Unemployment benefits extensions at the zero lower bound on

... Christiano et al. (2011) and Carrillo & Poilly (2013) documented that the government spending multiplier is larger (than one) when the ZLB on nominal interest rate binds. Eggertsson (2011) shows that an increase in labor supply when the ZLB binds raises the real interest rate which lowers output. Th ...

... Christiano et al. (2011) and Carrillo & Poilly (2013) documented that the government spending multiplier is larger (than one) when the ZLB on nominal interest rate binds. Eggertsson (2011) shows that an increase in labor supply when the ZLB binds raises the real interest rate which lowers output. Th ...

Price-level targeting as a monetary policy strategy

... taken in this context to mean a low inflation rate. In recent times, however, an ever-growing number of academics, in particular, have been asking whether it would not be better to base monetary policy on a target path for the price level. Theory does suggest that price-level targeting could wield a ...

... taken in this context to mean a low inflation rate. In recent times, however, an ever-growing number of academics, in particular, have been asking whether it would not be better to base monetary policy on a target path for the price level. Theory does suggest that price-level targeting could wield a ...

NBER WORKING PAPER SERIES MONETARY POLICIES FOR DEVELOPING COUNTRIES: Haizhou Huang

... As many developing countries lack credibility in their monetary policy, a subject heavily studied in the literature,1 a conventional wisdom is that these developing countries should peg their currency to a major currency from a low-inflationary country, have a currency board, or dollarize. Our analy ...

... As many developing countries lack credibility in their monetary policy, a subject heavily studied in the literature,1 a conventional wisdom is that these developing countries should peg their currency to a major currency from a low-inflationary country, have a currency board, or dollarize. Our analy ...

Chapter 29 Aggregate Demand and Aggregate Supply

... A. explain why the aggregate demand curve is downsloping. B. explain shifts in the aggregate demand curve. C. demonstrate why real output and the price level are inversely related. D. include input prices and resource productivity. 7. Other things equal, if the national incomes of the major trading ...

... A. explain why the aggregate demand curve is downsloping. B. explain shifts in the aggregate demand curve. C. demonstrate why real output and the price level are inversely related. D. include input prices and resource productivity. 7. Other things equal, if the national incomes of the major trading ...

analysis of structural problems in the us economy. why long term

... (Pissarides 2000, chap. 1) and by following the methodology used by Daly, Hobijn, Sahin, Valletta 2012. The model used consists of two curves the Beveridge curve and the job creation curve and the intersection point of these two curves is the point where the labor market is at equilibrium at every m ...

... (Pissarides 2000, chap. 1) and by following the methodology used by Daly, Hobijn, Sahin, Valletta 2012. The model used consists of two curves the Beveridge curve and the job creation curve and the intersection point of these two curves is the point where the labor market is at equilibrium at every m ...

Paper 1 - Cambridge Resources for the IB Diploma

... o Illegal labour that used to work at wages below the minimum wage may be reduced. Synthesis or evaluation (discuss). Discussion may include: rationale of imposing minimum wages, weighing up of costs and benefits, possibility that minimum wages may not always lead to unemployment if they lead to inc ...

... o Illegal labour that used to work at wages below the minimum wage may be reduced. Synthesis or evaluation (discuss). Discussion may include: rationale of imposing minimum wages, weighing up of costs and benefits, possibility that minimum wages may not always lead to unemployment if they lead to inc ...

The Evolution of Economic Understanding and Postwar Stabilization Policy Christina D. Romer

... 1970s, they would have set the real federal funds rate nearly 4 percentage points higher than did Arthur Burns and G. William Miller. On the other hand, William McChesney Martin set interest rates on average in the 1950s in much the same way Volcker or Greenspan would have, though with substantially ...

... 1970s, they would have set the real federal funds rate nearly 4 percentage points higher than did Arthur Burns and G. William Miller. On the other hand, William McChesney Martin set interest rates on average in the 1950s in much the same way Volcker or Greenspan would have, though with substantially ...

Macroeconomics Chapter 13W Disputes Over Macro Theory and

... financial assets, holding real assets, and buying current output. The factors that determine the amount of money the public wants to hold depend mainly on the level of nominal GDP. Example: Assume that when the level of nominal GDP is $400 billion, the public desires $100 billion of money to purchas ...

... financial assets, holding real assets, and buying current output. The factors that determine the amount of money the public wants to hold depend mainly on the level of nominal GDP. Example: Assume that when the level of nominal GDP is $400 billion, the public desires $100 billion of money to purchas ...

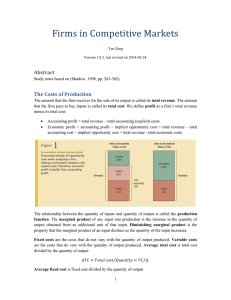

perfectly competitive firm`s supply curve

... the short run we can only choose: whether to produce or to temporarily shut down If we do produce, how much to produce ...

