• Lesson 21-2 ACTIVITY 21 Learning Targets:

... will give them a top rating. If 85% of the customers are extremely happy with their work, how many customers out of 120 should they expect to be extremely happy? d. The loan that Nate and Isaac got from their parents was at 2% interest for one year. How much will the boys pay in interest on their lo ...

... will give them a top rating. If 85% of the customers are extremely happy with their work, how many customers out of 120 should they expect to be extremely happy? d. The loan that Nate and Isaac got from their parents was at 2% interest for one year. How much will the boys pay in interest on their lo ...

economic insight GREATER CHINA Quarterly briefing Q3 2013

... Source: Chinese National Bureau of Statistics, Cebr analysis ...

... Source: Chinese National Bureau of Statistics, Cebr analysis ...

Chapter 3

... Interest rates typically vary by maturity The term structure of interest rates defines the relationship between maturity and yield • The Yield Curve is the plot of current interest yields versus time to maturity ...

... Interest rates typically vary by maturity The term structure of interest rates defines the relationship between maturity and yield • The Yield Curve is the plot of current interest yields versus time to maturity ...

Going Into Debt $$$

... Bankruptcy – the inability to pay debts based on the income received Buying on credit is a serious consumer activity During bankruptcy creditors must give up much of what they own and are still responsible to pay certain debts (taxes). Personal bankruptcy remains on your record for 10 years and make ...

... Bankruptcy – the inability to pay debts based on the income received Buying on credit is a serious consumer activity During bankruptcy creditors must give up much of what they own and are still responsible to pay certain debts (taxes). Personal bankruptcy remains on your record for 10 years and make ...

PDF - Nedgroup Investments

... money after paying taxes but no income. So he won’t sell and others, who want or need more return than a conservative investment might yield, are liquidating those investments for even more risky propositions. It’s an unusual environment we find ourselves in, much of it thanks to extraordinary Fed p ...

... money after paying taxes but no income. So he won’t sell and others, who want or need more return than a conservative investment might yield, are liquidating those investments for even more risky propositions. It’s an unusual environment we find ourselves in, much of it thanks to extraordinary Fed p ...

CHAP1.WP (Word5)

... provide the channel of funds from savers to borrowers between all sectors of the economy, it is the very mechanism that facilitates the economy’s “circular flow of income” described in Chapter 2. Thus, it would be reasonable to expect that the effects of financial crisis not only impact the economy ...

... provide the channel of funds from savers to borrowers between all sectors of the economy, it is the very mechanism that facilitates the economy’s “circular flow of income” described in Chapter 2. Thus, it would be reasonable to expect that the effects of financial crisis not only impact the economy ...

2007 First Quarter Newsletter

... A major concern of many US investors is housing prices. However, in October, sales of existing homes increased 0.5%, which was the first monthly gain since February of last year, and new home sales rose 3.2%. This could possibly be an indicator that housing has seen the bottom and is starting to rec ...

... A major concern of many US investors is housing prices. However, in October, sales of existing homes increased 0.5%, which was the first monthly gain since February of last year, and new home sales rose 3.2%. This could possibly be an indicator that housing has seen the bottom and is starting to rec ...

Introduction to Elliott Wave

... according to the FXCM SSI which measures the positioning of thousands of retail traders. However, the higher the number of short orders in a bear market the more dangerous is to take additional short positions because many traders are leaving their stop losses just above the current price action. Th ...

... according to the FXCM SSI which measures the positioning of thousands of retail traders. However, the higher the number of short orders in a bear market the more dangerous is to take additional short positions because many traders are leaving their stop losses just above the current price action. Th ...

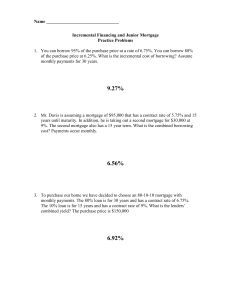

Adjustable Rate Mortgage

... offered for sale at $1,875,000 with special financing arranged by the seller. The seller is offering the property at 5.5% amortized over 15 years assuming a down payment of 20% is included up front. A balloon payment will be required in 5 years. Assuming you go to the bank and take out a mortgage wi ...

