benefits of alternative investments

... of benefits, they do have some risks. There will also be restrictions on accessing your investment funds as the Funds are non-liquid managed investment schemes. You can find more information on the types of assets available in the Fund and the risks of investing in the ...

... of benefits, they do have some risks. There will also be restrictions on accessing your investment funds as the Funds are non-liquid managed investment schemes. You can find more information on the types of assets available in the Fund and the risks of investing in the ...

The Evolution of Quantitative Investment Strategies

... its exposure to the overall market. The CAPM argued that only this source of nondiversifiable risk should be rewarded by the market. All other fluctuations in an individual security’s price, termed as diversifiable risk, will become very small if an investor holds a diversified portfolio, and should ...

... its exposure to the overall market. The CAPM argued that only this source of nondiversifiable risk should be rewarded by the market. All other fluctuations in an individual security’s price, termed as diversifiable risk, will become very small if an investor holds a diversified portfolio, and should ...

3. Market microstructure: inventory models

... - Constant relative risk aversion (CRRA): $1000 is not the same for all: U(W) = W1-a/(1 – a), a ≠ 1 = -ln(W), a=1 zCRRA (W) = -WU´´(W)/U´(W) = a is constant ...

... - Constant relative risk aversion (CRRA): $1000 is not the same for all: U(W) = W1-a/(1 – a), a ≠ 1 = -ln(W), a=1 zCRRA (W) = -WU´´(W)/U´(W) = a is constant ...

CR slides

... • Given the lack of predictive power of CR, a single indicator may not be enough. There are other indexes that may be also signal the true riskiness of a country –i.e., they can be correlated with the CR. • Popular indicators - A.T. Kearny: Globalizaton Index (it measures a country’s global links) - ...

... • Given the lack of predictive power of CR, a single indicator may not be enough. There are other indexes that may be also signal the true riskiness of a country –i.e., they can be correlated with the CR. • Popular indicators - A.T. Kearny: Globalizaton Index (it measures a country’s global links) - ...

Financial Investments and Stock Markets

... to create companies and institutions, and establish different projects, but they may not have the sufficient funds to do so. Individual savers, on the other hand, are those who have the money, but do not have the desire, knowledge or ability to invest it by themselves. Usually, savers belong to diff ...

... to create companies and institutions, and establish different projects, but they may not have the sufficient funds to do so. Individual savers, on the other hand, are those who have the money, but do not have the desire, knowledge or ability to invest it by themselves. Usually, savers belong to diff ...

how the p/e ratio can really help you

... The computation of the P/E ratio is simple arithmetic but it is not always done by using the correct and relevant figure of earnings. You should know the correct way of computing the ratio and should not uncritically accept the reported or published figures. For example: Earnings may include “extr ...

... The computation of the P/E ratio is simple arithmetic but it is not always done by using the correct and relevant figure of earnings. You should know the correct way of computing the ratio and should not uncritically accept the reported or published figures. For example: Earnings may include “extr ...

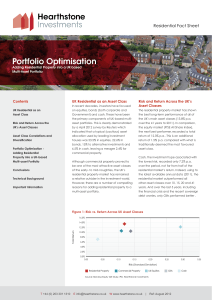

Portfolio Optimisation - Hearthstone Investments

... provided both a higher average total return and a lower level of risk than most other asset types. This in itself is counter-intuitive as it would be expected that in order to achieve a higher level of return, an investor must take additional risk. As shown in figure 1, however, this does not prove ...

... provided both a higher average total return and a lower level of risk than most other asset types. This in itself is counter-intuitive as it would be expected that in order to achieve a higher level of return, an investor must take additional risk. As shown in figure 1, however, this does not prove ...

Consumer Discretionary and Technology were April`s top performing

... Charts and graphs are provided for illustrative purposes. Past performance is not an indication or guarantee of future results. The charts and graphs may reflect hypothetical historical performance. All information presented prior to the launch date is back-tested. Back-tested performance is not act ...

... Charts and graphs are provided for illustrative purposes. Past performance is not an indication or guarantee of future results. The charts and graphs may reflect hypothetical historical performance. All information presented prior to the launch date is back-tested. Back-tested performance is not act ...

Study Guide Exit Exam

... Explain the three different types of market efficiency and its implications to abnormal returns. Calculate the beta and alpha of a common stock based on historical stock price data Explain the benefits of diversification Understand the difference between systematic and unsystematic risk. C ...

... Explain the three different types of market efficiency and its implications to abnormal returns. Calculate the beta and alpha of a common stock based on historical stock price data Explain the benefits of diversification Understand the difference between systematic and unsystematic risk. C ...

Finance Policy Supporting Organization

... (4) The portfolios need not maintain a cash balance among the assets, except as may be dictated for investment or operational reasons. All capital gains, interest, and dividends paid can be reinvested. G. In any separately managed accounts customized for HCCFSO, short sales, commodities transactions ...

