- FRASER (St.Louis Fed)

... for government securities. Of course, since equities involve credit risk and government bonds do not, equities ought to pay more on average. However, the advantage of stocks has ...

... for government securities. Of course, since equities involve credit risk and government bonds do not, equities ought to pay more on average. However, the advantage of stocks has ...

CHAPTER 6 Risk, Return, and the Capital Asset Pricing Model 1

... Portfolio expected return (9.6%) is between Alta (17.4%) and Repo (1.7%) Portfolio standard deviation is much lower than: ...

... Portfolio expected return (9.6%) is between Alta (17.4%) and Repo (1.7%) Portfolio standard deviation is much lower than: ...

lecture 02 - risk and return relationship

... Is the new project crucial to the firm’s performance and how does it fit with the firm business strategy? Does the startup possess or have access to the necessary expertise/experience to successfully complete the project? What is the level of resources to be committed? What is the expected risk-retu ...

... Is the new project crucial to the firm’s performance and how does it fit with the firm business strategy? Does the startup possess or have access to the necessary expertise/experience to successfully complete the project? What is the level of resources to be committed? What is the expected risk-retu ...

officer`s certificate

... , a duly authorized officer of (“Customer”), understanding that the NYISO is relying on this certification as evidence that Customer meets the minimum participation requirements set forth in Section 26.1 of Attachment K to the NYISO Market Administration and Control Area Services Tariff, hereby cert ...

... , a duly authorized officer of (“Customer”), understanding that the NYISO is relying on this certification as evidence that Customer meets the minimum participation requirements set forth in Section 26.1 of Attachment K to the NYISO Market Administration and Control Area Services Tariff, hereby cert ...

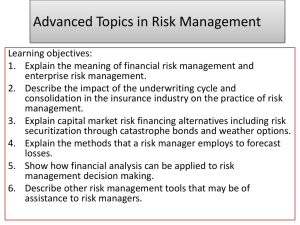

Advanced Topics in Risk Management

... Loss-control investments are undertaken in an effort to reduce the frequency and severity of losses. Such investments can be analyzed from a capital budgeting perspective by employing time value of money analysis. Capital budgeting : a method of determining which capital investment projects a compan ...

... Loss-control investments are undertaken in an effort to reduce the frequency and severity of losses. Such investments can be analyzed from a capital budgeting perspective by employing time value of money analysis. Capital budgeting : a method of determining which capital investment projects a compan ...

On the Construction of an Early-Warning System for Systematic Risk

... M 1 = A1B1 = (a11, a12, a13, a14, a15)(b11, b12, b13, b14, b15)T = (m11, m12, m13, m14, m15) M 2 = A2 B 2 = (a 21, a 22, a 23, a 24, a 25)(b 21, b 22, b 23, b 24, b 25)T = (m 21, m 22, m 23, m 24, m 25) M 3 = A3 B3 = (a 31, a 32, a33, a34)(b31, b32, b33, b34)T = (m31, m32, m33, m34) M 4 = A4 B 4 = ( ...

... M 1 = A1B1 = (a11, a12, a13, a14, a15)(b11, b12, b13, b14, b15)T = (m11, m12, m13, m14, m15) M 2 = A2 B 2 = (a 21, a 22, a 23, a 24, a 25)(b 21, b 22, b 23, b 24, b 25)T = (m 21, m 22, m 23, m 24, m 25) M 3 = A3 B3 = (a 31, a 32, a33, a34)(b31, b32, b33, b34)T = (m31, m32, m33, m34) M 4 = A4 B 4 = ( ...

Portfolio Analysis and Theory in a Nutshell

... • If systematic risk is priced, than high beta stocks should have an average return, over the ups and downs in the market, higher than the market index. • The high Beta stock has greater systematic risk because when the market goes down the high Beta stock will go down even more. • However, in theor ...

... • If systematic risk is priced, than high beta stocks should have an average return, over the ups and downs in the market, higher than the market index. • The high Beta stock has greater systematic risk because when the market goes down the high Beta stock will go down even more. • However, in theor ...

