Spring 2007

... seems the most likely explanation of this fact? a) The Federal Reserve Bank is less subject to political pressure than Congress. b) Most economists do not believe that contractionary fiscal policy would work to lower aggregate expenditures. c) Large deficits have limited the use of monetary policy t ...

... seems the most likely explanation of this fact? a) The Federal Reserve Bank is less subject to political pressure than Congress. b) Most economists do not believe that contractionary fiscal policy would work to lower aggregate expenditures. c) Large deficits have limited the use of monetary policy t ...

Economics, by R. Glenn Hubbard and Anthony Patrick O`Brien

... Source: Conf erence Board & University of Michigan ...

... Source: Conf erence Board & University of Michigan ...

FedViews

... an engine of growth. More recently, falling nationwide property and home sales have become an increasing drag on the economy, raising concerns about whether the country will meet its official target growth rate of 7.5%. ...

... an engine of growth. More recently, falling nationwide property and home sales have become an increasing drag on the economy, raising concerns about whether the country will meet its official target growth rate of 7.5%. ...

chapter_13_Unemployment_and_inflation

... Index,” which uses changing weights. The CPI differs from the GDP deflator in important ways. ...

... Index,” which uses changing weights. The CPI differs from the GDP deflator in important ways. ...

Downshifting to Sustainable Growth

... the weight of heavy debt loads. At the other end of the spectrum are those who believe the Federal Reserve has not acted quickly enough to dampen emerging inflationary pressures. They opine that while the economy will continue to grow, the Fed is merely postponing the day of reckoning when it will b ...

... the weight of heavy debt loads. At the other end of the spectrum are those who believe the Federal Reserve has not acted quickly enough to dampen emerging inflationary pressures. They opine that while the economy will continue to grow, the Fed is merely postponing the day of reckoning when it will b ...

Will we be hit by hyperinflation?

... During the crisis, the ECB's claims (mostly against banks), that is, funding, have risen by 70% until March 2009. The increase has meanwhile receded to 50% compared with year-end 2007. The money supply has expanded by only 15%, and lending volume by no more than 12%. The latter has moreover been sta ...

... During the crisis, the ECB's claims (mostly against banks), that is, funding, have risen by 70% until March 2009. The increase has meanwhile receded to 50% compared with year-end 2007. The money supply has expanded by only 15%, and lending volume by no more than 12%. The latter has moreover been sta ...

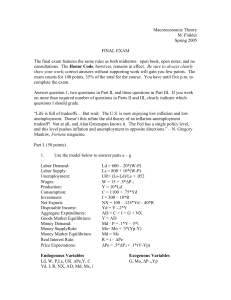

Endogenous Variables Exogenous Variables

... The final exam features the same rules as both midterms: open book, open notes, and no consultations. The Honor Code, however, remains in effect. Be sure to always clearly show your work; correct answers without supporting work will gain you few points. The exam counts for 140 points, 35% of the tot ...

... The final exam features the same rules as both midterms: open book, open notes, and no consultations. The Honor Code, however, remains in effect. Be sure to always clearly show your work; correct answers without supporting work will gain you few points. The exam counts for 140 points, 35% of the tot ...

Inverted Real Yields vs. Gold

... In the U.K, a weak Pound will increase the price of imports by as much as 10 percent for a nation that imports up to 60 percent of its goods. In the United States, Donald Trump’s fiscal policy is expected to increase wages and spending in the economy - leading to higher wages and inflation. ...

... In the U.K, a weak Pound will increase the price of imports by as much as 10 percent for a nation that imports up to 60 percent of its goods. In the United States, Donald Trump’s fiscal policy is expected to increase wages and spending in the economy - leading to higher wages and inflation. ...

CPI Easter - WordPress.com

... Politicians often use inflation to support their cause during election time. Easy money policies make everyone feel richer (which is good for re-election) but eventually everyone has more money and prices go up. Watching the inflation rate over time also allows us to monitor prices in the long run s ...

... Politicians often use inflation to support their cause during election time. Easy money policies make everyone feel richer (which is good for re-election) but eventually everyone has more money and prices go up. Watching the inflation rate over time also allows us to monitor prices in the long run s ...

Business Cycles, Unemployment, and Inflation

... mental illness Can lead to violent social and political change ...

... mental illness Can lead to violent social and political change ...

monetarism & supply

... idea that output (Y) depends upon the difference between the actual price level and the expected price ...

... idea that output (Y) depends upon the difference between the actual price level and the expected price ...

Trinidad_and_Tobago_en.pdf

... prices had yet to be passed through to domestic prices. Food price inflation should ease in 2009 as rises in imported food prices slow. Conversely, there are signs that wage demands may increase in the private and public sectors alike to compensate for the sharp increases in food prices, which will ...

... prices had yet to be passed through to domestic prices. Food price inflation should ease in 2009 as rises in imported food prices slow. Conversely, there are signs that wage demands may increase in the private and public sectors alike to compensate for the sharp increases in food prices, which will ...

PDF

... Spain, as in eighteenth century France; as with wampum in Colonial America, greenbacks during the American Civil War, and monetized government bonds in the United States today. Deflation is associated with a shrinking supply of money, as we saw after the American Civil War and during the Great Depre ...

