EC 102.07-08-09 Exercises for Chapter 33 SPRING 2006 1. Ceteris

... TBMM reduces purchases of new weapons systems. The Central Bank buys bonds in the open market. The price level falls. Net exports fall. ...

... TBMM reduces purchases of new weapons systems. The Central Bank buys bonds in the open market. The price level falls. Net exports fall. ...

Aggregate Supply and Aggregate Demand

... • changes in the prices at which output is valued • We want to use GDP to look at changes in the physical volume of output. Since Nominal GDP can also change due to changes in the prices at which output is valued it is necessary to "deflate" the value recorded for Nominal GDP (GDP with inflation) in ...

... • changes in the prices at which output is valued • We want to use GDP to look at changes in the physical volume of output. Since Nominal GDP can also change due to changes in the prices at which output is valued it is necessary to "deflate" the value recorded for Nominal GDP (GDP with inflation) in ...

A Model of Fiat Money

... direction. For example, a higher sales tax reduces wealth and makes future consumption more expensive; both of these effects serve to reduce desired consumption. On the other hand, while a higher sales tax reduces wealth, it also make leisure relatively cheaper. Here, the two effects work in opposite ...

... direction. For example, a higher sales tax reduces wealth and makes future consumption more expensive; both of these effects serve to reduce desired consumption. On the other hand, while a higher sales tax reduces wealth, it also make leisure relatively cheaper. Here, the two effects work in opposite ...

Monetary Policy Statement December 2007 Contents

... costs for firms, and indirectly via increased household spending. Furthermore, the fact that next year is an election ...

... costs for firms, and indirectly via increased household spending. Furthermore, the fact that next year is an election ...

PPT

... • Most relevant for the Fed: changes in money supply directly affect this interest rate Usually, the two interest rates are closely related; an increase in one results in the other increasing also. Copyright © 2017 Pearson Education, Inc. All Rights Reserved ...

... • Most relevant for the Fed: changes in money supply directly affect this interest rate Usually, the two interest rates are closely related; an increase in one results in the other increasing also. Copyright © 2017 Pearson Education, Inc. All Rights Reserved ...

Answers to Homework #3

... aspects. (a) The calculation of the GDP deflator and the CPI involves different goods and services. For example, goods and services like exports that are produced but not consumed domestically are used in the calculation of the GDP deflator but not in that of the CPI. The goods and services like imp ...

... aspects. (a) The calculation of the GDP deflator and the CPI involves different goods and services. For example, goods and services like exports that are produced but not consumed domestically are used in the calculation of the GDP deflator but not in that of the CPI. The goods and services like imp ...

A Keynesian Macroeconomic Model with New

... the effects on aggregate supply of unexpectedchanges in the price level. DisequilibriumKeynesians in principle need not disagree with the existence of such an effect. Be that as it may, disequilibriumKeynesians emphasize that demand-sidedisturbancesmay affect output because of price-level stickiness ...

... the effects on aggregate supply of unexpectedchanges in the price level. DisequilibriumKeynesians in principle need not disagree with the existence of such an effect. Be that as it may, disequilibriumKeynesians emphasize that demand-sidedisturbancesmay affect output because of price-level stickiness ...

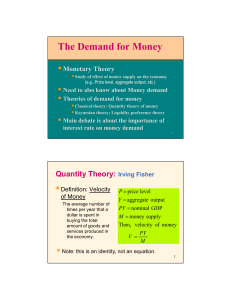

The Demand for Money - Spears School of Business

... with money supply Keynes: since velocity is unpredictable, monetary policy may not be an effective tool to affect aggregate spending Friedman: although velocity not constant it is quite predictable. Hence, can still affect aggregate spending with money supply ...

... with money supply Keynes: since velocity is unpredictable, monetary policy may not be an effective tool to affect aggregate spending Friedman: although velocity not constant it is quite predictable. Hence, can still affect aggregate spending with money supply ...

Monetary Policy Statement June 2011 Contents

... The early signs of recovery noted in the March Statement have continued. Despite some continuing signs of weakness in the world economy, commodity prices remain very strong and firms expect to increase their hiring and capital investment. Reconstruction in Canterbury is projected to add about 2 perc ...

... The early signs of recovery noted in the March Statement have continued. Despite some continuing signs of weakness in the world economy, commodity prices remain very strong and firms expect to increase their hiring and capital investment. Reconstruction in Canterbury is projected to add about 2 perc ...

