Solvency II – San Diego

... - but focus is more on modeling, looking to the particular circumstances of the individual insurer, (- information in FCR&ILVR) • Requirement to follow the “relevant professional standard” (PS300 for liabilities) where no conflict - so wording of that also important. (Where there is overlap, general ...

... - but focus is more on modeling, looking to the particular circumstances of the individual insurer, (- information in FCR&ILVR) • Requirement to follow the “relevant professional standard” (PS300 for liabilities) where no conflict - so wording of that also important. (Where there is overlap, general ...

ART can mitigate economic fallout

... place benefit accordingly. In this context, capacity aggregation is essentially about taking big deductibles on risks where risk management is well controlled and financing this by using multi-year solutions with real risk transfer, which is given on predetermined reinstatement ...

... place benefit accordingly. In this context, capacity aggregation is essentially about taking big deductibles on risks where risk management is well controlled and financing this by using multi-year solutions with real risk transfer, which is given on predetermined reinstatement ...

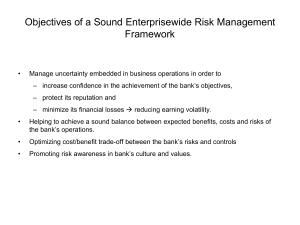

Objectives of a Sound Enterprisewide Risk

... Objectives of a Sound Enterprisewide Risk Management Framework ...

... Objectives of a Sound Enterprisewide Risk Management Framework ...

The Upside of Pooling Regulation

... Strict Filing Requirements -Required forms (signatures needed) -Minimum Documentation (Justification): Three years of premium and loss information and; Explanation of rate-making procedures; including at least one: • A description of any statistical and actuarial methods used • A statement of facts ...

... Strict Filing Requirements -Required forms (signatures needed) -Minimum Documentation (Justification): Three years of premium and loss information and; Explanation of rate-making procedures; including at least one: • A description of any statistical and actuarial methods used • A statement of facts ...

On Regulation of Financial Institutions – 07/11/97

... NOW, THEREFORE, BE IT RESOLVED, that the National Conference of Insurance Legislators (NCOIL) joins with the National Conference of State Legislatures (NCSL) and the National Association of Insurance Commissioners (NAIC) to support such functional regulation of the financial services industry becaus ...

... NOW, THEREFORE, BE IT RESOLVED, that the National Conference of Insurance Legislators (NCOIL) joins with the National Conference of State Legislatures (NCSL) and the National Association of Insurance Commissioners (NAIC) to support such functional regulation of the financial services industry becaus ...

Assignment #1 File

... Question1.a. Tom, age 32, is a bookkeeper. Tom believes that he will have average annual earnings of $80,000 per year up until he retires in 30 years. Roughly 50 percent of Tom’s average annual earnings are used to pay taxes, insurance premiums, and for self-maintenance; with the balance available f ...

... Question1.a. Tom, age 32, is a bookkeeper. Tom believes that he will have average annual earnings of $80,000 per year up until he retires in 30 years. Roughly 50 percent of Tom’s average annual earnings are used to pay taxes, insurance premiums, and for self-maintenance; with the balance available f ...

Longevity risk transfer markets: market structure, growth drivers and

... fund management and investment and then builds the management skills associated with the application of these techniques. The training includes the derivation and application of ‘mortality tables’ used to assess probabilities of death or survival. It also includes the financial mathematics of intere ...

... fund management and investment and then builds the management skills associated with the application of these techniques. The training includes the derivation and application of ‘mortality tables’ used to assess probabilities of death or survival. It also includes the financial mathematics of intere ...

X - Department of Mathematics | Illinois State University

... online seminar: http://smartURL.it/onlineactuary If you find these exercises valuable, please consider buying the manual or attending our seminar, and if you can’t, please consider making a donation to the Actuarial Program at Illinois State University: https://www.math.ilstu.edu/actuary/giving/ Don ...

... online seminar: http://smartURL.it/onlineactuary If you find these exercises valuable, please consider buying the manual or attending our seminar, and if you can’t, please consider making a donation to the Actuarial Program at Illinois State University: https://www.math.ilstu.edu/actuary/giving/ Don ...

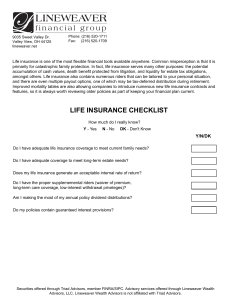

life insurance checklist - Lineweaver Financial Group

... Life insurance is one of the most flexible financial tools available anywhere. Common misperception is that it is primarily for catastrophic family protection. In fact, life insurance serves many other purposes: the potential accumulation of cash values, death benefit protected from litigation, and ...

... Life insurance is one of the most flexible financial tools available anywhere. Common misperception is that it is primarily for catastrophic family protection. In fact, life insurance serves many other purposes: the potential accumulation of cash values, death benefit protected from litigation, and ...