... the short run we can only choose: whether to produce or to temporarily shut down If we do produce, how much to produce ...

Chapter 21 The IS

... where U n is the NAIRU unemployment level and U c the remainder unemployment, often called cyclical unemployment (a positive number in a recession, a negative number in a boom). So U n is de…ned as the level of unemployment prevailing when the unemployment rate, U=N ; equals what is known as the NAI ...

... where U n is the NAIRU unemployment level and U c the remainder unemployment, often called cyclical unemployment (a positive number in a recession, a negative number in a boom). So U n is de…ned as the level of unemployment prevailing when the unemployment rate, U=N ; equals what is known as the NAI ...

Monetary Theory I

... Economic Fluctuations in the United States Shocks to Aggregate Demand, 1964–1969 During the Vietnam War, the Fed was concerned that the rise in aggregate demand caused by increases in government purchases would increase money demand and the interest rate. To avoid an increase in the interest rate, ...

... Economic Fluctuations in the United States Shocks to Aggregate Demand, 1964–1969 During the Vietnam War, the Fed was concerned that the rise in aggregate demand caused by increases in government purchases would increase money demand and the interest rate. To avoid an increase in the interest rate, ...

Inflation Report 3/2000

... Norges Bank projects consumer price inflation at 3% in 2000, 2¾% in 2001 and 2¼% in 2002. Compared with the June Inflation Report, the estimate for next year has been adjusted upwards by a quarter percentage point while the estimate for 2002 has been lowered by a quarter percentage point. The underl ...

... Norges Bank projects consumer price inflation at 3% in 2000, 2¾% in 2001 and 2¼% in 2002. Compared with the June Inflation Report, the estimate for next year has been adjusted upwards by a quarter percentage point while the estimate for 2002 has been lowered by a quarter percentage point. The underl ...

This PDF is a selection from an out-of-print volume from... of Economic Research Volume Title: Exchange Rate Theory and Practice

... the long-term real interest rate and the impulse’s coming from real government expenditures and foreign trade determine actual output. The interest rate effect on output is expected to take place with a substantial lag because investment reacts slowly. It takes time to decide on and plan capital pro ...

... the long-term real interest rate and the impulse’s coming from real government expenditures and foreign trade determine actual output. The interest rate effect on output is expected to take place with a substantial lag because investment reacts slowly. It takes time to decide on and plan capital pro ...

IOSR Journal of Economics and Finance (IOSR-JEF)

... efficient allocation of resources. Hence, the extent of trade openness becomes much crucial for the economic growth of a country. In the similar way, the convergence hypothesis of Solow states that the level of gross domestic product would determine whether an economy will grow at a low or high rate ...

... efficient allocation of resources. Hence, the extent of trade openness becomes much crucial for the economic growth of a country. In the similar way, the convergence hypothesis of Solow states that the level of gross domestic product would determine whether an economy will grow at a low or high rate ...

1 Efficiency and equity 1 Efficiency and equity CH5 Efficiency and

... one more unit of the good or one less unit of the good uses resources less efficiently. ...

... one more unit of the good or one less unit of the good uses resources less efficiently. ...

Economic growth and unemployment rate. Case of Albania

... cyclical unemployment that happens when the economy cannot provide jobs or the classical unemployment that usually happens because of the low wages. To find a relation let’s tell about the economy of Albania which according to some statistics like those of IMF the country even though of crises econo ...

... cyclical unemployment that happens when the economy cannot provide jobs or the classical unemployment that usually happens because of the low wages. To find a relation let’s tell about the economy of Albania which according to some statistics like those of IMF the country even though of crises econo ...

Phillips curve

In economics, the Phillips curve is a historical inverse relationship between rates of unemployment and corresponding rates of inflation that result in an economy. Stated simply, decreased unemployment, (i.e., increased levels of employment) in an economy will correlate with higher rates of inflation.While there is a short run tradeoff between unemployment and inflation, it has not been observed in the long run. In 1968, Milton Friedman asserted that the Phillips Curve was only applicable in the short-run and that in the long-run, inflationary policies will not decrease unemployment. Friedman then correctly predicted that, in the upcoming years after 1968, both inflation and unemployment would increase. The long-run Phillips Curve is now seen as a vertical line at the natural rate of unemployment, where the rate of inflation has no effect on unemployment. Accordingly, the Phillips curve is now seen as too simplistic, with the unemployment rate supplanted by more accurate predictors of inflation based on velocity of money supply measures such as the MZM (""money zero maturity"") velocity, which is affected by unemployment in the short but not the long term.