Business Economics Quiz 6B (EC:017, EC:082) NAME_____

... 5. __B___ The gross domestic product (GDP) is calculated each year in the United States to determine A. the level of exports. B. the health of the economy. C. whether income taxes should be lowered or raised. D. how much money should be printed during the year. 6.__C___ What often happens when a nat ...

... 5. __B___ The gross domestic product (GDP) is calculated each year in the United States to determine A. the level of exports. B. the health of the economy. C. whether income taxes should be lowered or raised. D. how much money should be printed during the year. 6.__C___ What often happens when a nat ...

still the word du jour - Thomas R. Brown Foundations

... Since 1962 the US has reached the debt ceiling 76 times 4 times we did not immediately raise the ceiling—but we always eventually did ...

... Since 1962 the US has reached the debt ceiling 76 times 4 times we did not immediately raise the ceiling—but we always eventually did ...

Colombia_en.pdf

... of GDP. In addition, the country’s finances will be hurt by both the higher price of the dollar, which pushes up the local-currency cost of dollar-denominated debt, and the steeper cost of external borrowing resulting from the financial crisis. Some uncertainty therefore surrounds the possibility of ...

... of GDP. In addition, the country’s finances will be hurt by both the higher price of the dollar, which pushes up the local-currency cost of dollar-denominated debt, and the steeper cost of external borrowing resulting from the financial crisis. Some uncertainty therefore surrounds the possibility of ...

agenda

... “ it is considered that social security schemes do not result in a contractual liability for the government, i.e., there is no direct link between the contributions made and the benefits eventually paid. Indeed, it is not uncommon for governments to change unilaterally the structure of benefits (e.g ...

... “ it is considered that social security schemes do not result in a contractual liability for the government, i.e., there is no direct link between the contributions made and the benefits eventually paid. Indeed, it is not uncommon for governments to change unilaterally the structure of benefits (e.g ...

INNOVATION

... From April 2010, a 50p rate of income tax on income above £150,000 and withdrawal of the personal allowance (PA) from incomes above £100,000, from April 2011, restriction of tax relief on their pension contributions for anyone who saves in a pension whose gross income is above £130,000 and whose inc ...

... From April 2010, a 50p rate of income tax on income above £150,000 and withdrawal of the personal allowance (PA) from incomes above £100,000, from April 2011, restriction of tax relief on their pension contributions for anyone who saves in a pension whose gross income is above £130,000 and whose inc ...

key challenges for economic policy

... Greece has recently had one of the highest public debt and deficit positions among Member countries, despite also having one of the strongest real growth performances (Handout, second and third page). The growth of public spending needs to be reined back sharply right away, with further consolidatio ...

... Greece has recently had one of the highest public debt and deficit positions among Member countries, despite also having one of the strongest real growth performances (Handout, second and third page). The growth of public spending needs to be reined back sharply right away, with further consolidatio ...

projected numbers of higher rate tax payers

... Revised projected numbers of higher rate taxpayers Projections for the public finances are based on the assumption that tax allowances and thresholds are indexed in line with retail price inflation. But earnings typically rise by more than inflation, which means that over time a higher proportion of ...

... Revised projected numbers of higher rate taxpayers Projections for the public finances are based on the assumption that tax allowances and thresholds are indexed in line with retail price inflation. But earnings typically rise by more than inflation, which means that over time a higher proportion of ...

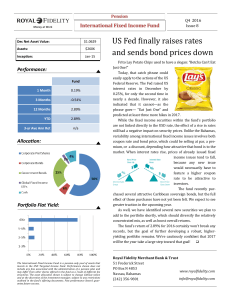

US Fed finally raises rates and sends bond prices down

... Federal Reserve. The Fed raised US interest rates in December by 0.25%, for only the second time in nearly a decade. However, it also indicated that it cannot—as the phrase goes— “Eat Just One” and predicted at least three more hikes in 2017. While the fixed income securities within the fund’s portf ...

... Federal Reserve. The Fed raised US interest rates in December by 0.25%, for only the second time in nearly a decade. However, it also indicated that it cannot—as the phrase goes— “Eat Just One” and predicted at least three more hikes in 2017. While the fixed income securities within the fund’s portf ...

Both Fiscal Policy

... Contractionary Fiscal Policy Loose Monetary Policy Tight Monetary Policy None of the above ...

... Contractionary Fiscal Policy Loose Monetary Policy Tight Monetary Policy None of the above ...

Barbados_en.pdf

... growth and create jobs. At the same time, the authorities sought to achieve fiscal consolidation, the aim being to reduce the fiscal deficit and the overall public debt within the shortest possible time. Responding to weak economic growth, the Central Bank maintained the loose monetary policy that i ...

... growth and create jobs. At the same time, the authorities sought to achieve fiscal consolidation, the aim being to reduce the fiscal deficit and the overall public debt within the shortest possible time. Responding to weak economic growth, the Central Bank maintained the loose monetary policy that i ...