Utility and Preference

... by the dollar vote of consumers every day in their decision to purchase this good and not that good. ...

... by the dollar vote of consumers every day in their decision to purchase this good and not that good. ...

Answers to Paper Practice Test

... .A.-Money-r.upply-increases, interest rates decrease, consumption and investment increase, aggregate demand increases, and output and price level increases. -11r-Moneysupply-increases, interest rates decrease, consumption and investment decrease, aggregate demand decreases, and output and price leve ...

... .A.-Money-r.upply-increases, interest rates decrease, consumption and investment increase, aggregate demand increases, and output and price level increases. -11r-Moneysupply-increases, interest rates decrease, consumption and investment decrease, aggregate demand decreases, and output and price leve ...

14 - The Citadel

... people with higher income demand more money. The increase in money demand leads to a shortage of money. To obtain the needed funds, people sell bonds. Bond prices fall and the nominal and real interest rate on bonds rises. So the short run effect of an increase in government spending is to raise rea ...

... people with higher income demand more money. The increase in money demand leads to a shortage of money. To obtain the needed funds, people sell bonds. Bond prices fall and the nominal and real interest rate on bonds rises. So the short run effect of an increase in government spending is to raise rea ...

Monetary Misperceptions: Optimal Monetary Policy

... Lucas described a world composed of many isolated islands with each island producing a different good. Agents on any given island are aware of economic conditions on their specific island, but are unaware of aggregate economic conditions. As a result of the isolation of islands, if the central bank ...

... Lucas described a world composed of many isolated islands with each island producing a different good. Agents on any given island are aware of economic conditions on their specific island, but are unaware of aggregate economic conditions. As a result of the isolation of islands, if the central bank ...

The Labor Market, Unemployment, and Inflation

... supplied are brought into equilibrium by rising and falling wage rates. There should be no persistent unemployment above the frictional and structural amount. ...

... supplied are brought into equilibrium by rising and falling wage rates. There should be no persistent unemployment above the frictional and structural amount. ...

FRBSF E L

... conducting monetary policy in a way that reduces the creation of private-sector money-like assets. I am not personally advocating either of these proposals, but I do view them as creative ways to think of how to bend the curve in terms of macroeconomic and financial stability tradeoffs. The idea tha ...

... conducting monetary policy in a way that reduces the creation of private-sector money-like assets. I am not personally advocating either of these proposals, but I do view them as creative ways to think of how to bend the curve in terms of macroeconomic and financial stability tradeoffs. The idea tha ...

The Evolution of US Monetary Policy: 2000-2007

... plots quarterly series over 1960 through 2007 for three variables: Inflation, the output gap, and the federal funds rate.3 These graphs confirm that the Federal Reserve responded to what was, in retrospect, a relatively brief and mild recession in 2001 with an extended period of very low interest ra ...

... plots quarterly series over 1960 through 2007 for three variables: Inflation, the output gap, and the federal funds rate.3 These graphs confirm that the Federal Reserve responded to what was, in retrospect, a relatively brief and mild recession in 2001 with an extended period of very low interest ra ...

Chapter 13 power point

... Aggregate demand shock – a rapid and unexpected shift in the AD curve (spending growth) • Short-run: Increase in AD is split between increases in inflation and increases in real growth. • Long-run: Increase in AD results only in higher inflation. • Essence of the short-run aggregate supply curve – ...

... Aggregate demand shock – a rapid and unexpected shift in the AD curve (spending growth) • Short-run: Increase in AD is split between increases in inflation and increases in real growth. • Long-run: Increase in AD results only in higher inflation. • Essence of the short-run aggregate supply curve – ...

The Evolution of US Monetary Policy: 2000 - 2007

... plots quarterly series over 1960 through 2007 for three variables: Inflation, the output gap, and the federal funds rate.3 These graphs confirm that the Federal Reserve responded to what was, in retrospect, a relatively brief and mild recession in 2001 with an extended period of very low interest ra ...

... plots quarterly series over 1960 through 2007 for three variables: Inflation, the output gap, and the federal funds rate.3 These graphs confirm that the Federal Reserve responded to what was, in retrospect, a relatively brief and mild recession in 2001 with an extended period of very low interest ra ...

M o n e t a r y ... Contents 1 May 2001

... As things now stand, we have been left with an unusual configuration of influences. Growth in the United States and Australia has slowed, without being replaced by acceleration elsewhere. Yet prices for many of New Zealand’s commodity exports have remained relatively strong. It is also unusual for N ...