Lecture Presentation to accompany Investment Analysis & Portfolio

... Country risk (also called political risk) refers to the uncertainty of returns caused by the possibility of a major change in the political or economic environment in a country. Individuals who invest in countries that have unstable political-economic systems must include a country risk-premium ...

... Country risk (also called political risk) refers to the uncertainty of returns caused by the possibility of a major change in the political or economic environment in a country. Individuals who invest in countries that have unstable political-economic systems must include a country risk-premium ...

(DOC file) No 177/2006 amending Rules No 530/2004

... These Rules specify the criteria applied by the Financial Supervisory Authority (FME) for assessing levels of exposure and the need to request capital adequacy ratios above 8% for financial undertakings. Article 2 The weighted overall grade of a financial undertaking must on average be lower than 2. ...

... These Rules specify the criteria applied by the Financial Supervisory Authority (FME) for assessing levels of exposure and the need to request capital adequacy ratios above 8% for financial undertakings. Article 2 The weighted overall grade of a financial undertaking must on average be lower than 2. ...

1 - JustAnswer

... 2. For the risk-averse financial manager, the more risky a given course of action, the higher the expected return must be. (True/False) TRUE 3. The corporation is the best form of organization in terms of raising capital? True/False TRUE ...

... 2. For the risk-averse financial manager, the more risky a given course of action, the higher the expected return must be. (True/False) TRUE 3. The corporation is the best form of organization in terms of raising capital? True/False TRUE ...

docx - Minds on the Markets

... inflationary period, $1 will not be able to buy as much as it did previously. In other words, one dollar today will not be able to buy as much as a year from now. Inflation Risk The rate of inflation is more than investors expected. Had they known, they would have demanded a higher coupon. ...

... inflationary period, $1 will not be able to buy as much as it did previously. In other words, one dollar today will not be able to buy as much as a year from now. Inflation Risk The rate of inflation is more than investors expected. Had they known, they would have demanded a higher coupon. ...

chapter 27 powerpoint abridged for students

... The high and low returns average out, so the portfolio is likely to earn an intermediate return more consistently than any of the assets it contains. THE BASIC TOOLS OF FINANCE ...

... The high and low returns average out, so the portfolio is likely to earn an intermediate return more consistently than any of the assets it contains. THE BASIC TOOLS OF FINANCE ...

Expected Return Standard Deviation Increasing Utility

... A review of Portfolio Mathematics Example: Suppose that the value of the Best Candy stock is sensitive to the price of sugar. In years when world sugar crops are low, the price of sugar increases and Best Candy suffers considerable ...

... A review of Portfolio Mathematics Example: Suppose that the value of the Best Candy stock is sensitive to the price of sugar. In years when world sugar crops are low, the price of sugar increases and Best Candy suffers considerable ...

Equity Investment Approach - Retirement Income Management

... keeping risk at a manageable level. In the stock arena, we can diversify away non-systematic risk by allocating to multiple securities across industries and sizes of companies. Longstanding literature will tell us that most of the elimination of non-systematic risk can be accomplished by holding 10- ...

... keeping risk at a manageable level. In the stock arena, we can diversify away non-systematic risk by allocating to multiple securities across industries and sizes of companies. Longstanding literature will tell us that most of the elimination of non-systematic risk can be accomplished by holding 10- ...

Press release

... BI remains the top peril in the Allianz Risk Barometer for the fourth year in succession with 38% of responses. Indeed BI losses for businesses are increasing, typically accounting for a much higher proportion of the overall loss than a decade ago and often substantially exceeding the direct propert ...

... BI remains the top peril in the Allianz Risk Barometer for the fourth year in succession with 38% of responses. Indeed BI losses for businesses are increasing, typically accounting for a much higher proportion of the overall loss than a decade ago and often substantially exceeding the direct propert ...

Systemic Risk and Sentiment

... below 30. During 2002, it rose to about 40 and then fell sharply to about 21. Between 2003 and late 2007, the crash confidence index trended up, peaking just Below 60. During the decline, crash confidence fell to the mid 30s, where it remained until the Lehman Brothers bankruptcy. After the bankrupt ...

