold their wealth as money rather than bonds ...

... • If interest rates are below this normal level, then individuals will expect them to rise – As interest rates rise, the price of bonds will decrease and they will suffer a capital loss – Individuals are more likely to hold their wealth as money rather than bonds ...

Recent Arguments against the Gold Standard Executive Summary by Lawrence H. White

... price volatility” makes it unsuitable to “provide a basis for international commercial and financial transactions on a twenty-firstcentury scale.”15 Klein declares, “The problems with the gold standard are legion, but the most obvious is that our currency fluctuates with the global price of gold as ...

... price volatility” makes it unsuitable to “provide a basis for international commercial and financial transactions on a twenty-firstcentury scale.”15 Klein declares, “The problems with the gold standard are legion, but the most obvious is that our currency fluctuates with the global price of gold as ...

The Monetary Transmission Mechanism in Pre

... used in retail transactions. Meanwhile, silver was circulated as the medium of exchange in wholesale commerce, long-distance trade and tax payments because of its high value. Silver was used as bullion bars, or in the form of imported foreign coins (Leavens, 1939) With the development of Chinese eco ...

... used in retail transactions. Meanwhile, silver was circulated as the medium of exchange in wholesale commerce, long-distance trade and tax payments because of its high value. Silver was used as bullion bars, or in the form of imported foreign coins (Leavens, 1939) With the development of Chinese eco ...

Did France Cause the Great Depression?

... gold standard. One concern at the time was that there would be insufficient new gold production to keep up with the growing demand for gold, thereby producing deflation. Because the nominal price of gold was fixed in terms of national currencies, a decrease in the supply of gold would manifest itsel ...

... gold standard. One concern at the time was that there would be insufficient new gold production to keep up with the growing demand for gold, thereby producing deflation. Because the nominal price of gold was fixed in terms of national currencies, a decrease in the supply of gold would manifest itsel ...

(Accounting Enquiries Volume 10 No. 2 Spring/Summer

... recent example of monetary dislocation - the flight from the domestic currency (the ruble) into foreign exchange [Sachs and Woo 1994, 127]. In the absence of monetary dislocation, while changing demand and supply conditions for goods and services will produce different general price levels, nominal ...

... recent example of monetary dislocation - the flight from the domestic currency (the ruble) into foreign exchange [Sachs and Woo 1994, 127]. In the absence of monetary dislocation, while changing demand and supply conditions for goods and services will produce different general price levels, nominal ...

Historical Validity of Money.wps

... Gold and silver coins were in this category since they not only were circulated but were ornate objects. However, in recent times most economies are based upon fiduciary (fiat) money. Owing to its assured (certain) nominal value, paper money currently provides a level of predictability which would b ...

... Gold and silver coins were in this category since they not only were circulated but were ornate objects. However, in recent times most economies are based upon fiduciary (fiat) money. Owing to its assured (certain) nominal value, paper money currently provides a level of predictability which would b ...

Sectoral Analysis

... The government can fully control H: as will be seen, the monetary authority affects H mostly through the Open Market Operation (OMO). The central bank does have other means of controlling H such as the `Switching Operation' (= Withdrawal and Re-deposits of the central bank's account with the commerc ...

... The government can fully control H: as will be seen, the monetary authority affects H mostly through the Open Market Operation (OMO). The central bank does have other means of controlling H such as the `Switching Operation' (= Withdrawal and Re-deposits of the central bank's account with the commerc ...

Money and the Payments System

... it used to!” They really mean that the purchasing power of a dollar has fallen, that a given amount of money will buy a smaller quantity of the same goods and services in the economy than it once did. Just how much has the dollar shrunk? Consider the quantity of real goods and services that $1.00 wo ...

... it used to!” They really mean that the purchasing power of a dollar has fallen, that a given amount of money will buy a smaller quantity of the same goods and services in the economy than it once did. Just how much has the dollar shrunk? Consider the quantity of real goods and services that $1.00 wo ...

the magic triangle and its implications for barter

... credit and debit balance) are a preferable transactional tool to actual money, with its inflational acceleration. The interest-free bartering of transactional units greatly reduces transactional costs in comparison with bank credit money charged with interest. Bibliography recommended for this secti ...

... credit and debit balance) are a preferable transactional tool to actual money, with its inflational acceleration. The interest-free bartering of transactional units greatly reduces transactional costs in comparison with bank credit money charged with interest. Bibliography recommended for this secti ...

Gold, Fiat Money and Price Stability

... made by legislators and prominent economists.1 Perhaps the most well known is the compensated dollar proposal made by Fisher (1913) himself. Since the end of the gold standard, many economists have argued that a fiat money regime based on credible rules for low inflation could do better than commodi ...

... made by legislators and prominent economists.1 Perhaps the most well known is the compensated dollar proposal made by Fisher (1913) himself. Since the end of the gold standard, many economists have argued that a fiat money regime based on credible rules for low inflation could do better than commodi ...

Coin's Financial School

Coin's Financial School was a popular pamphlet written in 1894 that helped popularize the free silver and populist movements. The author of the text ""Coin"", William Hope Harvey, would later go on to aid William Jennings Bryan in his bid for the presidency and would run for the presidency himself in the 1930s. The book was remarkably popular in its day, selling an estimated 1 million copies.The thesis of Coin's Financial School is that London arranged the end of the free coinage of silver in 1873 because they had gold cornered and thus the large Civil War debt became payable in gold instead of silver. The Coinage Act of 1873 demonetized silver by allowing repayment of all debts in gold or silver at the option of the holder of the debt. The deflation resulting from the immediate removal of a significant portion of the nation's money supply affected agriculture and business severely.