Ch. 10: Handout

... The lower the CPI , the higher purchasing power of nominal income The higher the CPI, the lower purchasing power of nominal income Therefore, those whose incomes increase at a higher rate than the rise in prices have a higher standard of living, visa versa Limitations of CPI 1. _____________________ ...

... The lower the CPI , the higher purchasing power of nominal income The higher the CPI, the lower purchasing power of nominal income Therefore, those whose incomes increase at a higher rate than the rise in prices have a higher standard of living, visa versa Limitations of CPI 1. _____________________ ...

1 Danger of Deflation and Stagflation by Gustav A. Horn Düsseldorf

... Primarily exports and private investment will suffer from these developments. In addition to that there are a few countries in particular Spain and Ireland where the bursting of speculative bubbles in the real estate sector and the banking sector will require structural adjustments. Therefore these ...

... Primarily exports and private investment will suffer from these developments. In addition to that there are a few countries in particular Spain and Ireland where the bursting of speculative bubbles in the real estate sector and the banking sector will require structural adjustments. Therefore these ...

Why Business Cycles?

... • According to this view, a self-perpetuating wage/price spiral of wages and prices begins that is difficult to stop • The final and most popular explanation for inflation is excessive monetary growth • This occurs when the money supply grows faster than real GDP • Inflation cannot be maintained wit ...

... • According to this view, a self-perpetuating wage/price spiral of wages and prices begins that is difficult to stop • The final and most popular explanation for inflation is excessive monetary growth • This occurs when the money supply grows faster than real GDP • Inflation cannot be maintained wit ...

Speech before an Australian Business Economists luncheon

... the trend rate of around two and a half percent. One argument on the side of slowing productivity growth is the recent moderation in the pace of price declines for high-tech goods. This could imply that technological progress is slowing to some extent. While this is a source of concern, it’s too soo ...

... the trend rate of around two and a half percent. One argument on the side of slowing productivity growth is the recent moderation in the pace of price declines for high-tech goods. This could imply that technological progress is slowing to some extent. While this is a source of concern, it’s too soo ...

Inflation - Potomanto

... Inflation causes redistribution of income. It redistribute income between debtors and creditors. Unexpected inflation benefits debtors (borrowers) at the expense of ...

... Inflation causes redistribution of income. It redistribute income between debtors and creditors. Unexpected inflation benefits debtors (borrowers) at the expense of ...

Macroeconomics Topic 7

... measures the percentage increase in money loaned over the course of a year. The real interest rate measures the percentage increased in the buying power of the money loaned over the course of the year. As a consequence: the Real Interest Rate ≈ the Nominal Interest Rate – the Inflation Rate The Fish ...

... measures the percentage increase in money loaned over the course of a year. The real interest rate measures the percentage increased in the buying power of the money loaned over the course of the year. As a consequence: the Real Interest Rate ≈ the Nominal Interest Rate – the Inflation Rate The Fish ...

Inflation 100 pts

... 5% would be the nominal interest rate. If the inflation rate is 3% the year Company A borrows the loan. Then the real interest rate would be 2%. The real interest rate reflects the fact that due to inflation the loan has less purchasing power at the end of one year as opposed to the time when the ...

... 5% would be the nominal interest rate. If the inflation rate is 3% the year Company A borrows the loan. Then the real interest rate would be 2%. The real interest rate reflects the fact that due to inflation the loan has less purchasing power at the end of one year as opposed to the time when the ...

29 U.S. INFLATION, UNEMPLOYMENT, AND BUSINESS CYCLES**

... Argentina experienced inflation in 1994, 1995, 2000, 2002, 2003, and 2004. Argentina experienced deflation in 1997, 1998, 1999, and 2001. Argentina had recessions in 1995, 2000, 2001, and 2002. Argentina had expansions in 1994, 1996, 1997, 1998, 2003, and 2004. The unemployment rate was probably hig ...

... Argentina experienced inflation in 1994, 1995, 2000, 2002, 2003, and 2004. Argentina experienced deflation in 1997, 1998, 1999, and 2001. Argentina had recessions in 1995, 2000, 2001, and 2002. Argentina had expansions in 1994, 1996, 1997, 1998, 2003, and 2004. The unemployment rate was probably hig ...

