GLOBAL INSIGHT Model of the U

... policy concerns as the price level and the unemployment rate. Monetarist Aspects. The model carefully represents the diverse portfolio aspects of money demand. It also captures the central bank's role in long-term inflation phenomena. The private sector may demand money balances as one portfolio cho ...

... policy concerns as the price level and the unemployment rate. Monetarist Aspects. The model carefully represents the diverse portfolio aspects of money demand. It also captures the central bank's role in long-term inflation phenomena. The private sector may demand money balances as one portfolio cho ...

Econ summary

... the swap line, thus selling a certain amount of its currency to the Federal Reserve at the prevailing market exchange rate in exchange for dollars. This market rate becomes the swap exchange rate. At the same time, the Federal Reserve and the foreign central bank enter into a binding agreement for ...

... the swap line, thus selling a certain amount of its currency to the Federal Reserve at the prevailing market exchange rate in exchange for dollars. This market rate becomes the swap exchange rate. At the same time, the Federal Reserve and the foreign central bank enter into a binding agreement for ...

Department of Economics

... real versus nominal: GDP, wages, interest rates, rent etc. causes of inflation: - printing money - demand pull - cost push inflationary expectations and inflationary psychology impacts of inflation: - adverse impact on balance of trade [under a fixed foreign exchange rate regime] - acts like a regre ...

... real versus nominal: GDP, wages, interest rates, rent etc. causes of inflation: - printing money - demand pull - cost push inflationary expectations and inflationary psychology impacts of inflation: - adverse impact on balance of trade [under a fixed foreign exchange rate regime] - acts like a regre ...

quiz no 5

... reserves, the demand curve for reserves is ________. A) vertical B) horizontal C) positively sloped D) negatively sloped Answer: D 2. When the federal funds rate equals the interest rate paid on excess reserves ________. A) the supply curve of reserves is vertical B) the supply curve of reserves is ...

... reserves, the demand curve for reserves is ________. A) vertical B) horizontal C) positively sloped D) negatively sloped Answer: D 2. When the federal funds rate equals the interest rate paid on excess reserves ________. A) the supply curve of reserves is vertical B) the supply curve of reserves is ...

Demand-side Policies

... Vertical axis: rate of interest § The ‘price’ for money services § As rate of interest falls, quantity of money demanded by the public (consumers, firms, government) increases (downward sloping demand curve) § Supply of money is fixed at level decided upon by the central bank (vertical line as it ...

... Vertical axis: rate of interest § The ‘price’ for money services § As rate of interest falls, quantity of money demanded by the public (consumers, firms, government) increases (downward sloping demand curve) § Supply of money is fixed at level decided upon by the central bank (vertical line as it ...

Notes on government policy

... Another example of manipulation is that pressure groups may ask politicians to pass special laws that favor that group with special tax breaks or spending. Politicians can frame these taxes and expenditures as activist fiscal policy, but it’s really just a political pay-off. That pressure groups exp ...

... Another example of manipulation is that pressure groups may ask politicians to pass special laws that favor that group with special tax breaks or spending. Politicians can frame these taxes and expenditures as activist fiscal policy, but it’s really just a political pay-off. That pressure groups exp ...

Economics 101

... When aggregate output equals $2400, AEd = C + Id + G = $2400. Since Y = AEd, the economy is in equilibrium and aggregate output will have a tendency to remain constant. 3 C The net exogenous change in AEd equals 50 – 20 = $30 million. Using the Keynesian multiplier, we can find the change in income ...

... When aggregate output equals $2400, AEd = C + Id + G = $2400. Since Y = AEd, the economy is in equilibrium and aggregate output will have a tendency to remain constant. 3 C The net exogenous change in AEd equals 50 – 20 = $30 million. Using the Keynesian multiplier, we can find the change in income ...

Price Stability Financial Stability Payment Systems Exchange Rate Regime

... the amount of credits extended by banks, as well as asset prices, such as equities and foreign exchange. ...

... the amount of credits extended by banks, as well as asset prices, such as equities and foreign exchange. ...