... Spain, as in eighteenth century France; as with wampum in Colonial America, greenbacks during the American Civil War, and monetized government bonds in the United States today. Deflation is associated with a shrinking supply of money, as we saw after the American Civil War and during the Great Depre ...

Inflation and the Consumer Price Index Review for AP

... items that compose GDP. But not all goods that fall into GDP are goods that the everyday household shops for. If United Airlines buys a 767 from Boeing, it falls in GDP, but the price of a new 767 doesn't exactly fall within what we might call consumer spending. We need a statistic that focuses on c ...

... items that compose GDP. But not all goods that fall into GDP are goods that the everyday household shops for. If United Airlines buys a 767 from Boeing, it falls in GDP, but the price of a new 767 doesn't exactly fall within what we might call consumer spending. We need a statistic that focuses on c ...

Institute of Business Management Semester II Course Instructor

... c. An influx of working-age immigrants increases labor supply (ignore any other possible effects of Increased population). d. Increased usage of automatic teller machines reduces the demand for money. Q#9 a) According to the misperceptions theory, what effect does an increase in the price level hav ...

... c. An influx of working-age immigrants increases labor supply (ignore any other possible effects of Increased population). d. Increased usage of automatic teller machines reduces the demand for money. Q#9 a) According to the misperceptions theory, what effect does an increase in the price level hav ...

Business Cycles

... - inflation is defined as a persistent increase in the level of consumer prices or a persistent decline in the purchasing power of money, caused by an increase in the money supply (because of available currency and credit beyond the proportion of available goods and services.) Calculating Inflation ...

... - inflation is defined as a persistent increase in the level of consumer prices or a persistent decline in the purchasing power of money, caused by an increase in the money supply (because of available currency and credit beyond the proportion of available goods and services.) Calculating Inflation ...

Homework for Chapter 8

... e. A retired business executive whose current income comes entirely from interest on government bonds f. The owner of an independent small-town department store (a) Assuming the pensioned railway worker has no other income and that the pension is not indexed against inflation, the retired worker’s r ...

... e. A retired business executive whose current income comes entirely from interest on government bonds f. The owner of an independent small-town department store (a) Assuming the pensioned railway worker has no other income and that the pension is not indexed against inflation, the retired worker’s r ...

Week One Quiz

... B) savings bonds C) money market deposit accounts D) overnight repurchase agreements Answer: B 9) The narrowest money measure is A) currency plus non-interest bearing checking accounts. B) currency plus all checking accounts. C) currency plus all deposits at financial institutions. D) definitive mon ...

... B) savings bonds C) money market deposit accounts D) overnight repurchase agreements Answer: B 9) The narrowest money measure is A) currency plus non-interest bearing checking accounts. B) currency plus all checking accounts. C) currency plus all deposits at financial institutions. D) definitive mon ...

Inflation

In economics, inflation is a sustained increase in the general price level of goods and services in an economy over a period of time.When the price level rises, each unit of currency buys fewer goods and services. Consequently, inflation reflects a reduction in the purchasing power per unit of money – a loss of real value in the medium of exchange and unit of account within the economy. A chief measure of price inflation is the inflation rate, the annualized percentage change in a general price index (normally the consumer price index) over time. The opposite of inflation is deflation.Inflation affects an economy in various ways, both positive and negative. Negative effects of inflation include an increase in the opportunity cost of holding money, uncertainty over future inflation which may discourage investment and savings, and if inflation were rapid enough, shortages of goods as consumers begin hoarding out of concern that prices will increase in the future.Inflation also has positive effects: Fundamentally, inflation gives everyone an incentive to spend and invest, because if they don't, their money will be worth less in the future. This increase in spending and investment can benefit the economy. However it may also lead to sub-optimal use of resources. Inflation reduces the real burden of debt, both public and private. If you have a fixed-rate mortgage on your house, your salary is likely to increase over time due to wage inflation, but your mortgage payment will stay the same. Over time, your mortgage payment will become a smaller percentage of your earnings, which means that you will have more money to spend. Inflation keeps nominal interest rates above zero, so that central banks can reduce interest rates, when necessary, to stimulate the economy. Inflation reduces unemployment to the extent that unemployment is caused by nominal wage rigidity. When demand for labor falls but nominal wages do not, as typically occurs during a recession, the supply and demand for labor cannot reach equilibrium, and unemployment results. By reducing the real value of a given nominal wage, inflation increases the demand for labor, and therefore reduces unemployment.Economists generally believe that high rates of inflation and hyperinflation are caused by an excessive growth of the money supply. However, money supply growth does not necessarily cause inflation. Some economists maintain that under the conditions of a liquidity trap, large monetary injections are like ""pushing on a string"". Views on which factors determine low to moderate rates of inflation are more varied. Low or moderate inflation may be attributed to fluctuations in real demand for goods and services, or changes in available supplies such as during scarcities. However, the consensus view is that a long sustained period of inflation is caused by money supply growing faster than the rate of economic growth.Today, most economists favor a low and steady rate of inflation. Low (as opposed to zero or negative) inflation reduces the severity of economic recessions by enabling the labor market to adjust more quickly in a downturn, and reduces the risk that a liquidity trap prevents monetary policy from stabilizing the economy. The task of keeping the rate of inflation low and stable is usually given to monetary authorities. Generally, these monetary authorities are the central banks that control monetary policy through the setting of interest rates, through open market operations, and through the setting of banking reserve requirements.