Trustee Effectiveness: The Need for Strategic Choices

... on Pension Boards?” by Johann Weststar and Anil Verma (Forthcoming 2007, Labor Studies Journal) and “Just Having a Voice is Not Enough: Labour’s Voice on Pension Boards,” by Johanna Weststar and Anil Verma (Forthcoming as a chapter in Socially Responsible Investment of Union-Based Pension Funds, Jac ...

... on Pension Boards?” by Johann Weststar and Anil Verma (Forthcoming 2007, Labor Studies Journal) and “Just Having a Voice is Not Enough: Labour’s Voice on Pension Boards,” by Johanna Weststar and Anil Verma (Forthcoming as a chapter in Socially Responsible Investment of Union-Based Pension Funds, Jac ...

Gospodarska zbornica Slovenije –Povezujemo podjetja

... iii. simplifying the tax procedure unions & employers agree! iv. change of corporate tax (lower rate without any tax deductions) v. real estate tax (real estate register, was to be adopted by 2005 already, then prolonged to 2007) ...

... iii. simplifying the tax procedure unions & employers agree! iv. change of corporate tax (lower rate without any tax deductions) v. real estate tax (real estate register, was to be adopted by 2005 already, then prolonged to 2007) ...

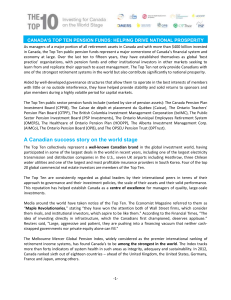

Canada`s top 10 pension funds: Helping drive national

... While the Top Ten pension funds seek the best risk-adjusted returns for their members globally, they are also major long-term investors in the Canadian economy. Together they have more than $400 billion invested across various asset classes in Canada, including $100 billion in real estate, infrastru ...

... While the Top Ten pension funds seek the best risk-adjusted returns for their members globally, they are also major long-term investors in the Canadian economy. Together they have more than $400 billion invested across various asset classes in Canada, including $100 billion in real estate, infrastru ...

Study summary

... While the Top Ten pension funds seek the best risk-adjusted returns for their members globally, they are also major long-term investors in the Canadian economy. Together they have more than $400 billion invested across various asset classes in Canada, including $100 billion in real estate, infrastru ...

... While the Top Ten pension funds seek the best risk-adjusted returns for their members globally, they are also major long-term investors in the Canadian economy. Together they have more than $400 billion invested across various asset classes in Canada, including $100 billion in real estate, infrastru ...

Facing America’s Long-Term Budget Challenges

... Social Security reform may involve transitioning to a system whereby individuals’ payroll taxes go into their own personal retirement fund. ...

... Social Security reform may involve transitioning to a system whereby individuals’ payroll taxes go into their own personal retirement fund. ...

The Debt Crisis

... The debt is currently about equal to our annual GDP of $15 trillion, but it is rising faster than economic growth. As the debt rises, more of our revenue goes to pay interest on the debt. Current rate of spending, especially because of entitlement programs is not ...

... The debt is currently about equal to our annual GDP of $15 trillion, but it is rising faster than economic growth. As the debt rises, more of our revenue goes to pay interest on the debt. Current rate of spending, especially because of entitlement programs is not ...

DC after the Budget: is your default dangerous?

... saver’s position should again be unchanged. However, all bets are off if the pre-retirement saver is not intending to buy an annuity immediately when they retire. Someone who does not want to use their money for an annuity immediately has a rather different objective. Even though they may, with luck ...

... saver’s position should again be unchanged. However, all bets are off if the pre-retirement saver is not intending to buy an annuity immediately when they retire. Someone who does not want to use their money for an annuity immediately has a rather different objective. Even though they may, with luck ...

... The main focus in this study is to analyze, both qualitatively and quantitatively, the impact of a tax reform, i.e., an informed in advance progressive increase (in phases) of taxes as opposed to a reform at once. Our results indicate that a reform in phases should produce two effects: substitution ...

Answers to pause for thought questions

... demand for imports (a withdrawal). The effect will therefore be to dampen the rise in aggregate demand. Also, the unpredictability of international financial flows makes the effects of fiscal (and monetary policy) changes less predictable. Note that if there had been a policy of maintaining interest ...

... demand for imports (a withdrawal). The effect will therefore be to dampen the rise in aggregate demand. Also, the unpredictability of international financial flows makes the effects of fiscal (and monetary policy) changes less predictable. Note that if there had been a policy of maintaining interest ...

PDF Download

... with low qualifications that we can help more by making jobs in the low-productivity range possible, by providing incentives for entering employment through income supplements and by consistently building on training and further education. This is at any rate better than leaving people unemployed an ...

... with low qualifications that we can help more by making jobs in the low-productivity range possible, by providing incentives for entering employment through income supplements and by consistently building on training and further education. This is at any rate better than leaving people unemployed an ...