... (4) The portfolios need not maintain a cash balance among the assets, except as may be dictated for investment or operational reasons. All capital gains, interest, and dividends paid can be reinvested. G. In any separately managed accounts customized for HCCFSO, short sales, commodities transactions ...

Mr Madoff`s Amazing Returns: An analysis of the Split Strike

... for the 215 month period. We ignore transaction costs and any price impact of the trades. In order to price the options we use the Black Scholes formula. As a proxy for the implied volatility we use we use the VIX to price both3 the call and put options. The average level of the VIX over this period ...

... for the 215 month period. We ignore transaction costs and any price impact of the trades. In order to price the options we use the Black Scholes formula. As a proxy for the implied volatility we use we use the VIX to price both3 the call and put options. The average level of the VIX over this period ...

Neuberger Berman Millennium Fund

... Because the prices of most growth stocks are based on future expectations, these stocks tend to be more "sensitive than value stocks to bad economic news and negative earnings surprises. Bad economic news or changing investor perceptions can negatively affect growth stocks across several industries ...

... Because the prices of most growth stocks are based on future expectations, these stocks tend to be more "sensitive than value stocks to bad economic news and negative earnings surprises. Bad economic news or changing investor perceptions can negatively affect growth stocks across several industries ...

Return On A Portfolio

... • With the assumption that stock returns can be described by a single market model, the number of estimated inputs required for the covariances reduces to the number of assets (one beta for each) plus one (the variance of the Index’s return) • No. of estimated inputs required for covariances: No. of ...

... • With the assumption that stock returns can be described by a single market model, the number of estimated inputs required for the covariances reduces to the number of assets (one beta for each) plus one (the variance of the Index’s return) • No. of estimated inputs required for covariances: No. of ...

Buy and Hold is Dead (Again)

... Nobel Prize winning work of Harry Markowitz, published in 1952 in a paper called, Portfolio Selection1, the industry has relied on Markowitz’s insight that portfolios can be built in an efficient manner that maximizes return for each incremental increase in the level of risk. Unfortunately the imple ...

... Nobel Prize winning work of Harry Markowitz, published in 1952 in a paper called, Portfolio Selection1, the industry has relied on Markowitz’s insight that portfolios can be built in an efficient manner that maximizes return for each incremental increase in the level of risk. Unfortunately the imple ...

Better portfolio evaluations – quantitative analysis to improve

... The visualization of the resulting valuation risk clearly highlights the portfolio clusters and single assets that require subsequent analysis and possible follow-up action, such as a revaluation of individual securities. We can also monitor security portfolios over time in terms of performance, fin ...

... The visualization of the resulting valuation risk clearly highlights the portfolio clusters and single assets that require subsequent analysis and possible follow-up action, such as a revaluation of individual securities. We can also monitor security portfolios over time in terms of performance, fin ...

Ch16 - NYU Stern

... institutional investors. When looking at less liquid technology stocks, held and traded primarily by individuals, you should be more cautious about using the conventional measures of risk. If you do assume that it is, in fact, appropriate to value technology stocks using the perspective of a well di ...

... institutional investors. When looking at less liquid technology stocks, held and traded primarily by individuals, you should be more cautious about using the conventional measures of risk. If you do assume that it is, in fact, appropriate to value technology stocks using the perspective of a well di ...

Exorbitant Privilege and Exorbitant Duty

... Table: Exorbitant Duty over Time. The table reports the results from an OLS regression of the U.S. net foreign asset position relative to GDP (nagdp) on the VIX index extended before 1986 with the volatility of the MSCI-ex US index. vagdp refers to the valuation component (relative to GDP) defined a ...

... Table: Exorbitant Duty over Time. The table reports the results from an OLS regression of the U.S. net foreign asset position relative to GDP (nagdp) on the VIX index extended before 1986 with the volatility of the MSCI-ex US index. vagdp refers to the valuation component (relative to GDP) defined a ...

The Effect of Credit Risk on Stock Returns

... clear if the size effect is a proxy for systematic risk or more true unknown factors correlated with size. In addition, also other academics (Reinganum, 1981; Blume & Stambaugh, 1983; Brown, Kleidon & Marsh, 1983; Chan et al., 1991; Fama & French, 1992) are confirming the size effect. Nowadays, no c ...

... clear if the size effect is a proxy for systematic risk or more true unknown factors correlated with size. In addition, also other academics (Reinganum, 1981; Blume & Stambaugh, 1983; Brown, Kleidon & Marsh, 1983; Chan et al., 1991; Fama & French, 1992) are confirming the size effect. Nowadays, no c ...

SmartMoney - Dyan Machan.com

... last winter’s abyss, and a reforming White House trying to restore some order to the Wild West of the markets with new regulation, we’re starting to regain confidence in our investments. But when it comes to our feelings about big-name investors—well, it’s going to take a lot of wooing to teach us h ...