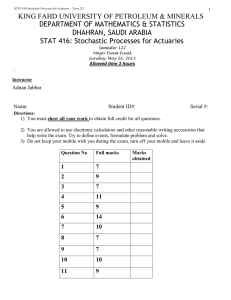

Final - Academic Information System (KFUPM AISYS)

... 1) You must show all your work to obtain full credit for all questions. 2) You are allowed to use electronic calculators and other reasonable writing accessories that help write the exam. Try to define events, formulate problem and solve. 3) Do not keep your mobile with you during the exam, turn off ...

... 1) You must show all your work to obtain full credit for all questions. 2) You are allowed to use electronic calculators and other reasonable writing accessories that help write the exam. Try to define events, formulate problem and solve. 3) Do not keep your mobile with you during the exam, turn off ...

Global insurance regulation and systemic risk

... The insurance business model has specific features that make it a source of stability in the financial system ...

... The insurance business model has specific features that make it a source of stability in the financial system ...

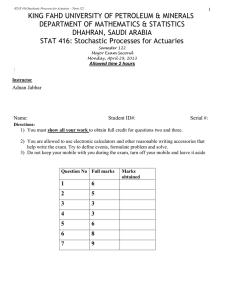

Exam2 - Academic Information System (KFUPM AISYS)

... 1) You must show all your work to obtain full credit for questions two and three. 2) You are allowed to use electronic calculators and other reasonable writing accessories that help write the exam. Try to define events, formulate problem and solve. 3) Do not keep your mobile with you during the exam ...

... 1) You must show all your work to obtain full credit for questions two and three. 2) You are allowed to use electronic calculators and other reasonable writing accessories that help write the exam. Try to define events, formulate problem and solve. 3) Do not keep your mobile with you during the exam ...

Law for Business

... What is a Insurance? Protection against financial loss Insurance companies share risk and charge a premium which represents their estimate of average losses plus a competitive profit The contract outlining payments between you and the insurance company is known as a policy ...

... What is a Insurance? Protection against financial loss Insurance companies share risk and charge a premium which represents their estimate of average losses plus a competitive profit The contract outlining payments between you and the insurance company is known as a policy ...

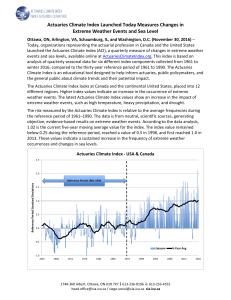

Actuaries Climate Index Launched Today Measures Changes in

... About the Sponsoring Organizations The American Academy of Actuaries is an 18,500+ member professional association whose mission is to serve the public and the U.S. actuarial profession. For more than 50 years, the Academy has assisted public policymakers on all levels by providing leadership, obje ...

... About the Sponsoring Organizations The American Academy of Actuaries is an 18,500+ member professional association whose mission is to serve the public and the U.S. actuarial profession. For more than 50 years, the Academy has assisted public policymakers on all levels by providing leadership, obje ...

Insurance

... Insurance • Insurance: an arrangement where a company or government agency provides guaranteed compensation in case of a certain event for a premium (payment). • This provides you with a certain financial protection. • Types of insurance: – Car, health, renters, life, liability (lawsuits), travel, d ...

... Insurance • Insurance: an arrangement where a company or government agency provides guaranteed compensation in case of a certain event for a premium (payment). • This provides you with a certain financial protection. • Types of insurance: – Car, health, renters, life, liability (lawsuits), travel, d ...

Continuing Care Retirement Communities Encounter Actuarial

... We actuaries have been striving for improved methods of ...

... We actuaries have been striving for improved methods of ...

The Society of Actuaries of Indonesia >> Membership

... The Society of Actuaries of Indonesia >> What are Major Roles of the Actuaries? • Major roles of pension (and employee benefit) actuaries are to perform statutory valuations, plan design, plan documentation, conversion and liquidation, training, and expense calculations for accounting purpose Dem ...

... The Society of Actuaries of Indonesia >> What are Major Roles of the Actuaries? • Major roles of pension (and employee benefit) actuaries are to perform statutory valuations, plan design, plan documentation, conversion and liquidation, training, and expense calculations for accounting purpose Dem ...

Actuary

An actuary is a business professional who deals with the measurement and management of risk and uncertainty (BeAnActuary 2011a). The name of the corresponding profession is actuarial science. These risks can affect both sides of the balance sheet, and require asset management, liability management, and valuation skills (BeAnActuary 2011b). Actuaries provide assessments of financial security systems, with a focus on their complexity, their mathematics, and their mechanisms (Trowbridge 1989, p. 7).While the concept of insurance dates to antiquity (Johnston 1903, §475–§476, Loan 1992, Lewin 2007, pp. 3–4), the mathematics and finance needed to scientifically measure and mitigate risks have their origins in the 17th century studies of probability and annuities (Heywood 1985). Actuaries of the 21st century require analytical skills, business knowledge, and an understanding of human behavior and information systems to design and manage programs that control risk (BeAnActuary 2011c). The actual steps needed to become an actuary are usually country-specific; however, almost all processes share a rigorous schooling or examination structure and take many years to complete (Feldblum 2001, p. 6, Institute and Faculty of Actuaries 2014).The profession has consistently ranked as one of the most desirable (Riley 2013). In various studies, being an actuary was ranked number one or two multiple times since 2010 (Thomas 2012, Weber 2013, CareerCast 2015).