Saving

... Effect of changes in real interest rates on investment Other factors that affect investment Changes in investment have a multiplier effect on real GDP ...

... Effect of changes in real interest rates on investment Other factors that affect investment Changes in investment have a multiplier effect on real GDP ...

Why Net Domestic Product Should Replace Gross Domestic Product

... • the potential for increasing wages without inflationary risks to the labour market; • gross business profits, thus increasing the risk of stock market bubbles; and • differences in growth rates between countries (e.g. between the United States and Europe). The OECD should play a leading role in pr ...

... • the potential for increasing wages without inflationary risks to the labour market; • gross business profits, thus increasing the risk of stock market bubbles; and • differences in growth rates between countries (e.g. between the United States and Europe). The OECD should play a leading role in pr ...

837 b. Which type of fiscal policy—expansionary or

... c. Anticipating the possibility of war, the government ...

... c. Anticipating the possibility of war, the government ...

PROCYCLICAL AND COUNTERCYCLICAL FISCAL MULTIPLIERS

... (2012), the threshold is estimated from the data but it could still be argued that the selection of the threshold variable itself is arbitrary. In a related, but di¤erent, approach, Auerbach and Gorodnichenko (AG) (2010) solve the issue of threshold selection by extending early work by Granger and T ...

... (2012), the threshold is estimated from the data but it could still be argued that the selection of the threshold variable itself is arbitrary. In a related, but di¤erent, approach, Auerbach and Gorodnichenko (AG) (2010) solve the issue of threshold selection by extending early work by Granger and T ...

Macroeconomics, Spring 2009, Exam 3, several versions

... ____ 22. (Repeat your answer on Scantron lines 43 and 44.) The Fed typically increases the money supply by a. selling government bonds b. buying government loans c. selling government loans d. printing more currency e. buying government bonds ____ 23. Which of the following would be most likely to i ...

... ____ 22. (Repeat your answer on Scantron lines 43 and 44.) The Fed typically increases the money supply by a. selling government bonds b. buying government loans c. selling government loans d. printing more currency e. buying government bonds ____ 23. Which of the following would be most likely to i ...

NBER WORKING PAPER SERIES OKUN’S LAW Menzie D. Chinn

... continued on into the recovery period, although the most recent observations have been above the regression line. There does seem to be a consistent pattern wherein contractions are associated with employment growth below that implied by the relationship that obtains over both upswings ...

... continued on into the recovery period, although the most recent observations have been above the regression line. There does seem to be a consistent pattern wherein contractions are associated with employment growth below that implied by the relationship that obtains over both upswings ...

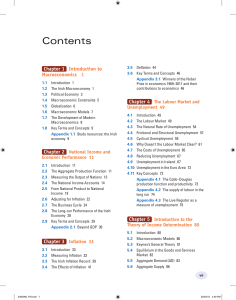

Contents Contents

... $10 would in the USA. An evening meal, for example, would cost much less in Thailand than in the USA. The poorest countries in the world are not as poor as is suggested by comparing their national income per person at market exchange rates. To get a truer picture of relative standards of living roun ...

... $10 would in the USA. An evening meal, for example, would cost much less in Thailand than in the USA. The poorest countries in the world are not as poor as is suggested by comparing their national income per person at market exchange rates. To get a truer picture of relative standards of living roun ...

Bank of England Inflation Report November 2009

... (a) Chart 5.2 represents a cross-section of the GDP fan chart in 2010 Q4 for the market interest rate projection. It has been conditioned on the assumption that the stock of purchased assets financed by the issuance of central bank reserves reaches £200 billion and remains there throughout the forec ...

... (a) Chart 5.2 represents a cross-section of the GDP fan chart in 2010 Q4 for the market interest rate projection. It has been conditioned on the assumption that the stock of purchased assets financed by the issuance of central bank reserves reaches £200 billion and remains there throughout the forec ...

GDP and GNP

... GDP is the sum value of all goods and services produced within a country. GNP is the sum value of all goods and services produced by permanent residents of a country regardless of their ...

... GDP is the sum value of all goods and services produced within a country. GNP is the sum value of all goods and services produced by permanent residents of a country regardless of their ...

The Macroeconomic Situation in the Czech Republic - Cerge-Ei

... consumption and investment in favour of higher exports. Of course, devaluation contributed significantly to domestic inflation (more than one quarter of total inflation). Macroeconomic policy (including monetary and fiscal policy as well as wage regulation) in 1991 appeared to be too restrictive, es ...

... consumption and investment in favour of higher exports. Of course, devaluation contributed significantly to domestic inflation (more than one quarter of total inflation). Macroeconomic policy (including monetary and fiscal policy as well as wage regulation) in 1991 appeared to be too restrictive, es ...

The Data of Macroeconomics

... The value of final goods and services measured at current prices is called nominal GDP. It can change over time, either because there is a change in the amount (real value) of goods and services or a change in the prices of those goods and services. Hence, nominal GDP Y = P y, where P is the pric ...

... The value of final goods and services measured at current prices is called nominal GDP. It can change over time, either because there is a change in the amount (real value) of goods and services or a change in the prices of those goods and services. Hence, nominal GDP Y = P y, where P is the pric ...

Some perspectives on past recessions ARTICLES

... main focus, however, is on the five main recessionary periods ...

... main focus, however, is on the five main recessionary periods ...