(Il Sole 24 Ore Radiocor) -

... fine. The prospect of emergency aid connected with hard corrective fiscal action would boost the confidence of financial markets, thus preventing a deepening of the crisis and obviating the eurozone members’ need to call upon the IMF in future. Emergency liquidity aid may never be taken for granted. ...

... fine. The prospect of emergency aid connected with hard corrective fiscal action would boost the confidence of financial markets, thus preventing a deepening of the crisis and obviating the eurozone members’ need to call upon the IMF in future. Emergency liquidity aid may never be taken for granted. ...

A modest recovery is expected in the second half of 2002

... – Continuing the reform of social security system, and decrease inefficient spending structures. This would make it possible to promote employment by decreasing nonwage labour costs. (addresses Challenge 1,2,3 ) – Go on with the restructuring and privatisation of large state owned enterprises. ...

... – Continuing the reform of social security system, and decrease inefficient spending structures. This would make it possible to promote employment by decreasing nonwage labour costs. (addresses Challenge 1,2,3 ) – Go on with the restructuring and privatisation of large state owned enterprises. ...

to the pdf. - Student Health Services

... rates rise with inflation, discouraging savings. The result in the 1970s, for example, was “stagflation”—high inflation coupled with high unemployment and idle production capacity. Paul Volcker, chairman of the Federal Reserve Bank (Fed), recognizing that inflation does not bring full employment, en ...

... rates rise with inflation, discouraging savings. The result in the 1970s, for example, was “stagflation”—high inflation coupled with high unemployment and idle production capacity. Paul Volcker, chairman of the Federal Reserve Bank (Fed), recognizing that inflation does not bring full employment, en ...

Paraguay_en.pdf

... users and service-providers and loosened restrictions on service supply modes for those services, with the exception of voice over internet protocol (VOIP) services. ...

... users and service-providers and loosened restrictions on service supply modes for those services, with the exception of voice over internet protocol (VOIP) services. ...

Monetary policy and asset prices

... asset prices only insofar as they have implications for future output and inflation. Central banks should not attempt to influence the speculative component of asset prices. This strategy is supported by the so-called Efficient Market Hypothesis, which claims that profitoriented rational agents woul ...

... asset prices only insofar as they have implications for future output and inflation. Central banks should not attempt to influence the speculative component of asset prices. This strategy is supported by the so-called Efficient Market Hypothesis, which claims that profitoriented rational agents woul ...

1. Refer to the above graph. If the supply of money was $250 billion

... Refer to the above graphs, in which the numbers in parentheses after the AD 1 , AD2 , and AD3 labels indicate the level of investment spending associated with each curve, respectively. All numbers are in billions of dollars. The interest rate and the level of investment spending in the economy are a ...

... Refer to the above graphs, in which the numbers in parentheses after the AD 1 , AD2 , and AD3 labels indicate the level of investment spending associated with each curve, respectively. All numbers are in billions of dollars. The interest rate and the level of investment spending in the economy are a ...

the 9-letter dirty word - global plains advisory group

... Prairie Village-based independent keeps up with the rate of comprehensive wealth management inflation. firm. For more information, visit www.GP-AG.com ...

... Prairie Village-based independent keeps up with the rate of comprehensive wealth management inflation. firm. For more information, visit www.GP-AG.com ...

Introduction to Microeconomics

... system (so no currency). The total reserves in the banking system are TR=$70. With all that, answer the following: 1. What is the total money supply? 2. What is the equilibrium interest rate? 3. What is the equilibrium level of national income? NOW Suppose: YFE=$9,600. 4. Should the FED buy or sell ...

... system (so no currency). The total reserves in the banking system are TR=$70. With all that, answer the following: 1. What is the total money supply? 2. What is the equilibrium interest rate? 3. What is the equilibrium level of national income? NOW Suppose: YFE=$9,600. 4. Should the FED buy or sell ...

AP MACROECONOMCIS Unit 1: Basic Economic Concepts Define

... Illustrate, manipulate, and interpret demand and supply graphs to show equilibrium, shifts in supply or demand curves and effects. Illustrate, manipulate, and interpret circular flow models with emphasis on households and businesses, resource and product markets, government role, and open economy. ...

