International Economics PPT

... 1. US rate of inflation compared to other countries 2. The value of foreign currency relative to the US dollar 3. US demand for foreign goods 4. The federal budget deficit 5. US interest rates compared to other countries ...

... 1. US rate of inflation compared to other countries 2. The value of foreign currency relative to the US dollar 3. US demand for foreign goods 4. The federal budget deficit 5. US interest rates compared to other countries ...

14.02 Principles of Macroeconomics Spring 06 Quiz 1

... c0 , c1 , b0 , b1 , b2 , d0 , d1 are positive constants, and c1 + b1 < 1. The price level is given. So are G and T . The central bank chooses the money stock M so as to achieve a given interest rate i0 (in other words, the money stock is endogenous). Note: For all questions, assume that the central ...

... c0 , c1 , b0 , b1 , b2 , d0 , d1 are positive constants, and c1 + b1 < 1. The price level is given. So are G and T . The central bank chooses the money stock M so as to achieve a given interest rate i0 (in other words, the money stock is endogenous). Note: For all questions, assume that the central ...

Long Run Exchange Rate Determination

... Long-term investment profitability Consumer tastes Long-term real GDP growth rates Productivity Trade policy ...

... Long-term investment profitability Consumer tastes Long-term real GDP growth rates Productivity Trade policy ...

National income accounting:

... 8. Use the Keynesian model for a small open economy with its own currency. Some of the assumptions of this model are: Equilibrium in the goods market: Y = C(Y-T) + I(r=r*) + G + NX (real exchange rate) Equilibrium in the money market: M/P = L(r=r*,Y) Assumption 1: r is the real interest rate and r* ...

... 8. Use the Keynesian model for a small open economy with its own currency. Some of the assumptions of this model are: Equilibrium in the goods market: Y = C(Y-T) + I(r=r*) + G + NX (real exchange rate) Equilibrium in the money market: M/P = L(r=r*,Y) Assumption 1: r is the real interest rate and r* ...

Test#1

... Keynes and the Keynesians integrated the analysis of the money market and the price level into the general macroeconomic model, rather than leaving it as an appendage to the analysis of the commodity markets. They also introduced bonds as an alternative asset to money in the demand for money and mad ...

... Keynes and the Keynesians integrated the analysis of the money market and the price level into the general macroeconomic model, rather than leaving it as an appendage to the analysis of the commodity markets. They also introduced bonds as an alternative asset to money in the demand for money and mad ...

Toward Free-Market Money

... because it can’t be disproved; prices go up because there is a bubble; prices go down because there was a bubble. Either outcome is proof of the existence of a bubble. With hindsight the overwhelming consensus is that there was a stock market bubble, particularly with tech stocks (although there wer ...

... because it can’t be disproved; prices go up because there is a bubble; prices go down because there was a bubble. Either outcome is proof of the existence of a bubble. With hindsight the overwhelming consensus is that there was a stock market bubble, particularly with tech stocks (although there wer ...

Nicaragua_en.pdf

... On the wages front, a new consensus was reached between employers, the government and workers, providing for an increase in the minimum wage that did not upset the favourable climate for labour and investment. In the first half of the year minimum wages were raised by 6.5% in the agricultural sector ...

... On the wages front, a new consensus was reached between employers, the government and workers, providing for an increase in the minimum wage that did not upset the favourable climate for labour and investment. In the first half of the year minimum wages were raised by 6.5% in the agricultural sector ...

Homework 5

... 3. Money Market Assume there is a negative supply shock in the United States which reduces real and nominal GDP. The central bank wants to conduct monetary policy to stabilize the price level. Draw a picture of the money market. Show how the money supply and demand curve would shift in response to ...

... 3. Money Market Assume there is a negative supply shock in the United States which reduces real and nominal GDP. The central bank wants to conduct monetary policy to stabilize the price level. Draw a picture of the money market. Show how the money supply and demand curve would shift in response to ...

1. Cost-push inflation

... Description: In this case, the overall price level increases due to higher costs of production which reflects in terms of increased prices of goods and commodities which majorly use these inputs. This is inflation triggered from supply side i.e. because of less supply. (The opposite effect of this i ...

... Description: In this case, the overall price level increases due to higher costs of production which reflects in terms of increased prices of goods and commodities which majorly use these inputs. This is inflation triggered from supply side i.e. because of less supply. (The opposite effect of this i ...

Does Europe`s Path to Monetary Union Provide Lessons for East Asia?

... not fully liberalize capital flows until the late 1980s or very early 1990s, after their domestic financial markets were well developed and the integration process was well along. In contrast, many countries in East Asia (China is a notable exception), liberalized their capital accounts before their ...

... not fully liberalize capital flows until the late 1980s or very early 1990s, after their domestic financial markets were well developed and the integration process was well along. In contrast, many countries in East Asia (China is a notable exception), liberalized their capital accounts before their ...

... emerges because monetary policy, which would normally be used to stabilize the economy in response to country-specific shocks, can instead be used only to address union-wide disturbances. To stabilize a member economy, national fiscal policy should “lean against the wind,” with policy expansionary w ...