Dangerous currents flowing against full employment

... inherent in neo-liberalism have been diversified into several separate policy agendas, which has obscured its failure to achieve full employment. Unemployment has been desensitised and rendered an individual problem – the ultimate “privatisation”. A series of “solution packages” or separate policy a ...

... inherent in neo-liberalism have been diversified into several separate policy agendas, which has obscured its failure to achieve full employment. Unemployment has been desensitised and rendered an individual problem – the ultimate “privatisation”. A series of “solution packages” or separate policy a ...

ExcessCasualty-030910

... Investment income consists primarily of interest on bonds and stock dividends. Both were hit hard during the financial crisis as the Fed slashed interest rates to near zero and corporations cut dividends. A recovery in investment asset values beginning in Q2 2009—which reduced realized capital losse ...

... Investment income consists primarily of interest on bonds and stock dividends. Both were hit hard during the financial crisis as the Fed slashed interest rates to near zero and corporations cut dividends. A recovery in investment asset values beginning in Q2 2009—which reduced realized capital losse ...

Equity Markets and Business Cycles

... A: PE is where SRAS crosses LRAS Q: What is the significance of PE? A: PE is the expected price level. If the actual price were equal to the expected price level, real wages would be as expected and output would be at its long run level. Q: How does PE affect the business cycle. A: When actual price ...

... A: PE is where SRAS crosses LRAS Q: What is the significance of PE? A: PE is the expected price level. If the actual price were equal to the expected price level, real wages would be as expected and output would be at its long run level. Q: How does PE affect the business cycle. A: When actual price ...

Chapter 5 Lecture Outline 9E

... costs; but are necessary to meet consumer demands. Product substitution (e.g., the trend toward replacing wood framing material with less costly materials), along with engineering enhancements, helps keep costs under control. ...

... costs; but are necessary to meet consumer demands. Product substitution (e.g., the trend toward replacing wood framing material with less costly materials), along with engineering enhancements, helps keep costs under control. ...

Balance of recovery

... operate within the real economy. Businesses sell their output to customers at home and abroad. In terms of its impact on demand, the value of a sale to a UK customer should be seen as equivalent to the value of a sale of the same magnitude to an overseas customer. So we should be looking for a frame ...

... operate within the real economy. Businesses sell their output to customers at home and abroad. In terms of its impact on demand, the value of a sale to a UK customer should be seen as equivalent to the value of a sale of the same magnitude to an overseas customer. So we should be looking for a frame ...

Chapter 7 - LECTURE NOTES

... 2. An alternative method is to gather separate data on the quantity of physical output and determine what it would sell for in the base year. The result is Real GDP. The price index is implied in the ratio: Nominal GDP/Real GDP. Multiply by 100 to put it in standard index form (see equation 3). C. R ...

... 2. An alternative method is to gather separate data on the quantity of physical output and determine what it would sell for in the base year. The result is Real GDP. The price index is implied in the ratio: Nominal GDP/Real GDP. Multiply by 100 to put it in standard index form (see equation 3). C. R ...

Interactive Tool

... and the resulting low interest rates helped increase investment and consumer spending during and since the recession. As the economy recovered, the growth of real GDP increased and beginning in June 2004, the Federal Reserve began to be concerned with potential inflationary pressures. The target fed ...

... and the resulting low interest rates helped increase investment and consumer spending during and since the recession. As the economy recovered, the growth of real GDP increased and beginning in June 2004, the Federal Reserve began to be concerned with potential inflationary pressures. The target fed ...

Bangladesh, Cambodia, Lao PDR, Myanmar

... Macroeconomic stability has improved in general although pockets of risks exist. In recent years, inflation has come down from double-digit levels, but overheating remains a risk. Credit growth has been very high in recent years (35% yoy in FY2009/10). The fiscal deficit rose in recent years to arou ...

... Macroeconomic stability has improved in general although pockets of risks exist. In recent years, inflation has come down from double-digit levels, but overheating remains a risk. Credit growth has been very high in recent years (35% yoy in FY2009/10). The fiscal deficit rose in recent years to arou ...

The Austerity Delusion

... and even the supposed powerhouse of the region, Germany, saw its economy contract by 0.6 percent. The United Kingdom, despite not being in the eurozone, only barely escaped having the developed world’s first-ever triple-dip recession. The only surprise is that any of this should come as a surprise. ...

... and even the supposed powerhouse of the region, Germany, saw its economy contract by 0.6 percent. The United Kingdom, despite not being in the eurozone, only barely escaped having the developed world’s first-ever triple-dip recession. The only surprise is that any of this should come as a surprise. ...

Macro Chapter 7

... Q7.6 If the GDP deflator in 2006 was 130 compared to a value of 100 during the 1996 base year, this would indicate that 1. the inflation rate during 2006 was 30 percent. 2. the general level of prices during 2006 was 30 percent higher than during 1996. 3. the inflation rate during 2006 was 130 perc ...

... Q7.6 If the GDP deflator in 2006 was 130 compared to a value of 100 during the 1996 base year, this would indicate that 1. the inflation rate during 2006 was 30 percent. 2. the general level of prices during 2006 was 30 percent higher than during 1996. 3. the inflation rate during 2006 was 130 perc ...

Government Borrowing - McGraw Hill Higher Education

... • A flow that occurs during a period of time – one year Debt • The cumulative result of the deficits in prior years • A stock that is measured at a point in time ...

... • A flow that occurs during a period of time – one year Debt • The cumulative result of the deficits in prior years • A stock that is measured at a point in time ...