... below 30. During 2002, it rose to about 40 and then fell sharply to about 21. Between 2003 and late 2007, the crash confidence index trended up, peaking just Below 60. During the decline, crash confidence fell to the mid 30s, where it remained until the Lehman Brothers bankruptcy. After the bankrupt ...

Interrogatories

... ___________________________________________________________________________ ___________________________________________________________________________ 2. If the company is part of any holding company system, attach hereto a complete organization chart listing all related entities (may be omitted if ...

... ___________________________________________________________________________ ___________________________________________________________________________ 2. If the company is part of any holding company system, attach hereto a complete organization chart listing all related entities (may be omitted if ...

Risks, opportunities and trends in corporate governance

... tax’ debate in at least four respects: 1. As owners of companies that in turn pay tax, investors have a vested interest in any activity affecting profitability; 2. reputational and commercial risks arising from aggressive tax avoidance can form part of the battery of risks investors should monitor a ...

... tax’ debate in at least four respects: 1. As owners of companies that in turn pay tax, investors have a vested interest in any activity affecting profitability; 2. reputational and commercial risks arising from aggressive tax avoidance can form part of the battery of risks investors should monitor a ...

Omega:A Sharper Ratio

... Go away and think about implied volatilities derived from option prices Go away and think about Merton based models of Credit When these are based upon equity prices, you will need to calibrate for both the likelihood and volatility of the likelihood of default. Go away and think about where the exc ...

... Go away and think about implied volatilities derived from option prices Go away and think about Merton based models of Credit When these are based upon equity prices, you will need to calibrate for both the likelihood and volatility of the likelihood of default. Go away and think about where the exc ...

Presentation title

... subject to change without notice. This document is for information purposes only. It does not constitute any offer, recommendation or solicitation to any person to enter into any transaction or adopt any hedging, trading or investment strategy, nor does it constitute any prediction of likely future ...

... subject to change without notice. This document is for information purposes only. It does not constitute any offer, recommendation or solicitation to any person to enter into any transaction or adopt any hedging, trading or investment strategy, nor does it constitute any prediction of likely future ...

2009 Pillar 3 - Sucden Financial

... The European Union Capital Requirements Directive came into effect on the 1st January 2007, introducing consistent adequate capital adequacy standards in the EU based on the Basel II rules. Implementation of the Directive in the UK was by way of rules introduced by the Financial Services Authority. ...

... The European Union Capital Requirements Directive came into effect on the 1st January 2007, introducing consistent adequate capital adequacy standards in the EU based on the Basel II rules. Implementation of the Directive in the UK was by way of rules introduced by the Financial Services Authority. ...

Agriculture Risk Management - Western Region Colorado State

... ◦ Willing to accept some probability of lower income or losses for the opportunity of higher income. ◦ Individuals between risk adverse and risk preferring. ◦ They choose the decision with the highest expected return. ...

... ◦ Willing to accept some probability of lower income or losses for the opportunity of higher income. ◦ Individuals between risk adverse and risk preferring. ◦ They choose the decision with the highest expected return. ...

Correlation of Risks, Integrating Risk Measurement – Risk

... An enterprise is a portfolio of businesses, defined in terms of business processes, not only as corporate entities ERM should not only aggregate the balance sheet risks ERM should consider the correlation of business risks of the business processes Implications to ERM ...

... An enterprise is a portfolio of businesses, defined in terms of business processes, not only as corporate entities ERM should not only aggregate the balance sheet risks ERM should consider the correlation of business risks of the business processes Implications to ERM ...

Risk

Risk is potential of losing something of value. Values (such as physical health, social status, emotional well being or financial wealth) can be gained or lost when taking risk resulting from a given action, activity and/or inaction, foreseen or unforeseen. Risk can also be defined as the intentional interaction with uncertainty. Uncertainty is a potential, unpredictable, unmeasurable and uncontrollable outcome, risk is a consequence of action taken in spite of uncertaintyRisk perception is the subjective judgment people make about the severity and/or probability of a risk, and may vary person to person. Any human endeavor carries some risk, but some are much riskier than others.