A Few Thoughts on the Employment Numbers

... The weakness in real income is probably lost in an environment in which the Fed is touting the gain in stock prices and consumer wealth resulting from the latest quantitative easing (QE), but QE has unintended negative consequences for real household income. Due to higher prices of energy and food c ...

... The weakness in real income is probably lost in an environment in which the Fed is touting the gain in stock prices and consumer wealth resulting from the latest quantitative easing (QE), but QE has unintended negative consequences for real household income. Due to higher prices of energy and food c ...

NBER WORKING PAPER SERIES U.S. MACROECONOMIC POLICY AND PERFORMANCE IN THE 198Os:

... the CPI—U index reported by the Bureau of Labor Statistics (BLS). Before 1983, the BLSc CR1—U index has serious distortions because of its treatment of housing prices. Specifically, it overstates the inflation rate when mortgage rates are rising as In 1980 (see Blinder (1980)). ThIs problem led the ...

... the CPI—U index reported by the Bureau of Labor Statistics (BLS). Before 1983, the BLSc CR1—U index has serious distortions because of its treatment of housing prices. Specifically, it overstates the inflation rate when mortgage rates are rising as In 1980 (see Blinder (1980)). ThIs problem led the ...

Lecture 22

... implemented; the lag that occurs because of the operation of the economy itself. – E.g., The delay in the multiplier of government spending occurs because neither individuals nor firms revise their spending plans ...

... implemented; the lag that occurs because of the operation of the economy itself. – E.g., The delay in the multiplier of government spending occurs because neither individuals nor firms revise their spending plans ...

market moves 12.20.2013

... This final chart further demonstrates bank lending has not grown meaningfully since the beginning of the so-called Great Recession. This further suggests that the “money creation” concerns of the monetarists have not occurred and hence their associated inflation concerns have not been realized. At s ...

... This final chart further demonstrates bank lending has not grown meaningfully since the beginning of the so-called Great Recession. This further suggests that the “money creation” concerns of the monetarists have not occurred and hence their associated inflation concerns have not been realized. At s ...

ECON 4423-001 International Finance

... This course presents International Economics theory and applies it towards gaining an understanding of recent events and current policy issues. The theory presented in this course covers a broad range of topics including exchange rate determination, monetary and fiscal policy in an open economy, bal ...

... This course presents International Economics theory and applies it towards gaining an understanding of recent events and current policy issues. The theory presented in this course covers a broad range of topics including exchange rate determination, monetary and fiscal policy in an open economy, bal ...

Argentina_en.pdf

... virtually nil (-0.1%). Assuming the economic growth rate in the fourth quarter remains stable (zero quarter-on-quarter growth), the GDP growth rate in 2014 is expected to be about -0.2%. The growth projection for 2015, when the country’s treasury has large currency repayments falling due (over US$ 1 ...

... virtually nil (-0.1%). Assuming the economic growth rate in the fourth quarter remains stable (zero quarter-on-quarter growth), the GDP growth rate in 2014 is expected to be about -0.2%. The growth projection for 2015, when the country’s treasury has large currency repayments falling due (over US$ 1 ...

2. What is deflation?

... which puts additional downward pressure on prices. The appreciation of the exchange rate might further exacerbate this tendency. A well-known example of a self-reinforcing price– income mechanism is Japan’s experience in the 1990s, also referred to as the “lost decade”. A deflation triggered by a s ...

... which puts additional downward pressure on prices. The appreciation of the exchange rate might further exacerbate this tendency. A well-known example of a self-reinforcing price– income mechanism is Japan’s experience in the 1990s, also referred to as the “lost decade”. A deflation triggered by a s ...

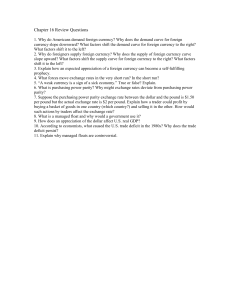

Chapter 29

... 6. What is purchasing power parity? Why might exchange rates deviate from purchasing power parity? 7. Suppose the purchasing power parity exchange rate between the dollar and the pound is $1.50 per pound but the actual exchange rate is $2 per pound. Explain how a trader could profit by buying a bask ...

... 6. What is purchasing power parity? Why might exchange rates deviate from purchasing power parity? 7. Suppose the purchasing power parity exchange rate between the dollar and the pound is $1.50 per pound but the actual exchange rate is $2 per pound. Explain how a trader could profit by buying a bask ...

Monetary policy

Monetary policy is the process by which the monetary authority of a country controls the supply of money, often targeting an inflation rate or interest rate to ensure price stability and general trust in the currency.Further goals of a monetary policy are usually to contribute to economic growth and stability, to lower unemployment, and to maintain predictable exchange rates with other currencies.Monetary economics provides insight into how to craft optimal monetary policy.Monetary policy is referred to as either being expansionary or contractionary, where an expansionary policy increases the total supply of money in the economy more rapidly than usual, and contractionary policy expands the money supply more slowly than usual or even shrinks it. Expansionary policy is traditionally used to try to combat unemployment in a recession by lowering interest rates in the hope that easy credit will entice businesses into expanding. Contractionary policy is intended to slow inflation in order to avoid the resulting distortions and deterioration of asset values.Monetary policy differs from fiscal policy, which refers to taxation, government spending, and associated borrowing.