... offered for sale at $1,875,000 with special financing arranged by the seller. The seller is offering the property at 5.5% amortized over 15 years assuming a down payment of 20% is included up front. A balloon payment will be required in 5 years. Assuming you go to the bank and take out a mortgage wi ...

II. Domestic Economic Outlook 2

... rebounded again. The recent volatility in portfolio flows to Turkey was higher than that experienced after the Euro area debt crisis in 2011 (Chart II.1). The current account deficit (CAD) makes the domestic economy more vulnerable to capital flows. Even if a slight deterioriation was observed in cu ...

... rebounded again. The recent volatility in portfolio flows to Turkey was higher than that experienced after the Euro area debt crisis in 2011 (Chart II.1). The current account deficit (CAD) makes the domestic economy more vulnerable to capital flows. Even if a slight deterioriation was observed in cu ...

Document

... • There should be an adequate number of buyers and sellers such that all market participants are pricetakers • The primary market (for all issuance) should have a large number of participants • Valuations in the secondary market should be transparent and liquid enough to allow easy exit • The bid-as ...

... • There should be an adequate number of buyers and sellers such that all market participants are pricetakers • The primary market (for all issuance) should have a large number of participants • Valuations in the secondary market should be transparent and liquid enough to allow easy exit • The bid-as ...

CH17

... C) any gold that it owns and foreign and domestic assets. D) any silver that it owns and foreign and domestic assets. 2.The liabilities side of a central bank include A)deposits held by the private banks. B) currency in circulation. C) deposits held by the private banks and currency in circulation. ...

... C) any gold that it owns and foreign and domestic assets. D) any silver that it owns and foreign and domestic assets. 2.The liabilities side of a central bank include A)deposits held by the private banks. B) currency in circulation. C) deposits held by the private banks and currency in circulation. ...

Bond insurers and the markets

... cities, universities and the like to raise long-term funds, much of it from individuals. Were the monolines to lose their top-notch ratings, they fear, many issuers could struggle to meet higher funding costs. Municipal borrowers are already being affected by the lack of confidence in the insurers. ...

... cities, universities and the like to raise long-term funds, much of it from individuals. Were the monolines to lose their top-notch ratings, they fear, many issuers could struggle to meet higher funding costs. Municipal borrowers are already being affected by the lack of confidence in the insurers. ...

EU MONETARY AND FISCAL POLICY TOPICS IN ECONOMIC …

... given quantity of money (mortgage, etc) • 2) It’s what I give up in order to be able to hold money in my pocket (= liquidity) : opportunity cost. Raising the interest rate makes money more expensive (so it cools down the economy) Decreasing the interest rate makes money cheaper (so it boosts the eco ...

... given quantity of money (mortgage, etc) • 2) It’s what I give up in order to be able to hold money in my pocket (= liquidity) : opportunity cost. Raising the interest rate makes money more expensive (so it cools down the economy) Decreasing the interest rate makes money cheaper (so it boosts the eco ...

POLICY CONFUSION, CROWDED TRADES, AND A RISE IN Highlights

... As we begin to see nascent signs of wage inflation, there are also secular dynamics at play (in the energy sector, in particular) that are creating what might be termed “positive disinflation.” Specifically, since mid-2014 we have seen commodity prices decline across the board, resulting in an effec ...

... As we begin to see nascent signs of wage inflation, there are also secular dynamics at play (in the energy sector, in particular) that are creating what might be termed “positive disinflation.” Specifically, since mid-2014 we have seen commodity prices decline across the board, resulting in an effec ...

Biggest Player

... - Provides credit analysis services for corporates, project finances, public financings and financial service companies. ...

... - Provides credit analysis services for corporates, project finances, public financings and financial service companies. ...

Indian Banking Industry: Regulatory Challenges

... The sixth challenge relates to the Basel III proposal for countercyclical capital buffers for the banking system. The primary aim of the buffer is to achieve the broader macro prudential goal of protecting the banking sector from periods of excess aggregate credit growth which are often associated w ...

... The sixth challenge relates to the Basel III proposal for countercyclical capital buffers for the banking system. The primary aim of the buffer is to achieve the broader macro prudential goal of protecting the banking sector from periods of excess aggregate credit growth which are often associated w ...