... last winter’s abyss, and a reforming White House trying to restore some order to the Wild West of the markets with new regulation, we’re starting to regain confidence in our investments. But when it comes to our feelings about big-name investors—well, it’s going to take a lot of wooing to teach us h ...

(DOC file) No 177/2006 amending Rules No 530/2004

... Weighted overall rating from: Supplementary ratio, % ...

... Weighted overall rating from: Supplementary ratio, % ...

Document

... • MARKET ORDER: You buy or sell the stock at its current price • LIMIT ORDER: you specify the price you will buy or sell the stock price at – when and if the market price reaches your limit-order price, the order is executed • SELL SHORT: borrow from the the brokerage house and sells to another; Buy ...

... • MARKET ORDER: You buy or sell the stock at its current price • LIMIT ORDER: you specify the price you will buy or sell the stock price at – when and if the market price reaches your limit-order price, the order is executed • SELL SHORT: borrow from the the brokerage house and sells to another; Buy ...

Lower Middle Market Direct Lending

... market. The idea that risk, or even access to liquidity, is simply a function of a company’s size of revenue and EBITDA is misguided. This ignores critically important credit fundamentals, such as security type, structure, yield, leverage, covenants and market conditions. Beane found value in overlo ...

... market. The idea that risk, or even access to liquidity, is simply a function of a company’s size of revenue and EBITDA is misguided. This ignores critically important credit fundamentals, such as security type, structure, yield, leverage, covenants and market conditions. Beane found value in overlo ...

Money Market instruments

... • Understand risk profile. Be aware of how much you can afford to invest and how much losses you can afford to incur • Investor education. Understand how the product works before you invest. Do not invest in anything you do not understand or are not comfortable with • Long term to ride out cycles ...

... • Understand risk profile. Be aware of how much you can afford to invest and how much losses you can afford to incur • Investor education. Understand how the product works before you invest. Do not invest in anything you do not understand or are not comfortable with • Long term to ride out cycles ...

An Application on Merton Model in the Non

... Over the last 4 decades, a large number of structural models which is one broad category of credit risk models have been developed to estimate and price credit risk. The philosophy of these models, which goes back to Black-Scholes and Merton, is to consider corporate liabilities (equity and debt) as ...

... Over the last 4 decades, a large number of structural models which is one broad category of credit risk models have been developed to estimate and price credit risk. The philosophy of these models, which goes back to Black-Scholes and Merton, is to consider corporate liabilities (equity and debt) as ...

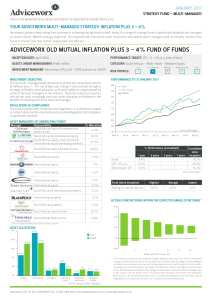

adviceworx old mutual inflation plus 3

... • Unit trusts are traded at ruling prices, may borrow to fund client disinvestments and may engage in scrip lending. The daily price is based on the current market value of the fund’s assets plus income minus expenses (NAV of the portfolio) divided by the number of units on issue. Daily prices are ...

... • Unit trusts are traded at ruling prices, may borrow to fund client disinvestments and may engage in scrip lending. The daily price is based on the current market value of the fund’s assets plus income minus expenses (NAV of the portfolio) divided by the number of units on issue. Daily prices are ...

Beta (finance)

In finance, the beta (β) of an investment is a measure of the risk arising from exposure to general market movements as opposed to idiosyncratic factors. The market portfolio of all investable assets has a beta of exactly 1. A beta below 1 can indicate either an investment with lower volatility than the market, or a volatile investment whose price movements are not highly correlated with the market. An example of the first is a treasury bill: the price does not go up or down a lot, so it has a low beta. An example of the second is gold. The price of gold does go up and down a lot, but not in the same direction or at the same time as the market.A beta greater than one generally means that the asset both is volatile and tends to move up and down with the market. An example is a stock in a big technology company. Negative betas are possible for investments that tend to go down when the market goes up, and vice versa. There are few fundamental investments with consistent and significant negative betas, but some derivatives like equity put options can have large negative betas.Beta is important because it measures the risk of an investment that cannot be reduced by diversification. It does not measure the risk of an investment held on a stand-alone basis, but the amount of risk the investment adds to an already-diversified portfolio. In the capital asset pricing model, beta risk is the only kind of risk for which investors should receive an expected return higher than the risk-free rate of interest.The definition above covers only theoretical beta. The term is used in many related ways in finance. For example, the betas commonly quoted in mutual fund analyses generally measure the risk of the fund arising from exposure to a benchmark for the fund, rather than from exposure to the entire market portfolio. Thus they measure the amount of risk the fund adds to a diversified portfolio of funds of the same type, rather than to a portfolio diversified among all fund types.Beta decay refers to the tendency for a company with a high beta coefficient (β > 1) to have its beta coefficient decline to the market beta. It is an example of regression toward the mean.