Module Types of Inflation, Disinflation, and Deflation

... quantity of money, M/P, at its original level. As a result, there is no long-run effect on aggregate demand or real GDP. The classical model presumes that the adjustment from the first long-run equilibrium point to the second is automatic and ...

... quantity of money, M/P, at its original level. As a result, there is no long-run effect on aggregate demand or real GDP. The classical model presumes that the adjustment from the first long-run equilibrium point to the second is automatic and ...

ppt

... • The second is the real exchange rate. When prices rise unexpectedly, the real exchange rate appreciates (if the nominal exchange rate is fixed). This leads to an deterioration in the primary current account. • The third is the Keynes effect. When prices rise unexpectedly, people need more money fo ...

... • The second is the real exchange rate. When prices rise unexpectedly, the real exchange rate appreciates (if the nominal exchange rate is fixed). This leads to an deterioration in the primary current account. • The third is the Keynes effect. When prices rise unexpectedly, people need more money fo ...

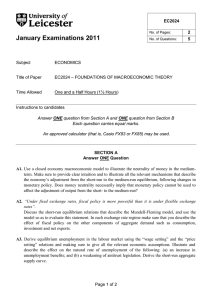

January Examinations 2011

... A1. Use a closed economy macroeconomic model to illustrate the neutrality of money in the mediumterm. Make sure to provide clear intuition and to illustrate all the relevant mechanisms that describe the economy’s adjustment from the short-run to the medium-run equilibrium, following changes in monet ...

... A1. Use a closed economy macroeconomic model to illustrate the neutrality of money in the mediumterm. Make sure to provide clear intuition and to illustrate all the relevant mechanisms that describe the economy’s adjustment from the short-run to the medium-run equilibrium, following changes in monet ...

Chapter 2 Section 4 – External Forces Shaping the

... Vocabulary- The following terms should be completely explained on notecards. Aggregate, aggregate supply, Board of Governors, business cycle, consumer price index (CPI), consumption, contraction, cyclical unemployment debt, deficit, deflation, depression, “easy money” policy, expansion, Federal Open ...

... Vocabulary- The following terms should be completely explained on notecards. Aggregate, aggregate supply, Board of Governors, business cycle, consumer price index (CPI), consumption, contraction, cyclical unemployment debt, deficit, deflation, depression, “easy money” policy, expansion, Federal Open ...

Chapter 6 - FIU Faculty Websites

... standard of living with less money. The CPI would miss that change. ...

... standard of living with less money. The CPI would miss that change. ...

Slide 1

... r* is the equilibrium real interest rate, π inflation rate, π* is inflation target, y is log output gap [log(Y/Yp)], b and c are parameters. 2. Assume for now that inflation is at target. So π = π* and we have financial market: ...

... r* is the equilibrium real interest rate, π inflation rate, π* is inflation target, y is log output gap [log(Y/Yp)], b and c are parameters. 2. Assume for now that inflation is at target. So π = π* and we have financial market: ...

Study Guide 12/13

... 19. What happens to aggregate demand when the price levels fall? 20. How would aggregate supply be affected if people stopped spending? 21. How do fears of future economic problems affect GDP? 22. What is an example of depreciation? 23. What is an external shock? 24. What is the difference between r ...

... 19. What happens to aggregate demand when the price levels fall? 20. How would aggregate supply be affected if people stopped spending? 21. How do fears of future economic problems affect GDP? 22. What is an example of depreciation? 23. What is an external shock? 24. What is the difference between r ...

Costa_Rica_en.pdf

... Following the referendum of 7 October which approved the Dominican Republic-Central AmericaUnited States Free Trade Agreement (CAFTA-DR), the country’s President enacted the agreement as a law of the Republic. The approval by Congress of the implementation programme remained pending, ...

... Following the referendum of 7 October which approved the Dominican Republic-Central AmericaUnited States Free Trade Agreement (CAFTA-DR), the country’s President enacted the agreement as a law of the Republic. The approval by Congress of the implementation programme remained pending, ...

Demand for Loans Real Interest Rate

... D) People who borrowed funds at the nominal interest rate during this time would lose. E) The economy would expand because of increased investment and spending. ...

... D) People who borrowed funds at the nominal interest rate during this time would lose. E) The economy would expand because of increased investment and spending. ...

Fed Focus: A Community Conference Dixie Center, St. George, Utah

... But in the long-run, the goal is low inflation, because monetary policy is the main determinant of inflation in the long run. ...