... As things now stand, we have been left with an unusual configuration of influences. Growth in the United States and Australia has slowed, without being replaced by acceleration elsewhere. Yet prices for many of New Zealand’s commodity exports have remained relatively strong. It is also unusual for N ...

NBER WORKING PAPER SERIES EXCHANGE RATE RULES AND MACROECONOMIC STABILITY Rudiger Dornbusch

... possess the potential for instability since now wage inflation leads in the first place to appreciation but appreciation Only further raises real wages and widens the external imbalance. The managed exchange rate system can be used in this context to stabilize the system and assure convergence.; it ...

... possess the potential for instability since now wage inflation leads in the first place to appreciation but appreciation Only further raises real wages and widens the external imbalance. The managed exchange rate system can be used in this context to stabilize the system and assure convergence.; it ...

Chapter 18 - The Citadel

... long-run effects on any nation’s economy. Most also agree that aggregate supply shocks contribute to business cycles. There is a general consensus that monetary and fiscal policy measures are effective in the short run. Slide 18-57 ...

... long-run effects on any nation’s economy. Most also agree that aggregate supply shocks contribute to business cycles. There is a general consensus that monetary and fiscal policy measures are effective in the short run. Slide 18-57 ...

I Inflation, Asset Markets, and Economic Stabilization:

... pernicious effects of rapidly rising prices, just when various theoreticians were arguing that monetary policy was prone to an inflationary bias. Moreover, while aggressive efforts to combat inflation by the Volcker Fed and central bankers in Japan and Germany led to recession in the early 1980s, th ...

... pernicious effects of rapidly rising prices, just when various theoreticians were arguing that monetary policy was prone to an inflationary bias. Moreover, while aggressive efforts to combat inflation by the Volcker Fed and central bankers in Japan and Germany led to recession in the early 1980s, th ...

Inflation

In economics, inflation is a sustained increase in the general price level of goods and services in an economy over a period of time.When the price level rises, each unit of currency buys fewer goods and services. Consequently, inflation reflects a reduction in the purchasing power per unit of money – a loss of real value in the medium of exchange and unit of account within the economy. A chief measure of price inflation is the inflation rate, the annualized percentage change in a general price index (normally the consumer price index) over time. The opposite of inflation is deflation.Inflation affects an economy in various ways, both positive and negative. Negative effects of inflation include an increase in the opportunity cost of holding money, uncertainty over future inflation which may discourage investment and savings, and if inflation were rapid enough, shortages of goods as consumers begin hoarding out of concern that prices will increase in the future.Inflation also has positive effects: Fundamentally, inflation gives everyone an incentive to spend and invest, because if they don't, their money will be worth less in the future. This increase in spending and investment can benefit the economy. However it may also lead to sub-optimal use of resources. Inflation reduces the real burden of debt, both public and private. If you have a fixed-rate mortgage on your house, your salary is likely to increase over time due to wage inflation, but your mortgage payment will stay the same. Over time, your mortgage payment will become a smaller percentage of your earnings, which means that you will have more money to spend. Inflation keeps nominal interest rates above zero, so that central banks can reduce interest rates, when necessary, to stimulate the economy. Inflation reduces unemployment to the extent that unemployment is caused by nominal wage rigidity. When demand for labor falls but nominal wages do not, as typically occurs during a recession, the supply and demand for labor cannot reach equilibrium, and unemployment results. By reducing the real value of a given nominal wage, inflation increases the demand for labor, and therefore reduces unemployment.Economists generally believe that high rates of inflation and hyperinflation are caused by an excessive growth of the money supply. However, money supply growth does not necessarily cause inflation. Some economists maintain that under the conditions of a liquidity trap, large monetary injections are like ""pushing on a string"". Views on which factors determine low to moderate rates of inflation are more varied. Low or moderate inflation may be attributed to fluctuations in real demand for goods and services, or changes in available supplies such as during scarcities. However, the consensus view is that a long sustained period of inflation is caused by money supply growing faster than the rate of economic growth.Today, most economists favor a low and steady rate of inflation. Low (as opposed to zero or negative) inflation reduces the severity of economic recessions by enabling the labor market to adjust more quickly in a downturn, and reduces the risk that a liquidity trap prevents monetary policy from stabilizing the economy. The task of keeping the rate of inflation low and stable is usually given to monetary authorities. Generally, these monetary authorities are the central banks that control monetary policy through the setting of interest rates, through open market operations, and through the setting of banking reserve requirements.