... Illustrate, manipulate, and interpret demand and supply graphs to show equilibrium, shifts in supply or demand curves and effects. Illustrate, manipulate, and interpret circular flow models with emphasis on households and businesses, resource and product markets, government role, and open economy. ...

14.02 Principles of Macroeconomics Problem Set 3 Solutions Fall 2004

... expansionary fiscal policy comes at a cost of a larger trade deficit. (See page 430.) So far, we have focused primarily on the negative side of a fixed exchange rate system. To stay within the scope of Chapter 20, we will only mention some of the pros. If the Mundellian economy closely followed the ...

... expansionary fiscal policy comes at a cost of a larger trade deficit. (See page 430.) So far, we have focused primarily on the negative side of a fixed exchange rate system. To stay within the scope of Chapter 20, we will only mention some of the pros. If the Mundellian economy closely followed the ...

Embargoed for release at 2:00 p.m., EDT, March 20, 2013

... Unemployment Rate—the average civilian unemployment rate in the fourth quarter of each year, with values plotted at the end of each year. PCE Inflation—as measured by the change in the personal consumption expenditures (PCE) price index from the fourth quarter of the previous year to the fourth ...

... Unemployment Rate—the average civilian unemployment rate in the fourth quarter of each year, with values plotted at the end of each year. PCE Inflation—as measured by the change in the personal consumption expenditures (PCE) price index from the fourth quarter of the previous year to the fourth ...

Lecture 3. Measuring Macroeconomic Variables

... interest minus the inflation rate. The expected real rate of interest is the nominal rate of interest minus the expected inflation rate. ...

... interest minus the inflation rate. The expected real rate of interest is the nominal rate of interest minus the expected inflation rate. ...

PRESS RELEASE SUMMARY OF THE MONETARY POLICY COMMITTEE MEETING No: 2016-13

... the EU recovery affects external demand favorably. Wage increases and low oil prices support domestic demand through the income channel. Overall, economic activity remains on a moderate growth path. Monetary Policy and Risks 12. Annual loan growth continues at reasonable levels in response to the t ...

... the EU recovery affects external demand favorably. Wage increases and low oil prices support domestic demand through the income channel. Overall, economic activity remains on a moderate growth path. Monetary Policy and Risks 12. Annual loan growth continues at reasonable levels in response to the t ...

Filipa Sá Pascal Towbin Tomasz Wieladek 10 March 2011, VOX.EU

... increases the impact of capital inflows shocks on real house prices, real residential investment, and real credit to the private sector by a factor of two, three and five, respectively (see Figure 2). This may be explained by the fact that securitisation packages mortgages together and slices them i ...

... increases the impact of capital inflows shocks on real house prices, real residential investment, and real credit to the private sector by a factor of two, three and five, respectively (see Figure 2). This may be explained by the fact that securitisation packages mortgages together and slices them i ...

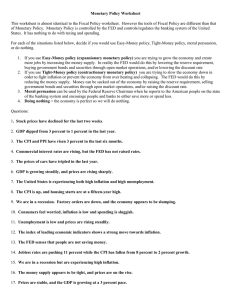

Monetary policy

Monetary policy is the process by which the monetary authority of a country controls the supply of money, often targeting an inflation rate or interest rate to ensure price stability and general trust in the currency.Further goals of a monetary policy are usually to contribute to economic growth and stability, to lower unemployment, and to maintain predictable exchange rates with other currencies.Monetary economics provides insight into how to craft optimal monetary policy.Monetary policy is referred to as either being expansionary or contractionary, where an expansionary policy increases the total supply of money in the economy more rapidly than usual, and contractionary policy expands the money supply more slowly than usual or even shrinks it. Expansionary policy is traditionally used to try to combat unemployment in a recession by lowering interest rates in the hope that easy credit will entice businesses into expanding. Contractionary policy is intended to slow inflation in order to avoid the resulting distortions and deterioration of asset values.Monetary policy differs from fiscal policy, which refers to taxation, government spending, and associated borrowing.