... But in the long-run, the goal is low inflation, because monetary policy is the main determinant of inflation in the long run. ...

Institute of Business Management

... Q#8 Use the IS-LM model to determine the effects of each of the following on the general equilibrium values of the real wage, employment, output, real interest rate, consumption, investment, and price level. a. A reduction in the effective tax rate on capital increases desired investment. b. The ex ...

... Q#8 Use the IS-LM model to determine the effects of each of the following on the general equilibrium values of the real wage, employment, output, real interest rate, consumption, investment, and price level. a. A reduction in the effective tax rate on capital increases desired investment. b. The ex ...

The Demand for Base Money in Turkey: Implications for

... average inflation rate for Turkey consistent with the need to generate the maximum possible seigniorage revenues? (3) Is the average inflation rate for Turkey inefficient in the sense that it is higher than necessary to generate a given level of seigniorage? The currency crisis in 1994 is an importa ...

... average inflation rate for Turkey consistent with the need to generate the maximum possible seigniorage revenues? (3) Is the average inflation rate for Turkey inefficient in the sense that it is higher than necessary to generate a given level of seigniorage? The currency crisis in 1994 is an importa ...

Macroeconomic Goals and Instruments Macroeconomics

... The most common measure of the overall price level is the consumer price index (CPI). The CPI measures the cost of a fixed basket of goods bought by the typical urban consumer. The rate of inflation measures changes in the level of prices. It denotes the rate of growth or decline of the price level ...

... The most common measure of the overall price level is the consumer price index (CPI). The CPI measures the cost of a fixed basket of goods bought by the typical urban consumer. The rate of inflation measures changes in the level of prices. It denotes the rate of growth or decline of the price level ...

Inflation

In economics, inflation is a sustained increase in the general price level of goods and services in an economy over a period of time.When the price level rises, each unit of currency buys fewer goods and services. Consequently, inflation reflects a reduction in the purchasing power per unit of money – a loss of real value in the medium of exchange and unit of account within the economy. A chief measure of price inflation is the inflation rate, the annualized percentage change in a general price index (normally the consumer price index) over time. The opposite of inflation is deflation.Inflation affects an economy in various ways, both positive and negative. Negative effects of inflation include an increase in the opportunity cost of holding money, uncertainty over future inflation which may discourage investment and savings, and if inflation were rapid enough, shortages of goods as consumers begin hoarding out of concern that prices will increase in the future.Inflation also has positive effects: Fundamentally, inflation gives everyone an incentive to spend and invest, because if they don't, their money will be worth less in the future. This increase in spending and investment can benefit the economy. However it may also lead to sub-optimal use of resources. Inflation reduces the real burden of debt, both public and private. If you have a fixed-rate mortgage on your house, your salary is likely to increase over time due to wage inflation, but your mortgage payment will stay the same. Over time, your mortgage payment will become a smaller percentage of your earnings, which means that you will have more money to spend. Inflation keeps nominal interest rates above zero, so that central banks can reduce interest rates, when necessary, to stimulate the economy. Inflation reduces unemployment to the extent that unemployment is caused by nominal wage rigidity. When demand for labor falls but nominal wages do not, as typically occurs during a recession, the supply and demand for labor cannot reach equilibrium, and unemployment results. By reducing the real value of a given nominal wage, inflation increases the demand for labor, and therefore reduces unemployment.Economists generally believe that high rates of inflation and hyperinflation are caused by an excessive growth of the money supply. However, money supply growth does not necessarily cause inflation. Some economists maintain that under the conditions of a liquidity trap, large monetary injections are like ""pushing on a string"". Views on which factors determine low to moderate rates of inflation are more varied. Low or moderate inflation may be attributed to fluctuations in real demand for goods and services, or changes in available supplies such as during scarcities. However, the consensus view is that a long sustained period of inflation is caused by money supply growing faster than the rate of economic growth.Today, most economists favor a low and steady rate of inflation. Low (as opposed to zero or negative) inflation reduces the severity of economic recessions by enabling the labor market to adjust more quickly in a downturn, and reduces the risk that a liquidity trap prevents monetary policy from stabilizing the economy. The task of keeping the rate of inflation low and stable is usually given to monetary authorities. Generally, these monetary authorities are the central banks that control monetary policy through the setting of interest rates, through open market operations, and through the setting of banking reserve requirements.